A Pour-Over Will simply directs your named Executor to “pour over” any asset which you failed to included in your trust, for distribution under the terms of your living trust.

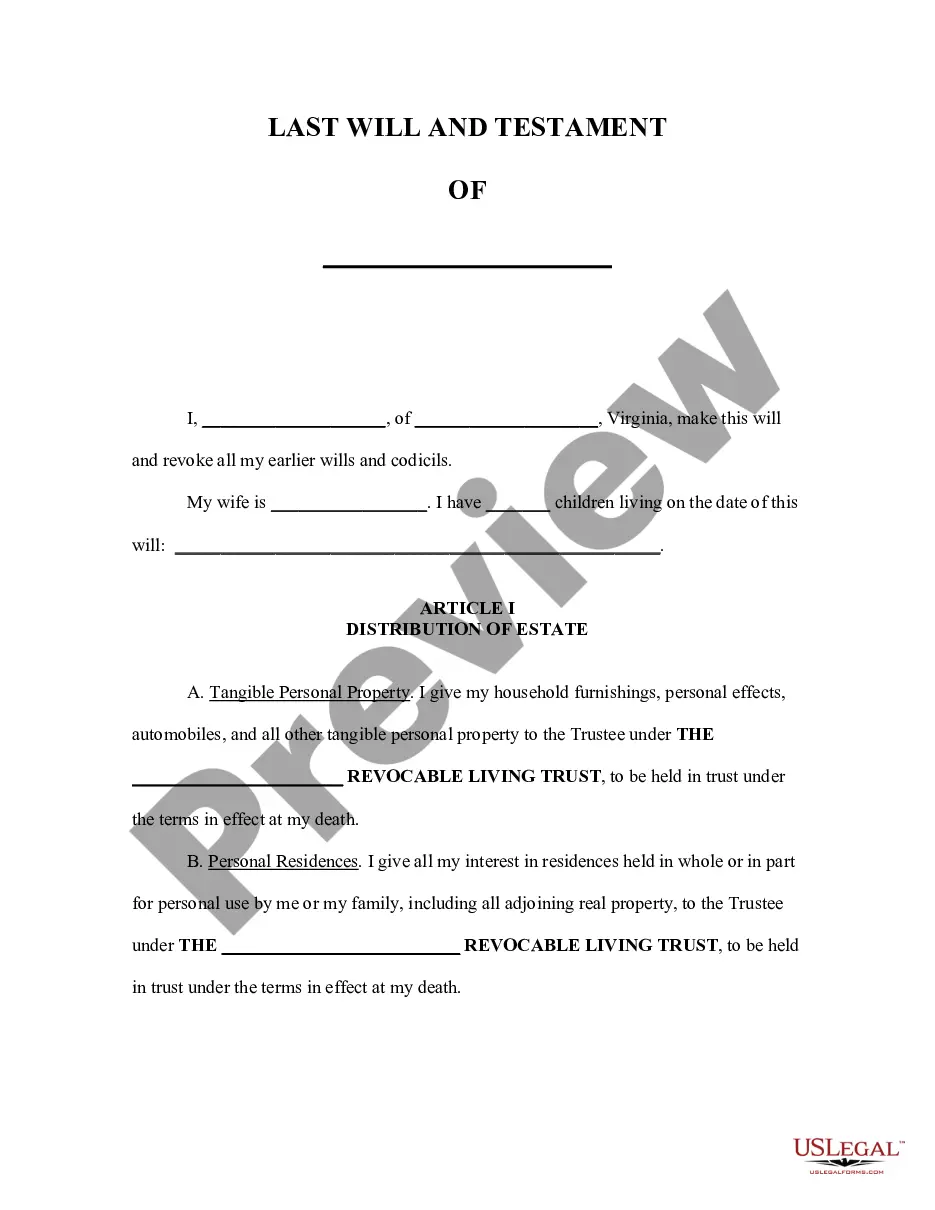

Virginia Pour Over Will for Husband

Description Distribution Of Personal Property Form

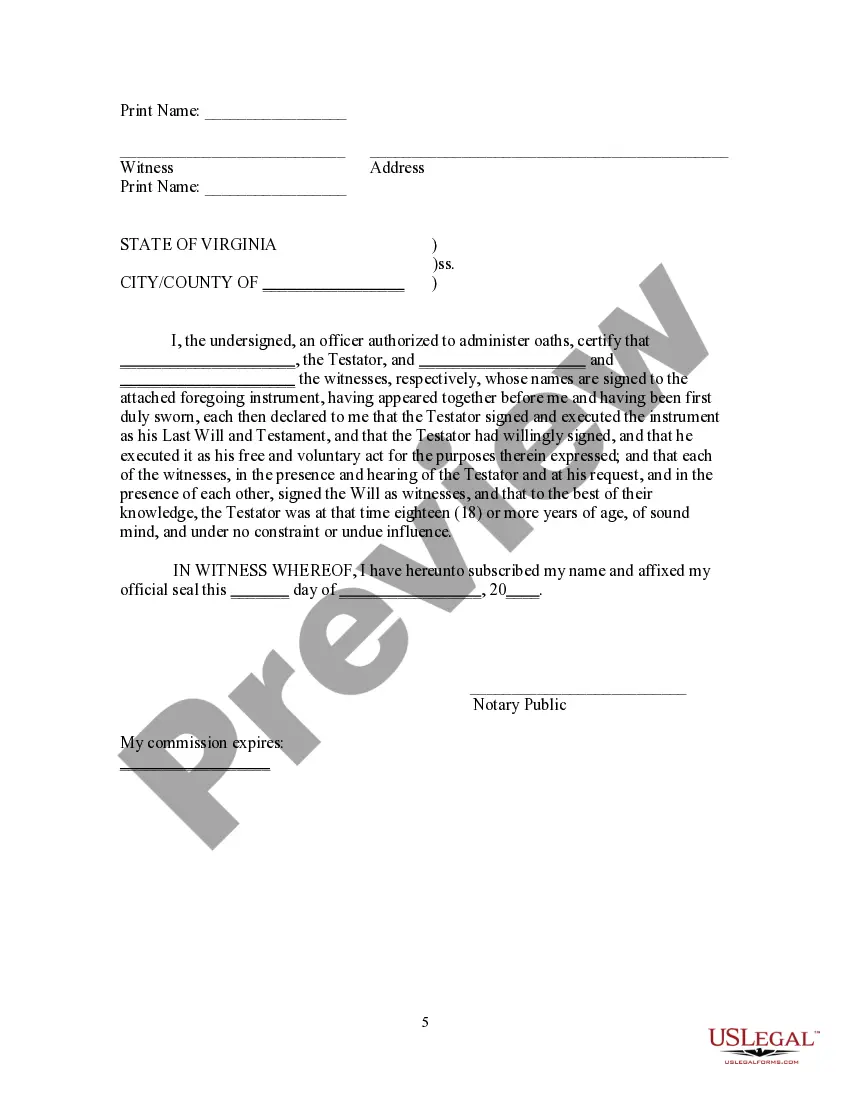

How to fill out Virginia Pour Over Will For Husband?

Searching for a Virginia Pour Over Will for Husband online might be stressful. All too often, you see documents that you simply believe are ok to use, but discover later they are not. US Legal Forms provides over 85,000 state-specific legal and tax forms drafted by professional lawyers according to state requirements. Get any document you’re searching for quickly, hassle-free.

If you already have the US Legal Forms subscription, just log in and download the sample. It’ll automatically be added in to the My Forms section. In case you don’t have an account, you should sign-up and pick a subscription plan first.

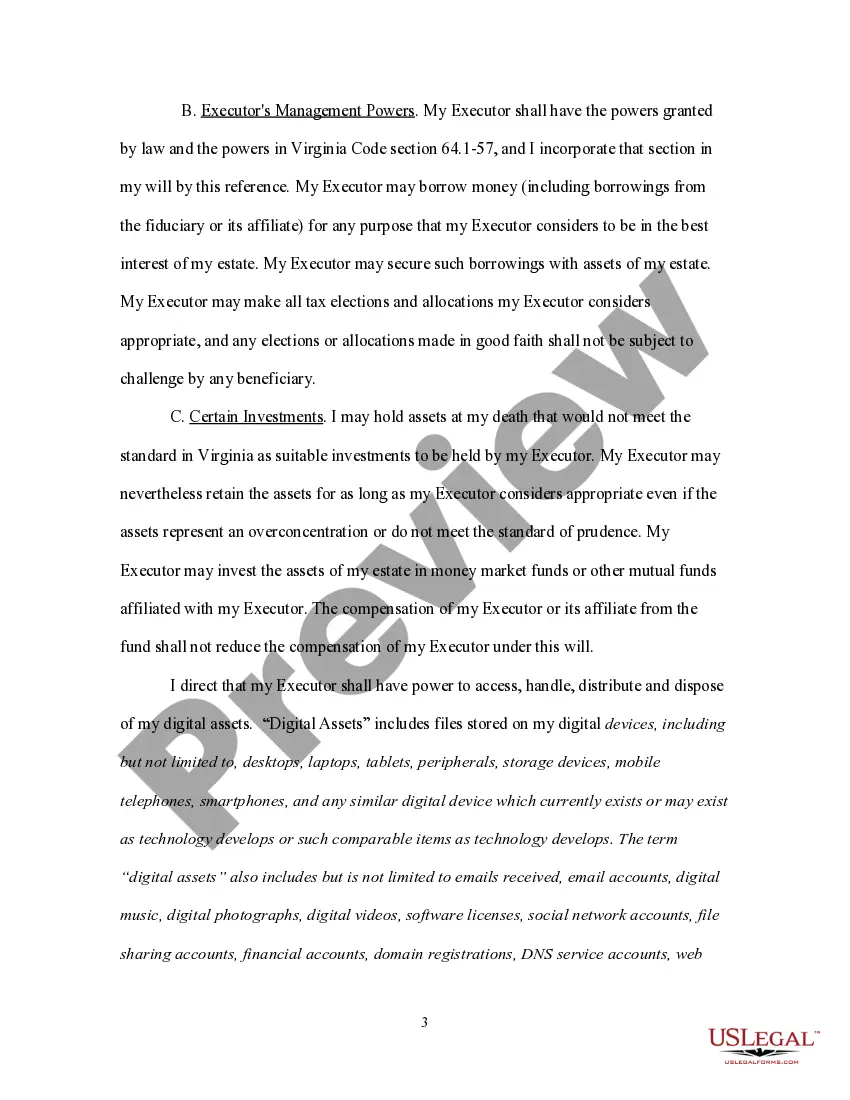

Follow the step-by-step instructions below to download Virginia Pour Over Will for Husband from the website:

- Read the form description and click Preview (if available) to verify whether the template meets your requirements or not.

- In case the form is not what you need, find others using the Search engine or the provided recommendations.

- If it’s appropriate, just click Buy Now.

- Choose a subscription plan and create an account.

- Pay via bank card or PayPal and download the template in a preferable format.

- Right after getting it, it is possible to fill it out, sign and print it.

Get access to 85,000 legal templates right from our US Legal Forms library. Besides professionally drafted samples, customers may also be supported with step-by-step instructions concerning how to get, download, and fill out templates.

Pour Over Will Template Form popularity

Trust Under Will Other Form Names

FAQ

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.

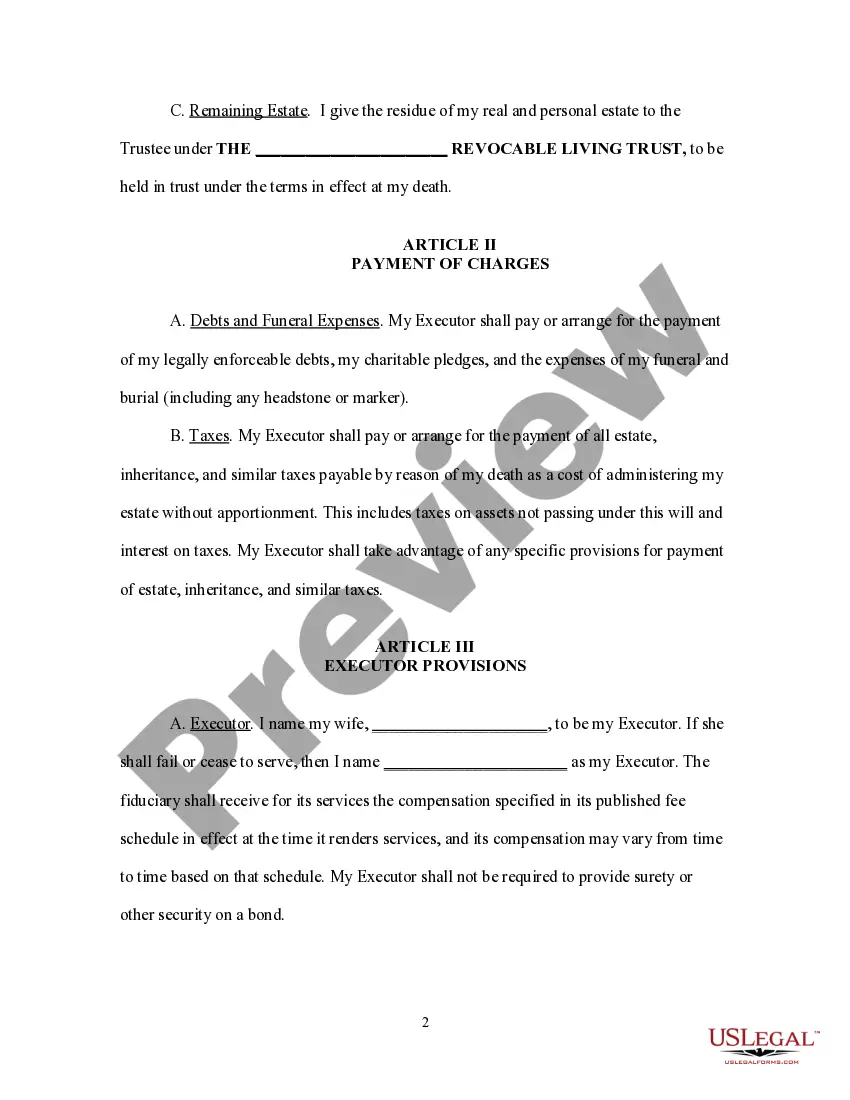

A pour-over will is a testamentary device wherein the writer of a will creates a trust, and decrees in the will that the property in his or her estate at the time of his or her death shall be distributed to the Trustee of the trust.

Pour-over wills are subject to probate since the assets have not yet been transferred into the trust. Some states also require your assets to go through the probate process any time your assets or property are over a certain value.Even though pour-over wills don't avoid probate, there is still a measure of privacy.

The pour over will does not need to be notarized; however, in California it does need to be signed by two disinterested witnesses.

If your spouse passed away in California without a Trust, you may think you'll need to go through probate. However, in many cases, the surviving spouse does not need to probate the estate of their loved one to gain access to his or her assets. Instead, you may only need to file a Spousal Property Petition.

Probate is required when an estate's assets are solely in the deceased's name. In most cases, if the deceased owned property that had no other names attached, an estate must go through probate in order to transfer the property into the name(s) of any beneficiaries.

The surviving spouse has the right to Family Exempt Property.The surviving spouse has the right to receive Letters of Administration, which means that ahead of all other family members, he/she has the right to serve as the Administrator when someone dies intestate.

Pour-over wills are subject to probate since the assets have not yet been transferred into the trust. Some states also require your assets to go through the probate process any time your assets or property are over a certain value.Even though pour-over wills don't avoid probate, there is still a measure of privacy.

Most married couples own most of their assets jointly. Assets owned jointly between husband and wife pass automatically to the survivor.This requires the will to be probated and an executor to be appointed in order to secure the assets. There are exceptions to the probate requirement for estates of $50,000 or less.