The Virginia Gift of Unregistered Securities pursuant to the Uniform Gifts to Minors Act is a legal provision that allows individuals to gift unregistered securities to minors. This act is aimed at facilitating the transfer of assets to minors while maintaining certain legal safeguards and tax benefits. When gifting unregistered securities in Virginia, the donor is essentially transferring ownership and control of those securities to the minor, who will then be the legal owner of those assets. This act provides a convenient way for parents or guardians to transfer securities such as stocks, bonds, or other securities to their children or other minors. By utilizing the Virginia Gift of Unregistered Securities pursuant to the Uniform Gifts to Minors Act, both the donor and the minor enjoy certain advantages. For the donor, this act allows for potential tax advantages, as the gifted assets are considered a completed gift and no longer subject to the donor's estate tax. Additionally, any income generated from these assets will be taxed at the minor's rate, which is usually lower compared to the donor's tax bracket. For the minor, this act ensures that the gifted securities are protected by law and managed in their best interest. A custodial account is established, with a custodian appointed to manage the assets until the minor reaches the age of majority, typically 18 or 21. The custodian oversees the investment decisions and may make distributions for the minor's benefit, such as funding education expenses, purchasing assets, or covering other financial needs. It is important to note that there are different types of Virginia Gifts of Unregistered Securities pursuant to the Uniform Gifts to Minors Act. These types may include stocks, bonds, mutual funds, or any other form of unregistered securities that are allowed under state and federal regulations. The specific type of securities gifted depends on the donor's preference and the suitability for the minor's financial goals and risk tolerance. In conclusion, the Virginia Gift of Unregistered Securities pursuant to the Uniform Gifts to Minors Act provides a legal framework for gifting unregistered securities to minors while ensuring protection and potential tax advantages for both the donor and the minor. The act allows for the transfer of various types of securities, depending on the individual's preference and the suitability for the minor's long-term financial growth and development.

Virginia Gift of Unregistered Securities pursuant to the Uniform Gifts to Minors Act

Description

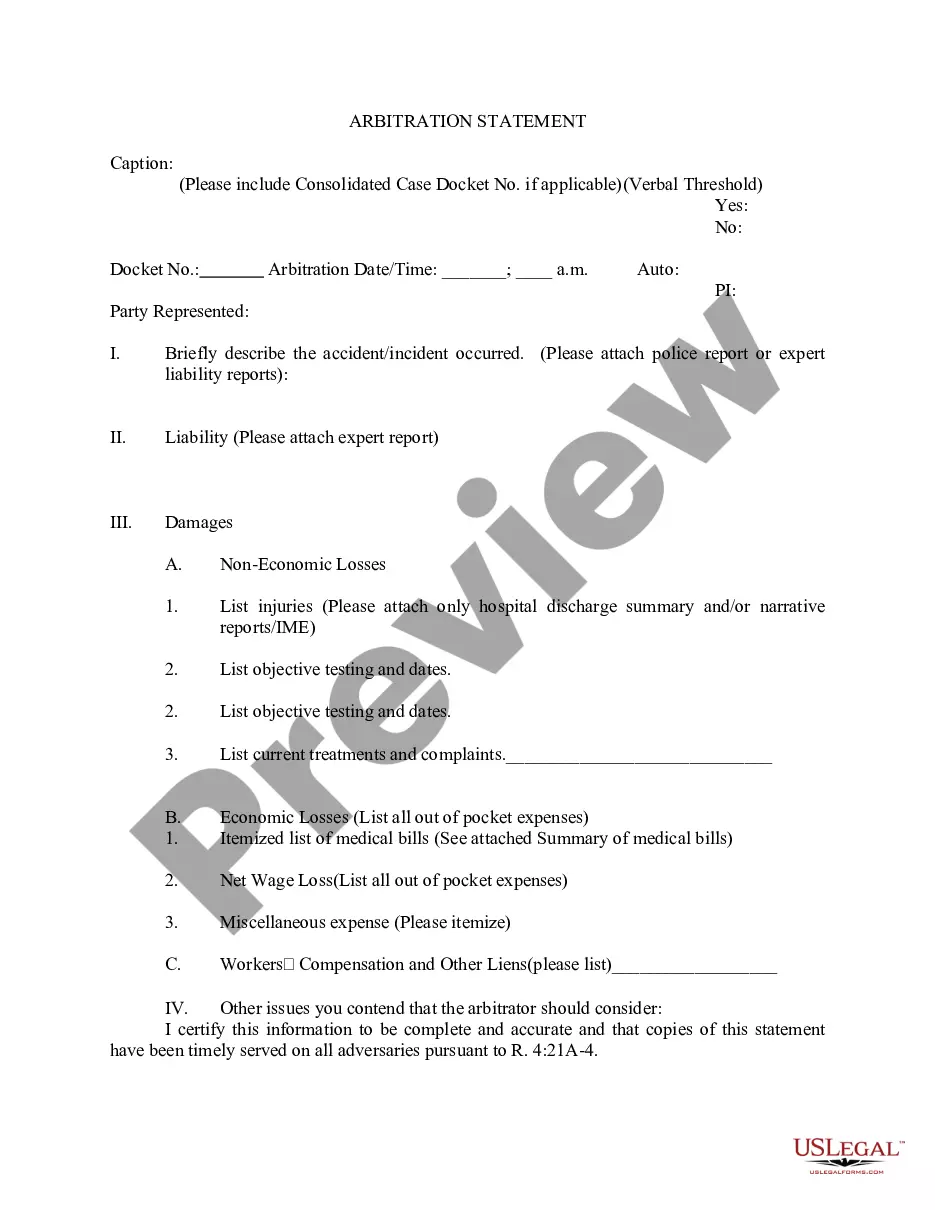

How to fill out Virginia Gift Of Unregistered Securities Pursuant To The Uniform Gifts To Minors Act?

US Legal Forms - one of the largest libraries of legitimate types in the USA - delivers a wide range of legitimate file templates you may acquire or produce. While using website, you can find a huge number of types for business and individual purposes, sorted by groups, states, or keywords.You will find the newest models of types just like the Virginia Gift of Unregistered Securities pursuant to the Uniform Gifts to Minors Act within minutes.

If you have a membership, log in and acquire Virginia Gift of Unregistered Securities pursuant to the Uniform Gifts to Minors Act in the US Legal Forms library. The Acquire option will appear on each develop you perspective. You have accessibility to all earlier delivered electronically types in the My Forms tab of the account.

In order to use US Legal Forms the very first time, listed here are straightforward recommendations to obtain started:

- Be sure to have picked out the proper develop for your personal town/region. Click the Review option to check the form`s articles. Read the develop outline to ensure that you have chosen the proper develop.

- In the event the develop does not suit your requirements, use the Search area on top of the display to find the the one that does.

- If you are happy with the form, confirm your decision by visiting the Get now option. Then, choose the prices plan you want and give your references to sign up for the account.

- Procedure the transaction. Make use of Visa or Mastercard or PayPal account to perform the transaction.

- Find the formatting and acquire the form on your own gadget.

- Make alterations. Load, change and produce and signal the delivered electronically Virginia Gift of Unregistered Securities pursuant to the Uniform Gifts to Minors Act.

Every template you included with your bank account does not have an expiration time and is also your own property permanently. So, in order to acquire or produce yet another backup, just visit the My Forms area and then click on the develop you require.

Obtain access to the Virginia Gift of Unregistered Securities pursuant to the Uniform Gifts to Minors Act with US Legal Forms, by far the most substantial library of legitimate file templates. Use a huge number of professional and state-specific templates that fulfill your small business or individual demands and requirements.