The Virginia Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage is a legally binding contract used when a sole proprietor wants to sell their retail store, including its goods and fixtures, to another party. This agreement outlines the terms and conditions of the sale, including the cost of goods based on the original invoice and an additional percentage. Keywords: Virginia, agreement for sale, retail store, sole proprietorship, goods, fixtures, invoice cost, percentage. Types of Virginia Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage: 1. Basic Agreement: This type of agreement covers the essential terms of the sale, including the identification of the parties involved, the date of the transaction, a detailed description of the retail store, goods, and fixtures being sold, the invoice cost of the goods, and the agreed-upon percentage to be added. 2. Inventory and Fixture List: This variation of the agreement includes a comprehensive list of all the goods and fixtures included in the sale. The list can cover items such as inventory, display shelves, furniture, signage, and any other essential elements of the retail store. 3. Seller Financing Agreement: In some cases, the seller may provide financing options to the buyer. This type of agreement outlines the terms and conditions related to financing, including the down payment, interest rates, installment schedule, and any collateral required. 4. Lease Assignment Agreement: If the retail store is leased rather than owned by the sole proprietor, a lease assignment agreement may be necessary. This agreement allows the buyer to assume the lease agreement with the landlord, ensuring the continuity of the business in the same location. 5. Non-Compete Agreement: To protect the seller's interests, a non-compete agreement may be included. This agreement prohibits the seller from engaging in similar retail business activities within a specified geographic area and timeframe. 6. Bill of Sale: A bill of sale is typically attached to the agreement to provide a comprehensive list of the goods and fixtures being sold. It includes specific details such as the item descriptions, quantities, prices, and conditions. It is important to consult with legal professionals to ensure that the agreement aligns with Virginia's laws and covers all necessary aspects of the sale process.

Virginia Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage

Description

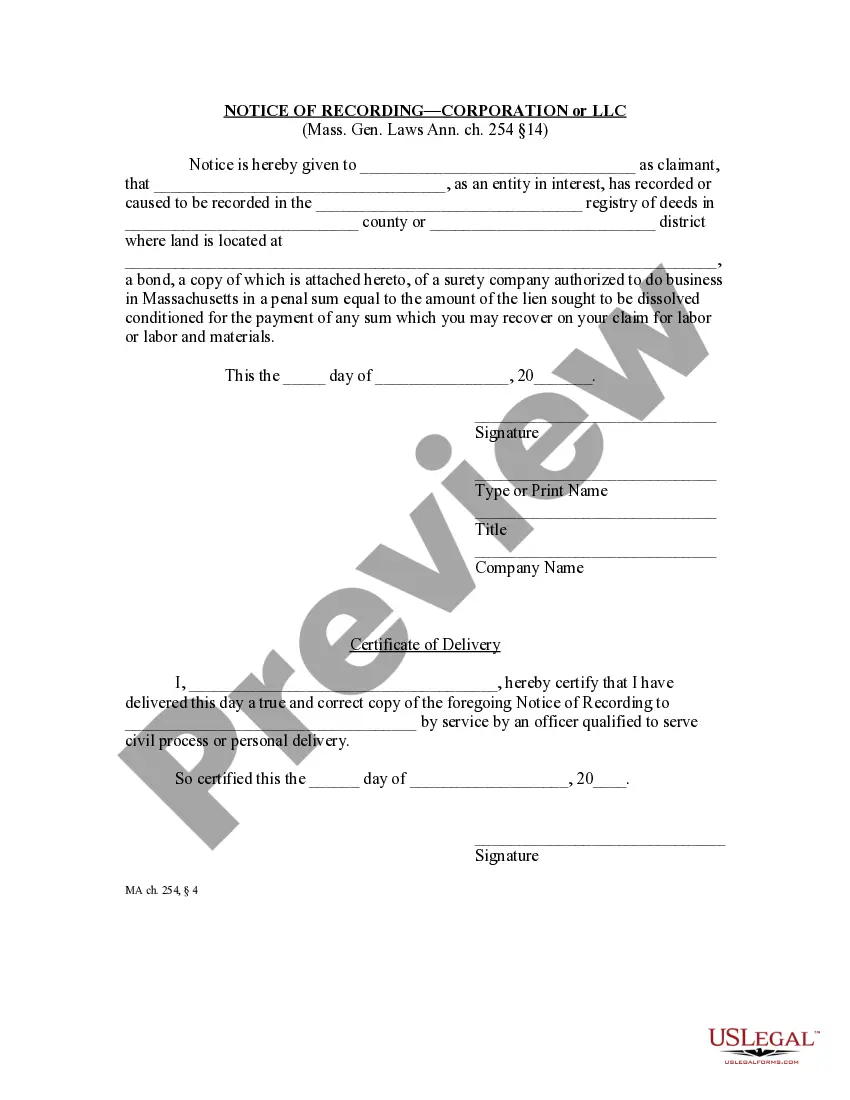

How to fill out Virginia Agreement For Sale Of Retail Store By Sole Proprietorship With Goods And Fixtures At Invoice Cost Plus Percentage?

Choosing the right legitimate file web template might be a struggle. Needless to say, there are a variety of web templates accessible on the Internet, but how will you get the legitimate type you will need? Make use of the US Legal Forms internet site. The service gives a large number of web templates, such as the Virginia Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage, which you can use for organization and private requirements. All the varieties are examined by professionals and meet federal and state needs.

In case you are currently registered, log in to your accounts and click on the Download option to have the Virginia Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage. Use your accounts to check through the legitimate varieties you have ordered previously. Go to the My Forms tab of your own accounts and get an additional copy in the file you will need.

In case you are a whole new user of US Legal Forms, allow me to share basic guidelines that you should follow:

- Initially, be sure you have selected the correct type for your personal metropolis/region. You are able to look over the shape while using Review option and read the shape description to ensure it will be the right one for you.

- When the type fails to meet your expectations, use the Seach field to find the correct type.

- When you are sure that the shape is proper, select the Buy now option to have the type.

- Pick the prices prepare you desire and enter in the essential details. Build your accounts and buy an order making use of your PayPal accounts or Visa or Mastercard.

- Select the data file file format and obtain the legitimate file web template to your gadget.

- Comprehensive, revise and produce and indication the obtained Virginia Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage.

US Legal Forms may be the most significant catalogue of legitimate varieties that you can find a variety of file web templates. Make use of the company to obtain professionally-created files that follow state needs.