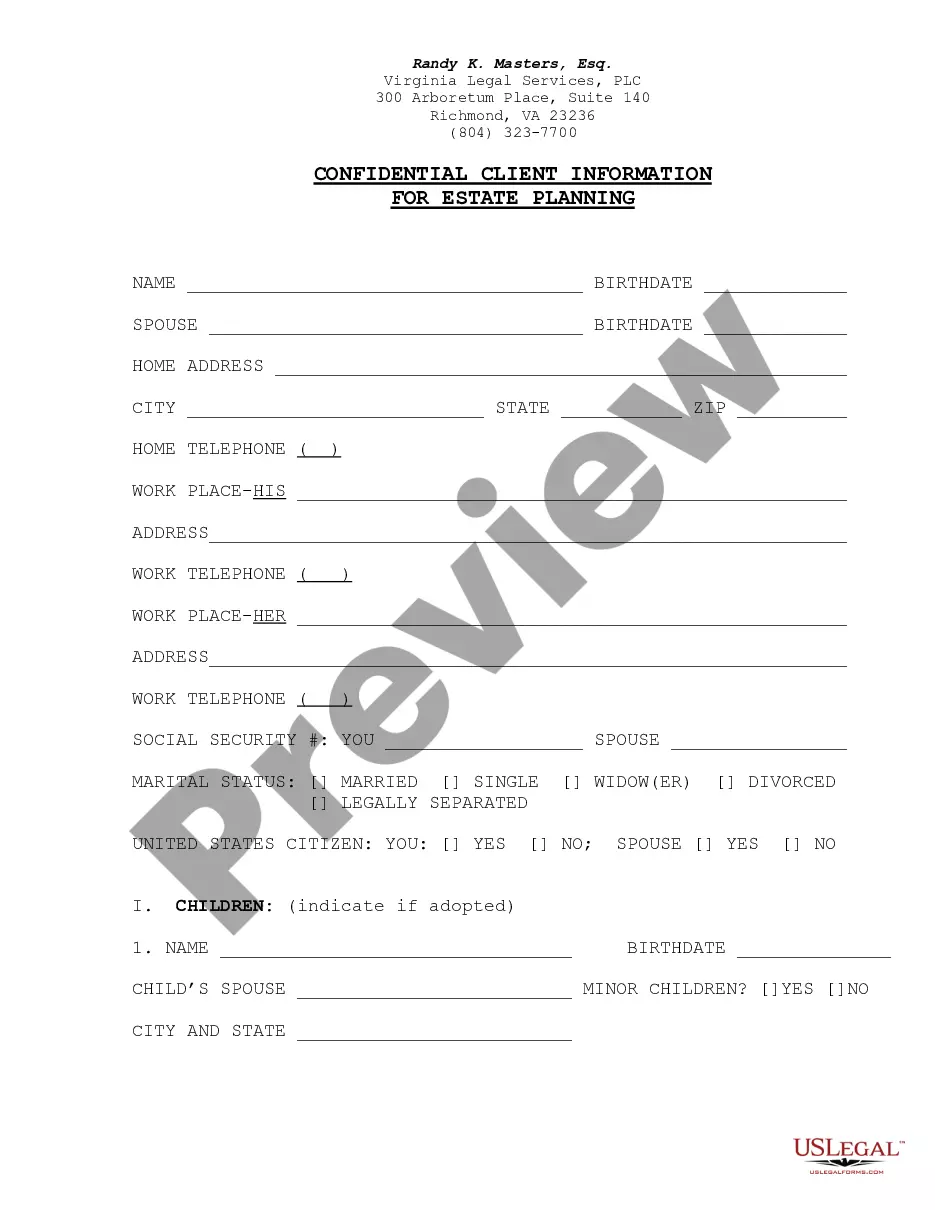

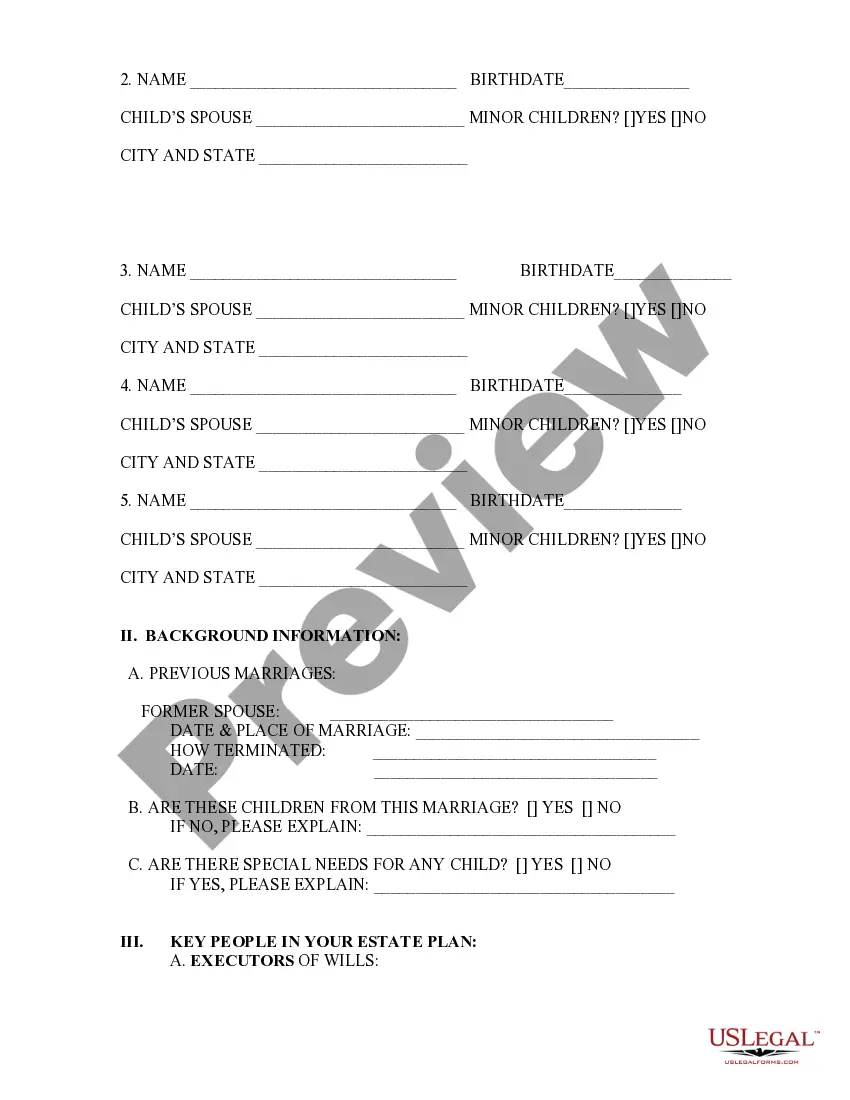

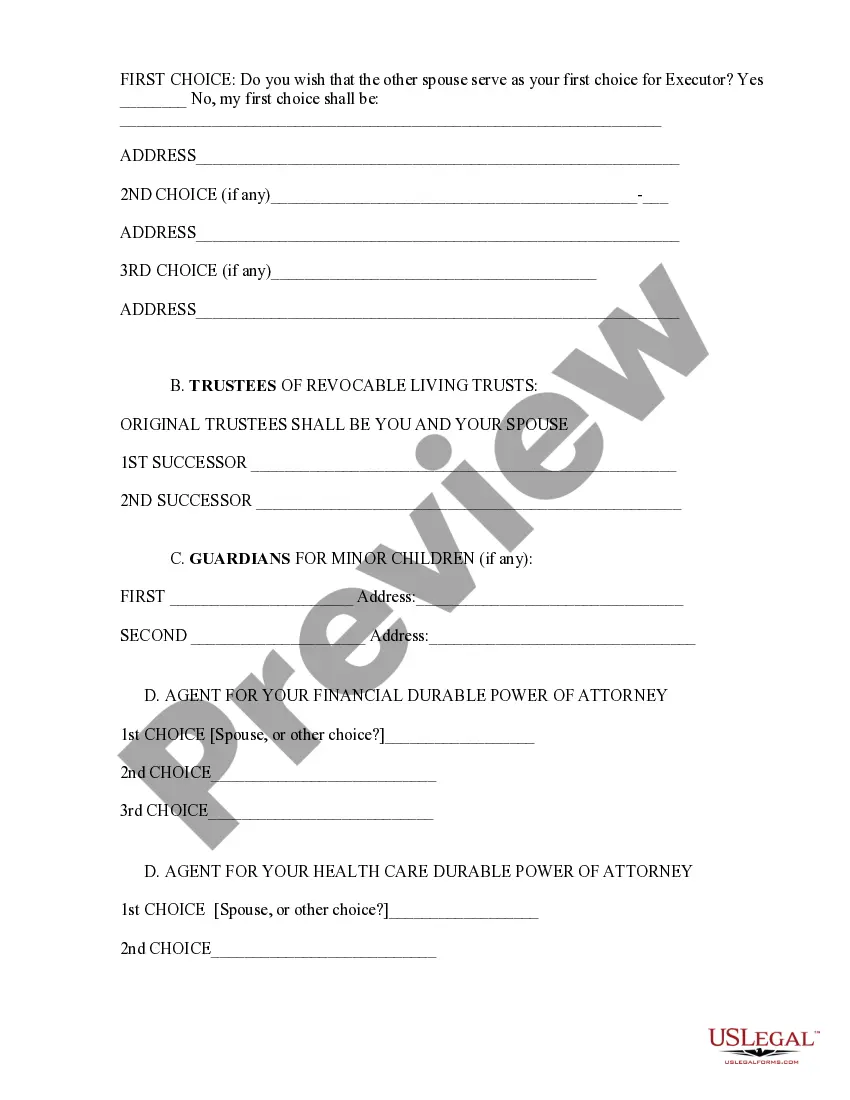

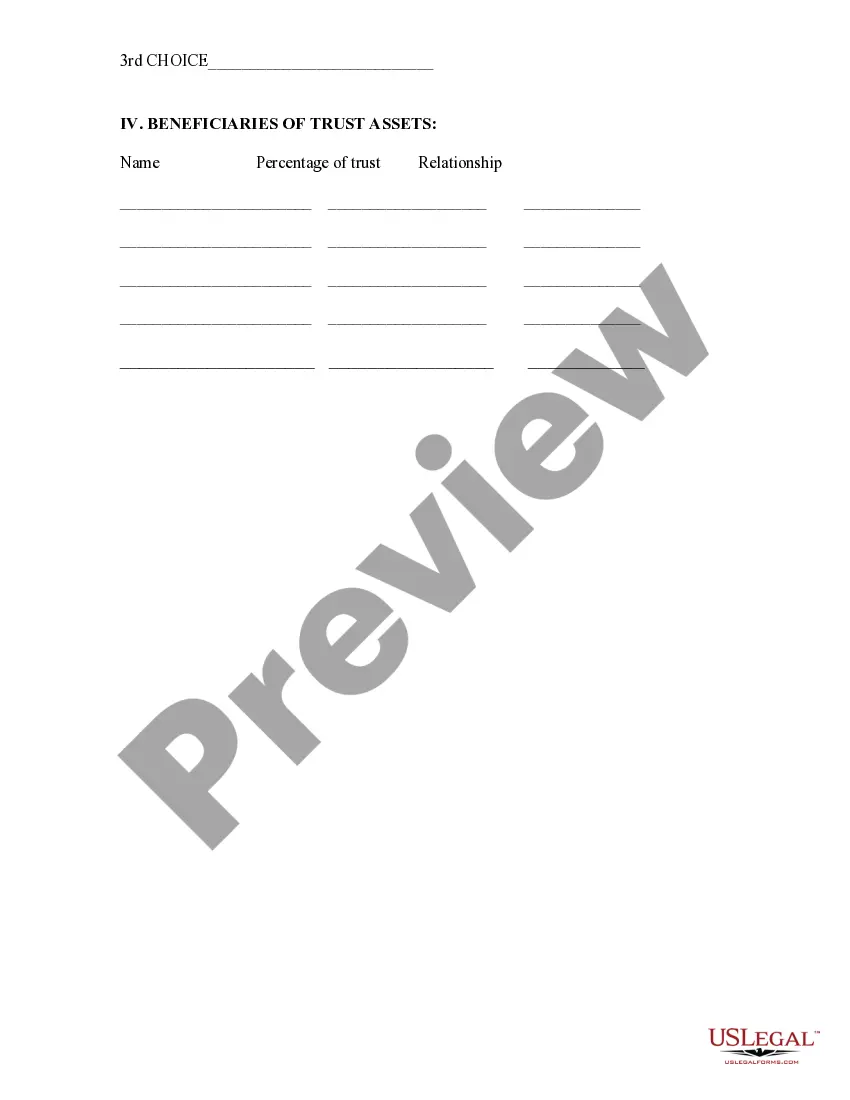

This is a form questionnaire an attorney may ask his/her client to answer to assist with estate planning.

Virginia Trust Questionnaire

Description

How to fill out Virginia Trust Questionnaire?

Searching for a Virginia Trust Questionnaire on the internet might be stressful. All too often, you see documents that you just think are fine to use, but find out afterwards they’re not. US Legal Forms offers more than 85,000 state-specific legal and tax forms drafted by professional legal professionals in accordance with state requirements. Have any document you’re searching for within a few minutes, hassle-free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It’ll automatically be included in your My Forms section. If you don’t have an account, you should sign-up and pick a subscription plan first.

Follow the step-by-step guidelines below to download Virginia Trust Questionnaire from our website:

- Read the form description and press Preview (if available) to verify whether the template suits your expectations or not.

- In case the document is not what you need, get others using the Search field or the listed recommendations.

- If it is appropriate, click on Buy Now.

- Choose a subscription plan and create an account.

- Pay with a bank card or PayPal and download the template in a preferable format.

- Right after downloading it, it is possible to fill it out, sign and print it.

Obtain access to 85,000 legal templates right from our US Legal Forms catalogue. In addition to professionally drafted templates, users may also be supported with step-by-step instructions concerning how to get, download, and complete templates.

Form popularity

FAQ

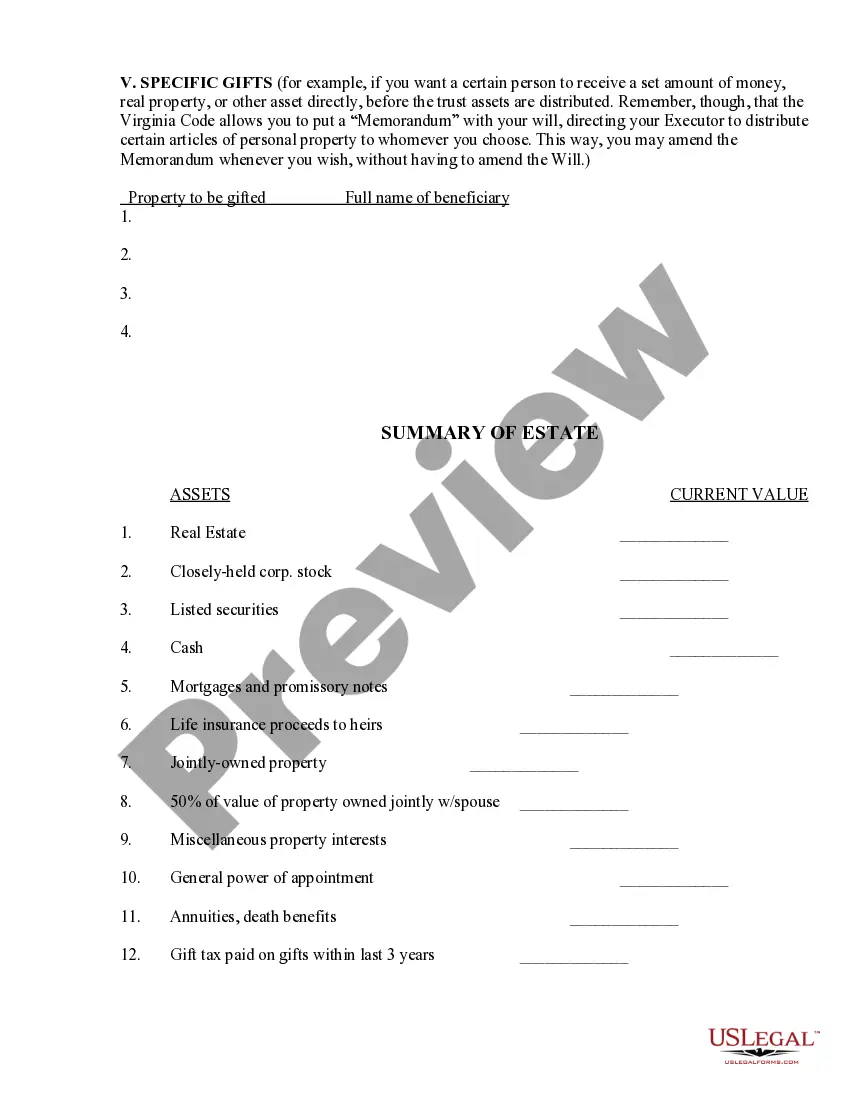

Your inventory should include the number of shares of each type of stock, the name of the corporation, and the name of the exchange on which the stock is traded. Meanwhile, you should note the total gross amount of a bond, the name of the entity that issued it, the interest rate on the bond, and its maturity date.

Contrary to popular belief, you do not need to have an attorney draft a will for you. Anyone can write this document on their own, and as long as it meets all of the legal requirements of the state, courts will recognize one you wrote yourself.

The irrevocable trust may be terminated by the consent of all beneficiaries and the court finds the termination is not inconsistent with a material purpose of the trust. Once the termination is approved by the court, the trustee is required to distribute the remaining assets as agreed by the beneficiaries.

What Do You Hope To Achieve With A Will? What Is Your Family Situation? What Assets Do You Own? Where Do You Want Your Assets To Be Distributed? Who Will Be Responsible For Your Estate?

This questionnaire provides for the preparation of your Will. Each individual should complete a questionnaire even if a husband and wife are both making Wills. GLOSSARY OF TERMS. BENEFICIARY: Any individual(s), church or organization chosen to receive your assets after death.

Select a type of trust. Inventory your assets and property. Choose a trustee. Put together your trust document. Visit a notary public and sign your living trust in front of them. Fund your trust.

There are certain types of property that legally cannot be included in a person's will. Depending on state laws, these may include: Any Property that is Co-Owned with Someone Else Through Joint-Tenancy: Married couples typically own the marital home in joint tenancy.Property being held in a living trust.

Your inventory should include the number of shares of each type of stock, the name of the corporation, and the name of the exchange on which the stock is traded. Meanwhile, you should note the total gross amount of a bond, the name of the entity that issued it, the interest rate on the bond, and its maturity date.

Beneficiaries of a will must be notified after the will is accepted for probate. 3feff Moreover, probated wills are automatically placed in the public record. If the will is structured to avoid probate, there are no specific notification requirements.