Title: Understanding Virginia UCC-1 for Personal Credit: Types and Detailed Overview Introduction: Virginia Uniform Commercial Code (UCC) plays a crucial role in regulating various aspects of commercial transactions, including personal credit. When it comes to securing a loan or collateralizing personal property in Virginia, the UCC-1 financing statement is a vital document to be aware of. This article aims to provide a detailed description of what Virginia UCC-1 for Personal Credit entails, covering different types existing within the state. 1. What is the Virginia UCC-1 for Personal Credit? The Virginia UCC-1 for Personal Credit refers to a financing statement that serves as a legal document which provides notice to the public regarding a creditor's security interest in personal property. Essentially, it is a means to secure a creditor's interest in property offered as collateral by an individual. 2. Importance of the Virginia UCC-1 for Personal Credit: The UCC-1 financing statement is crucial as it establishes a priority system for creditors and gives them legal rights to claim the collateral in the event of non-payment or default by the debtor. It provides protection and clarity to lenders, promoting trust in commercial transactions. 3. Types of Virginia UCC-1 for Personal Credit: While there are no specific types of UCC-1 forms exclusive to Virginia, understanding the broader classifications and variations within personal credit is essential. Common types of UCC-1 for Personal Credit include: a) UCC-1 Financing Statement: This is the standard and most commonly used form. It discloses the creditor's security interest in the personal property offered as collateral. It includes information about the debtor, creditor, collateral description, transaction details, and any additional provisions. b) UCC-1 Addendum: If there is a need to provide more information or clarify certain details that couldn't be accommodated within the main UCC-1 form, an addendum may be attached. This can include additional collateral descriptions, modifications to existing financing statements, or address specific circumstances of the transaction. c) UCC-1 Continuation: To extend the effectiveness of a previously filed UCC-1 financing statement beyond its initial five-year period, a UCC-1 continuation can be filed. This form allows creditors to maintain their priority rights in the collateral and continue their security interest. d) UCC-1 Termination: A UCC-1 termination statement is filed when the debt is fully repaid, or the collateral is released from the creditor's interest. This form ensures that the public record accurately reflects the satisfaction or release of the security interest, maintaining transparency and preventing potential disputes. Conclusion: In Virginia, understanding the UCC-1 for Personal Credit is crucial for both creditors and debtors engaging in commercial transactions involving personal property. By filing the appropriate UCC-1 forms, creditors can protect their rights and interests, while debtors can ensure clarity and transparency in the transaction. It is important to consult legal professionals or relevant authorities for specific guidance and to ensure compliance with Virginia's UCC regulations.

Virginia UCC-1 for Personal Credit

Description

How to fill out Virginia UCC-1 For Personal Credit?

If you wish to aggregate, download, or print valid document templates, utilize US Legal Forms, the foremost collection of legal forms available online.

Utilize the site’s straightforward and user-friendly search to locate the documents you need.

Various templates for commercial and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours forever.

You will have access to all forms you downloaded through your account. Click on the My documents section to select a form to print or download again.

- Use US Legal Forms to find the Virginia UCC-1 for Personal Credit within just a few clicks.

- If you are a current US Legal Forms customer, Log In to your account and click the Download button to acquire the Virginia UCC-1 for Personal Credit.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

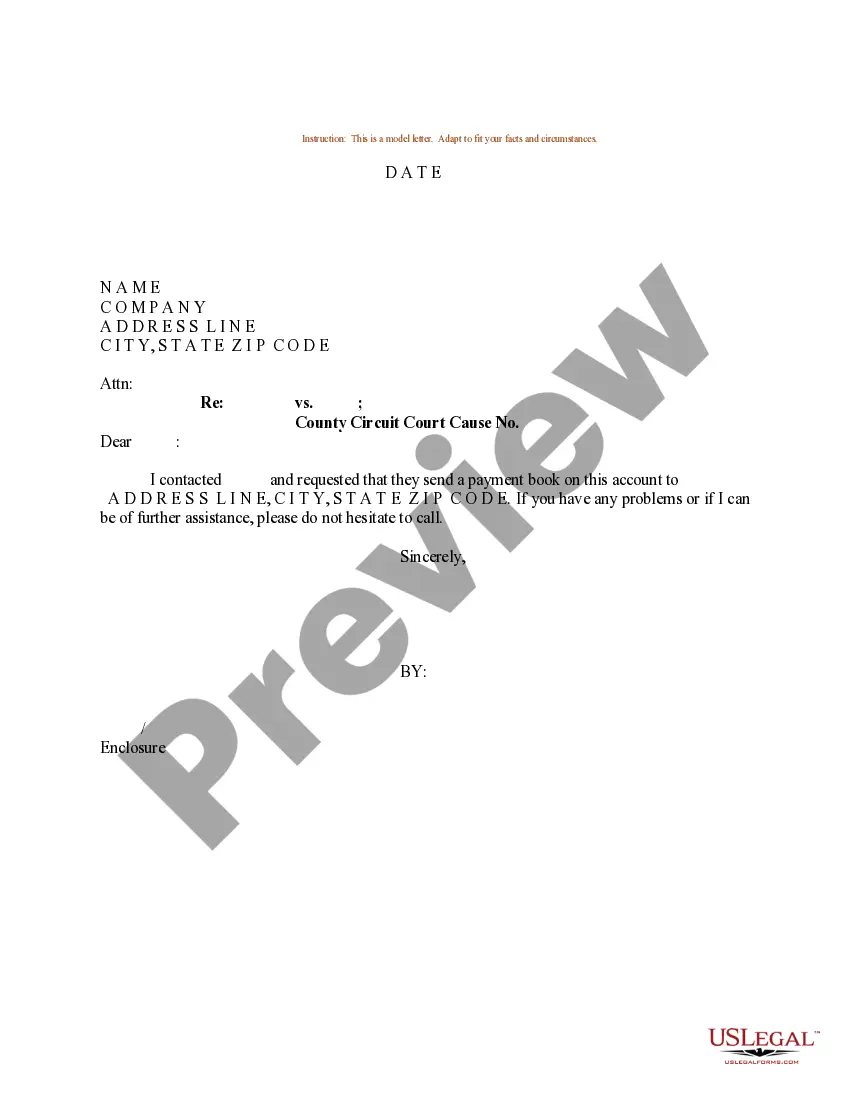

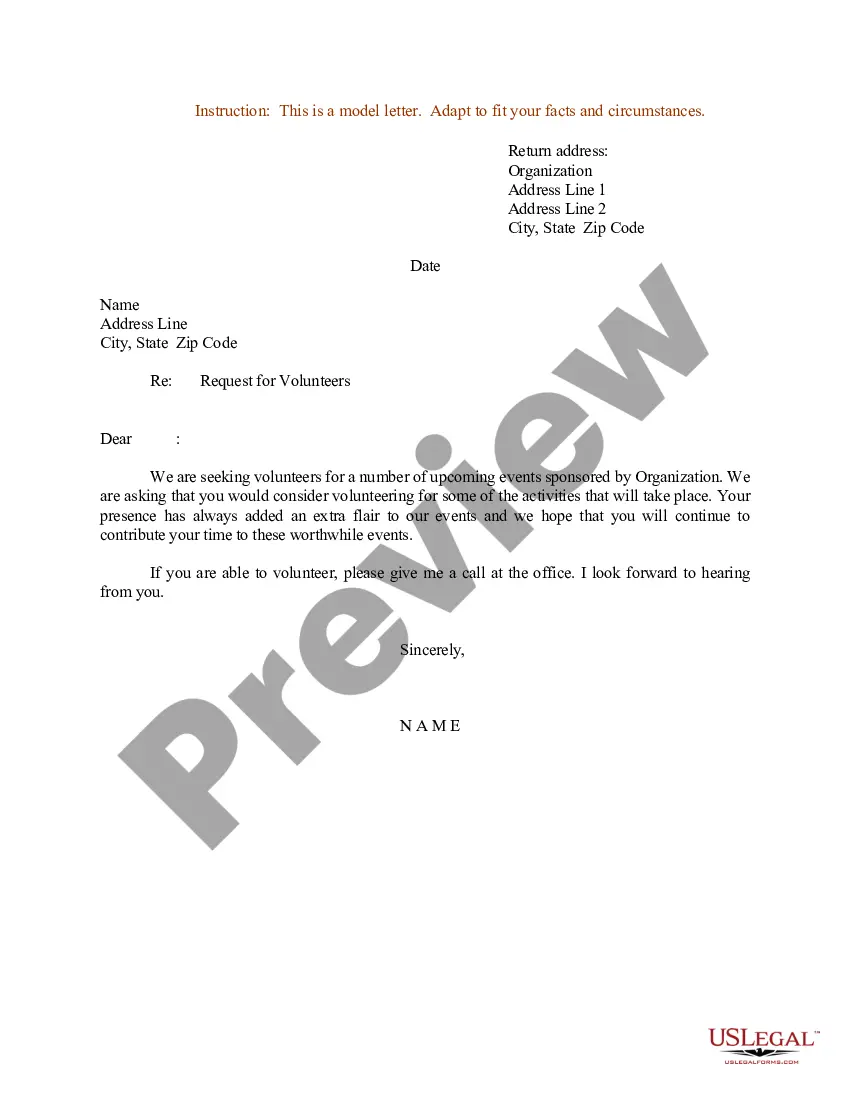

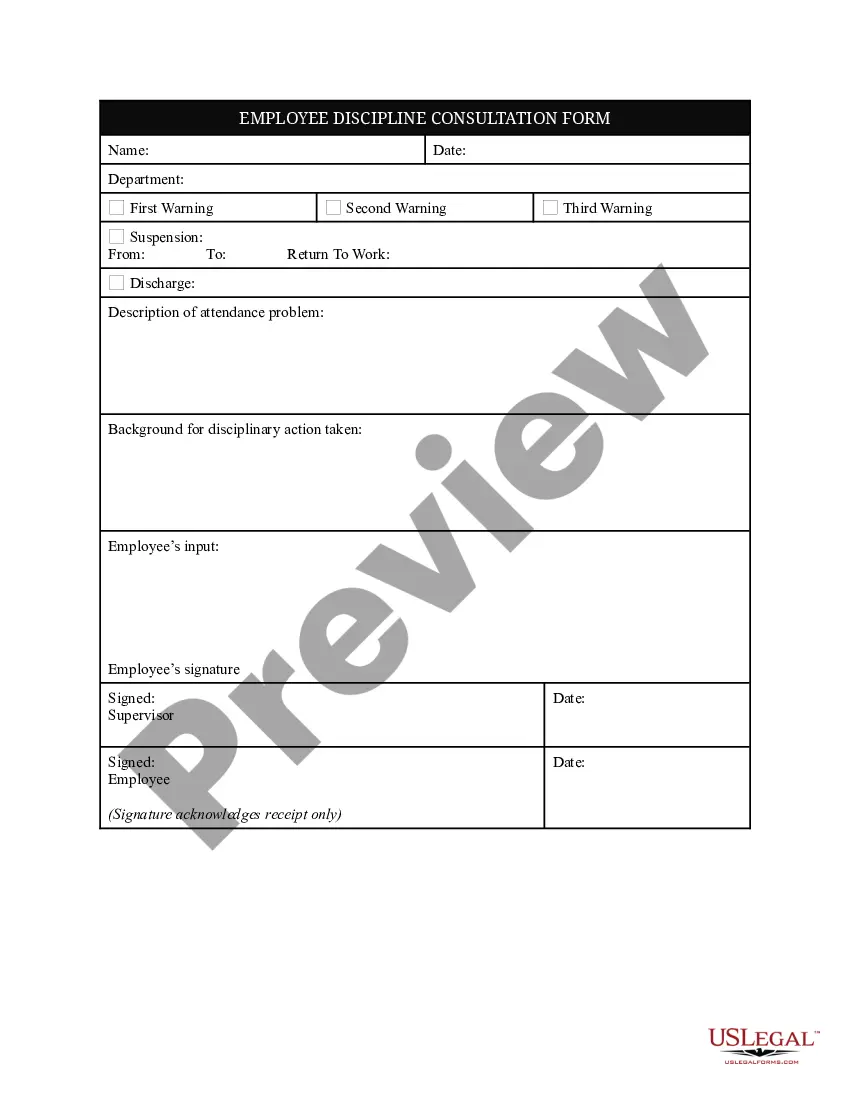

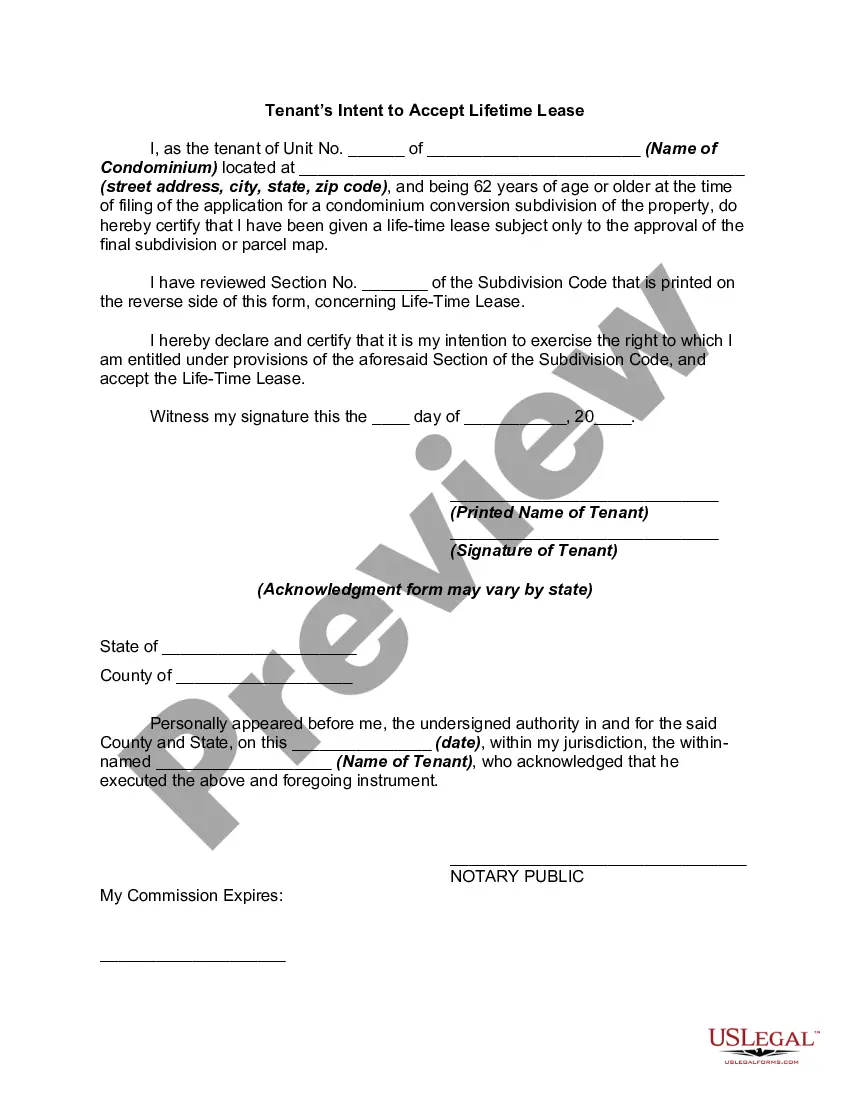

- Step 1. Ensure you have selected the form for the correct region/state.

- Step 2. Use the Preview option to review the form’s content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative types of the legal form template.

- Step 4. Once you have found the necessary form, select the Purchase now option. Choose the payment plan that suits you and enter your details to create an account.

- Step 5. Process the payment. You can use your Visa or MasterCard, or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal form and download it onto your device.

- Step 7. Fill out, edit, and print or sign the Virginia UCC-1 for Personal Credit.

Form popularity

FAQ

Filling out a UCC-1 involves several simple steps. Start by gathering necessary information, including your name, address, and the description of the collateral. Next, follow the form's sections in order, ensuring accuracy at each point. Lastly, submit the form through your state’s office or via services such as uslegalforms, which simplify online submissions for the Virginia UCC-1 for Personal Credit.

To properly fill out a UCC-1 form, begin by providing accurate and complete information about yourself and the collateral involved. Make sure to specify the type of property and its details clearly. Utilizing user-friendly platforms like uslegalforms can guide you through this process, making it easier to ensure all required fields are filled out correctly.

Filing a UCC-1 on yourself can help establish your claim to personal assets. This is particularly useful if you want to bolster your creditworthiness or protect your rights against potential creditors. By using the Virginia UCC-1 for Personal Credit, you create a public record of your assets, which can significantly enhance your financial credibility.

The Uniform Commercial Code (UCC) is a set of laws that govern commercial transactions in the United States. Essentially, it standardizes the regulations for submitting and managing financial agreements. In the context of the Virginia UCC-1 for Personal Credit, the UCC-1 filing allows you to claim a security interest in personal property, which can play a crucial role in protecting your credit and financial standing.

A UCC fixture filing is filed with the Secretary of State in Virginia, similar to a standard UCC-1 for personal credit. This filing applies to fixtures that are attached to real estate and requires specific details about the property. By filing correctly, you ensure that your credit claim is prioritized in case of bankruptcy. US Legal Forms can help you navigate the distinct requirements for fixture filings.

If you are filing a UCC-1 for a foreign entity in Virginia, you may need to file in the same state where your entity registered. Check whether your foreign entity has registered with the Virginia Secretary of State. This filing protects your interests in personal credit while operating in the state. The US Legal Forms platform can assist you in determining the correct filing location and requirements.

Your UCC-1 statement should be filed with the Secretary of State’s office in Virginia. This location serves as the main repository for UCC filings in the state. Ensuring that your UCC-1 is filed correctly provides protection for your personal credit assets. Consider using US Legal Forms, which offers guidance and resources for efficient filing.

To find your Virginia UCC-1 filing, you can access the state’s online database or contact the Secretary of State’s office directly. Many states, including Virginia, provide searchable online tools to view filed UCC statements. With your details, you can easily locate your filing and review its status. This transparency is beneficial for tracking your personal credit arrangements.

You should file a UCC-1 for personal credit with the appropriate state office, typically the Secretary of State in Virginia. This central filing system allows you to publicly record a secured interest in your personal assets. By filing the Virginia UCC-1, you notify creditors of your claims to personal credit. Using platforms like US Legal Forms can simplify this process and ensure accuracy.

In Virginia, you can file your UCC-1 in the Office of the Secretary of the Commonwealth or online through their official website. This state office handles all UCC filings and maintains the public records related to personal and commercial transactions. Ensuring your filing is done correctly is crucial, and using uslegalforms can help you navigate this process with ease.

Interesting Questions

More info

Less HTML5/JavaScript-to-HTML converter.