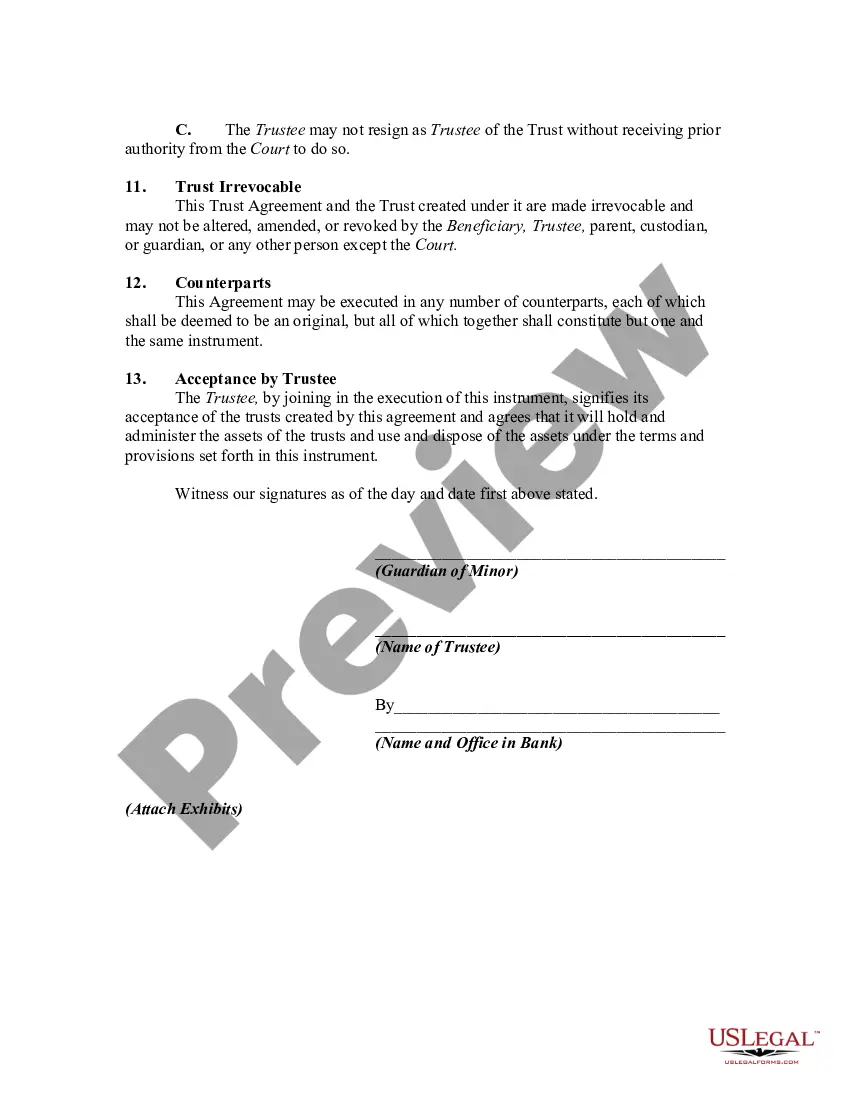

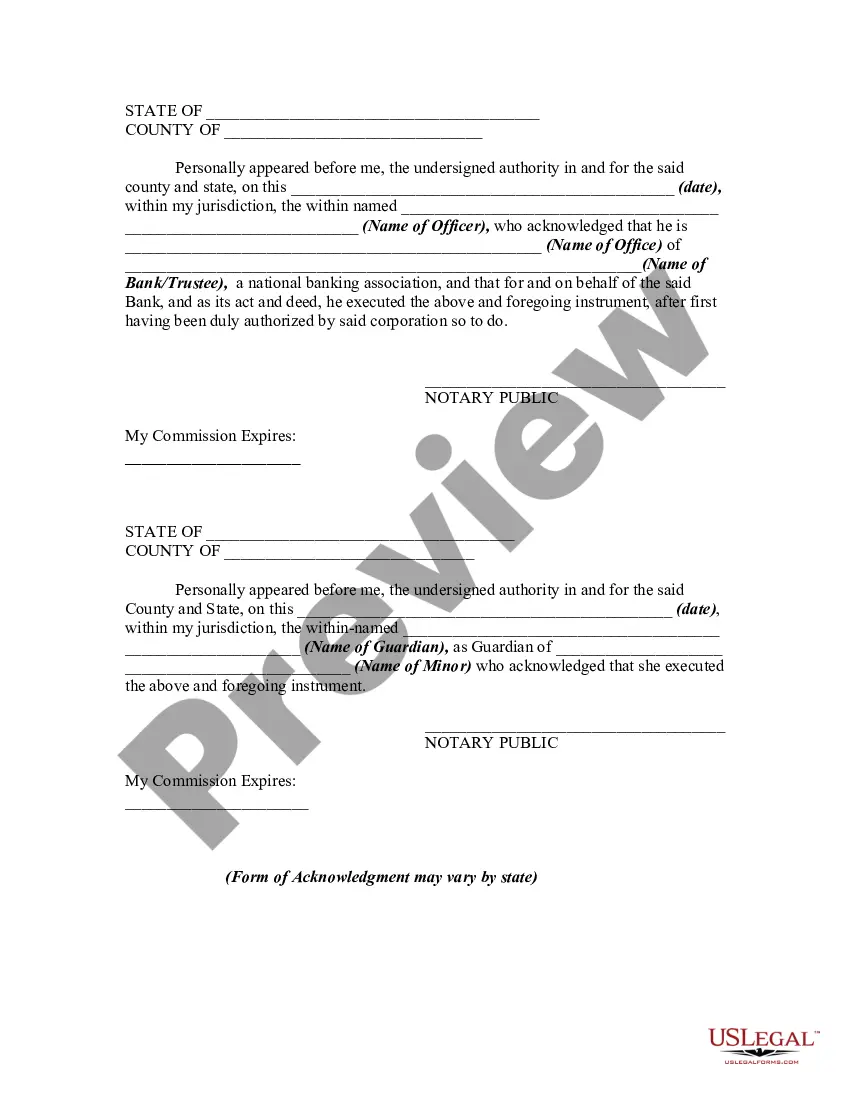

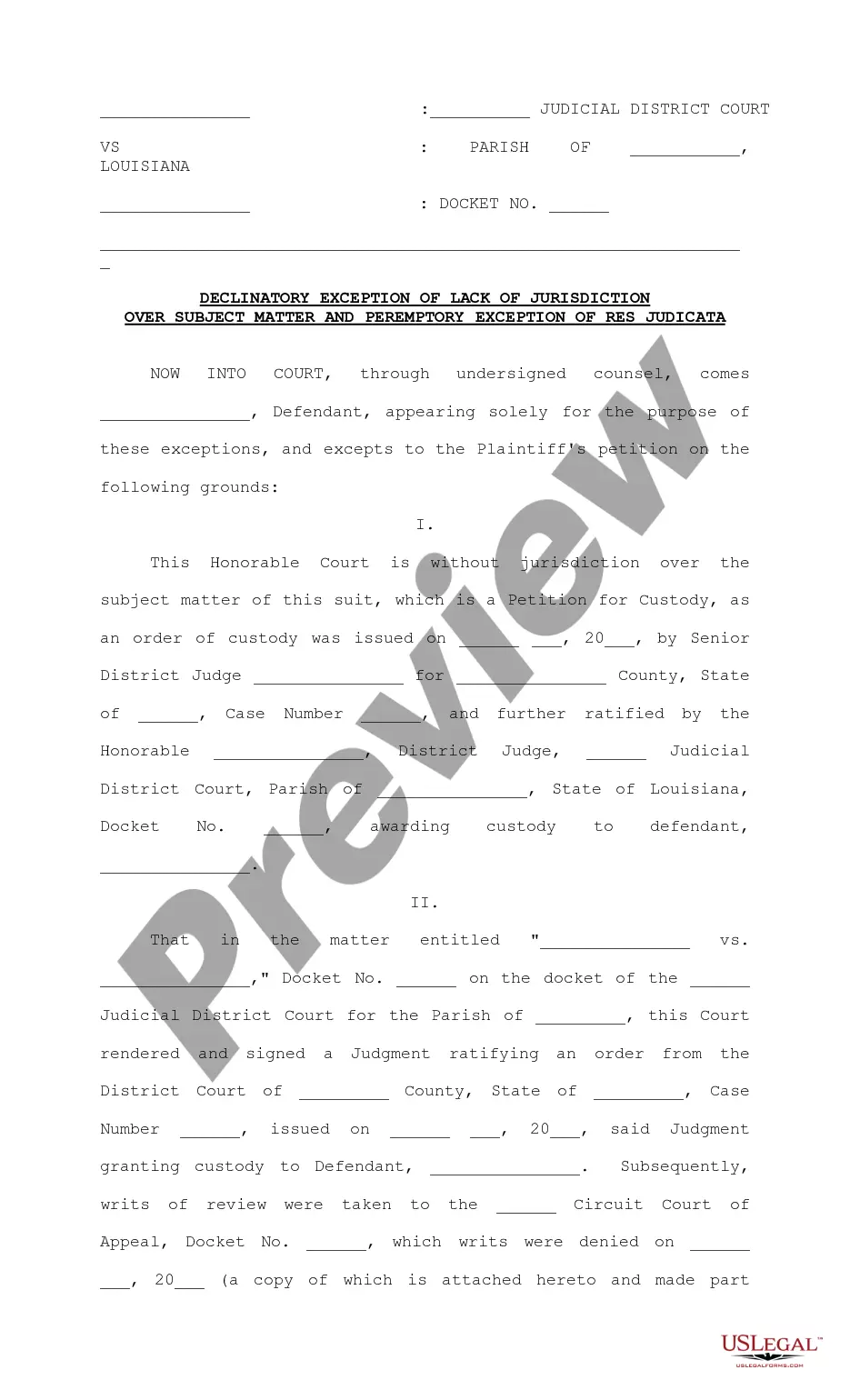

A trust is the legal relationship between one person, the trustee, having an equitable ownership or management of certain property and another person, the beneficiary, owning the legal title to that property. The beneficiary is entitled to the performance of certain duties and the exercise of certain powers by the trustee, which performance may be enforced by a court of equity. This form is an example of a trust that is subject to direct court oversight since the initial trust funds resulted from a civil judgment in favor of a minor.

Virginia Trust Agreement for Funds for Recovery of Judgment for Minor

Description

How to fill out Trust Agreement For Funds For Recovery Of Judgment For Minor?

Choosing the best legitimate document web template can be quite a have difficulties. Needless to say, there are tons of web templates available on the Internet, but how will you find the legitimate kind you require? Take advantage of the US Legal Forms site. The assistance delivers 1000s of web templates, for example the Virginia Trust Agreement for Funds for Recovery of Judgment for Minor, which can be used for company and personal requirements. All the varieties are examined by experts and satisfy federal and state demands.

When you are presently signed up, log in to the bank account and click on the Acquire switch to have the Virginia Trust Agreement for Funds for Recovery of Judgment for Minor. Utilize your bank account to search from the legitimate varieties you possess purchased formerly. Check out the My Forms tab of your own bank account and get an additional version in the document you require.

When you are a new user of US Legal Forms, listed here are basic directions so that you can stick to:

- Initially, ensure you have selected the correct kind for the area/area. It is possible to look through the shape while using Preview switch and study the shape explanation to make sure this is the right one for you.

- In case the kind is not going to satisfy your requirements, take advantage of the Seach industry to obtain the correct kind.

- Once you are sure that the shape would work, click the Purchase now switch to have the kind.

- Pick the pricing prepare you would like and enter the required information. Design your bank account and purchase an order making use of your PayPal bank account or Visa or Mastercard.

- Opt for the document file format and download the legitimate document web template to the product.

- Comprehensive, change and printing and signal the received Virginia Trust Agreement for Funds for Recovery of Judgment for Minor.

US Legal Forms is definitely the most significant collection of legitimate varieties in which you can discover various document web templates. Take advantage of the company to download appropriately-manufactured paperwork that stick to condition demands.

Form popularity

FAQ

The grantor shall be deemed to covenant that he will pay all taxes, levies, assessments, and charges upon the property, including the fees and charges of such agents or attorneys as the trustee may deem advisable to employ at any time for the purpose of the trust, so long as any obligation upon the grantor under the ...

For the purpose of selling, assigning, exchanging, transferring, or conveying such investments and property, the fiduciary has the power to make, execute, acknowledge, and deliver any and all instruments of conveyance, deeds of trust, or assignments in such form and with warranties and covenants as the fiduciary deems ...

Duty to inform and report. A. A trustee shall keep the qualified beneficiaries of the trust reasonably informed about the administration of the trust and of the material facts necessary for them to protect their interests.

A deed may include a general provision that states that such deed is subject to any and all covenants and restrictions of record; however, such provision shall not apply to the specific portion of a restrictive covenant purporting to restrict the ownership or use of the property as prohibited by subsection A of § 36- ...

If the secured party has received notification that the owner of the property to be sold is deceased, the notice required by clause (a) shall be given to (1) the last known address of such owner as such address appears in the records of the party secured; (2) any personal representative of the deceased's estate whose ...

No person may be named or act, in person or by agent or attorney, as the trustee of a deed of trust conveying property to secure the payment of money or the performance of an obligation, either individually or as one of several trustees, unless such person is a resident of the Commonwealth.

A deed of trust that has been recorded and that states that it secures indebtedness or other obligations under a loan document and that it also secures indebtedness or other obligations under such loan document as it may be amended, modified, supplemented, or restated shall secure such loan document as amended, ...

§64.1-57. Refers to Section 64.1-57 of the Code of Virginia, 1950, as amended, which lists a number of powers which are granted to a qualified executor when this section is referenced and incorporated into a will. For a list of the powers you can click on the above highlighted link. Testamentary Trust.