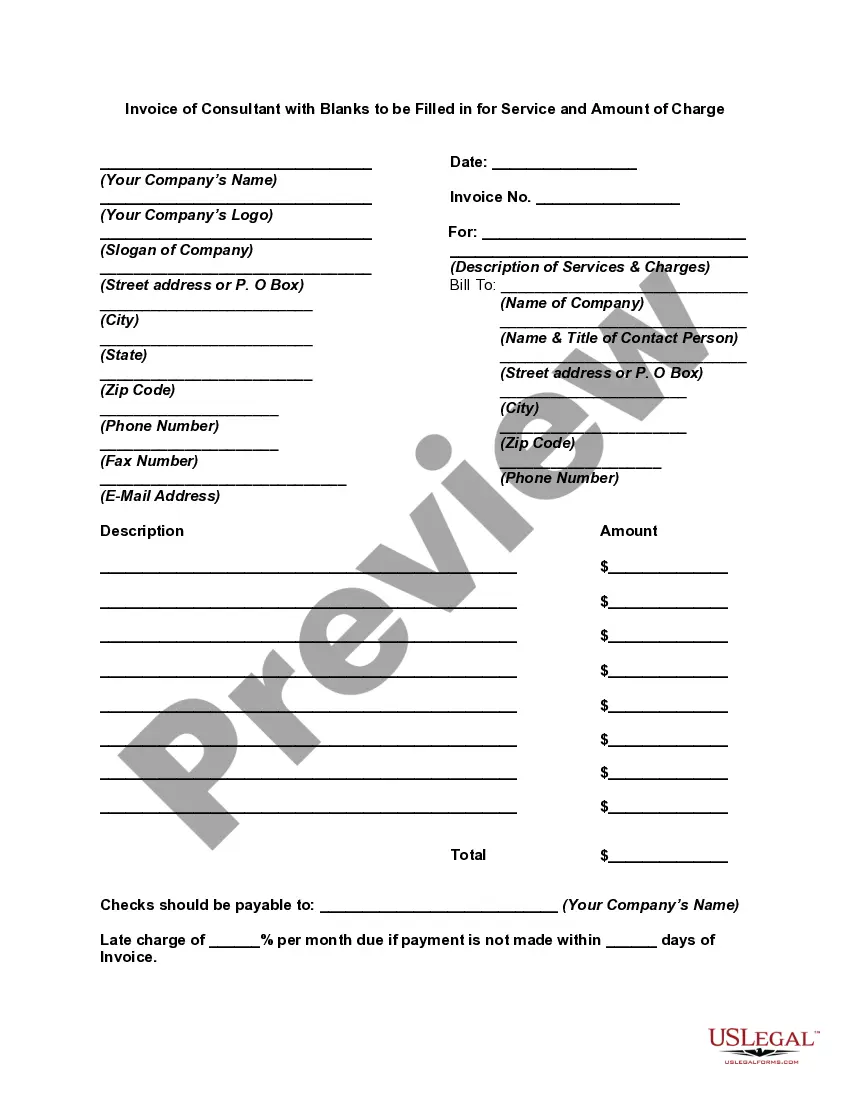

An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Keywords: Virginia invoice, consultant invoice, blanks to be filled in, service charge, amount of charge Title: Complete Guide to Virginia Invoices of Consultants with Fillable Blanks for Service and Amount of Charge Introduction: In Virginia, when hiring a consultant for various services, it is crucial to have a well-documented and professional invoice that accurately reflects the provided services and charges. This article will provide an in-depth description of Virginia invoices for consultants, including different types, their importance, and how to properly fill in the blanks for service and amount of charge to ensure clarity and accuracy. Types of Virginia Invoices for Consultants: 1. General Consultant Invoice: The general consultant invoice is used when the services provided by the consultant do not fall under any specific category. It allows for flexibility in describing the services rendered and the corresponding charges. 2. Legal Consultant Invoice: This type of invoice is utilized when a consultant provides legal advice or services. It is important to accurately fill in the blanks to specify the legal services offered and the corresponding charges in compliance with Virginia legal requirements. 3. Financial Consultant Invoice: When a consultant offers financial guidance or services, a financial consultant invoice is appropriate. It requires precise details of the financial services delivered and the corresponding charges. 4. IT Consultant Invoice: For consultants providing information technology-related services, an IT consultant invoice is necessary. It enables specific structuring of IT-based services offered and associated charges, promoting transparency. Filling in the Blanks: To create an effective Virginia invoice for consultants, it is essential to properly fill in the blanks for the service description and amount of charge. The following steps outline the process: 1. Service Description: a. Begin by clearly and concisely describing the services provided by the consultant. Include specific details, such as the scope, duration, and any relevant project milestones. b. Use appropriate industry jargon but ensure it remains comprehensible for all parties involved. c. Consider organizing the service description into categories or sections for better clarity, especially if multiple services were rendered. 2. Amount of Charge: a. Determine the accurate and fair remuneration for the consultant's services. This can be an hourly rate, flat fee, or project-based charge, depending on the agreement. b. Ensure that the amount of charge aligns with any agreements or contracts previously established between the consultant and client. c. Clearly indicate the currency and payment terms, including due dates or any applicable penalties for late payments. Conclusion: Virginia invoices for consultants play a vital role in maintaining professional relationships, ensuring clarity, and facilitating prompt payment. Understanding the different types of invoices and properly filling in the blanks for service and amount of charge allows for accurate record-keeping and efficient payment processes. By following the guidelines provided, consultants and clients can navigate the invoicing process smoothly while meeting their legal obligations.