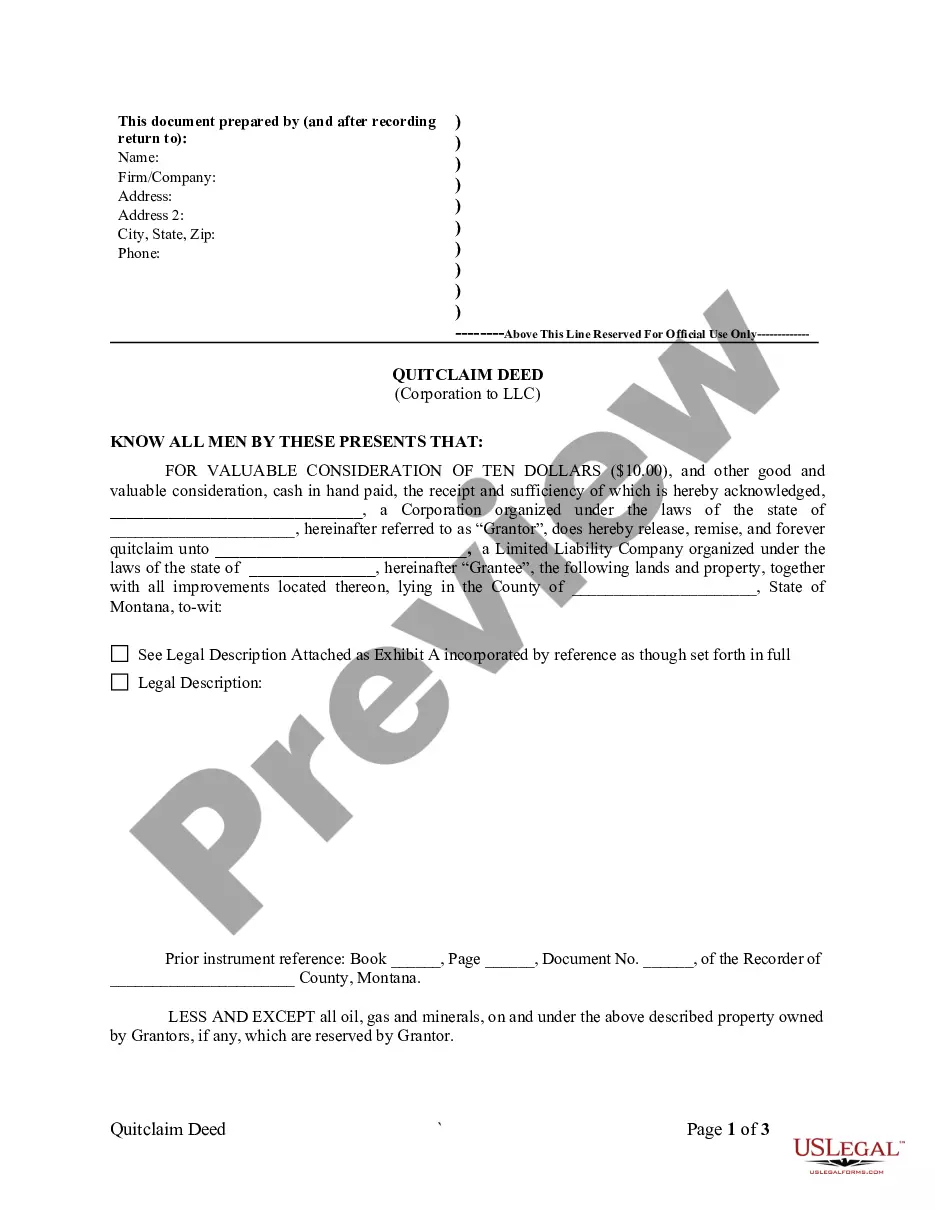

This form assumes that no registration statement or report is required to be filed with the secretary of state in which the LLC's are located or with the Securities and Exchange Commission and further assumes that no approval of either agency is necessary.

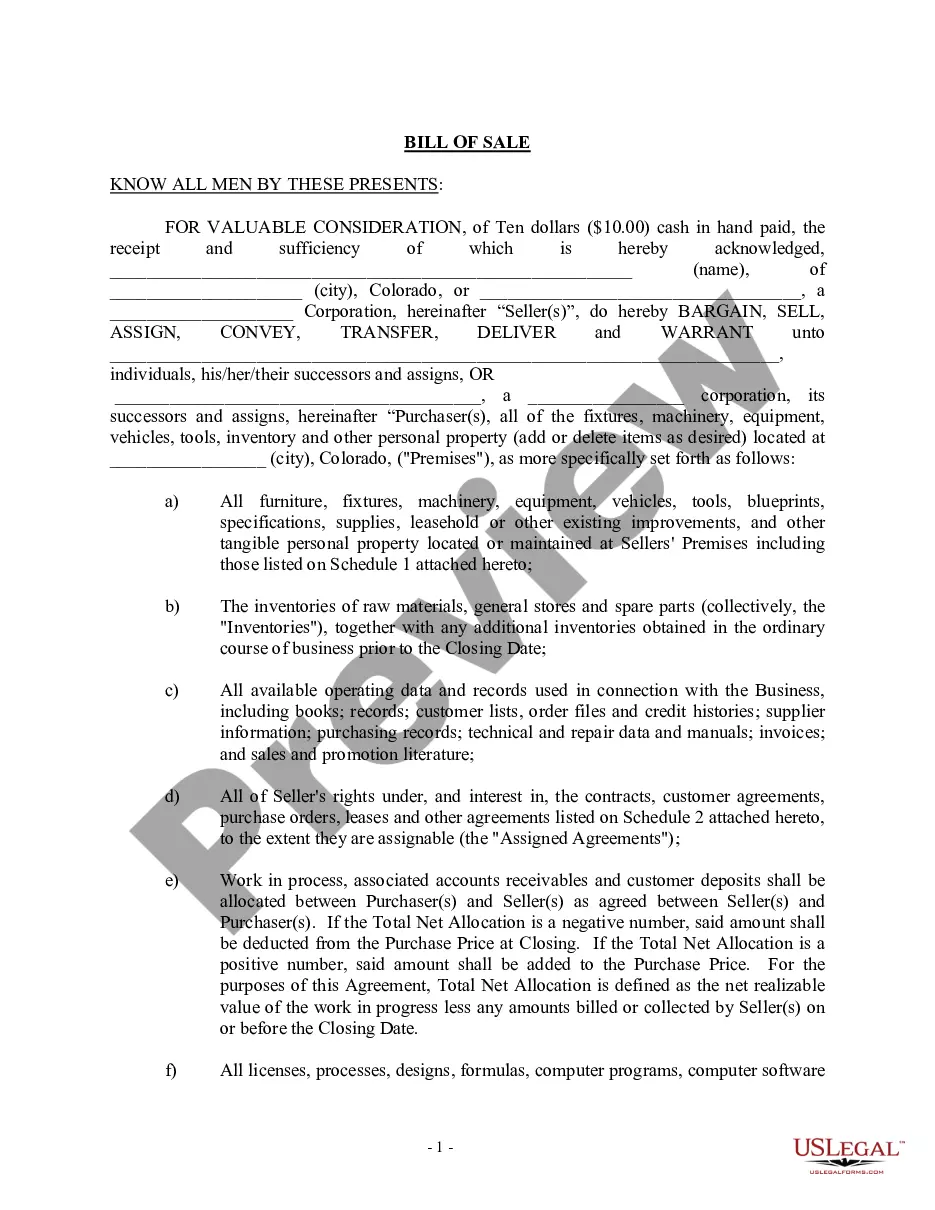

The Virginia Agreement for Sale of all Rights, Title and Interest in Limited Liability Company for Membership Units in another Limited Liability Company along with Assignment of Membership Units is a legal document that allows for the transfer of ownership of membership units from one limited liability company (LLC) to another. This agreement involves the sale of all rights, title, and interest in the LLC, including its assets and liabilities. Keywords: Virginia Agreement, Sale of all Rights, Title and Interest, Limited Liability Company, Membership Units, Assignment, Transfer of Ownership, Assets and Liabilities. There are different types of Virginia Agreement for Sale of all Rights, Title and Interest in Limited Liability Company for Membership Units in another Limited Liability Company along with Assignment of Membership Units, and they include: 1. General Agreement for Sale of all Rights, Title and Interest: This type of agreement encompasses the overall transfer of ownership of an LLC, including all its rights, title, and interest in membership units, along with the assignment of those units. 2. Specific Agreement for Sale of Membership Units: This agreement is used when only a specific portion or number of membership units in an LLC are being sold or assigned to another LLC. It details the terms and conditions specific to the sale and assignment of those particular units. 3. Partial Assignment Agreement: This type of agreement is used when only a portion of an LLC's rights, title, and interest in membership units are being transferred to another LLC. It involves assigning a specific percentage or fraction of the membership units to the acquiring LLC. 4. Assumption Agreement: An assumption agreement is often used in conjunction with the sale and assignment of membership units. It outlines the acquiring LLC's agreement to assume the assets, liabilities, and obligations of the selling LLC, connected to the membership units being transferred. These various types of agreements provide flexibility, allowing LLC owners to determine the extent and nature of the sale and assignment of membership units according to their specific needs and requirements. It is strongly advised to consult with legal professionals or seek legal advice when drafting or executing any of these agreements, as they involve complex legal considerations.