Gift taxes are taxes that supplement the Estate Tax. Gift taxes are placed on gifts given away to any person while you are still living, so that you may not avoid estate taxes by making gifts of your estate. You may give up to $12,000 a year in cash or assets to an unlimited number of people each year without incurring gift tax liability, but the gifts must have no conditions attached. Married couples can give, as a couple, a $24,000 gift per year to as many people as they want. Under federal tax law, gifts totaling more than $12,000 to one person in one year are considered a taxable gift and generate a potential gift tax. It does not matter if you give one $13,000 gift or 13 gifts of $1,000 each, or one gift of $12,000 and a "birthday gift" of $1,000.

Gifts beyond the $12,000 limit (there is an exception for gifts that are directly paid by the gift giver for tuition and medical expenses) are considered "taxable gifts." Taxable gifts create liability for a gift tax. But gift tax is not due to be paid until you give away over $1,000,000 in your lifetime.

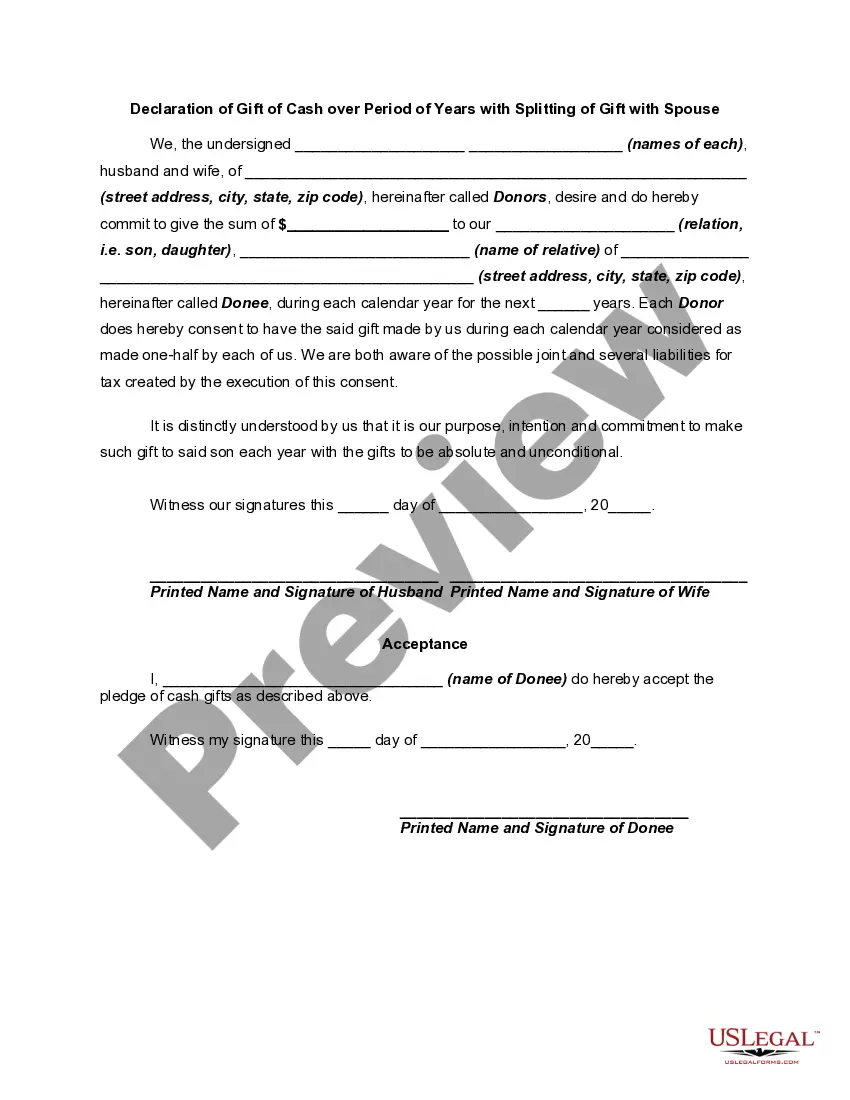

The Virginia Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse is a legal document that deals with the gifting of cash over a specific period of time while also allowing for the splitting of the gift with a spouse. This declaration is often used when individuals want to make a substantial cash gift to someone, such as a family member, friend, or charitable organization, but also want to involve their spouse in the process. By utilizing this declaration, the gift can be split between both parties, ensuring that both individuals can enjoy the benefits of the generosity. There are several types of Virginia Declarations of Gift of Cash over Period of Years with Splitting of Gift with Spouse, each catering to specific circumstances and intentions. These types may include: 1. Charitable Gifts: Individuals who wish to make a donation to a charitable organization over a period of years can utilize this declaration to split the gift with their spouse. This allows both partners to contribute to the cause while receiving certain tax benefits associated with charitable giving. 2. Family Gifts: A Virginia Declaration of Gift of Cash over Period of Years with Splitting of Gift with Spouse can be used when a person wants to provide financial support to a family member, such as a child or grandchild, over an extended period. By splitting the gift with their spouse, both partners can contribute to the financial well-being of their loved ones. 3. Estate Planning: This declaration can be utilized as a part of estate planning strategies. It allows individuals to gift a certain amount of cash to their spouse over a period of years, while also potentially reducing their taxable estate. By splitting the gift with their spouse, both partners can actively participate in estate planning decisions. 4. Business Succession: Business owners who are planning for the future succession of their company may utilize this declaration to make cash gifts to their spouse over a specific period of time. By doing so, they can ensure that their spouse receives their fair share of ownership and assets as part of the succession plan. Keywords: Virginia Declaration, Gift of Cash, Over Period of Years, Splitting of Gift, Spouse, Charitable Gifts, Family Gifts, Estate Planning, Business Succession.