Virginia Statutory Criteria for Fee Cap Waiver Guidelines is a set of criteria established by the Commonwealth of Virginia to determine whether to waive certain fees for public and private entities doing business in Virginia. These criteria include criteria for waivers of certain fees such as real estate transfer taxes, decoration taxes, and business, professional, and occupational license fees. The criteria include criteria related to the size, scope, and impact of the project, as well as the amount of revenue generated by the project and the economic impact on the surrounding area. The criteria also includes criteria related to the public purpose of the project, including the potential for job creation, public safety, and other public benefits. The types of Virginia Statutory Criteria for Fee Cap Waiver Guidelines are as follows: 1. Size, scope and impact of the project 2. Amount of revenue generated by the project 3. Economic impact on the surrounding area 4. Public purpose of the project 5. Potential for job creation 6. Potential for public safety and other public benefits.

Virginia Statutory Criteria for Fee Cap Waiver Guidelines

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Virginia Statutory Criteria For Fee Cap Waiver Guidelines?

Preparing official paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them comply with federal and state regulations and are examined by our experts. So if you need to complete Virginia Statutory Criteria for Fee Cap Waiver Guidelines, our service is the perfect place to download it.

Obtaining your Virginia Statutory Criteria for Fee Cap Waiver Guidelines from our library is as simple as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button once they find the proper template. Later, if they need to, users can get the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, registering with a valid subscription will take only a few moments. Here’s a quick guideline for you:

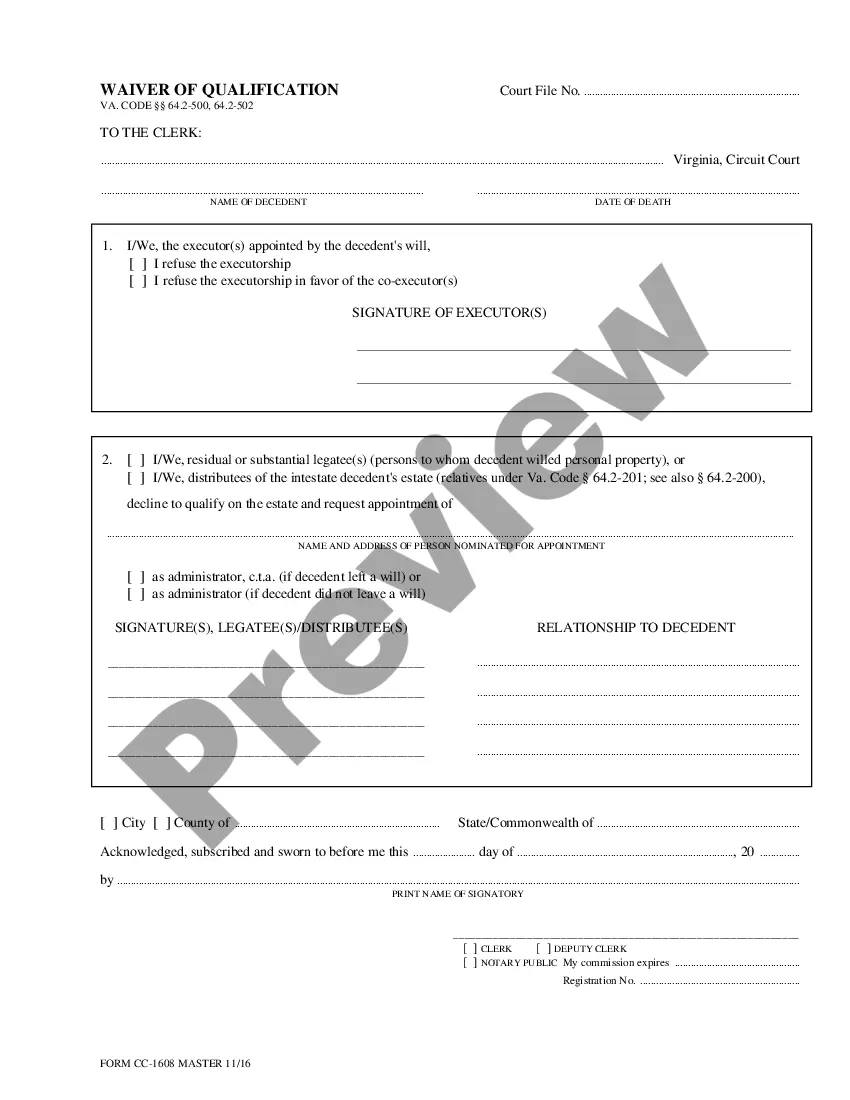

- Document compliance verification. You should carefully examine the content of the form you want and check whether it satisfies your needs and fulfills your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library through the Search tab on the top of the page until you find a suitable blank, and click Buy Now when you see the one you need.

- Account registration and form purchase. Create an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Virginia Statutory Criteria for Fee Cap Waiver Guidelines and click Download to save it on your device. Print it to fill out your papers manually, or use a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Sign up for our service today to get any official document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

Hourly Rate for Court-Appointed Counsel Unless otherwise specified, the Supreme Court of Virginia's established rate of up to $90 per hour (in and out of court) for court-appointed counsel shall apply. Time shall be recorded in increments not greater than . 10 hour (6 minutes).

Va. Code § 19.2-163 provides that in the event counsel is appointed to defend an indigent defendant charged with any felony, such counsel shall receive compensation as provided in Va.

The ?Petition for Proceeding in Civil Case Without Payment of Fees or Costs? is a form that allows a person who has little income (or who has very high expenses) to ask a Virginia court to ?waive? (which means ?not require?) the fees associated with civil court actions.

This form is to be used to recover fees and other allowable expenses incurred by court-appointed counsel, guardians ad litem, expert witnesses, court reporters, mediators, and others authorized by the court.

$42,202 is the 25th percentile. Salaries below this are outliers.