Virginia Private Annuity Agreement

Description

How to fill out Private Annuity Agreement?

If you wish to finish, obtain, or print official document templates, utilize US Legal Forms, the most significant selection of legal documents, which are accessible online.

Employ the site's simple and convenient search feature to find the forms you require. Various templates for business and personal applications are organized by categories and states, or keywords.

Use US Legal Forms to locate the Virginia Private Annuity Agreement with just a few clicks.

Every legal document template you purchase is yours permanently.

You will have access to each form you downloaded in your account. Click on the My documents section and select a form to print or download again.

- If you are an existing US Legal Forms customer, Log In to your account and click the Acquire button to download the Virginia Private Annuity Agreement.

- You may also access forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have chosen the form for the appropriate city/state.

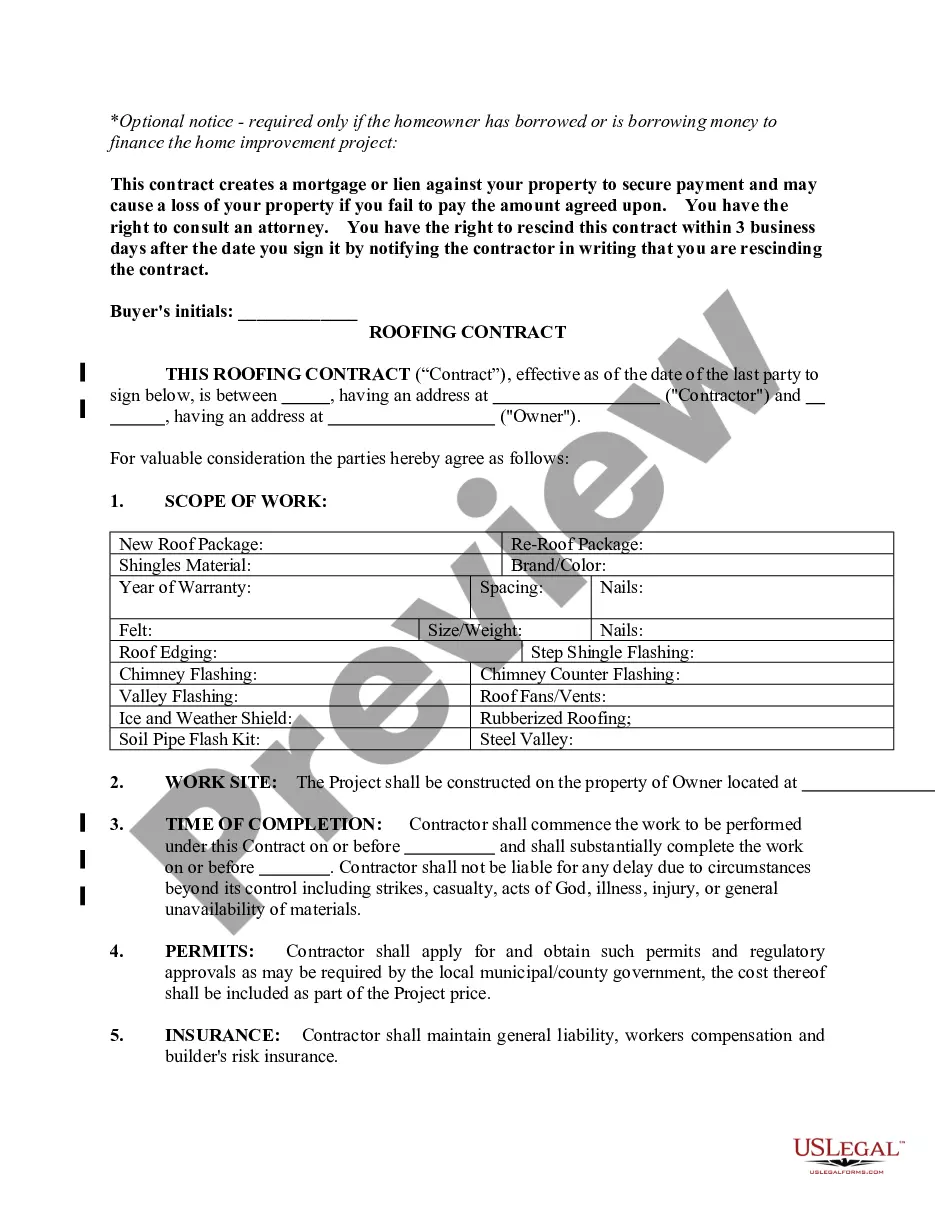

- Step 2. Use the Preview option to review the form's content. Don't forget to read the details.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the display to find other versions of the legal form format.

- Step 4. Once you have found the form you desire, click on the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Select the format of the legal form and download it on your device.

- Step 7. Fill out, modify, and print or sign the Virginia Private Annuity Agreement.

Form popularity

FAQ

Virginia has reciprocal tax agreements with several states, allowing for more straightforward tax filing for income earned across state lines. States such as Maryland and West Virginia are notable examples. If you're pursuing a Virginia Private Annuity Agreement, understanding these agreements can simplify your tax process significantly.

The taxable portion of your annuity income depends on the earnings relative to your original investment. Generally, any gain beyond your contributions is taxable as income. To accurately assess your tax situation regarding a Virginia Private Annuity Agreement, consider using resources or services from platforms like uslegalforms.

Yes, annuity income is taxable in Virginia. If you receive payments from a Virginia Private Annuity Agreement, you must report this income on your Virginia tax return. Consulting a tax professional can help clarify your specific obligations and potential deductions.

Many states, including Virginia, tax annuity income. Each state has its rules, so it's vital to check the specific regulations where you reside. If you have a Virginia Private Annuity Agreement, understanding these tax liabilities will help optimize your financial strategy.

Yes, a Virginia Private Annuity Agreement can be taxable. Generally, you will owe federal income tax on the portion of each payment that represents earnings, not your original investment. To navigate these complexities, consider seeking advice from a tax professional who understands the specifics of Virginia tax law.

A Single Premium Immediate Annuity (SPIA) can have certain downsides. Once you invest in a SPIA, you may lose flexibility, as the funds are typically locked in for the duration of the payout period. Additionally, the payments are often subject to taxation, which can affect your net income. Understanding these nuances is crucial when considering a Virginia Private Annuity Agreement.

An annuity agreement is a legally binding contract between two parties. It outlines the terms under which one party pays the other a fixed stream of income over time, usually in exchange for valuable assets. Such agreements can serve various financial goals, from retirement income to estate planning. A well-drafted Virginia Private Annuity Agreement ensures clarity and protection for both involved parties.

A private annuity involves one party making payments to another in exchange for the direct transfer of an asset. This arrangement allows the seller to receive regular payments while reducing their estate size for tax purposes. Essentially, it can help manage wealth transfer in a tax-efficient manner. Understanding the specifics of a Virginia Private Annuity Agreement can enhance your financial planning.

In Virginia, annuities can offer a level of protection under state law. Generally, they are considered assets that may be safeguarded from creditors in some situations. However, the degree of protection varies depending on specific circumstances. Consulting with a legal expert about your Virginia Private Annuity Agreement can provide further clarity on this topic.

A private annuity may come with several disadvantages. For instance, the initial setup can be complex, and it requires careful legal consideration. Moreover, the interest payments can be subject to income tax, which may affect your overall financial strategy. It is essential to thoroughly evaluate these factors when creating a Virginia Private Annuity Agreement.