Virginia Balloon Unsecured Promissory Note

Description

How to fill out Balloon Unsecured Promissory Note?

Are you in a situation where you frequently require documents for various business or personal reasons almost every day? Numerous legitimate document templates are available online, but locating reliable versions can be challenging.

US Legal Forms provides a vast selection of form templates, including the Virginia Balloon Unsecured Promissory Note, tailored to comply with state and federal requirements.

If you're already familiar with the US Legal Forms website and have an account, simply Log In. Subsequently, you can access the Virginia Balloon Unsecured Promissory Note template.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Virginia Balloon Unsecured Promissory Note at any time, if required. Just click on the necessary form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legitimate documents, to save time and minimize errors. The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

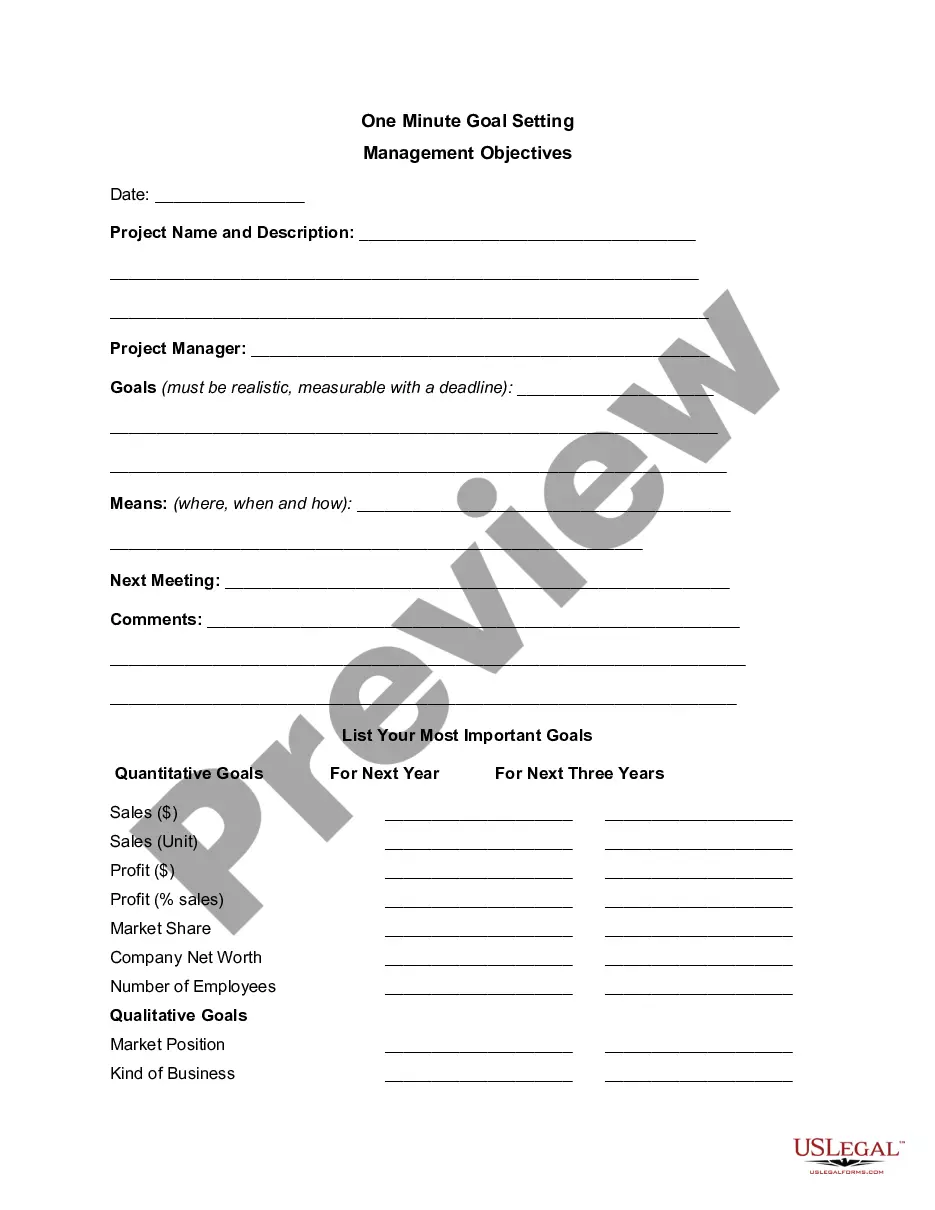

- Acquire the form you need and verify that it corresponds to the correct city/region.

- Use the Preview button to review the form.

- Examine the summary to confirm that you've selected the appropriate form.

- If the form isn’t what you’re looking for, utilize the Lookup field to find a form that meets your needs and requirements.

- Once you locate the correct form, click Get now.

- Choose the pricing plan you desire, complete the necessary information to create your account, and process the payment using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

To discharge a promissory note, like a Virginia Balloon Unsecured Promissory Note, you must fulfill the terms outlined in the note. This typically involves making full payment of the principal amount and any interest that may apply. Once payment is completed, you should obtain a written acknowledgment from the lender stating that the debt has been satisfied. If you need assistance with documentation or understanding the process, consider using the US Legal Forms platform, which offers reliable resources to help streamline your discharge process.

To obtain a copy of your Virginia Balloon Unsecured Promissory Note, start by reaching out to the lender or financial institution that issued it. They usually have a record of the note and can provide you with a copy. If you cannot locate them or access the document, consider using services like US Legal Forms, which can help you understand your rights and guide you in retrieving important financial documents.

Collecting on a Virginia Balloon Unsecured Promissory Note involves several steps. First, contact the borrower to discuss the missed payment and negotiate a possible repayment plan. If this does not resolve the issue, you may need to consider legal action, which could include filing a lawsuit. Using a platform like US Legal Forms can help you prepare the necessary documents to facilitate this process effectively.

When filling out a promissory demand note, it's essential to include similar elements to a standard promissory note but specify that the payment is due on demand. This means the lender can request payment at any time, which adds an element of urgency. If you are using US Legal Forms, templates are available to guide you in crafting a Virginia Balloon Unsecured Promissory Note with this feature.

In Virginia, a promissory note does not legally need to be notarized to be valid. However, having it notarized can provide extra security and assurance for both parties involved, especially in cases of potential disputes. If you use US Legal Forms, you can find templates that guide you through the notarization process for your Virginia Balloon Unsecured Promissory Note, ensuring legal compliance.

The requirements for a promissory note in Virginia typically include clear terms of payment, identification of parties, and signatures from both the borrower and lender. The note should outline the interest rate, payment schedule, and any applicable fees. For those drafting a Virginia Balloon Unsecured Promissory Note, adhering to these requirements ensures validity.

Promissory notes may sometimes qualify as exempt securities, depending on their terms and the regulatory framework. However, each situation requires careful assessment. If you are considering a Virginia Balloon Unsecured Promissory Note, examining its compliance with exemptions can be vital.

A promissory note can be classified as a security under certain conditions, primarily when it is part of an investment being sold to the public. For example, if structured correctly, it can qualify under securities regulations. It’s crucial to consider the specific nature of a Virginia Balloon Unsecured Promissory Note when assessing its classification.

Typically, an unsecured promissory note is not treated as a security, as it lacks collateral. The regulations governing securities can differ based on jurisdiction and specific circumstances. You may want to explore the details of a Virginia Balloon Unsecured Promissory Note with a legal professional to clarify its status.

Yes, a promissory note can indeed be unsecured. An unsecured promissory note does not have collateral backing it, meaning the lender relies solely on the borrower's creditworthiness. When dealing with a Virginia Balloon Unsecured Promissory Note, it is essential to understand the risks involved.