This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Virginia Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually

Description

How to fill out Promissory Note With No Payment Due Until Maturity And Interest To Compound Annually?

US Legal Forms - one of the largest collections of legal documentation in the United States - offers a range of legal document templates that you can obtain or print.

By utilizing the website, you can access thousands of forms for corporate and personal purposes, organized by categories, regions, or keywords. You can find the most recent iterations of documents such as the Virginia Promissory Note with no Payment Due Until Maturity and Interest Compounding Annually in mere moments.

If you are already a member, Log In and obtain the Virginia Promissory Note with no Payment Due Until Maturity and Interest Compounding Annually from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use a credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Edit. Fill out, amend, and print and sign the downloaded Virginia Promissory Note with no Payment Due Until Maturity and Interest Compounding Annually. Every template you included in your purchase has no expiration date and is yours indefinitely. Therefore, if you wish to obtain or print another copy, simply go to the My documents section and click on the form you desire. Access the Virginia Promissory Note with no Payment Due Until Maturity and Interest Compounding Annually through US Legal Forms, the largest collection of legal document templates. Utilize a vast array of professional and state-specific templates that cater to your business or personal needs and requirements.

- Ensure you have selected the appropriate form for your city/region.

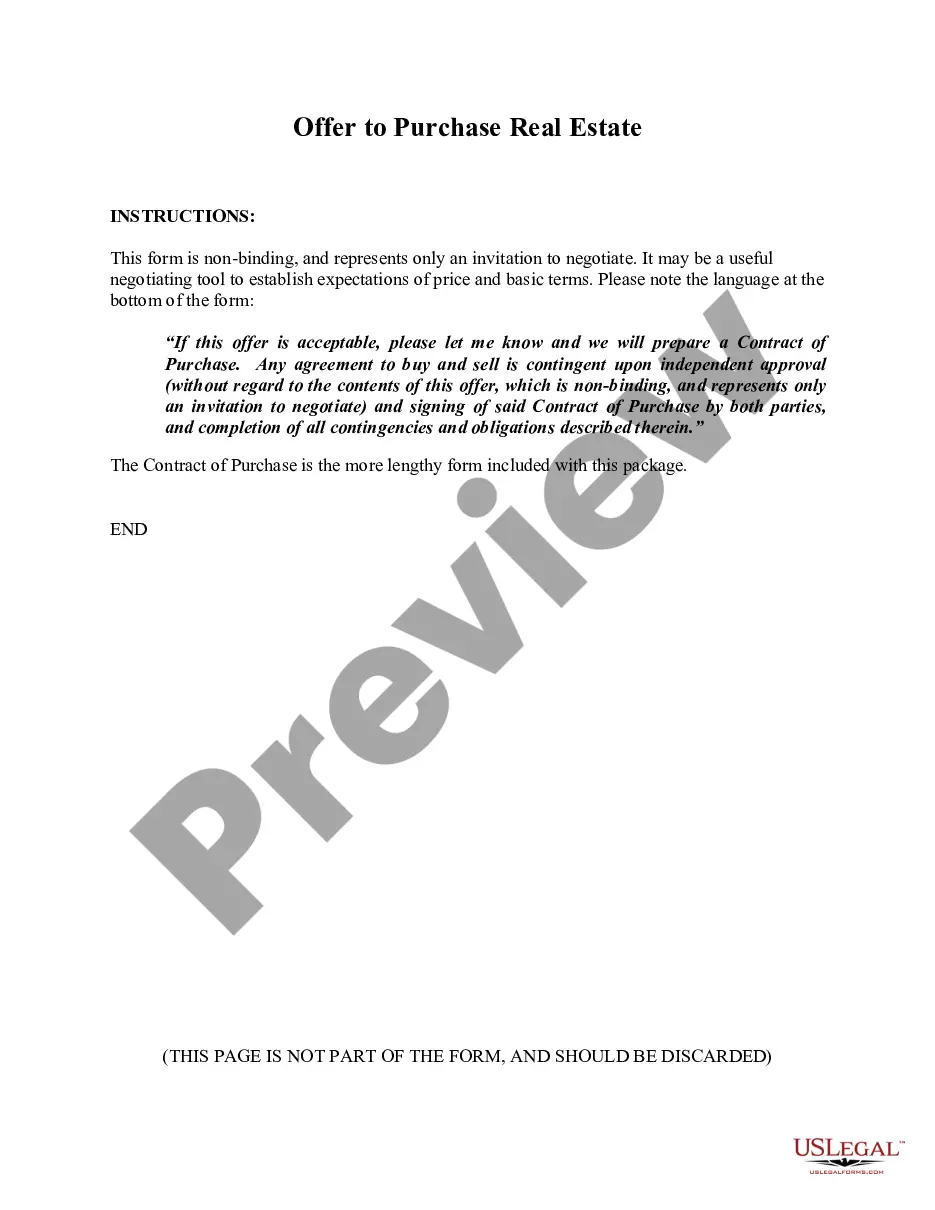

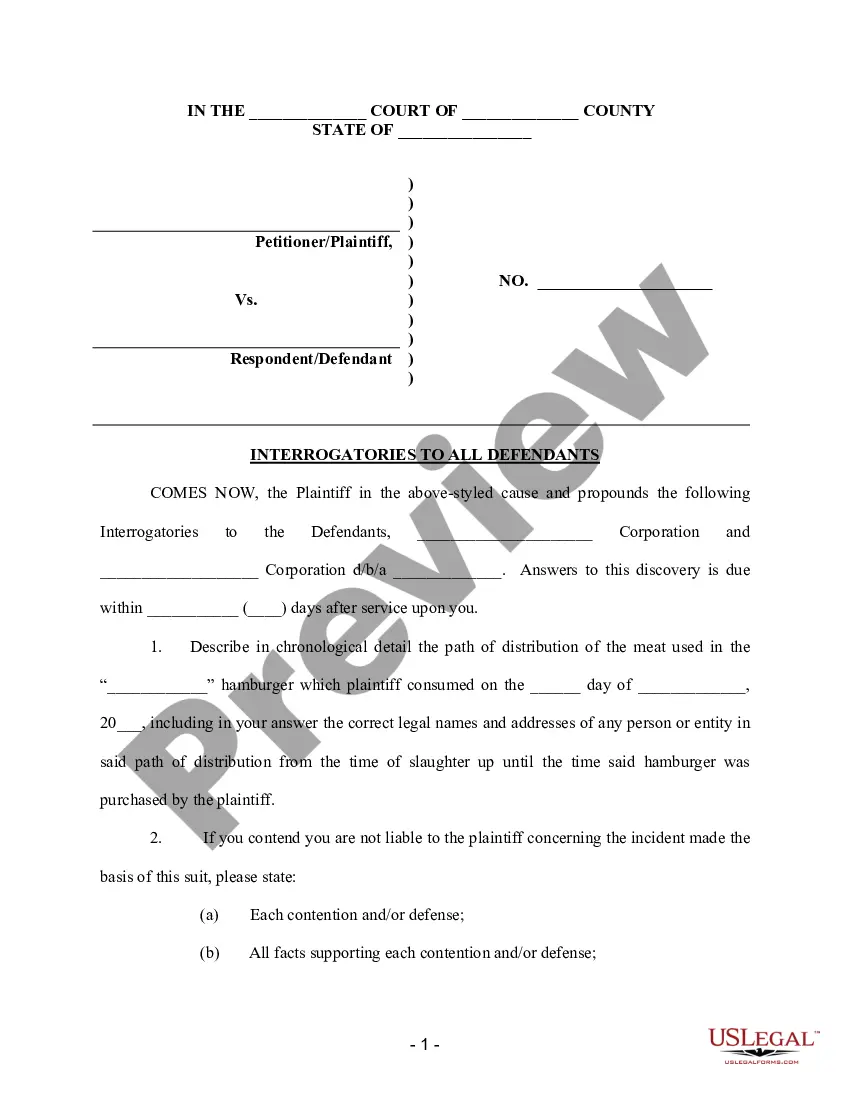

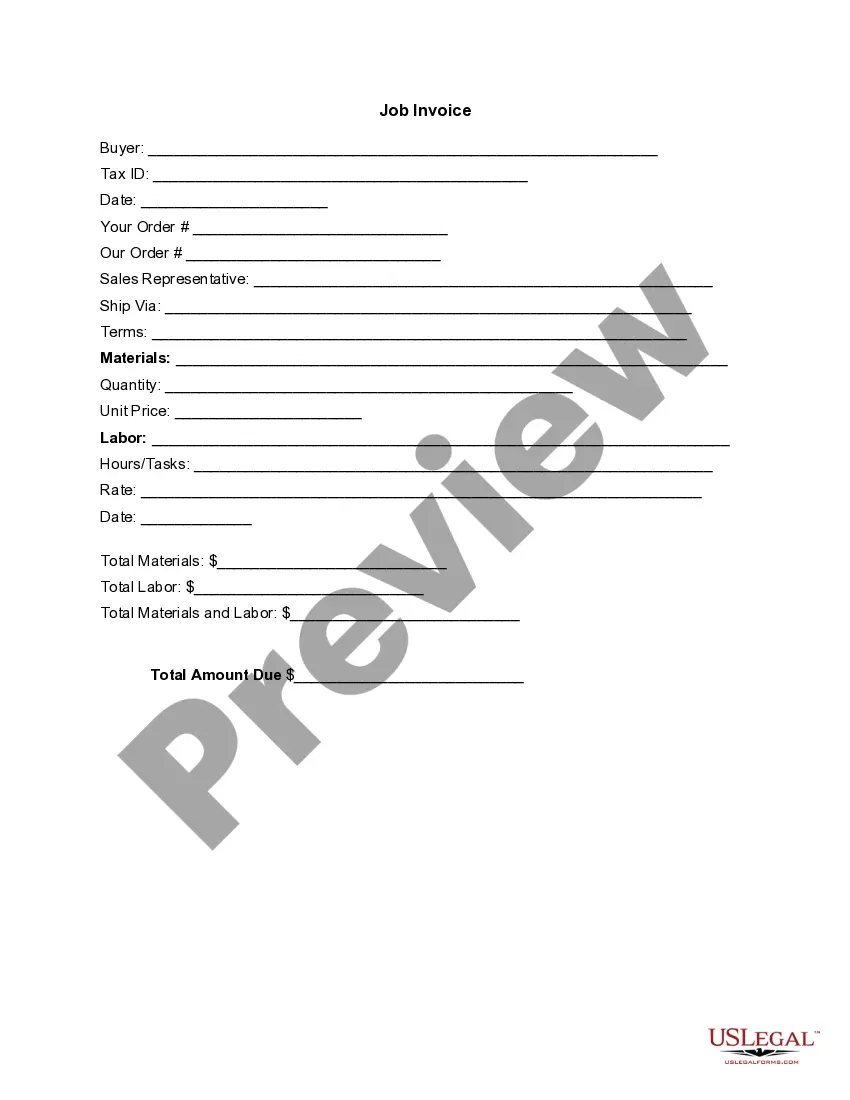

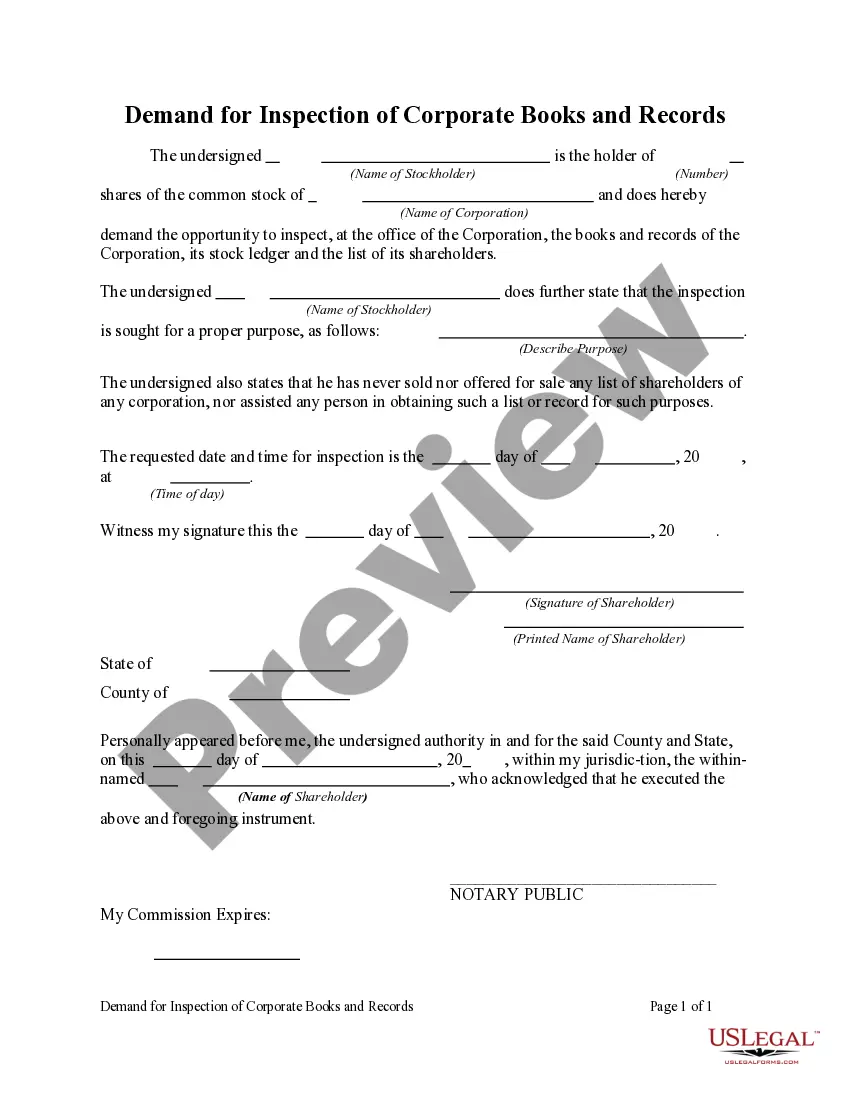

- Click the Preview button to review the contents of the form.

- Read the form details to make sure you have chosen the correct one.

- If the form does not meet your requirements, use the Search field at the top of the screen to find a suitable option.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the pricing plan you prefer and provide your information to register for the account.

Form popularity

FAQ

Yes, it is possible to create a promissory note that does not accrue interest. In this case, the Virginia Promissory Note with no Payment Due Until Maturity could be structured simply to require repayment of the principal amount at maturity. While this is less common, it can be a beneficial arrangement for both parties if agreed upon. If you're considering this option, tools like US Legal Forms provide templates to ensure your note is properly drafted and understood.

Promissory notes, including a Virginia Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, must clearly define the terms of repayment, interest rates, and maturity dates. Both the borrower and lender should agree on the terms, and it's essential to put everything in writing to prevent disputes. Generally, notes should be signed and dated by both parties to be legally binding. With US Legal Forms, you can access templates that guide you through the correct rules and regulations for drafting your note.

Interest on a Virginia Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is typically calculated on the principal amount. This means the interest starts accumulating from the moment the note is issued. As it compounds annually, you will see your overall debt increase, which is essential to understand for future payments. Utilizing a platform like US Legal Forms can help you easily create a promissory note that clearly outlines these terms.

Creating a promissory note in Virginia requires you to have the borrower's and lender's names, the principal amount, the interest rate, and the repayment schedule, including the maturity date. It is crucial to ensure all these details align with Virginia law. A Virginia Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually should also include a clear outline of interest accrual, making it easy for both parties to understand their obligations.

A promissory note must include key elements such as the borrower's promise to repay a specific amount, the interest rates, and the repayment terms. Furthermore, it should clearly state the due date for the repayment. In the case of a Virginia Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, it is crucial to specify how and when the interest will be calculated and accrued.

Indeed, promissory notes accrue interest based on the terms outlined in the agreement. For a Virginia Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, the accumulated interest can add significantly to the total amount owed by the time of repayment. This aspect is crucial for anyone utilizing a promissory note, as it impacts overall financial planning and repayment strategies.

In Virginia, a promissory note must include specific elements to be enforceable. These elements typically include the amount, interest rate, repayment terms, and the signature of the borrower. If you’re creating a Virginia Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, it’s advantageous to ensure that these details are clearly stated to avoid any future conflicts.

A promissory note without a maturity date is a type of agreement where the repayment terms are not fixed to a specific date. In the context of a Virginia Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, this means you may have greater flexibility in repayment. However, it’s essential to clarify the terms to avoid potential misunderstandings regarding when payment is due.

Yes, in a Virginia Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, interest does compound. This means that over time, the interest calculated in one period gets added to the principal, and you calculate the interest for future periods on the new total. This feature can benefit you by increasing the returns or reducing the balance over time, depending on your perspective.

A Virginia Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually typically uses compound interest. This means the interest earned gets added to the principal balance, allowing you to earn interest on both the initial amount and the accumulated interest. It can result in a higher total amount owed at maturity compared to simple interest. Understanding this can help you manage your financial obligations effectively.