A Virginia Shareholder Agreement to Sell Stock to Other Shareholder is a legally binding contract that establishes the terms and conditions for the sale of stock from one shareholder to another within a Virginia-based corporation. This agreement outlines the rights and obligations of both parties involved in the transaction, ensuring a smooth and transparent transfer of ownership. In essence, the Virginia Shareholder Agreement to Sell Stock to Other Shareholder outlines the key aspects of the stock sale, ranging from the agreed-upon sale price to any conditions or warranties associated with the shares being sold. Additionally, it addresses matters such as the timing of the sale, payment terms, and dispute resolution mechanisms. There are different types of Virginia Shareholder Agreements to Sell Stock to Other Shareholder, each tailored to diverse situations and circumstances. Here are a few common variations: 1. Virginia Stock Redemption Agreement: This type of agreement establishes a mechanism for the corporation itself to buy back shares from a shareholder. It usually includes provisions for the purchase price, payment terms, and any restrictions or limitations on the sale. 2. Virginia Stock Purchase Agreement: Unlike the Stock Redemption Agreement, a Stock Purchase Agreement allows one shareholder to sell their shares directly to another shareholder rather than the corporation itself. This agreement ensures a direct transfer of ownership and may include provisions for the transfer of other shareholder rights, such as voting or dividend rights. 3. Virginia Right of First Refusal Agreement: This agreement grants existing shareholders the right to purchase any shares that a selling shareholder intends to sell before they can be offered to outside parties. It aims to maintain control within the existing shareholder group and prevents unwanted outside influence. 4. Virginia Buy-Sell Agreement: In situations where shareholders wish to address potential future events, such as death, disability, retirement, or disagreement, a Buy-Sell Agreement may be used. This agreement outlines the predetermined terms and conditions for the sale of shares in the event of certain triggering events, ensuring a smooth transition and protecting the interests of the remaining shareholders. It is crucial for shareholders to consult legal experts familiar with Virginia corporate law when drafting or entering into a Shareholder Agreement to Sell Stock to Other Shareholder. This can help ensure that the agreement aligns with the specific needs and requirements of both parties and complies with applicable state laws.

Virginia Shareholder Agreement to Sell Stock to Other Shareholder

Description

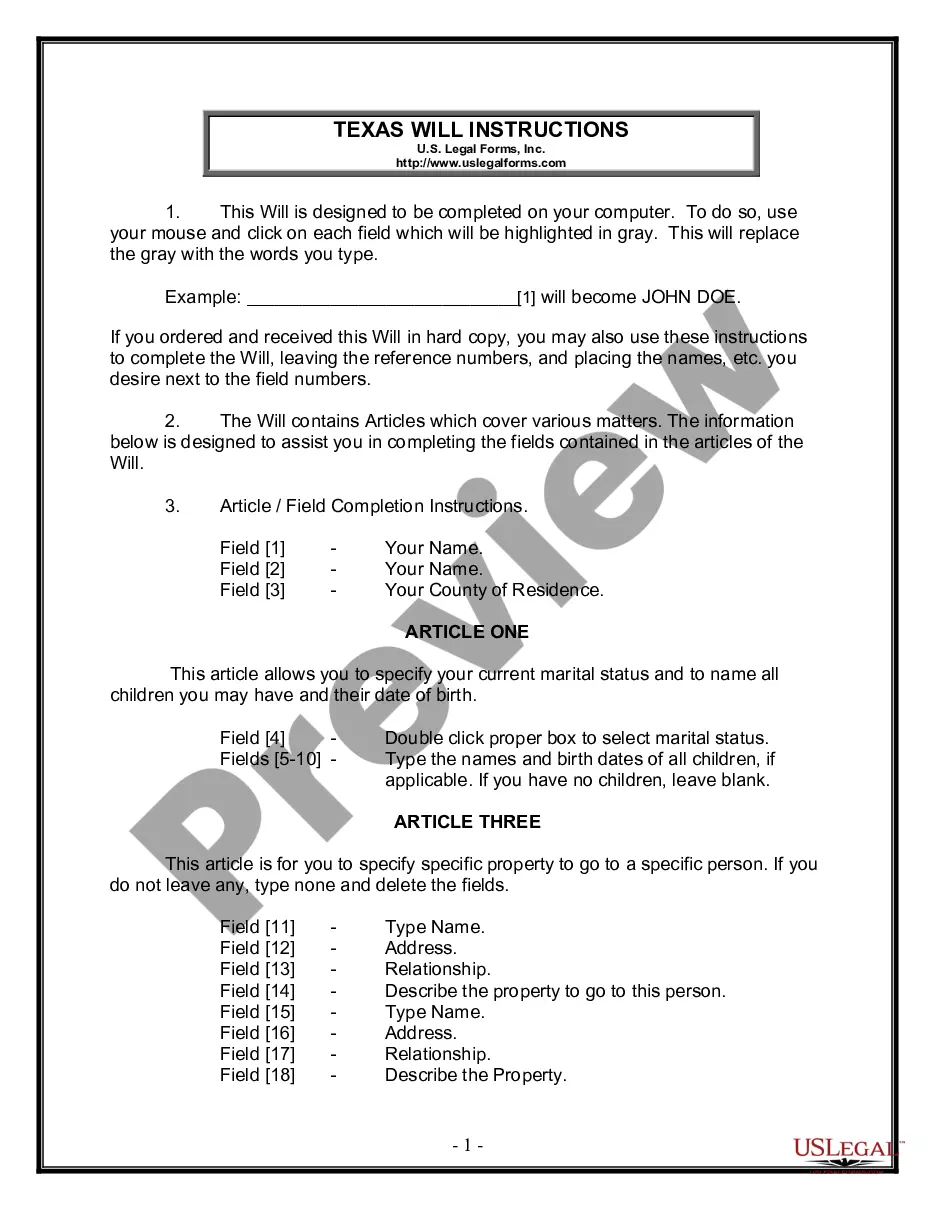

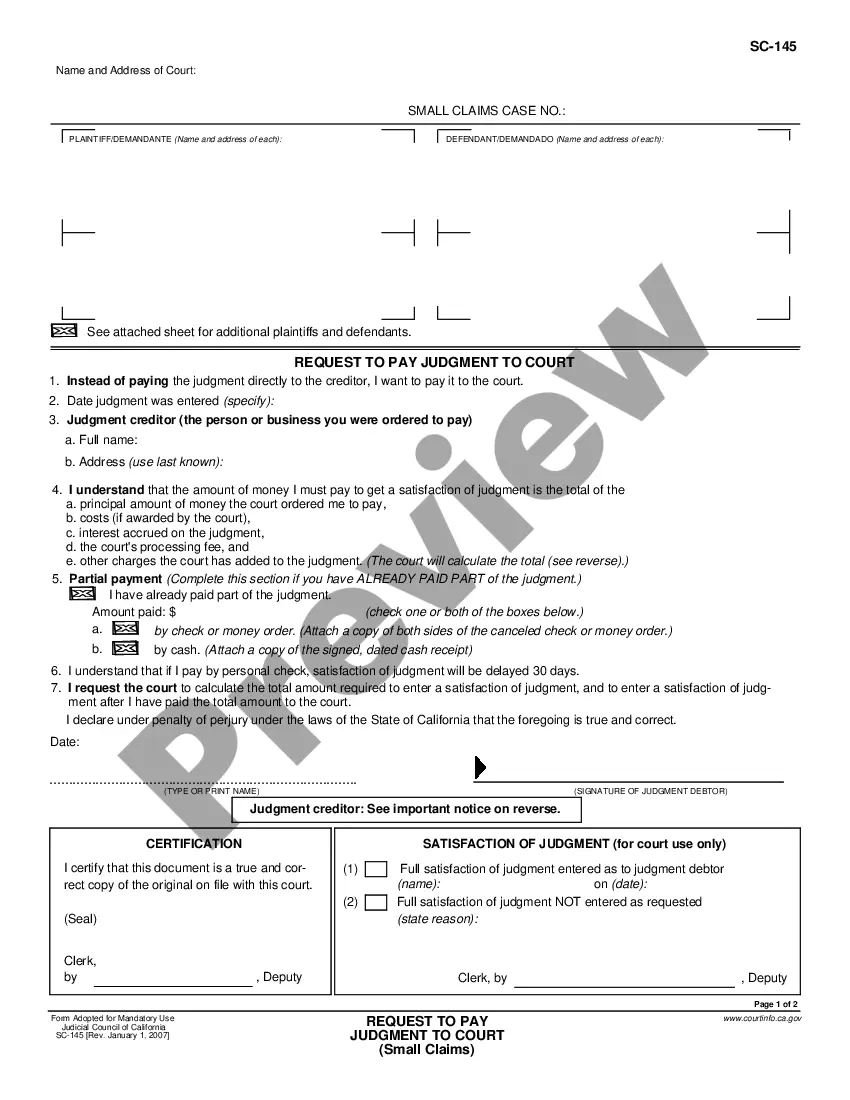

How to fill out Virginia Shareholder Agreement To Sell Stock To Other Shareholder?

You can invest hours online searching for the sanctioned document template that fulfills the federal and state requirements you have.

US Legal Forms offers a vast selection of legal forms that are verified by experts.

It is easy to download or print the Virginia Shareholder Agreement to Sell Stock to Other Shareholder from our platform.

Utilize the Preview button to review the document template as well, if available.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Virginia Shareholder Agreement to Sell Stock to Other Shareholder.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of any acquired form, go to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/area of your choice.

- Review the form description to confirm you have chosen the right template.

Form popularity

FAQ

To establish a Virginia Shareholder Agreement to Sell Stock to Other Shareholder, consult with legal professionals to ensure compliance with state laws. Begin with discussions among all shareholders to address their needs and expectations. Once you draft the agreement, all parties should review and sign it, ensuring clarity and mutual agreement on all terms.

To structure a Virginia Shareholder Agreement to Sell Stock to Other Shareholder, start by identifying the parties involved and their respective shares. Next, include terms regarding share valuation, transfer restrictions, and payment terms. Additionally, integrate sections on management decisions, exit strategies, and dispute resolution to create a comprehensive and effective agreement.

Typically, you cannot force a shareholder to sell their shares in a Virginia Shareholder Agreement to Sell Stock to Other Shareholder unless specific conditions are met. These conditions might include breaches of agreement terms or bankruptcy. It's vital to outline these scenarios within the agreement to manage expectations and provide a clear framework for addressing such situations.

A Virginia Shareholder Agreement to Sell Stock to Other Shareholder needs to clearly outline the rights and obligations of each shareholder. It should specify how shares are valued, the procedures for selling shares, and the conditions under which shareholders can sell their stock. Including provisions for dispute resolution and changes in ownership will help prevent conflicts in the future.

VA Code 13.1 724 provides details on the rights of limited liability companies in Virginia, particularly concerning the transfer of membership interests. While primarily pertinent to LLCs, the principles can influence shareholders in corporations as well. A well-crafted Virginia Shareholder Agreement to Sell Stock to Other Shareholder will incorporate elements of this code to protect all shareholders' rights during stock sales.

VA Code 13.1 742 addresses the powers and duties of the board of directors concerning share transfers. This code plays a crucial role in a Virginia Shareholder Agreement to Sell Stock to Other Shareholder by outlining the approvals required for such transactions. Understanding these provisions is vital for shareholders seeking to sell their shares, ensuring all actions comply with corporate governance.

Yes, a shareholder can sell their shares to another shareholder, provided that the sale complies with the company's bylaws and any relevant agreements. A Virginia Shareholder Agreement to Sell Stock to Other Shareholder often includes specific provisions on how such transactions should be handled, ensuring a smooth process. This structure safeguards all parties and promotes transparency during the transfer.

A shareholder agreement generally outlines all the terms between the shareholders regarding the management and operation of the corporation. In contrast, a buy-sell agreement specifically focuses on the conditions under which shares can be sold, including the rights of first refusal among shareholders. When discussing a Virginia Shareholder Agreement to Sell Stock to Other Shareholder, it is essential to recognize these distinctions to ensure proper governance and smooth transitions of stock ownership.

VA Code 13.1 758 addresses the procedures for transferring shares in Virginia corporations. This provision is particularly important during the execution of a Virginia Shareholder Agreement to Sell Stock to Other Shareholder, as it provides guidelines for handling transfers and potential disputes. Understanding this code helps shareholders navigate the complexities of ownership changes effectively.

The VA Code 13.1 746 pertains to the rights and obligations of shareholders within a corporation in Virginia. This code outlines the rules concerning the transfer of shares, especially regarding how shareholders may sell their stock to other shareholders. In the context of a Virginia Shareholder Agreement to Sell Stock to Other Shareholder, this code serves as a foundation for ensuring compliance and protecting the interests of all parties involved.

Interesting Questions

More info

Further, I further agree to the terms and conditions of an amended share transfer agreement between my Tumor Municipality, the Board of Directors of CARE DIE MACHINE, CARE DIE MACHINE and its affiliates, and Tumor Municipality that is hereby set forth below: Subject to the terms and conditions herein, CARE DIE MACHINE will issue and transfer to TUMOR MUNICIPALITY a total of (I) 100,000 shares of Common Stock of CARE DIE MACHINE, as described below, (II) 20,000 shares of Common Stock of CARE DIE MACHINE and its affiliates, (III) a non-recourse promissory note from CARE DIE MACHINE as security for my obligations in this Agreement, (IV) 200,000 shares of Common Stock of TUMOR MUNICIPAL, (V) 5,000 shares of Common Stock of CARE DIE MACHINE for TUMOR MUNICIPAL, (VI) 200 shares of Common Stock and (VII) 20 shares of Common Stock of CARE DIE MACHINE for the Carpe Diem Group (defined below) which CARE DIE MACHINE will pay in cash for each such share of Common Stock so issued by Tumor