Virginia Charitable Remainder Inter Vivos Annuity Trust

Description

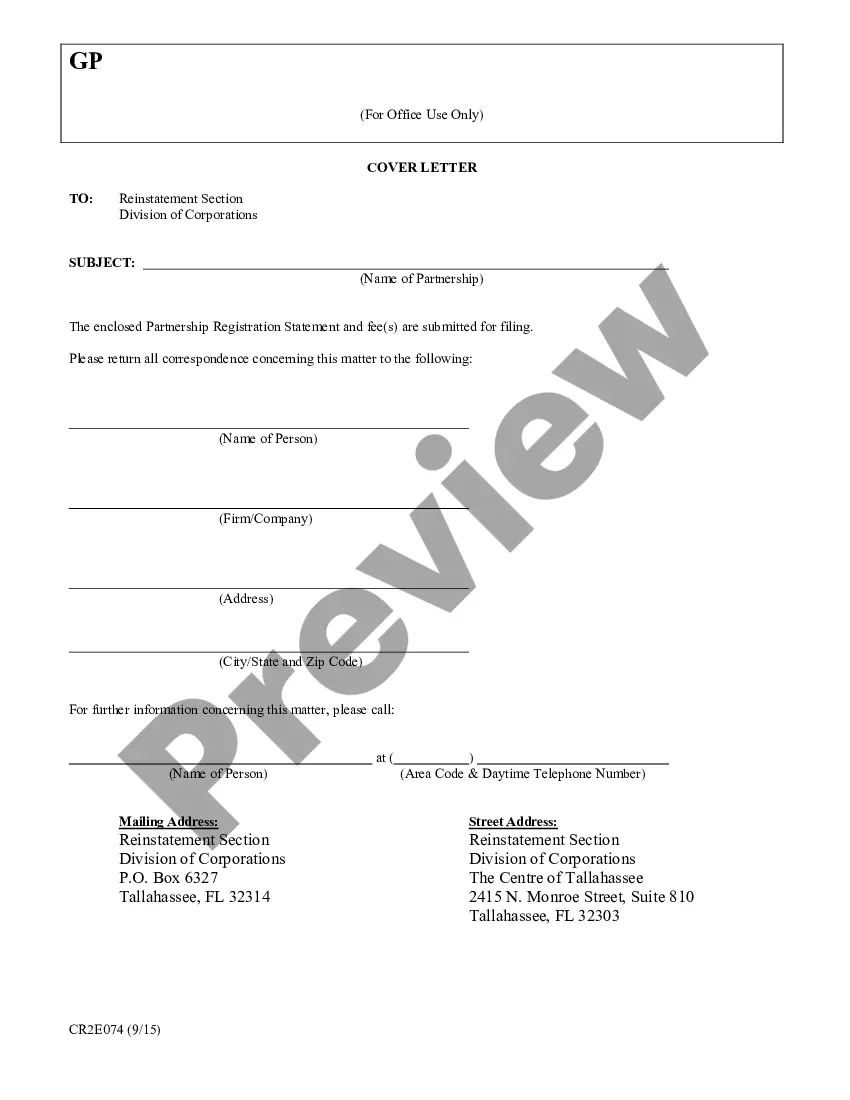

How to fill out Charitable Remainder Inter Vivos Annuity Trust?

You might invest hours online attempting to locate the legal document template that meets the federal and state requirements you need.

US Legal Forms provides a vast array of legal documents that are reviewed by experts.

It is easy to download or print the Virginia Charitable Remainder Inter Vivos Annuity Trust from our service.

To find another version of the form, utilize the Search field to discover the template that meets your needs and requirements.

- If you already possess a US Legal Forms account, you can Log In and click on the Obtain button.

- Subsequently, you can complete, alter, print, or sign the Virginia Charitable Remainder Inter Vivos Annuity Trust.

- Each legal document template you purchase is yours indefinitely.

- To obtain an additional copy of any purchased form, visit the My documents section and click the corresponding button.

- If this is your first time using the US Legal Forms website, adhere to the simple guidelines below.

- First, ensure that you have selected the appropriate document template for your preferred state/city.

- Review the form description to confirm that you have picked the right one.

Form popularity

FAQ

An alternative to a Virginia Charitable Remainder Inter Vivos Annuity Trust is the charitable gift annuity, which provides a fixed income while benefiting a charity. This option generally offers less administrative complexity, making it easier for you to manage. Another choice is a donor-advised fund, which allows for more control over charitable contributions while providing tax benefits, making it a suitable alternative for many.

Some downsides of a Virginia Charitable Remainder Inter Vivos Annuity Trust include the potential for higher costs related to legal fees, management expenses, and tax implications. You'll also face restrictions on contributions and withdrawals, which could limit your financial flexibility over time. Furthermore, if the trust does not meet IRS guidelines, it can result in unfavorable tax consequences.

The 10 percent rule for a Virginia Charitable Remainder Inter Vivos Annuity Trust stipulates that at least 10 percent of the trust's initial value must be allocated to the charity upon its termination. This requirement ensures that the charitable aspect of the trust is preserved while benefiting you during your lifetime. It also helps maintain the trust's tax-exempt status, providing additional advantages for your financial planning.

One disadvantage of a Virginia Charitable Remainder Inter Vivos Annuity Trust is the complexity involved in setting it up, which may require professional help. Additionally, you must adhere to specific regulations, adding to your responsibilities. Furthermore, once you've established this trust, you may have limited flexibility regarding changes or withdrawals, impacting your financial adaptability.

Yes, you are required to file an estate tax return in Virginia if the decedent's estate exceeds the exemption limit set by the state. The return provides details about the estate's total assets and liabilities. Filing is crucial for compliance and ensures that any obligations are met, even for estates associated with a Virginia Charitable Remainder Inter Vivos Annuity Trust. Always seek assistance to determine the necessary filings.

Setting up a charitable remainder trust involves several essential steps. First, you must define the terms of the trust, including the beneficiaries and any charitable organizations involved. Then, consult with a financial advisor or an attorney to draft the trust document according to state laws. This process can optimize your tax benefits while ensuring that your assets are directed towards a Virginia Charitable Remainder Inter Vivos Annuity Trust that aligns with your charitable goals.

VA Form 770 is a state tax form specifically for individuals and estates needing to report simple or complex income taxes. It serves as a means to declare income received, and both individual and joint filers can utilize it. Understanding this form is crucial for proper tax reporting and can affect the tax obligations connected to your Virginia Charitable Remainder Inter Vivos Annuity Trust.

A charitable remainder trust files Form 5227, which is the 'Split-Interest Trust Information Return.' This form provides the IRS with details about the trust's operations and distributions. It is essential to keep accurate records of all income and charitable contributions to ensure compliance. Properly managing your filings can help control taxes associated with your Virginia Charitable Remainder Inter Vivos Annuity Trust.

For Virginia state tax forms, the address depends on whether you are filing with or without payment. If you are submitting a payment, you should send it to the Virginia Department of Taxation. For returns without payments, there is a separate address designated for such filings. Always refer to the Virginia Department of Taxation's website for the latest mailing instructions to keep your records straight, especially in matters relating to the Virginia Charitable Remainder Inter Vivos Annuity Trust.

To mail a federal tax return for Virginia, you should send it to the appropriate address specified by the IRS. Generally, if you do not owe any tax, you can send it to the address listed for returns without payment. If you owe tax, make sure to check the IRS instructions for the correct address. This ensures your filing is processed efficiently, especially for trusts like the Virginia Charitable Remainder Inter Vivos Annuity Trust.