When it comes to real estate transactions in Virginia, it is important to understand the role of the UCC-1 financing statement. This document serves as a vital tool for secure and efficient real estate transactions by providing public notice of a creditor's interest in personal property collateral. The UCC-1, which stands for Uniform Commercial Code-1, is a legal form that establishes and perfects a security interest in personal property collateral. In the context of real estate, the UCC-1 is commonly used to secure loans and mortgages for properties, ensuring that a lender's interest is properly recorded and protected. There are several types of UCC-1 filings related to real estate in Virginia. Some of the most common ones are: 1. UCC-1 Financing Statement for Real Estate Mortgage: This type of UCC-1 filing is typically used when a lender provides a mortgage loan against real estate property. By filing a UCC-1 with the appropriate public office, the lender notifies the public of their interest in the property and establishes their priority over any subsequent creditors. 2. UCC-1 Financing Statement for Construction Liens: Contractors and suppliers who work on construction projects can secure their interests by filing a UCC-1 financing statement. This filing helps protect their rights to payment and establishes priority over other creditors in case of non-payment or default. 3. UCC-1 Financing Statement for Equipment Financing: In situations where real estate transactions involve equipment or machinery, a UCC-1 filing can be utilized to secure the creditor's interest in that specific collateral. This type of filing is common when equipment financing is involved, such as loans for industrial machinery or commercial vehicles used on real estate premises. It is important to note that a UCC-1 is different from a traditional mortgage or deed of trust, which primarily deal with real property. Instead, a UCC-1 mainly focuses on personal property collateral associated with real estate transactions. By filing a UCC-1, lenders and creditors can protect their interests and establish their priority rights in case of default or any other legal issues. In summary, the Virginia UCC-1 for Real Estate serves as a critical legal instrument in securing the interests of lenders and creditors in real estate transactions. Whether it involves mortgages, construction liens, or equipment financing, these UCC-1 filings play a crucial role in establishing and perfecting security interests, thereby ensuring transparent and efficient real estate dealings.

Virginia UCC-1 for Real Estate

Description

How to fill out Virginia UCC-1 For Real Estate?

Are you currently in a position where you frequently require documents for business or personal use.

There is a plethora of legal document templates available online, but locating reliable ones can be challenging.

US Legal Forms provides thousands of template options, including the Virginia UCC-1 for Real Estate, designed to comply with federal and state regulations.

Once you've found the appropriate form, click Purchase now.

Select the pricing plan you want, enter the necessary information to create your account, and pay for your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- You can then download the Virginia UCC-1 for Real Estate template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and verify it is for your specific city/state.

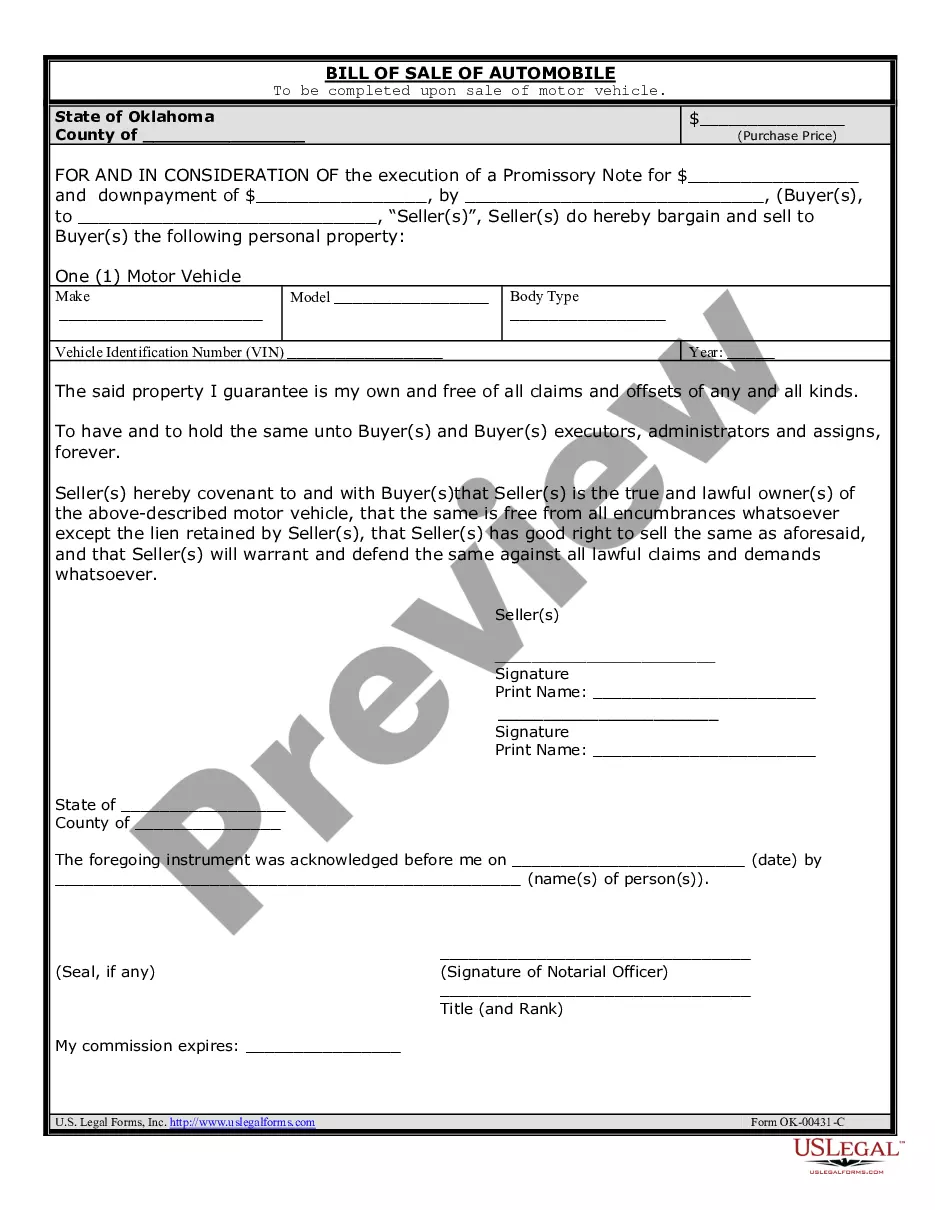

- Use the Preview button to review the form.

- Check the description to ensure you have selected the correct document.

- If the form is not what you need, utilize the Search box to find the form that meets your requirements.

Form popularity

FAQ

You cannot file a UCC directly on real estate but can file it against personal property tied to the real estate. This includes fixtures that can be sold separately from the real estate. For anyone considering Virginia UCC-1 for Real Estate, knowing how to properly file and what can be included is crucial for safeguarding your investment.

A UCC filing in real estate signals a secured interest in personal property associated with real estate transactions. It informs creditors of your claim, while establishing priority. Utilizing Virginia UCC-1 for Real Estate can help protect your investment and clarify your rights within the property.

Filing a UCC involves submitting the UCC-1 form to the appropriate state authority, typically the Secretary of State. In Virginia, this process often includes providing details about the secured party and the collateral. For those applying this to Virginia UCC-1 for Real Estate, working with a legal service like uslegalforms can simplify your filing.

UCC Article 9 primarily deals with personal property, not real property. However, in some cases, it may interact with real estate transactions. Understanding the nuances of UCC Article 9 is important when dealing with financing and securing interests in Virginia UCC-1 for Real Estate.

To file a Virginia UCC-1 for Real Estate, you need to gather the debtor's full name and address, along with a clear description of the collateral. You must also identify the secured party, as they are the one benefiting from the filing. It's essential to ensure all information is accurate to avoid processing delays. If you need assistance, uslegalforms offers resources that can guide you through the filing process smoothly.

Individuals and businesses file a Virginia UCC-1 for Real Estate to establish a legal claim on specific assets. This filing protects the lender's interests if the borrower defaults, ensuring that the lender has priority over other creditors. By creating a public record of the secured interest, it also helps prevent fraud and ambiguity regarding ownership. Utilizing uslegalforms can aid you in making this important legal step efficiently.

In Virginia, you file a UCC-1 with the State Corporation Commission, specifically the Clerk's Office. This can be done online, by mail, or in person, depending on your preference and urgency. The filing creates a public record of your secured interest in the property. For step-by-step guidance, our platform offers resources that make understanding where and how to file a Virginia UCC-1 for Real Estate easy.

1 in real estate is a legal instrument used to officially record the secured interest in real property. Although real estate deals generally fall outside the UCC’s typical applications, using a UCC1 can be vital when real estate acts as collateral. This filing protects the lender's rights and provides public notice of their interest. For a seamless process, consider how uslegalforms can guide you through utilizing the Virginia UCC1 for Real Estate.

The UCC primarily deals with personal property rather than real estate. However, certain aspects of it, like the UCC-1 filing, can apply to real estate when the property is used as collateral. This means that while UCC doesn't directly govern real estate transactions, it plays a role in securing loans involving real estate assets. Learning about the Virginia UCC-1 for Real Estate will clarify its function in such scenarios.

Yes, a landlord can file a UCC-1 to secure an interest in the property for unpaid rents or other obligations. This legal move allows landlords to protect their rights and ensure they are compensated for their investments. In Virginia, a UCC-1 enhances a landlord's ability to claim past dues. Utilizing our services simplifies the process for landlords needing to file effectively.

Interesting Questions

More info

Solicitor Contact Virginia Consumers Information Contact Virginia Corporations Information Office Telephone Toll-Free Number Contact Lawyer Office Hours of Operation Contact Webmaster Contact Broker This form is being protected by copyright. It may contain copyrighted information and images from the Office of the Secretary of State. This form is not a solicitation.