The Virginia Deferred Compensation Agreement — Short Form refers to a legal document that outlines the terms and conditions of a deferred compensation arrangement in the state of Virginia. This agreement is typically entered into between an employer and employee. The purpose of the Virginia Deferred Compensation Agreement is to provide employees with a way to save for retirement by deferring a portion of their compensation on a pre-tax basis. The agreement enables employees to contribute a certain percentage of their salary or wages to a qualified deferred compensation plan, such as a 401(k) plan or a 457 plan, which is then invested and grows over time. The agreement includes various important elements, such as the employee's contribution rate, the maximum annual contribution limit, and the investment options available to the employee. It also specifies the terms under which the employee can access the deferred compensation funds, such as upon retirement, disability, or termination of employment. Additionally, the agreement may outline any penalties or restrictions that apply if the employee withdraws the funds before a certain age or under certain circumstances. It's worth noting that there may be different types of Virginia Deferred Compensation Agreements — Short Form, depending on the specific plan chosen by the employer. For example, an employer may offer a 401(k) plan, which is a retirement savings plan sponsored by a private company. Alternatively, they may offer a 457 plan, which is a type of deferred compensation plan available to employees of state and local governments and some tax-exempt organizations. In summary, the Virginia Deferred Compensation Agreement — Short Form is a legally binding agreement that governs the terms and conditions of a deferred compensation arrangement in the state of Virginia. It allows employees to defer a portion of their salary or wages, contribute to a qualified retirement savings plan, and enjoy tax advantages while preparing for their future retirement.

Virginia Deferred Compensation Agreement - Short Form

Description

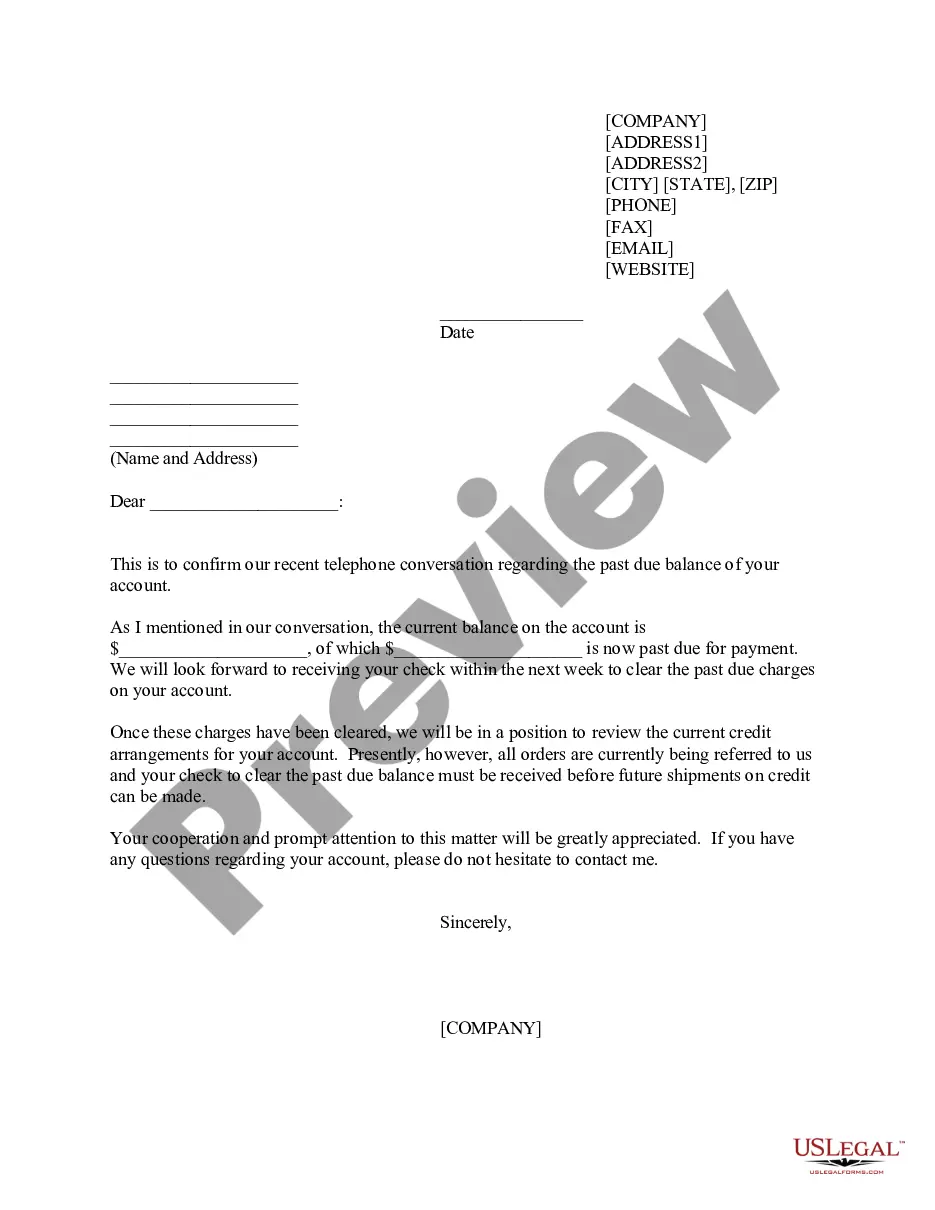

How to fill out Virginia Deferred Compensation Agreement - Short Form?

US Legal Forms - among the biggest libraries of lawful types in the United States - delivers a wide range of lawful document web templates you can acquire or produce. Utilizing the website, you will get 1000s of types for business and personal reasons, categorized by categories, says, or keywords and phrases.You will discover the most recent versions of types such as the Virginia Deferred Compensation Agreement - Short Form in seconds.

If you currently have a registration, log in and acquire Virginia Deferred Compensation Agreement - Short Form from the US Legal Forms local library. The Obtain key will show up on each and every type you view. You gain access to all earlier downloaded types within the My Forms tab of your respective profile.

If you want to use US Legal Forms for the first time, allow me to share simple recommendations to help you get started off:

- Make sure you have picked out the proper type for your area/region. Select the Preview key to check the form`s information. Read the type explanation to actually have selected the proper type.

- When the type does not match your specifications, utilize the Search area towards the top of the display screen to find the one which does.

- If you are satisfied with the shape, affirm your decision by clicking on the Acquire now key. Then, select the rates strategy you favor and offer your credentials to register on an profile.

- Approach the financial transaction. Make use of Visa or Mastercard or PayPal profile to finish the financial transaction.

- Find the formatting and acquire the shape on your own system.

- Make changes. Fill up, revise and produce and indicator the downloaded Virginia Deferred Compensation Agreement - Short Form.

Every format you added to your bank account lacks an expiry date and it is yours permanently. So, if you would like acquire or produce one more backup, just visit the My Forms segment and then click around the type you require.

Obtain access to the Virginia Deferred Compensation Agreement - Short Form with US Legal Forms, the most comprehensive local library of lawful document web templates. Use 1000s of expert and express-particular web templates that meet up with your company or personal requirements and specifications.