The word tender has been defined as an offer of money or goods in payment or satisfaction of a debt or other obligation. An offer to perform is a tender. A tender involves an unconditional offer by a the person making the tender to pay an amount in lawful currency that is at least equal to the amount owing in a specified debt. The purpose of tender is to close a transaction so that the person making the tender may be relieved of further liability for the debt or obligation. This form is a sample of a rejection of such a tender.

Virginia Letter Rejecting Tender of Check

Description

How to fill out Letter Rejecting Tender Of Check?

If you need to gather, download, or print official document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site's simple and user-friendly search feature to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 5. Complete the payment. You can use your Visa or MasterCard or PayPal account to finalize the order.

Step 6. Obtain the format of the legal form and download it to your device. Step 7. Fill out, modify and print or sign the Virginia Letter Disapproving Check Submission. Every legal document template you receive is yours permanently. You will have access to all forms you downloaded within your account. Click the My documents section and select a form to print or download again. Compete, download, and print the Virginia Letter Disapproving Check Submission with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal requirements.

- Use US Legal Forms to find the Virginia Letter Disapproving Check Submission in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Virginia Letter Disapproving Check Submission.

- You can also access forms you have previously downloaded via the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

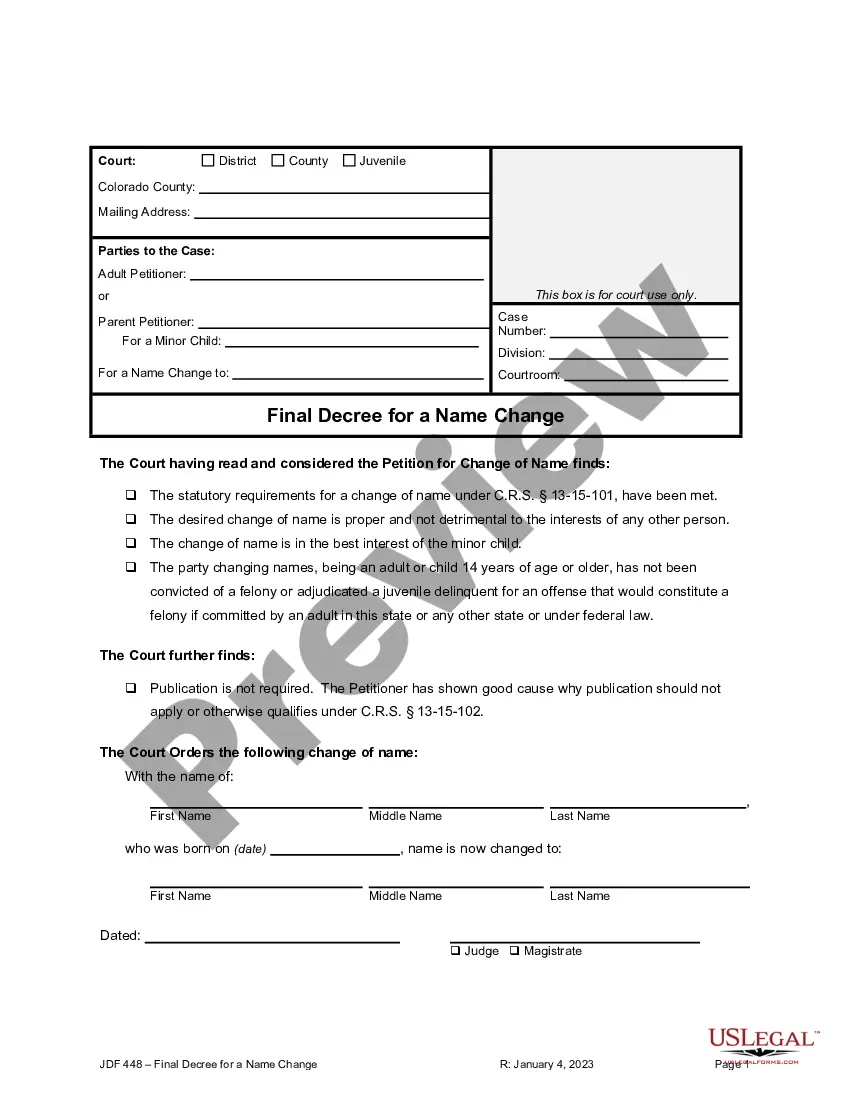

- Step 1. Ensure you have selected the form for the correct state/country.

- Step 2. Use the Preview option to review the content of the form. Do not forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you want, click the Download now button. Choose the payment plan you prefer and enter your information to create an account.

Form popularity

FAQ

Virginia Code 8.2 312 outlines the rules surrounding the validity of negotiable instruments, including checks. It specifies conditions that affect the enforceability of checks and provides insight into dealing with rejected payments. Knowledge of this code can aid in the effective preparation of a Virginia Letter Rejecting Tender of Check.

Code of Virginia 2.2 4319 covers the responsibilities related to the management of certain financial transactions by the state. It emphasizes the need for proper communication and documentation, which can be crucial when issuing a Virginia Letter Rejecting Tender of Check. Being informed about this section helps ensure compliance.

VA Code 8.2 314 addresses the requirements for the acceptance and processing of checks. This code outlines the legal obligations regarding checks, including how to respond if a check is returned. Understanding this code is beneficial when drafting a Virginia Letter Rejecting Tender of Check.

Virginia Code 2.2 4022 relates to the accounting and financial management duties of state agencies. This code provides a framework for proper financial practices, which is crucial when dealing with situations like issuing a Virginia Letter Rejecting Tender of Check. It assures that all financial dealings are conducted with integrity.

The Virginia Freedom of Information Act, referenced as VA Code 2.2 3700 ET SEQ, ensures public access to government records. It's designed to promote transparency and accountability in government operations. If you need a Virginia Letter Rejecting Tender of Check regarding a request, understanding your rights under this act can be beneficial.

Virginia Code 2.2 4309 details the procedures for how the state handles rejected checks. It specifies the necessary actions when a check is rejected, including communication with the issuer. Familiarity with this code is essential when drafting a Virginia Letter Rejecting Tender of Check.

Virginia Code 2.2 4300 pertains to the government’s authority regarding the receipt and processing of certain payments. This section outlines how state agencies must manage financial transactions, which may include situations involving a Virginia Letter Rejecting Tender of Check. Understanding this code can help ensure compliance with state regulations.

Filing a motion of reconsideration in Virginia involves submitting your request to the court that issued the original ruling. You will need to cite the specific reasons for your motion, along with any supporting evidence, including documentation like a Virginia Letter Rejecting Tender of Check if relevant. It's essential to follow the proper procedural steps and deadlines to ensure your motion is considered.

The best evidence rule in Virginia dictates that an original document is necessary to prove the content of that document, unless an exception applies. This is particularly relevant when dealing with disputes concerning a Virginia Letter Rejecting Tender of Check. By adhering to this rule, all parties can ensure that decisions are based on authentic evidence, promoting fairness in legal proceedings.

VA Code 17.1 517 pertains to the procedures for civil claims and how to handle certain disputes, including issues arising from a Virginia Letter Rejecting Tender of Check. This code provides guidance on how parties must proceed when disputes occur over check payments. Understanding this code is vital for anyone looking to navigate legal matters in Virginia effectively.