The Virginia Option to Purchase a Business is a legal agreement that provides a buyer with the exclusive right to buy a business within a specified timeframe at a predetermined price. Also referred to as an option agreement or a business purchase option, it allows potential buyers to secure the opportunity to purchase a business without committing to an immediate purchase. The Virginia Option to Purchase a Business is a valuable tool for both buyers and sellers. Buyers benefit from the ability to thoroughly evaluate the business before committing to its purchase. Sellers, on the other hand, can secure a potential buyer while still retaining control over the business until the option period ends. There are different types of Virginia Options to Purchase a Business, each with its own unique characteristics and purposes: 1. Standard Option Agreement: This type of option agreement is the most common and offers buyers the right, but not the obligation, to purchase the business. It typically includes details such as the purchase price, option period duration, and any specific terms or conditions. 2. Lease Option Agreement: In this type of option agreement, the buyer not only has an option to purchase the business but also to lease the property where the business operates. It provides an opportunity for buyers to test the business's profitability before committing to a complete purchase. 3. Right of First Refusal: A right of first refusal is similar to an option agreement, but it comes into effect when the business owner decides to sell. This type of agreement grants a potential buyer the first opportunity to purchase the business before the owner considers other offers. 4. Put Option Agreement: Unlike the previous types, a put option agreement gives the seller, rather than the buyer, the ability to force a sale. If certain predefined conditions are met, the seller can demand the buyer to purchase the business at the predetermined price, providing a valuable exit strategy for the seller. When entering into a Virginia Option to Purchase a Business, it is crucial to consult legal professionals to ensure all relevant details are included and the agreement aligns with the buyer's and seller's interests. This ensures a fair and transparent transaction process while protecting the rights and obligations of both parties.

Virginia Option to Purchase a Business

Description

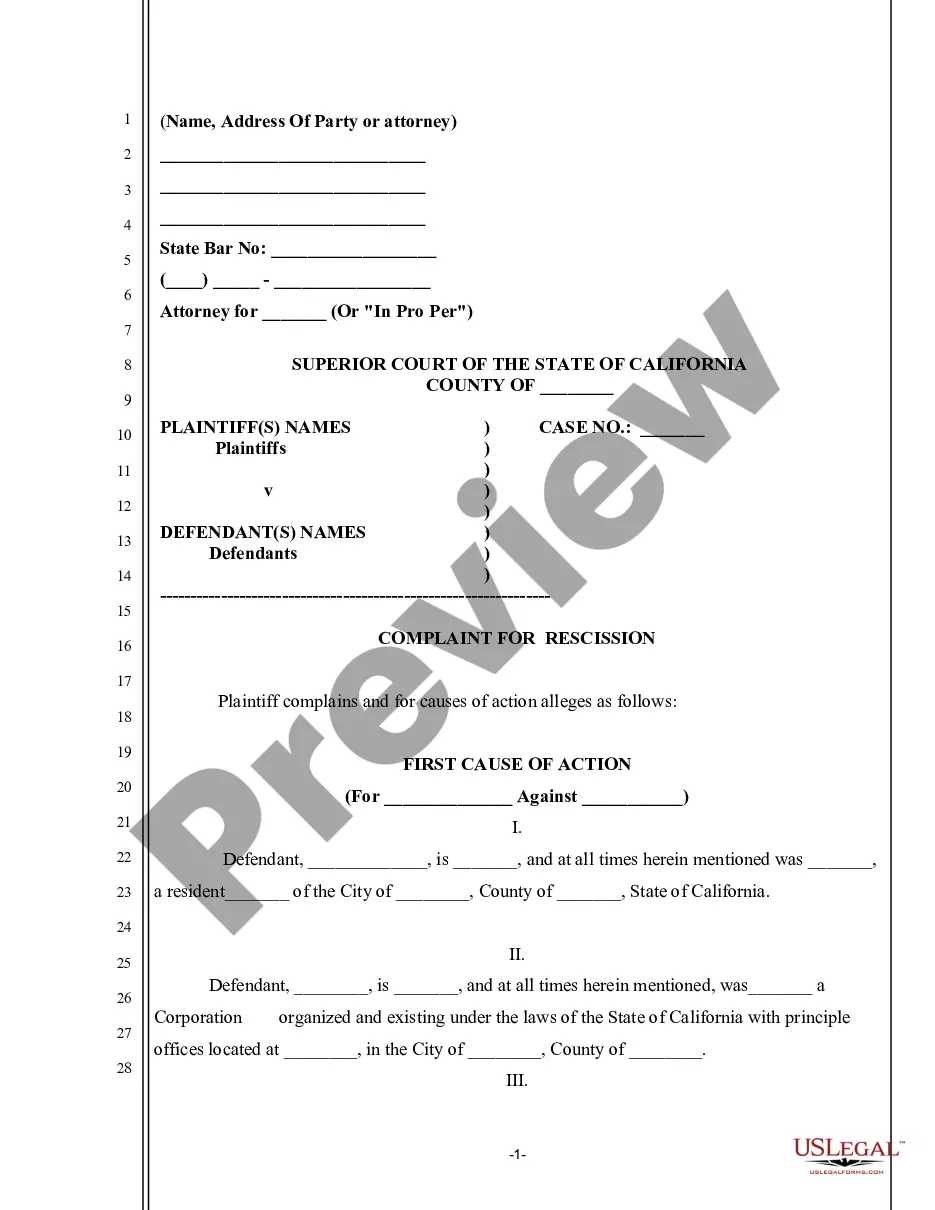

How to fill out Virginia Option To Purchase A Business?

US Legal Forms - one of the most important repositories of legal documents in the United States - offers a vast array of legal form templates that you can download or create.

By using the site, you will find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms like the Virginia Option to Purchase a Business within moments.

If you already have a subscription, Log In and download the Virginia Option to Purchase a Business from the US Legal Forms library. The Download button will appear on each template you browse.

Once you are satisfied with the form, confirm your selection by clicking the Acquire now button.

Then, select the payment plan you prefer and provide your details to sign up for an account. Complete the purchase. Use your credit card or PayPal account to finalize the transaction. Choose the format and download the form to your device.

You can make changes. Fill out, adjust, and print, and sign the obtained Virginia Option to Purchase a Business. Each template you add to your account has no expiration date and is yours indefinitely. So, if you wish to obtain or print an additional copy, simply navigate to the My documents section and click on the form you need.

Access the Virginia Option to Purchase a Business with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- To access all of the previously acquired forms, visit the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, below are simple instructions to get started.

- Ensure you have selected the correct form for your region/state.

- Click the Review button to examine the content of the form.

- Read the form description to ensure you have chosen the right one.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

Form popularity

FAQ

Credit Services Businesses under Virginia Code § 59.1-335.8: If you bought services to improve your credit, you have three days to cancel the services. To cancel the contract you should mail or deliver a signed and dated copy of the cancellation notice.

The fundamental difference between an Option and a Right of First Refusal is that an Option to Buy can be exercised at any time during the option period by the buyer. With a Right of First Refusal, the right of the potential buyer to complete the transaction is triggered only if the seller wants to complete a sale.

What Is An Option To Purchase? An option to purchase agreement gives a home buyer the exclusive right to purchase a property within a specified time period and for a fixed or sometimes variable price. This, in turn, prevents sellers from providing other parties with offers or selling to them within this time period.

There is a federal law (and similar laws in every state) allowing consumers to cancel contracts made with a door-to-door salesperson within three days of signing. The three-day period is called a "cooling off" period.

Unless a contract contains a specific rescission clause that grants the right for a party to cancel the contract within a certain amount of time, a party cannot back out of a contract once they have agreed and signed it.

A Virginia rent-to-own contract must adequately describe who will make repairs to and maintain the property during a lease. These responsibilities must be clearly outlined. If the consumer chooses to exercise a rent-to-own option instead of leasing, the consumer is responsible for repairs and maintenance.

An option- to-purchase agreement is an arrangement in which, for a fee, a tenant or investor acquires the right to purchase real property sometime in the future.

Under normal circumstances, if your purchase wasn't made in a retail establishment, you can use buyer's remorse, otherwise known as a right of rescission, to get out of the contract.

You may cancel this contract, without any penalty or obligation, at any time prior to midnight of the third business day after the date the contract is signed. If you cancel, any payment made by you under this contract will be returned within ten days following receipt by the seller of your cancellation notice.

Interesting Questions

More info

“ This status allows nonprofit corporations to retain all ownership and management, but only to do their regular, day-to-day work and do not engage in any of the business or financial activity of a business (other than as an employee). The franchisee must keep the franchise in good condition and must give 30 days' notice in writing unless granted a special permission.