A joint venture is a relationship between two or more people who combine their labor or property for a single business undertaking. They share profits and losses equally, or as otherwise provided in the joint venture agreement. The single business undertaking aspect is a key to determining whether or not a business entity is a joint venture as opposed to a partnership.

A joint venture is very similar to a partnership. In fact, some States treat joint ventures the same as partnerships with regard to partnership statutes such as the Uniform Partnership Act. The main difference between a partnership and a joint venture is that a joint venture usually relates to the pursuit of a single transaction or enterprise even though this may require several years to accomplish. A partnership is generally a continuing or ongoing business or activity. While a partnership may be expressly created for a single transaction, this is very unusual. Most Courts hold that joint ventures are subject to the same principles of law as partnerships.

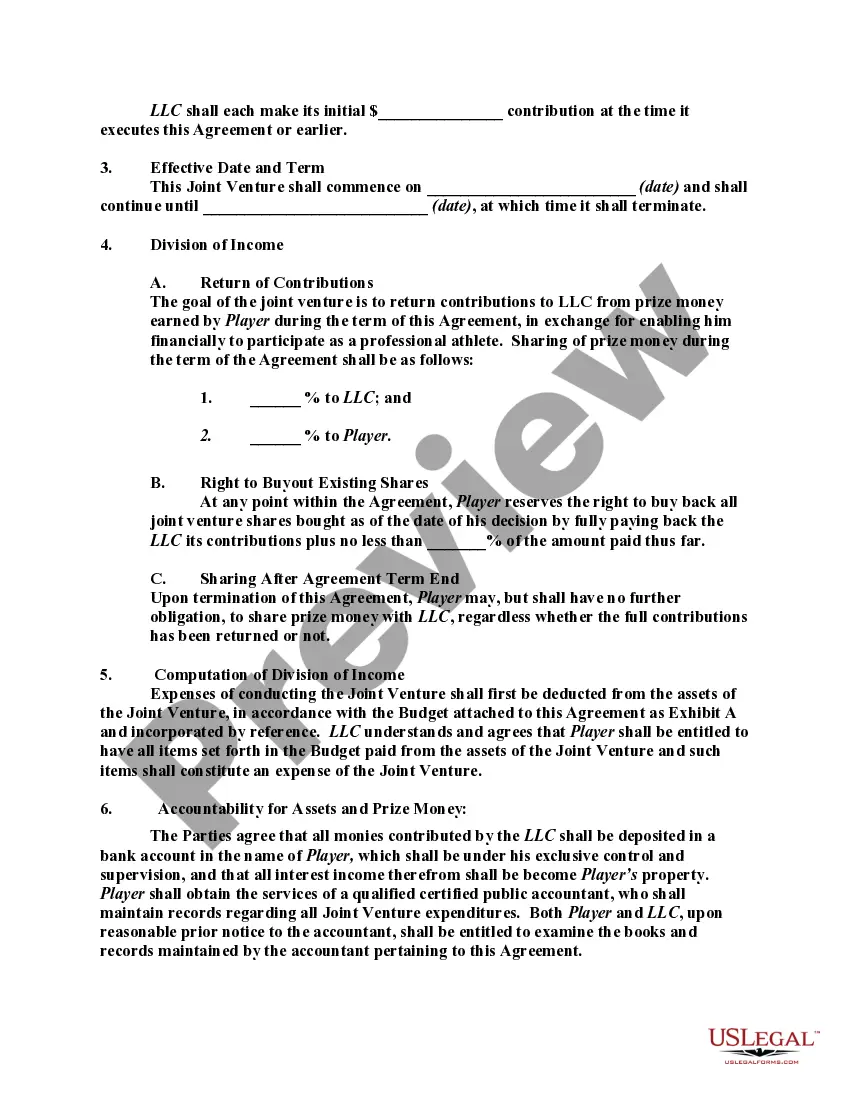

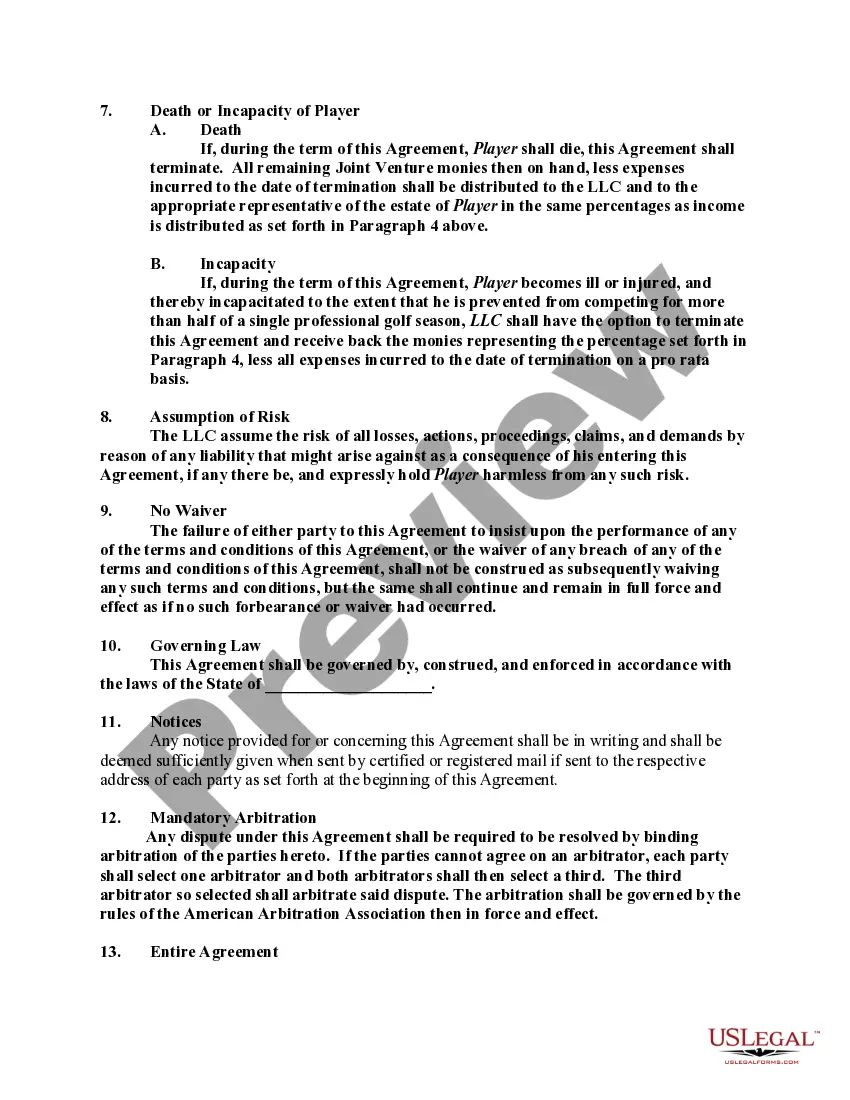

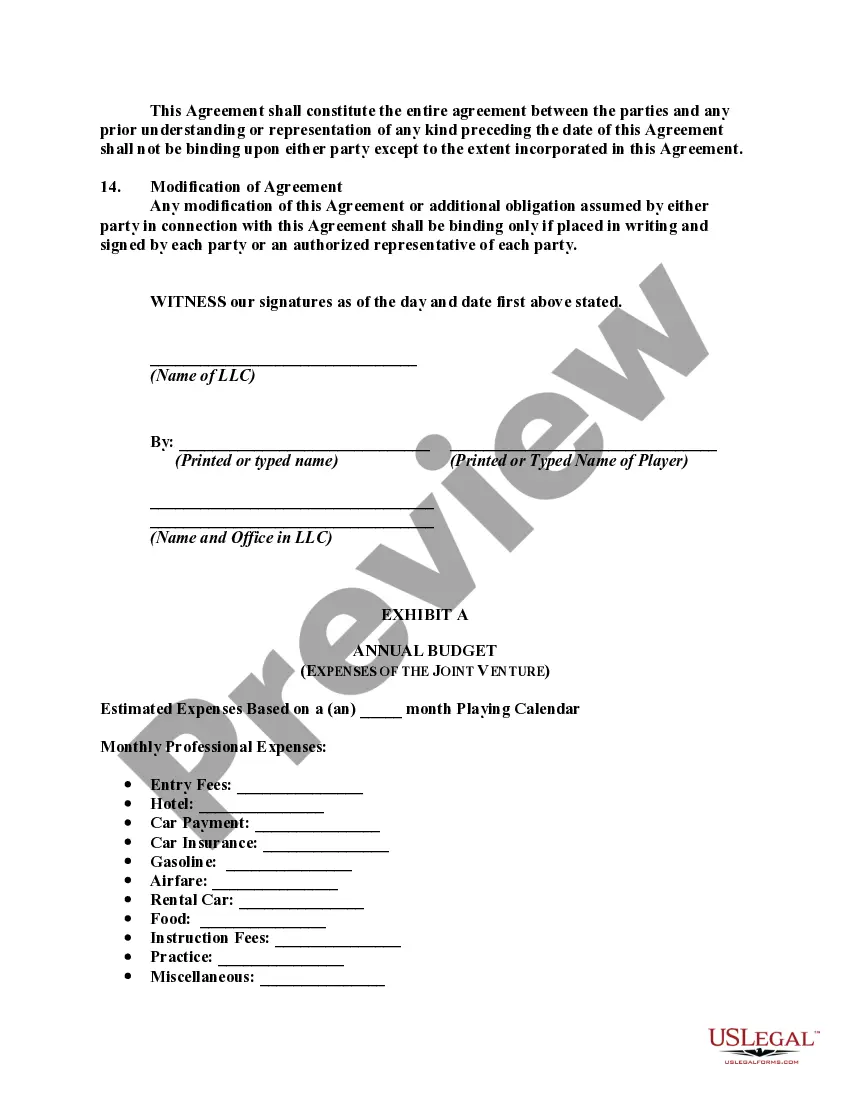

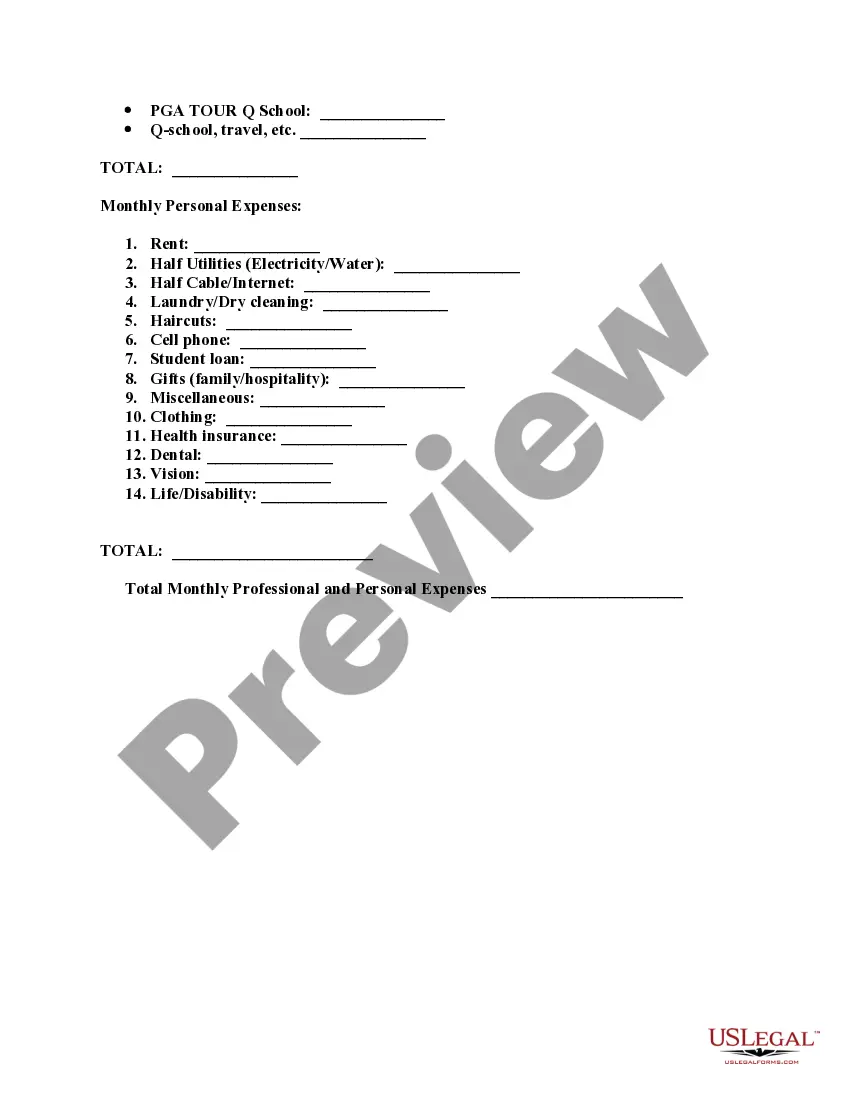

Title: Understanding the Virginia Joint Venture Agreement between a Limited Liability Company and Professional Golfer to Sponsor and Provide Funds. Keywords: Virginia Joint Venture Agreement, Limited Liability Company, Professional Golfer, Sponsorship, Funding. Introduction: A Virginia Joint Venture Agreement between a Limited Liability Company (LLC) and a Professional Golfer serves as a contractual arrangement where both parties collaboratively invest resources, knowledge, and effort to sponsor the golfer's career and provide necessary financial backing. This article aims to provide a detailed description of this agreement, its key components, and potential variations. 1. Cooperative Sponsorship and Funding: The primary purpose of the Virginia Joint Venture Agreement is to create a cooperative sponsorship and financial partnership between the LLC and a Professional Golfer. The LLC, acting as the sponsoring entity, agrees to provide the golfer with financial resources, marketing support, brand endorsements, and other necessary assistance to enhance the golfer's career prospects. 2. The Role of the Limited Liability Company: The LLC, within the scope of the agreement, assumes the role of the sponsor, offering financial backing to the golfer in exchange for negotiated returns. This may include sponsorship fees, a percentage of winnings, or other agreed-upon monetary considerations. The LLC also plays a crucial role in managing the strategic aspects of sponsorship, such as coordinating marketing campaigns, securing endorsement deals, and managing public relations. 3. Responsibilities of the Professional Golfer: In this joint venture, the Professional Golfer primarily focuses on honing their skills, participating in tournaments, and representing the sponsor's brand in a positive light. The golfer must maintain a high level of professionalism, deliver agreed-upon sponsorship benefits, and actively promote the partnership to maximize its value. 4. Key Components of the Agreement: a) Financial Arrangements: The agreement outlines the financial provisions agreed upon by both parties, such as sponsorship fees, profit-sharing mechanisms, expense allocations, and taxation considerations. b) Duration and Renew ability: The agreement specifies the duration of the joint venture and outlines the conditions for renewal or termination, offering flexibility for both parties. c) Intellectual Property and Licenses: The ownership, usage, and potential licensing of intellectual property rights, including the golfer's name and likeness, are addressed in the agreement to protect the sponsor's interests. d) Marketing and Branding: The agreement often includes provisions related to the golfer's branding obligations, promotional activities, use of sponsor trademarks, and guidelines for maintaining brand consistency. e) Performance Metrics: The agreement may establish specific performance goals or benchmarks tied to financial incentives, with provisions outlining how progress and success will be measured. Types of Virginia Joint Venture Agreements between an LLC and a Professional Golfer: 1. Standard Sponsorship Agreement: This type of joint venture agreement primarily focuses on traditional sponsorship roles and responsibilities, outlining the financial terms, marketing obligations, and intellectual property considerations. 2. Equity Investment Agreement: In some cases, the LLC might offer equity or ownership stake in the sponsorship agreement, investing in the golfer's career for potential future profits. This agreement may have additional clauses addressing profit-sharing and exit strategies. 3. Tournament-Specific Sponsorship Agreement: For specific tournaments, the joint venture agreement could be tailored to cover only the duration of the event, with distinctive financial terms and obligations for both parties. Conclusion: The Virginia Joint Venture Agreement between a Limited Liability Company and Professional Golfer provides a solid foundation for a mutually beneficial sponsorship and financial partnership. The agreement defines the roles, responsibilities, financial arrangements, and various other terms and conditions, creating a framework for successful collaboration. Understanding the different types of agreements allows parties to tailor their partnership to suit their unique needs and goals in the competitive world of professional golf.Title: Understanding the Virginia Joint Venture Agreement between a Limited Liability Company and Professional Golfer to Sponsor and Provide Funds. Keywords: Virginia Joint Venture Agreement, Limited Liability Company, Professional Golfer, Sponsorship, Funding. Introduction: A Virginia Joint Venture Agreement between a Limited Liability Company (LLC) and a Professional Golfer serves as a contractual arrangement where both parties collaboratively invest resources, knowledge, and effort to sponsor the golfer's career and provide necessary financial backing. This article aims to provide a detailed description of this agreement, its key components, and potential variations. 1. Cooperative Sponsorship and Funding: The primary purpose of the Virginia Joint Venture Agreement is to create a cooperative sponsorship and financial partnership between the LLC and a Professional Golfer. The LLC, acting as the sponsoring entity, agrees to provide the golfer with financial resources, marketing support, brand endorsements, and other necessary assistance to enhance the golfer's career prospects. 2. The Role of the Limited Liability Company: The LLC, within the scope of the agreement, assumes the role of the sponsor, offering financial backing to the golfer in exchange for negotiated returns. This may include sponsorship fees, a percentage of winnings, or other agreed-upon monetary considerations. The LLC also plays a crucial role in managing the strategic aspects of sponsorship, such as coordinating marketing campaigns, securing endorsement deals, and managing public relations. 3. Responsibilities of the Professional Golfer: In this joint venture, the Professional Golfer primarily focuses on honing their skills, participating in tournaments, and representing the sponsor's brand in a positive light. The golfer must maintain a high level of professionalism, deliver agreed-upon sponsorship benefits, and actively promote the partnership to maximize its value. 4. Key Components of the Agreement: a) Financial Arrangements: The agreement outlines the financial provisions agreed upon by both parties, such as sponsorship fees, profit-sharing mechanisms, expense allocations, and taxation considerations. b) Duration and Renew ability: The agreement specifies the duration of the joint venture and outlines the conditions for renewal or termination, offering flexibility for both parties. c) Intellectual Property and Licenses: The ownership, usage, and potential licensing of intellectual property rights, including the golfer's name and likeness, are addressed in the agreement to protect the sponsor's interests. d) Marketing and Branding: The agreement often includes provisions related to the golfer's branding obligations, promotional activities, use of sponsor trademarks, and guidelines for maintaining brand consistency. e) Performance Metrics: The agreement may establish specific performance goals or benchmarks tied to financial incentives, with provisions outlining how progress and success will be measured. Types of Virginia Joint Venture Agreements between an LLC and a Professional Golfer: 1. Standard Sponsorship Agreement: This type of joint venture agreement primarily focuses on traditional sponsorship roles and responsibilities, outlining the financial terms, marketing obligations, and intellectual property considerations. 2. Equity Investment Agreement: In some cases, the LLC might offer equity or ownership stake in the sponsorship agreement, investing in the golfer's career for potential future profits. This agreement may have additional clauses addressing profit-sharing and exit strategies. 3. Tournament-Specific Sponsorship Agreement: For specific tournaments, the joint venture agreement could be tailored to cover only the duration of the event, with distinctive financial terms and obligations for both parties. Conclusion: The Virginia Joint Venture Agreement between a Limited Liability Company and Professional Golfer provides a solid foundation for a mutually beneficial sponsorship and financial partnership. The agreement defines the roles, responsibilities, financial arrangements, and various other terms and conditions, creating a framework for successful collaboration. Understanding the different types of agreements allows parties to tailor their partnership to suit their unique needs and goals in the competitive world of professional golf.