A contract is based upon an agreement. An agreement arises when one person, the offeror, makes an offer and the person to whom is made, the offeree, accepts. There must be both an offer and an acceptance. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Virginia Offer and Acceptance of Employment

Description

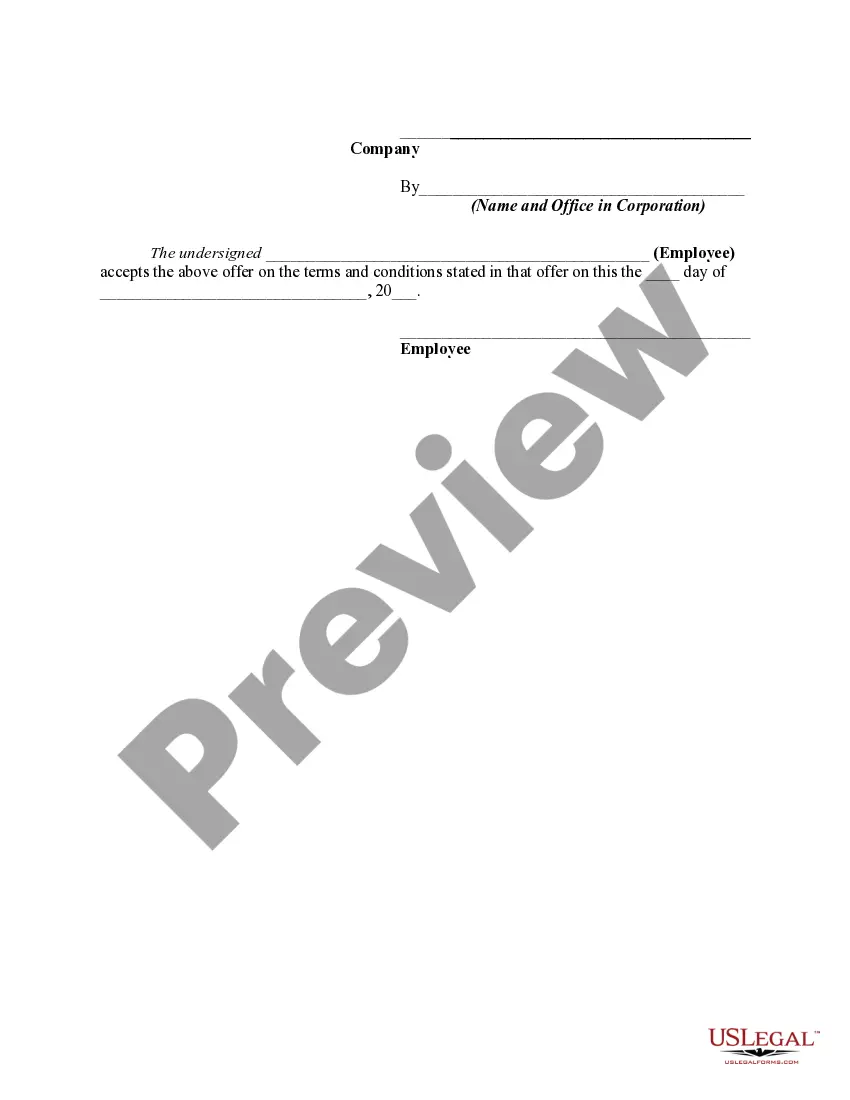

How to fill out Offer And Acceptance Of Employment?

You can dedicate time online searching for the legal document template that conforms to the state and federal requirements you require.

US Legal Forms provides thousands of legal forms that are vetted by experts.

It is easy to obtain or print the Virginia Offer and Acceptance of Employment from the service.

If available, utilize the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the Virginia Offer and Acceptance of Employment.

- Every legal document template you acquire is yours indefinitely.

- To obtain an extra copy of any received form, navigate to the My documents section and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

- Firstly, ensure you have selected the correct document template for the area/city that you choose.

- Review the form description to ensure you have chosen the right form.

Form popularity

FAQ

Whether to claim 0 or 1 on the VA-4 form depends on your financial situation. Claiming 0 typically means more taxes will be withheld, which can lead to a refund when you file your tax return. Conversely, claiming 1 may reduce your withholding, but could also lead to a tax bill. For optimal decision-making, referring to resources such as US Legal Forms can help you connect the implications to your Virginia Offer and Acceptance of Employment.

To fill out the Virginia VA-4 form, input your name, address, and Social Security number at the top. Next, determine the number of allowances you want to claim, along with any extra withholding if necessary. For easy navigation through the process, US Legal Forms can provide templates and instructions, enhancing your understanding of the Virginia Offer and Acceptance of Employment.

Filling out a G4 form can be straightforward. Start by entering your personal details, such as your name and Social Security number. Then, indicate the number of allowances you are claiming. For additional assistance on filling out this form, consider checking out US Legal Forms to streamline your process, especially if you are navigating your Virginia Offer and Acceptance of Employment.

Yes, Virginia does have a convenience of employer rule. This rule means that if you work remotely for a Virginia employer, you typically owe Virginia state taxes, even if you live in another state. This aspect is crucial when considering your Virginia Offer and Acceptance of Employment, to ensure you're aware of your tax obligations.

New employees in Virginia typically need to complete several forms, including the VA-4 for state income tax withholding and the federal W-4. Additionally, some employers may require specific documents depending on their policies. Understanding these requirements can enhance your Virginia Offer and Acceptance of Employment experience, and resources like US Legal Forms can provide the necessary templates.

Filling out form VA-4 requires you to provide your personal information, including your name and Social Security number. After that, you will choose your number of allowances and any additional withholding amounts. For a clearer understanding of the VA-4 instructions, you might find US Legal Forms useful in simplifying the process, linking it to your Virginia Offer and Acceptance of Employment.

To fill out a W-4V form, start by entering your name, address, and Social Security number at the top of the form. Next, specify the amount of federal income tax you wish to withhold from your payments. If you need help, consider using US Legal Forms for guidance on completing the form correctly, especially in the context of Virginia Offer and Acceptance of Employment.

An example of job acceptance could be a brief email stating, "I am pleased to accept your offer for the position of Marketing Manager at XYZ Corp, starting on January 1st. Thank you for this opportunity. I look forward to contributing to the team." This concise yet thorough approach encapsulates the essence of the Virginia Offer and Acceptance of Employment.

An acceptance letter for employment should begin with your contact information and the date, followed by the employer's details. Clearly express your acceptance, along with the agreed-upon job title, start date, and any other relevant terms. This letter serves as a vital step in the Virginia Offer and Acceptance of Employment, ensuring mutual understanding.

In Virginia, a new employee typically needs to complete a W-4 form for tax withholding, an I-9 for employment eligibility verification, and any other forms specific to your employer's policies or industry. Checking with HR can ensure you have all required documents. Being proactive in this process underscores your commitment to a smooth onboarding, reinforcing the principles of Virginia Offer and Acceptance of Employment.