Introduction: In Virginia, an Acknowledgment by a Charitable or Educational Institution of Receipt of a Pledged Gift serves as an essential document to affirm the acceptance of a promised donation by a nonprofit organization or educational institution. This detailed description will outline the purpose, content, and different types of Virginia Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift, while incorporating relevant keywords to provide a comprehensive understanding. Keywords: Virginia, acknowledgment, charitable institution, educational institution, receipt, pledged gift, nonprofit organization, donation. Purpose: The primary goal of a Virginia Acknowledgment by a Charitable or Educational Institution of Receipt of a Pledged Gift is to document the acceptance of a promised donation made by an individual or entity to a charitable or educational institution registered in Virginia. It serves to validate the receipt of a pledged gift, ensuring compliance with legal requirements and providing a record for both the donor and the institution. Keywords: purpose, acceptance, promised donation, individual, entity, compliance, legal requirements, record. Content: 1. Institution Name and Address: The acknowledgment should begin with the full legal name and mailing address of the nonprofit organization or educational institution issuing the receipt. 2. Donor Information: Include the donor's full legal name and address to ensure accurate identification and contact information. If the pledge gift is made on behalf of an entity, such as a company or foundation, the organization's details should be provided. 3. Date of Pledge: Specify the date when the donor made the pledge to ensure proper tracking and acknowledgment of the gift. 4. Description of the Pledge: Clearly state the nature of the pledged gift, whether it is a monetary contribution, in-kind donation, property, securities, or any other form of pledged support by the donor. 5. Pledge Amount/Value: Document the exact amount or estimated value of the pledged gift. If the gift is not monetary, a reasonable estimation should be provided. 6. Purpose/Intended Use of Pledged Gift: Explain how the pledged gift will be utilized by the charitable or educational institution. This section demonstrates transparency and assures the donor that their contribution will be used for the intended cause. 7. Tax-Exempt Status: Include a statement confirming the organization's tax-exempt status, providing the necessary information for the donor to claim any tax benefits associated with their contribution. 8. Signatures and Contact Information: The acknowledgment should bear the authorized signatures of a representative from the institution, alongside their printed name and position. Additionally, contact information, such as phone number and email address, should be provided for further donor inquiries. Different Types: While there aren't distinct types of Virginia Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift, the content and format of the acknowledgment may vary slightly depending on the specific requirements of the institution. For example, a university may have different acknowledgment templates compared to a local charitable organization, but the fundamental purpose remains the same — acknowledging the receipt of a pledged gift. Please note that this content description provides a general overview and does not substitute legal advice. It is always recommended consulting with legal professionals or refer to Virginia state laws for specific requirements and variations regarding acknowledgments by charitable or educational institutions of receipt of pledged gifts.

Virginia Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift

Description

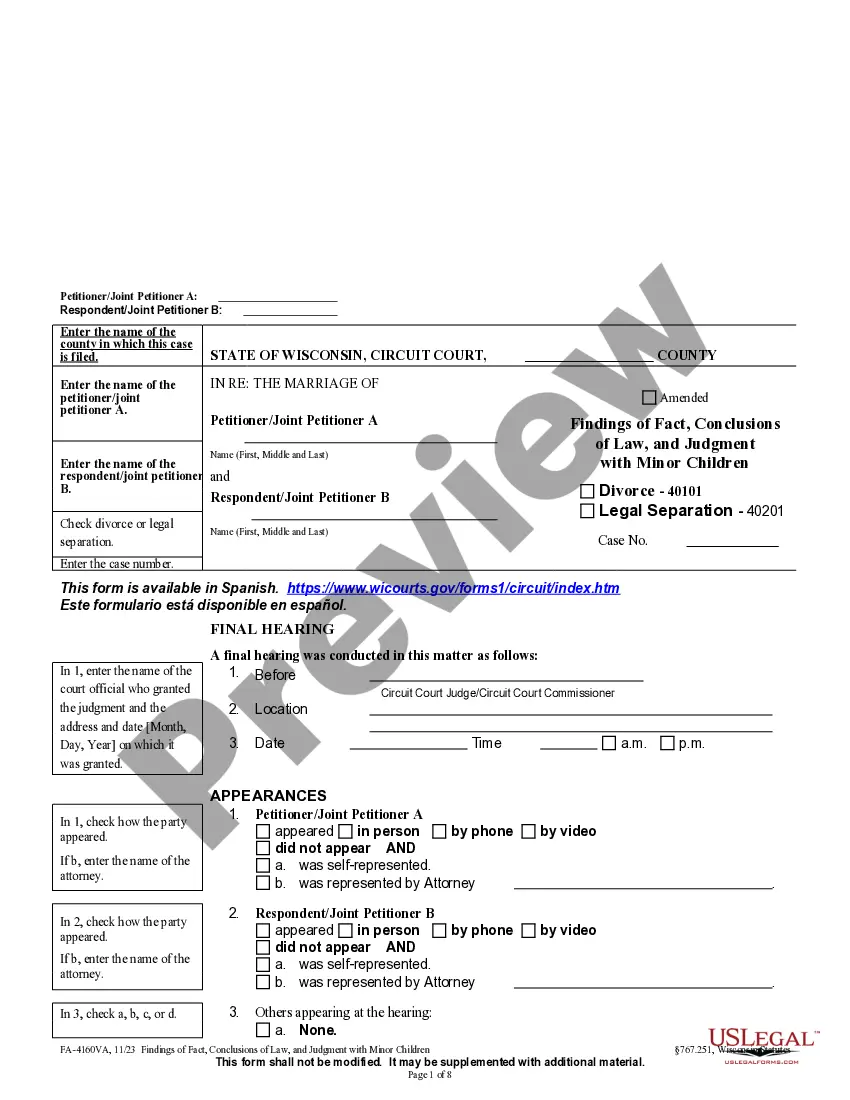

How to fill out Virginia Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift?

If you have to complete, download, or produce lawful record web templates, use US Legal Forms, the greatest assortment of lawful varieties, which can be found on-line. Use the site`s simple and easy hassle-free research to find the documents you want. A variety of web templates for enterprise and specific purposes are sorted by types and claims, or keywords and phrases. Use US Legal Forms to find the Virginia Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift with a couple of mouse clicks.

When you are previously a US Legal Forms consumer, log in to your account and click on the Obtain option to find the Virginia Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift. You can also entry varieties you formerly delivered electronically in the My Forms tab of your own account.

If you are using US Legal Forms initially, refer to the instructions under:

- Step 1. Be sure you have selected the shape to the correct city/nation.

- Step 2. Use the Preview choice to look through the form`s content. Do not forget to see the explanation.

- Step 3. When you are not satisfied using the form, make use of the Look for area on top of the monitor to discover other variations from the lawful form web template.

- Step 4. When you have discovered the shape you want, select the Get now option. Choose the costs prepare you prefer and put your accreditations to sign up for the account.

- Step 5. Approach the purchase. You should use your charge card or PayPal account to finish the purchase.

- Step 6. Choose the format from the lawful form and download it on the system.

- Step 7. Complete, edit and produce or signal the Virginia Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift.

Every lawful record web template you purchase is your own permanently. You may have acces to each and every form you delivered electronically within your acccount. Select the My Forms portion and select a form to produce or download once more.

Be competitive and download, and produce the Virginia Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift with US Legal Forms. There are millions of expert and condition-distinct varieties you can utilize for your personal enterprise or specific requires.

Form popularity

FAQ

However, no matter the form, every receipt must include six items to meet the standards set forth by the IRS. Name of the Charity and Name of the Donor. ... Date of the Contribution. ... Detailed Description of the Property Donated. ... Amount of the Contribution.

You should always have the following information on your donation receipts: Name of the organization. Donor's name. Recorded date of the donation. Amount of cash contribution or fair market value of in-kind goods and services. Organization's 501(c)(3) status.

Generally, itemizers can deduct 20% to 60% of their adjusted gross income for charitable donations. The exact percentage depends on the type of qualified contribution as well as the charity or organization.

The following is an example of a written acknowledgment where a charity accepts contributions in the name of one of its activities: "Thank you for your contribution of $250 to (Organization) made in the name of its Kids & Families program. No goods or services were provided in exchange for your donation."

Sample Donor Acknowledgement Letter for Non-Cash Donation On [DATE], you donated [DESCRIPTION ? WITHOUT MONETARY VALUE]. This gift is greatly appreciated and will be used to support our mission. In exchange for this contribution, you received [GOODS OR SERVICES ? WITH ESTIMATE OF FAIR MARKET VALUE].

The following is an example of a written acknowledgment where a charity accepts contributions in the name of one of its activities: "Thank you for your contribution of $250 to (Organization) made in the name of its Kids & Families program. No goods or services were provided in exchange for your donation."

What do you need to include in your donation acknowledgment letter? The donor's name. The full legal name of your organization. A declaration of your organization's tax-exempt status. Your organization's employer identification number. The date the gift was received. A description of the gift and the amount received.

For contributions of cash, check, or other monetary gift (regardless of amount), you must maintain a record of the contribution: a bank record or a written communication from the qualified organization containing the name of the organization, the amount, and the date of the contribution.