Title: Virginia Letter to Creditors Notifying Them of Identity Theft — A Comprehensive Guide Description: If you've fallen victim to identity theft in Virginia, it's crucial to take immediate action to protect your financial well-being. A Virginia Letter to Creditors notifying them of identity theft is an essential step in the process. This article will provide you with a detailed description of what a Virginia Identity Theft Letter to Creditors entails, along with relevant keywords for better understanding. Key Points: 1. Understanding Virginia's Identity Theft Laws: — Familiarize yourself with Virginia's legal framework surrounding identity theft to gain a comprehensive understanding of your rights and responsibilities when addressing the issue. 2. Importance of a Letter to Creditors: — One of the first steps in combating identity theft is notifying your creditors about the fraudulent activity. A Virginia Letter to Creditors serves as a formal notification, urging them to take immediate action in safeguarding your accounts and preventing further damage. 3. Contents of the Virginia Letter to Creditors: — Be sure to include key elements in your letter such as your personal information, nature of the identity theft incident, a detailed description of the fraudulent accounts, and any supporting documentation you might have. 4. Relevant Keywords: — Virginia identity theft letter to creditors — Virginia identity theft law— - Virginia fraud reporting — Reporting identity thefVirginianni— - Virginia credit reporting agencies — Virginia police report for identity theft — Identity theft victim rights in Virginia — Virginia credireprocesseses— - Virginia identity theft affidavit — Virginia consumer protection laws Types of Virginia Letters to Creditors Notifying Them of Identity Theft: 1. Initial Notification Letter: — This letter is sent to creditors soon after discovering the identity theft incident, aiming to inform them immediately and request immediate action. 2. Fraudulent Account Dispute Letter: — If you have already identified specific fraudulent accounts, you can send a letter to the respective creditors, providing detailed evidence and requesting the accounts be closed or frozen. 3. Follow-up and Documentation Letter: — This letter is sent to creditors as a follow-up to previous notifications, providing additional information, updating them on the progress of the investigation, and attaching supporting documents when available. Remember, dealing with identity theft requires prompt action. Always consult legal professionals or credit counseling agencies for accurate guidance based on your specific circumstances. Stay informed and act swiftly to protect your financial well-being in the face of identity theft in Virginia.

Virginia Letter to Creditors notifying them of Identity Theft

Description

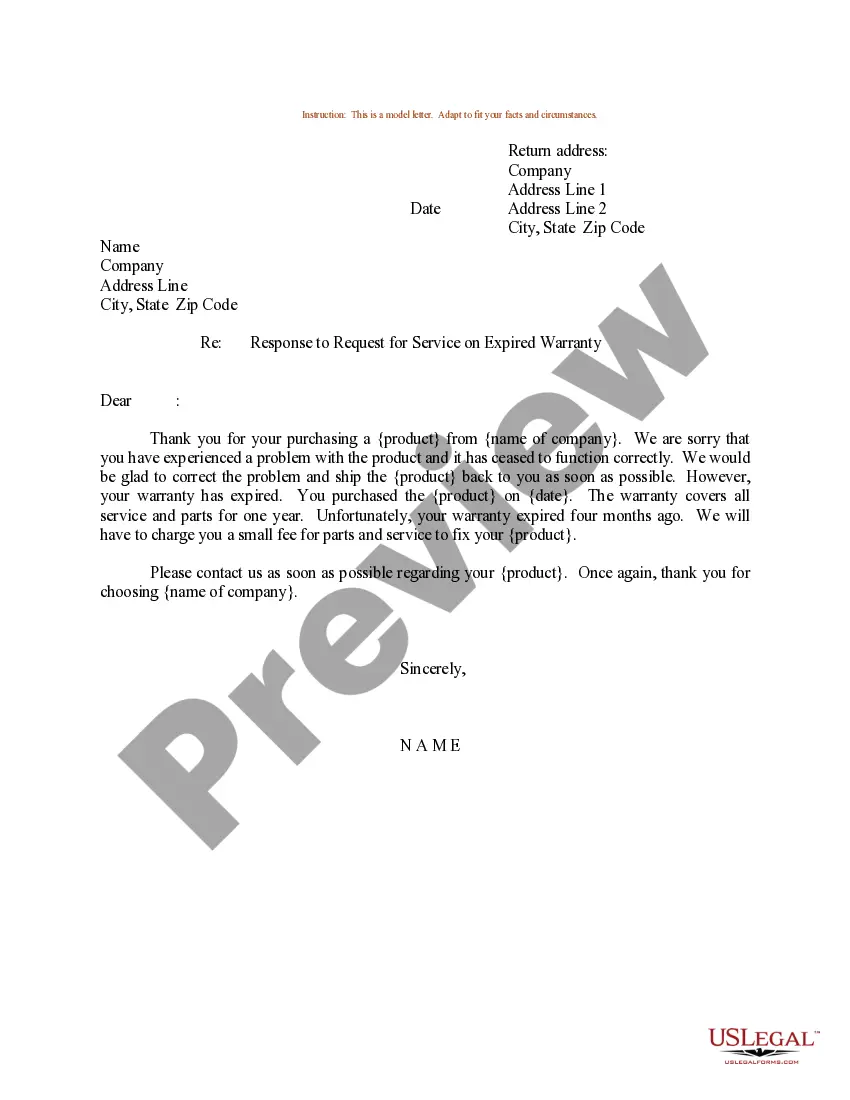

How to fill out Virginia Letter To Creditors Notifying Them Of Identity Theft?

You may spend hrs on the web trying to find the authorized record template that fits the federal and state needs you need. US Legal Forms offers a huge number of authorized kinds that are examined by experts. You can easily down load or print the Virginia Letter to Creditors notifying them of Identity Theft from our assistance.

If you already have a US Legal Forms account, you can log in and then click the Down load key. Afterward, you can comprehensive, change, print, or signal the Virginia Letter to Creditors notifying them of Identity Theft. Each authorized record template you acquire is the one you have eternally. To acquire yet another version for any obtained develop, visit the My Forms tab and then click the corresponding key.

If you work with the US Legal Forms internet site initially, keep to the basic guidelines under:

- Very first, make certain you have chosen the best record template to the region/town of your choice. Look at the develop description to make sure you have chosen the correct develop. If readily available, utilize the Preview key to look with the record template also.

- If you would like locate yet another variation of the develop, utilize the Research area to discover the template that suits you and needs.

- Once you have located the template you desire, click on Get now to carry on.

- Find the prices program you desire, type your credentials, and register for a free account on US Legal Forms.

- Complete the deal. You can utilize your Visa or Mastercard or PayPal account to purchase the authorized develop.

- Find the format of the record and down load it in your system.

- Make alterations in your record if possible. You may comprehensive, change and signal and print Virginia Letter to Creditors notifying them of Identity Theft.

Down load and print a huge number of record themes making use of the US Legal Forms website, that offers the biggest collection of authorized kinds. Use skilled and condition-distinct themes to tackle your company or person demands.

Form popularity

FAQ

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

Contact your local police or sheriff's department and file a criminal complaint. If you fall victim to identity theft while using the Internet, you should file a report with the Internet Crime Complaint Center (IC3). Request an Identity Theft Passport from the Office of the Attorney General.

Punishment for Identity Fraud in Virginia Identity fraud is a Class 1 misdemeanor with a penalty of up to 12 months in jail and a fine of up to $2,500. If the financial loss caused by the identity fraud is $500 or more, then it is a Class 6 felony punishable by up to five years in prison.

The Passport is designed to serve as notification to help protect victims from unlawful detention or arrest for crimes committed by another under a stolen identity. All applications must be submitted in person or by mail and will be acted upon promptly.

Penalties for Identity Theft in Virginia Identity theft is a Class 1 misdemeanor. However, if the identity theft results in financial loss of $1000 or more, identity theft is a Class 6 felony. As a misdemeanor, identity theft is punishable by up to 12 months in jail and a fine of up to $2,500.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. ... The fraud department at your credit card issuers, bank, and other places where you have accounts.

File a complaint with the Federal Trade Commission at 877-ID-THEFT (877-438- 4338). Apply for an Identity Theft Passport from the Virginia Office of the Attorney General after you have filed a police report, or obtained a court order expunging a record because of an identity crime.