Title: Virginia Sample Letter regarding Completion of Corporate Annual Report: A Comprehensive Guide Introduction: When it comes to completing a corporate annual report in the state of Virginia, it is essential to follow the appropriate guidelines and procedures. This article aims to provide a detailed description of various Virginia sample letters regarding the completion of a corporate annual report while incorporating relevant keywords to enhance your understanding. 1. Virginia Sample Letter: Annual Report Completion Notification: This type of sample letter is used to inform the appropriate authorities, such as the State Corporation Commission (SCC) or the Internal Revenue Service (IRS), about the successful completion of a corporate annual report. It highlights the essential information required in the report, including financial statements, director information, and any changes in the corporate structure. Keywords: Virginia corporate annual report, completion letter, SCC, IRS, financial statements, director information, corporate structure. 2. Virginia Sample Letter: Request for Extension to File Annual Report: In certain circumstances, businesses may face unexpected challenges that prevent them from submitting the annual report within the prescribed timeframe. This sample letter is utilized to seek an extension of the deadline from the SCC or other relevant authorities. It should articulate the reasons for the request professionally. Keywords: Virginia annual report extension, deadline extension letter, SCC, unexpected challenges, professional request. 3. Virginia Sample Letter: Annual Report Filing Reminder: This sample letter serves as a reminder to businesses regarding the approaching deadline for submitting their corporate annual report. It incorporates appropriate deadlines and emphasizes the importance of timely compliance. Keywords: Virginia annual report reminder, filing deadline, corporate compliance, timely submission. 4. Virginia Sample Letter: Annual Report Non-compliance Notification: When a business fails to file its corporate annual report within the mandated timeframe, authorities might send a notice of non-compliance. This sample letter helps businesses understand the consequences of non-compliance and outlines steps to rectify the situation. Keywords: Virginia annual report non-compliance, notification, consequences, rectification steps. 5. Virginia Sample Letter: Annual Report Dissolution Notification: If a business intends to dissolve, this sample letter is used to inform the relevant authorities of the decision. It outlines the necessary documents and steps required to complete the dissolution process accurately. Keywords: Virginia annual report dissolution, notification, relevant authorities, documents, dissolution process. Conclusion: Understanding the various Virginia sample letters regarding the completion of a corporate annual report is crucial for businesses operating within the state. Whether it's a completion notification, extension request, filing reminder, non-compliance notification, or dissolution notification, utilizing appropriate sample letters can streamline the process and ensure compliance with state regulations.

Virginia Sample Letter regarding Completion of Corporate Annual Report

Description

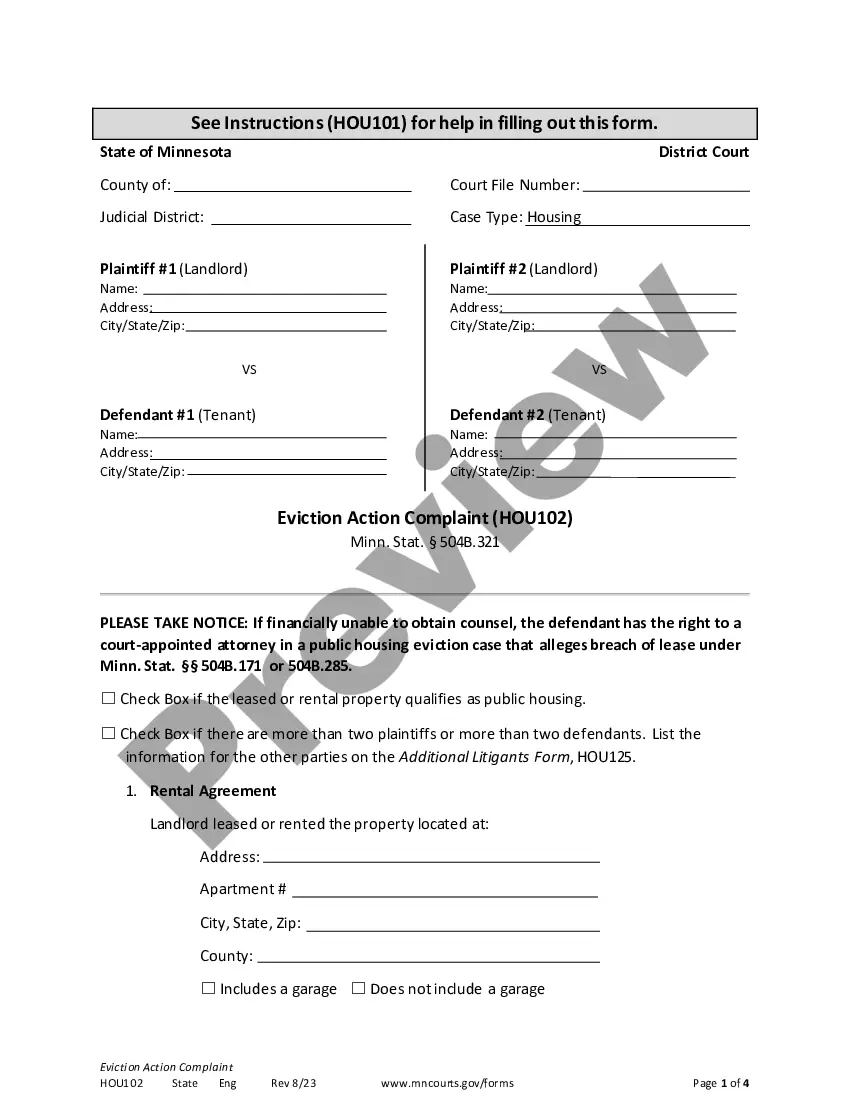

How to fill out Virginia Sample Letter Regarding Completion Of Corporate Annual Report?

Have you been inside a situation in which you will need files for either enterprise or specific reasons nearly every day time? There are plenty of lawful document themes available on the Internet, but finding types you can rely on is not simple. US Legal Forms provides 1000s of form themes, like the Virginia Sample Letter regarding Completion of Corporate Annual Report, which are created to fulfill state and federal specifications.

If you are currently knowledgeable about US Legal Forms web site and get a merchant account, simply log in. Following that, you may obtain the Virginia Sample Letter regarding Completion of Corporate Annual Report web template.

Should you not offer an bank account and need to begin using US Legal Forms, adopt these measures:

- Discover the form you require and make sure it is for the correct city/region.

- Use the Review switch to analyze the form.

- Browse the explanation to ensure that you have chosen the appropriate form.

- If the form is not what you`re trying to find, use the Research field to get the form that suits you and specifications.

- When you discover the correct form, simply click Buy now.

- Opt for the prices program you need, fill in the necessary info to make your bank account, and purchase your order making use of your PayPal or bank card.

- Pick a practical file file format and obtain your copy.

Get all the document themes you possess bought in the My Forms menus. You can aquire a more copy of Virginia Sample Letter regarding Completion of Corporate Annual Report anytime, if required. Just select the essential form to obtain or print out the document web template.

Use US Legal Forms, probably the most extensive selection of lawful kinds, to save lots of time and stay away from mistakes. The assistance provides professionally created lawful document themes which you can use for a selection of reasons. Create a merchant account on US Legal Forms and initiate generating your way of life easier.

Form popularity

FAQ

Virginia LLC Cost. Filing the registration paperwork to officially form your Virginia LLC will cost $100. You'll also need to pay a yearly $50 fee to file your Virginia Annual Registration.

Said another way, you have to pay this fee even if your LLC does nothing or makes no money. The $50 Annual Fee must be paid to the Virginia State Corporation Commission (SCC). It needs to be paid every year in order to keep your LLC in good standing.

Each Virginia corporation and foreign corporation authorized to do business in Virginia must file an Annual Report with the Office of the Clerk every year. The report is due annually by the last day of the 12th month after the entity was incorporated or issued a certificate of authority.

No, Virginia LLCs don't have to file annual reports; however, they do need to pay a $50 Annual Registration Fee.

Each Business Corporation, Limited Liability Company, Limited Liability Partnership and Limited Liability Limited Partnership is required to file an annual report with the Secretary of State.

After you form an LLC in Florida, you must file an Annual Report for your LLC and pay $138.75 every year. You need to file your Florida LLC Annual Report each year in order to avoid the penalty and keep your LLC in compliance and in good standing with the Florida Division of Corporations (aka ?Sunbiz?).