Virginia Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate

Description

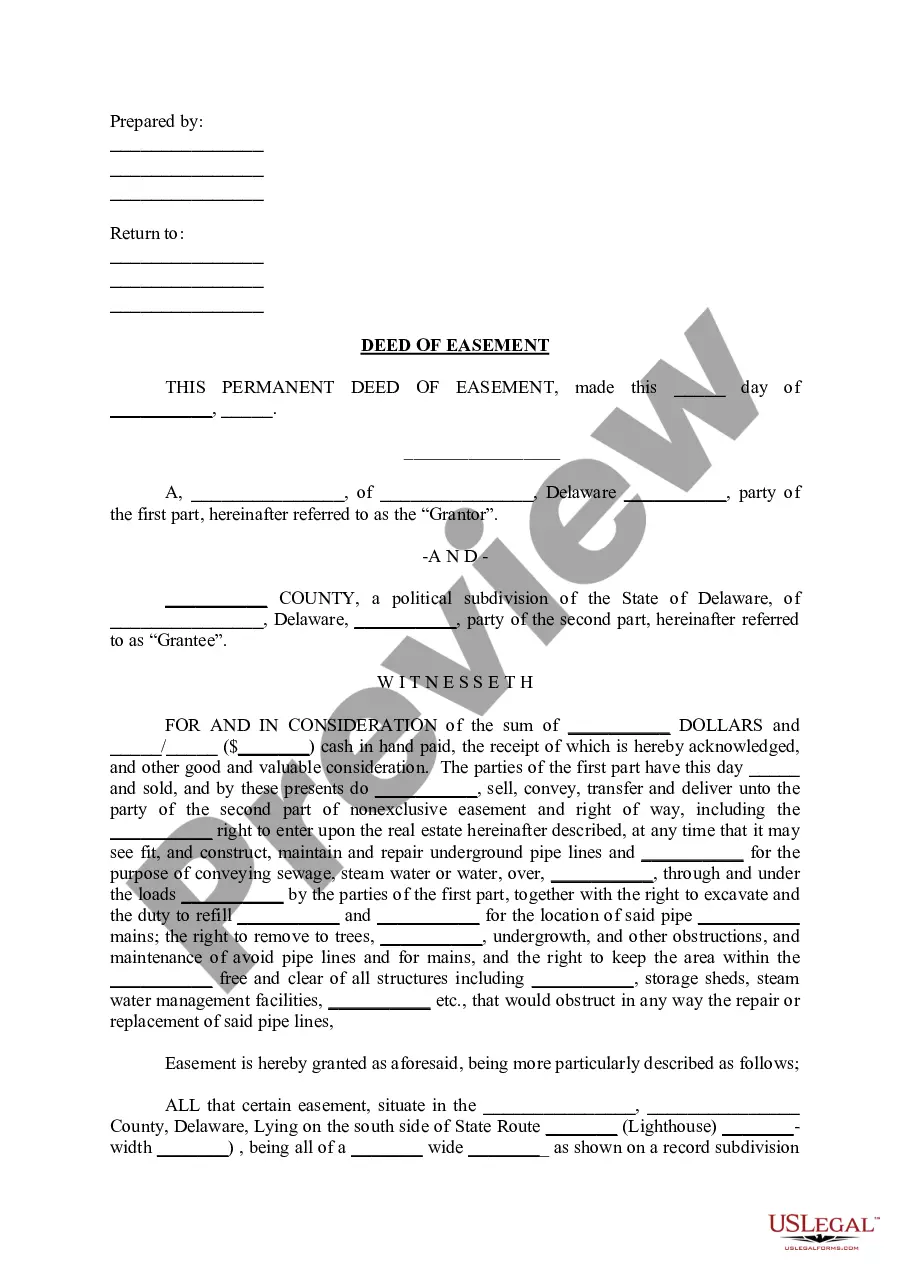

How to fill out Lease Of Retail Store With Additional Rent Based On Percentage Of Gross Receipts - Real Estate?

You might spend multiple hours online trying to locate the official document template that meets the federal and state regulations you need. US Legal Forms offers a vast collection of legal forms that can be analyzed by experts.

It is easy to obtain or generate the Virginia Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate through my service.

If you already possess a US Legal Forms account, you can Log In and then hit the Download button. After that, you can complete, edit, print, or sign the Virginia Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. Each legal document template you buy is yours indefinitely.

Complete the transaction. You may use your credit card or PayPal account to acquire the legal form. Select the format of the document and download it to your system. Make adjustments to your document if necessary. You can complete, edit, sign, and print the Virginia Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. Download and print numerous document templates using the US Legal Forms website, which provides the largest variety of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- To obtain an additional copy of any purchased form, navigate to the My documents tab and click on the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/city of your choice. Review the form description to verify you have chosen the appropriate form.

- If available, use the Preview button to review the document template as well.

- If you wish to find another version of the form, utilize the Search field to locate the template that satisfies your needs.

- Once you have found the template you want, click on Buy now to proceed.

- Choose the pricing plan you prefer, enter your details, and register for an account on US Legal Forms.

Form popularity

FAQ

The formula to calculate rental fees in a percentage rent lease involves adding the base rent to the percentage rent amount. You first calculate the percentage rent by multiplying gross receipts by the agreed percentage rate, then sum this with the base rent. Utilizing tools available on platforms like uslegalforms can help simplify the management of a Virginia Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate.

Percentage rent can be calculated by taking the gross sales of the retail store and multiplying it by the agreed percentage rate. After this calculation, you add the base rent amount to determine the total rent due. For anyone involved in a Virginia Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, clear calculations help avoid disputes and ensure transparency.

To calculate the lease percentage, divide the additional rent by the gross sales, then multiply by 100 to get a percentage figure. This calculation is essential to determine how much extra rent is due based on sales performance. In a Virginia Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, calculating lease percentages accurately can enhance financial planning.

A breakpoint in a lease refers to the sales threshold a tenant must reach before they start paying percentage rent. It establishes a clear starting point, ensuring the tenant only pays additional rent after achieving certain sales. In a Virginia Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, understanding breakpoints helps tenants budget accordingly.

Calculating a percentage involves determining the portion of a whole. For example, to find out how much 10% of a retail store's revenue is, you can multiply the total revenue by 0.10. If you are managing a Virginia Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, precise percentage calculations ensure both parties understand the financial terms.

A percentage rent deal is an agreement where the tenant pays a base rent plus an additional amount based on a percentage of their gross sales. This type of arrangement is common in retail leases, as it aligns the interests of both the landlord and tenant. For those exploring a Virginia Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, this model allows for greater flexibility and potential higher profitability.

The formula for the percentage of agreement typically refers to the terms outlined in your lease that specify the conditions for additional rent. In the case of the Virginia Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, this may involve determining the percentage of gross receipts after reaching the breakpoint. Clear documentation in the lease agreement is crucial for both parties' understanding.

The formula for a percentage lease generally includes the base rent plus a percentage of gross receipts exceeding a certain threshold. For the Virginia Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, ensure you document the percentages and thresholds clearly in your lease agreement. This helps maintain clarity in financial responsibilities.

To calculate the leased percentage, divide the gross receipts of the leased property by the total potential gross receipts. For those involved in the Virginia Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, keeping track of your performance against this percentage is vital for financial insights and future planning.

The lease factor percentage is the rate at which additional rent is calculated based on gross receipts. Specific to the Virginia Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, this percentage is predetermined in the lease contract. This ensures fair compensation for landlords while allowing tenants to manage costs effectively.