Virginia Bill of Transfer to a Trust

Description

How to fill out Bill Of Transfer To A Trust?

If you wish to gather, acquire, or print sanctioned document templates, utilize US Legal Forms, the largest repository of legal templates available online.

Employ the site’s straightforward and user-friendly search feature to locate the paperwork you require.

Numerous templates for business and personal needs are categorized by types and states, or keywords.

Every legal document template you purchase is yours indefinitely. You can access every form you acquired within your account. Go to the My documents section and select a form to print or download again.

Complete and download, and print the Virginia Bill of Transfer to a Trust with US Legal Forms. There are millions of professional and state-specific forms available for your individual business or personal needs.

- Use US Legal Forms to obtain the Virginia Bill of Transfer to a Trust in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to retrieve the Virginia Bill of Transfer to a Trust.

- You can also find forms you have previously purchased in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

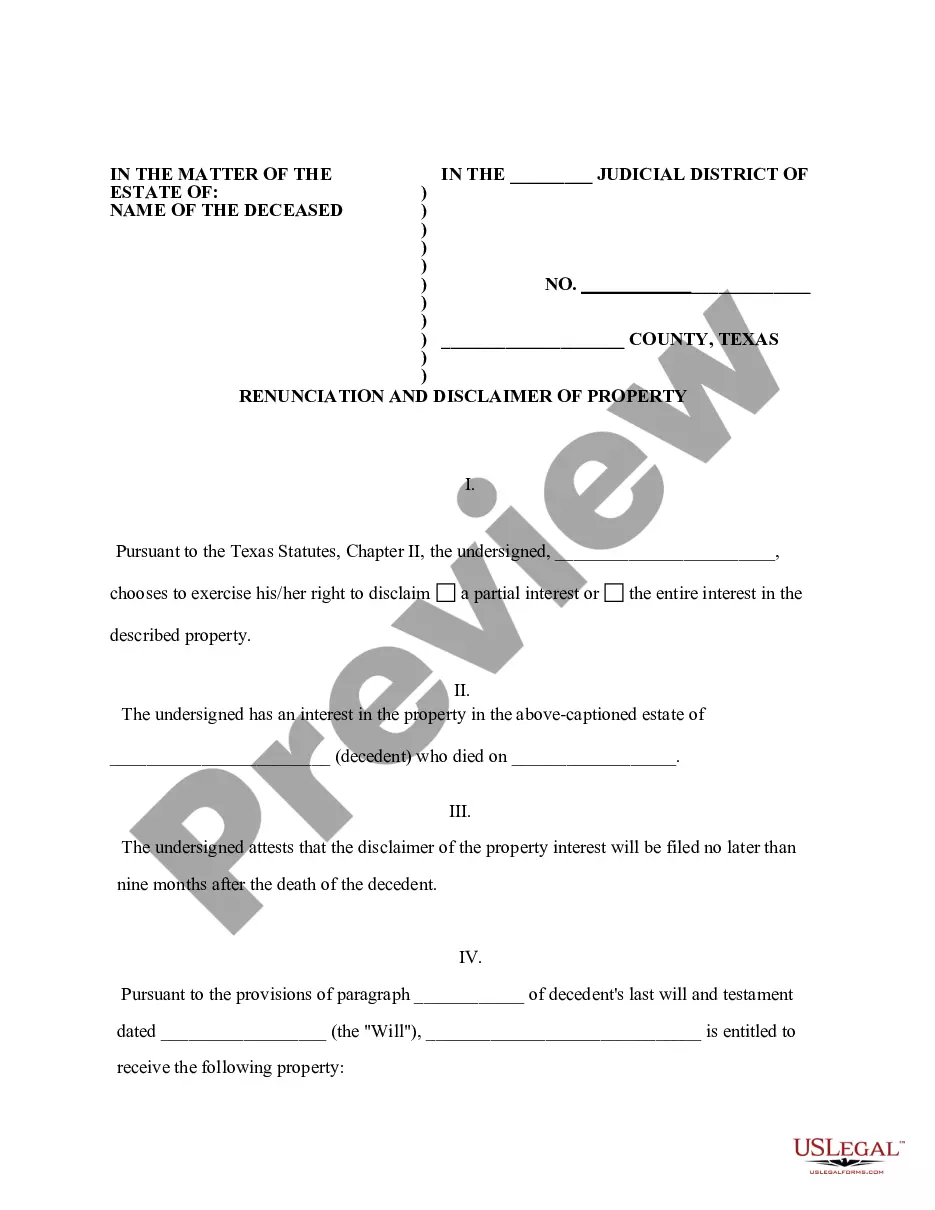

- Step 2. Use the Review option to examine the form’s content. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have located the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, revise, and print or sign the Virginia Bill of Transfer to a Trust.

Form popularity

FAQ

Transferring assets into a trust involves formally designating the trust as the owner of the assets, which may require filling out specific legal documents. This can include deeds for real estate, titles for vehicles, and designating beneficiaries for financial accounts. It's important to understand the Virginia Bill of Transfer to a Trust to ensure you successfully complete this process.

To transfer property into a trust in Virginia, you need to execute a bill of transfer that legally conveys the property from the individual to the trust. This process often requires careful documentation and may involve updating the deed for real estate. Utilizing the Virginia Bill of Transfer to a Trust will ensure you follow the correct procedures and avoid pitfalls.

Trust funds come with certain risks, including the potential for mismanagement or disputes among beneficiaries. Additionally, if the trust document is vague or not correctly executed, it could lead to legal challenges. Familiarity with the provisions of the Virginia Bill of Transfer to a Trust can help mitigate these risks and promote clarity.

One significant mistake parents make when setting up a trust fund is failing to fund the trust properly. This can lead to the trust not providing the intended benefits or protection. It's essential to understand the Virginia Bill of Transfer to a Trust to ensure that assets are effectively placed within the trust.

The bill of transfer for a trust is a legal document that facilitates the transfer of assets into a trust. This document ensures that the specified assets are correctly titled in the trust's name, which helps avoid the complexities of probate. Leveraging the Virginia Bill of Transfer to a Trust can simplify the process and lay a solid foundation for effective trust management.

Whether your parents should place their assets in a trust depends on their specific goals, financial situation, and family dynamics. A trust can protect assets from probate, ensuring a smoother transfer of wealth. It may be beneficial for your parents to consult with an expert about the Virginia Bill of Transfer to a Trust to weigh its advantages against potential complications.

Having a trust can present some downsides, such as ongoing maintenance costs and complexities involved in managing the trust. Additionally, if not properly set up, a trust may not provide the intended benefits, causing potential confusion and disputes among family members. Understanding the details of the Virginia Bill of Transfer to a Trust can help mitigate these risks.

Placing bank accounts in a trust can be beneficial for several reasons. Firstly, a Virginia Bill of Transfer to a Trust allows for smoother asset management and can help avoid probate upon your passing. By transferring your bank accounts into a trust, you can ensure that your beneficiaries gain access without delays or complications. Furthermore, using a trust may also provide privacy and protection from creditors, making it a prudent choice for many individuals.

To put a house in a trust in Virginia, you first need to create a trust document that specifies your intentions. Next, you'll complete a Virginia Bill of Transfer to a Trust to legally transfer the property's title into the trust's name. Our platform at US Legal Forms offers easy access to customizable trust documents and guidance, ensuring a smooth transition of your property into the trust.

VA Code 64.2-764 outlines the laws governing the administration of trusts in Virginia. This code provides essential guidelines on how trusts operate and the responsibilities of trustees. Understanding the Virginia Bill of Transfer to a Trust within this legal framework is vital for anyone looking to navigate their estate planning effectively.