Virginia Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser

Description

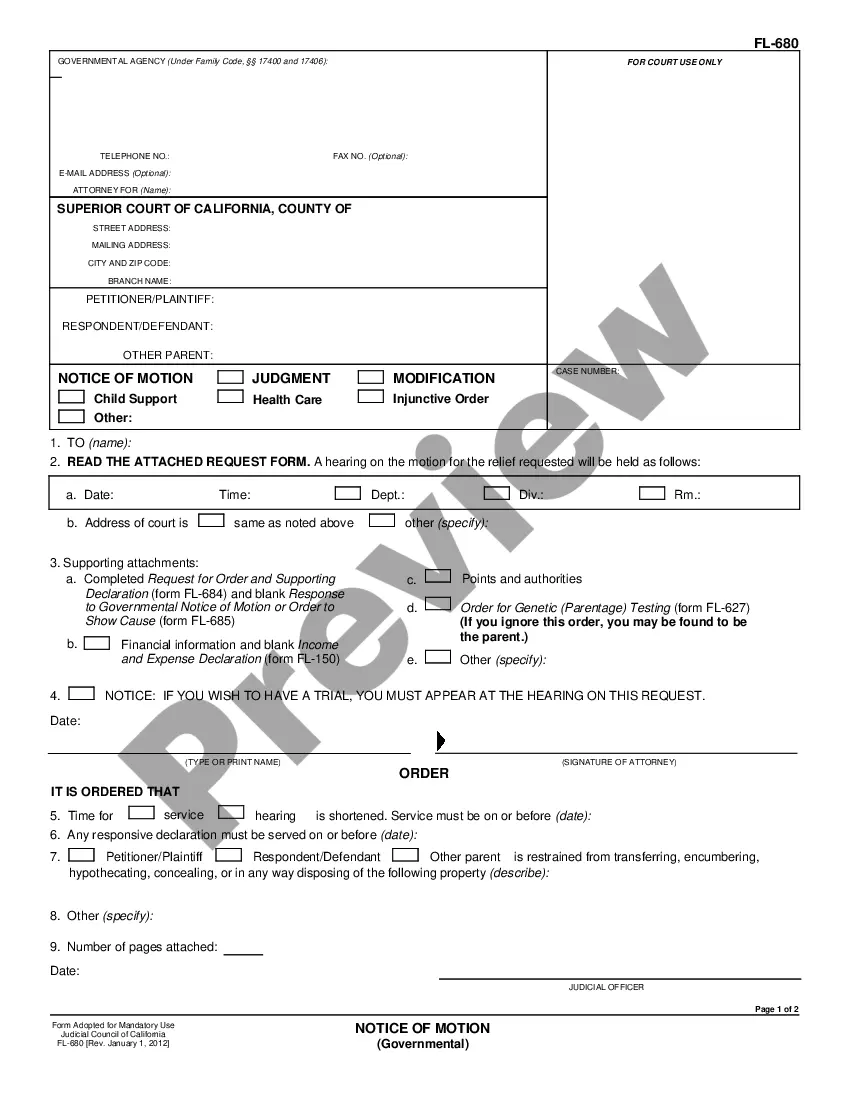

How to fill out Stock Sale And Purchase Agreement - Sale Of Corporation And All Stock To Purchaser?

If you need to download, acquire, or print legal document templates, utilize US Legal Forms, the premier collection of legal forms, accessible online.

Employ the site’s simple and convenient search feature to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click on the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to find the Virginia Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser in just a few clicks.

- If you are an existing US Legal Forms customer, Log In to your account and click on the Get button to obtain the Virginia Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser.

- You can also access forms you’ve previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have selected the form for the correct area/state.

- Step 2. Use the Preview option to review the form’s content.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find alternate forms of the legal template.

Form popularity

FAQ

To register an S Corporation in Virginia, you start by incorporating your business by filing Articles of Incorporation with the State Corporation Commission. After your corporation is approved, you must file Form 2553 with the IRS to elect S Corporation status. It can be beneficial to seek assistance from a legal service or platform like US Legal Forms to ensure you cover all necessary steps accurately and efficiently.

If you operate a foreign business in Virginia, you must register it to comply with state laws. This registration process allows your business to legally conduct operations within the state and protects your interests. It’s important to consult a legal professional familiar with Virginia's regulations to navigate this process smoothly. Utilizing resources like the US Legal Forms platform can streamline registration and related paperwork.

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.

A stock purchase agreement (SPA) is the contract that two parties, the buyers and the company or shareholders, written consent is required by law when shares of the company are being bought or sold for any dollar amount. In a stock deal, the buyer purchases shares directly from the shareholder.

Purchased Assets and Excluded Assets This can manifest in the agreement in one of two ways - the agreement can list only the assets that the buyer will choose to purchase, or an agreement can state that the buyer will purchase all the assets of the business, excluding certain listed assets.

In a stock purchase, the buyer purchases the entire company, including all assets and liabilities.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

The key provisions detail the terms of the transaction: the number and type of stock sold (i.e. common, preferred) the purchase price. when the transaction will take place.

What's Included In A Purchase And Sale Agreement?Purchase Price. One major purpose of the PSA is to establish an agreed-upon sale price in writing between the buyer and the seller.Earnest Money Details.Closing Date.Title Insurance Company Details.Title Condition.Escrow Company.Contingencies.Addendum.

First and foremost, a purchase agreement must outline the property at stake. It should include the exact address of the property and a clear legal description. Additionally, the contract should include the identity of the seller and the buyer or buyers.