A Virginia Demand Bond is a type of financial instrument that is issued by the Commonwealth of Virginia to raise capital for various government projects. It is a form of debt security that offers a fixed rate of interest to investors, and has a demand feature that allows the bondholder to request early repayment of the principal with accrued interest at any time. These bonds are backed by the full faith and credit of the Commonwealth of Virginia, making them a low-risk investment option. They are usually utilized to fund infrastructure development, educational facilities, transportation projects, and other public initiatives that require significant capital. There are several types of Virginia Demand Bonds, each designed to cater to specific funding needs and investment preferences: 1. General Obligation (GO) Bonds: These are backed by the full faith and credit of the Commonwealth, providing the highest level of security for bondholders. GO bonds are typically used to finance projects that benefit the public and are repaid through various revenue sources, including taxes and fees. 2. Revenue Bonds: These bonds are secured by specific revenue streams generated from particular projects, such as toll roads, airports, or water utilities. Unlike GO bonds, revenue bonds do not have the backing of the Commonwealth's general taxing power and rely solely on the project's generated income for repayment. 3. Education Bonds: This type of demand bond focuses specifically on funding educational institutions and related infrastructure, including public schools, colleges, and universities. These bonds finance the construction or renovation of educational facilities and may offer tax benefits to investors. 4. Transportation Bonds: Aimed at improving the transportation infrastructure within the Commonwealth, these bonds fund projects like highways, bridges, and public transit systems. Transportation bonds often have dedicated revenue sources, such as fuel taxes or tolls, ensuring a reliable repayment mechanism. 5. Infrastructure Bonds: These bonds finance a wide range of infrastructure projects, such as water systems, sewer systems, and public buildings. Infrastructure bonds help the government address critical social and economic needs by attracting private investments to finance public works. Investing in Virginia Demand Bonds can provide investors with a stable income stream through interest payments while supporting the development of public projects vital to the growth and prosperity of the Commonwealth. These bonds offer a flexible repayment option, allowing bondholders to request early redemption when needed, making them suitable for investors seeking liquidity. By investing in a Virginia Demand Bond, individuals can contribute to the progress of the Commonwealth and potentially earn a reliable return on their investment backed by the credit strength of the state government.

Virginia Demand Bond

Description

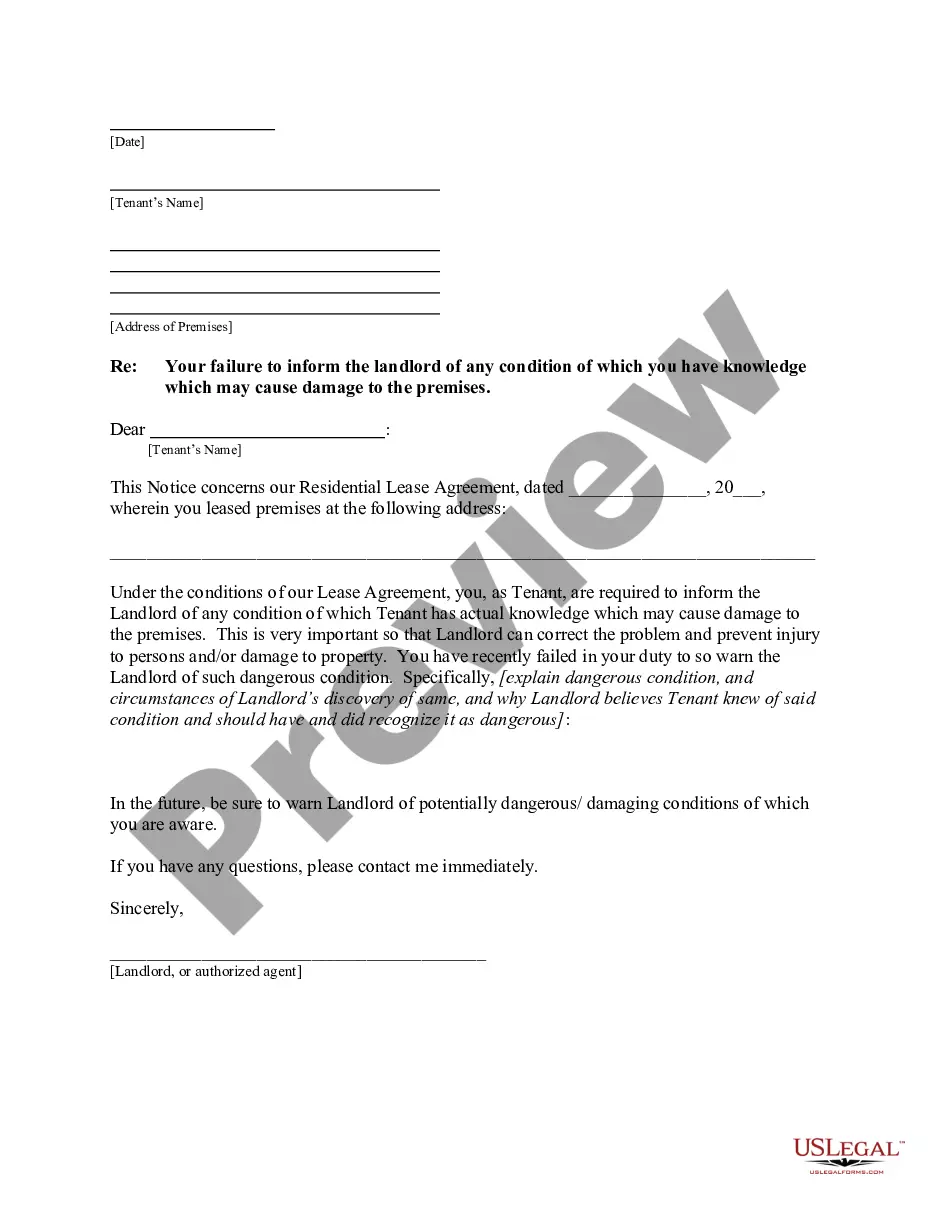

How to fill out Virginia Demand Bond?

If you want to full, obtain, or print out legitimate papers layouts, use US Legal Forms, the most important assortment of legitimate varieties, which can be found online. Utilize the site`s simple and hassle-free lookup to obtain the documents you need. Numerous layouts for organization and individual uses are sorted by types and suggests, or keywords and phrases. Use US Legal Forms to obtain the Virginia Demand Bond within a couple of clicks.

When you are presently a US Legal Forms customer, log in for your profile and click the Down load key to find the Virginia Demand Bond. You may also entry varieties you in the past saved from the My Forms tab of the profile.

If you use US Legal Forms initially, refer to the instructions below:

- Step 1. Be sure you have selected the shape to the proper metropolis/nation.

- Step 2. Use the Preview option to look over the form`s content. Never forget to learn the explanation.

- Step 3. When you are not satisfied with the type, make use of the Research area towards the top of the monitor to find other types of your legitimate type web template.

- Step 4. Upon having discovered the shape you need, click the Acquire now key. Select the rates program you favor and add your qualifications to register to have an profile.

- Step 5. Approach the financial transaction. You can utilize your bank card or PayPal profile to accomplish the financial transaction.

- Step 6. Find the formatting of your legitimate type and obtain it on the system.

- Step 7. Full, revise and print out or indicator the Virginia Demand Bond.

Every legitimate papers web template you get is your own property forever. You have acces to every single type you saved inside your acccount. Click on the My Forms area and select a type to print out or obtain yet again.

Be competitive and obtain, and print out the Virginia Demand Bond with US Legal Forms. There are thousands of specialist and state-particular varieties you can utilize for your personal organization or individual requires.

Form popularity

FAQ

The Virginia Bonding Program provides a $5,000 fidelity bond which provides coverage for the first six months of employment for job seekers with convictions.

Is the security an on-demand bond or guarantee? An on-demand security bond is an unconditional obligation to pay when a demand has been made. A surety bond or performance guarantee requires certain conditions to be met before payment is made. Some contracts provide standard form security documents.

The Virginia Contractor License surety bond can cost anywhere between $350 to $2,500 per year or $35 to $250 per month.

Demand bonds are long-term debt issuances with demand ("put") provisions that require the issuer to repurchase the bonds upon notice from the bondholder at a price equal to the principal plus accrued interest.

A surety bond is a promise to be liable for the debt, default, or failure of another. It is a three-party contract by which one party (the surety) guarantees the performance or obligations of a second party (the principal) to a third party (the obligee).

There are two main categories of surety bond: Contract Bonds and Commercial Bonds. Contract bonds guarantee a specific contract. Examples include Performance Bonds, Bid Bonds, Supply bonds, Maintenance Bonds, and Subdivision Bonds. Commercial Bonds guarantee per the terms of the bond form.

The essential difference between an 'on-demand' bond and a 'default' bond is that, under an 'on-demand' bond, the employer does not have to prove default.

Surety bonds also come with the following cons for contractors: A bonded contractor must pay for the bond and will also be responsible for paying valid bond claims. A lapse in a bond can result in a license suspension or the invalidation of a contract. Required renewals can add ongoing expenses.