Virginia Asset Purchase Agreement - Business Sale

Description

How to fill out Asset Purchase Agreement - Business Sale?

Are you currently in a position where you require documents for either business or personal needs almost every day.

There are many legal document templates accessible online, but finding ones you can rely on is challenging.

US Legal Forms provides thousands of template forms, including the Virginia Asset Purchase Agreement - Business Sale, which are designed to meet state and federal requirements.

When you find the appropriate form, click on Purchase now.

Choose the payment plan you want, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Virginia Asset Purchase Agreement - Business Sale template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

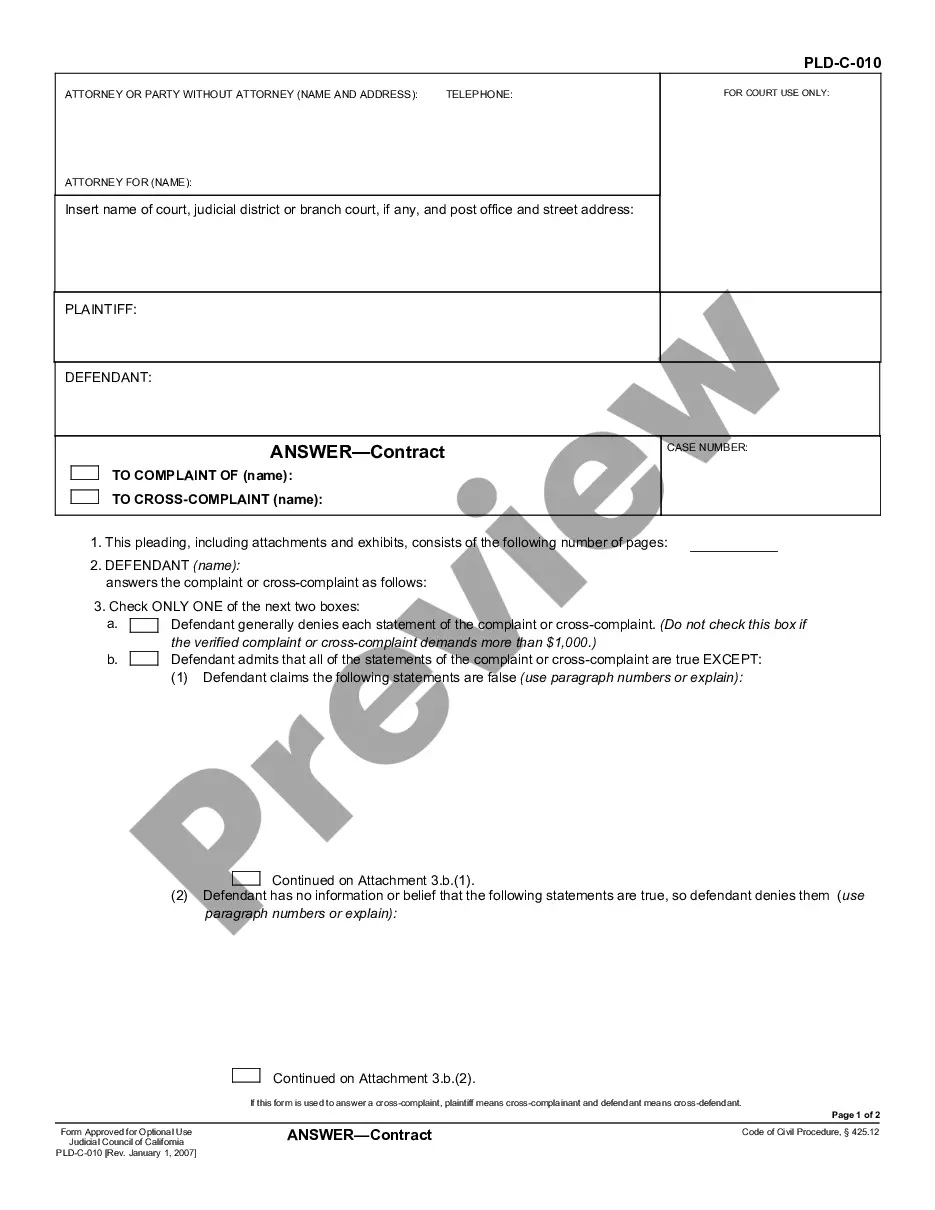

- Use the Preview button to check the form.

- Read the description to ensure you have selected the right form.

- If the form is not what you are looking for, use the Lookup field to find the form that fits your needs and specifications.

Form popularity

FAQ

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

The bill of sale is typically delivered as an ancillary document in an asset purchase to transfer title to tangible personal property. It does not cover intangible property (such as intellectual property rights or contract rights) or real property.

A business usually has many assets. When sold, these assets must be classified as capital assets, depreciable property used in the business, real property used in the business, or property held for sale to customers, such as inventory or stock in trade. The gain or loss on each asset is figured separately.

Sale of Business AssetsReport the sale of your business assets on Form 8594 and Form 4797, and attach these forms to your final tax return. Form 8594 is the Asset Acquisition Statement, which the buyer and seller must complete and submit to the IRS.

The result reflects whether your company made a profit or took a loss on the sale of the property.Step 1: Debit the Cash Account.Step 2: Debit the Accumulated Depreciation Account.Step 3: Credit the Property's Asset Account.Step 4: Determine the Property's Book Value.Step 5: Credit or Debit the Disposal Account.

The key difference is that a purchase order is sent by buyers to vendors with the intention to track and control the purchasing process. On the other hand, an invoice is an official payment request sent by vendors to buyers once their order is fulfilled.

In an asset sale, you retain the legal entity of the business and only sell the business' assets. For example, say you run a rental car company owned by Harry Smith Pty Ltd. You decide that you need to sell 50% of your fleet to upgrade your vehicles and want to sell those vehicles in one transaction to one buyer.

An asset sale involves the purchase of some or all of the assets owned by a company. Examples of common assets which are sold include; plant and equipment, land, buildings, machinery, stock, goodwill, contracts, records and intellectual property (including domain names and trademarks).

An asset purchase agreement is an agreement between a buyer and a seller to purchase property, like business assets or real property, either on their own or as part of a merger-acquisition.

In an asset sale, a firm sells some or all of its actual assets, either tangible or intangible. The seller retains legal ownership of the company that has sold the assets but has no further recourse to the sold assets. The buyer assumes no liabilities in an asset sale.