In the United States, the Fair Credit Billing Act allows there is protection for a consumer in the event of unsatisfactory purchases, and undelivered or misrepresented services/products. If you are unsatisfied with a purchase from a store, there are things you can do. If the merchant refuses to refund your money or replace the item, you may be able to take action against your credit card company. Your rights are established by law, but they depend on certain things, such as the purpose of your purchase (business or personal), how much the product cost, and how far from your home you were when you made the purchase.

There are some factors regarding your purchase that must be considered to determine if the credit card company is legally liable:

" Type of card that you used - You must have charged the item by using the charge card issued by the store where you bought it or by using a bank card, rebate card, or travel card. Even if two stores are owned by a parent company, one store may not give you a refund for purchases made at another store.

" Price of merchandise - If the merchandise was bought with a card not issued by the seller, then the product must cost more than $50. If you paid $49.99, then the dispute is between you and the merchant, and the credit card issuer does not have to resolve the matter.

" Form and timing of complaint - You must complain in writing within 60 days after the first bill containing the error arrives. Some bank cards will intervene on your behalf even if you do not write them until after the time limit, but they may charge you an additional fee for doing so.

" Location of transaction - The purchase must have occurred within your home state or within 100 miles of your billing address, unless the item was purchased with the seller's charge card. If you travel more than 100 miles from your billing address to make a purchase, your card issuers does not legally have to become involved in your request for a refund. However, many card issuers will waive this mileage rule.

There are some circumstances under which the card company is not legally responsible. Some of these include:

" Business purchases. The credit card issuer has no responsibility for the transaction if a purchase was made for business purposes.

" If you have already paid for your merchandise. It may not help to contact your credit card company if the purchase is paid for already. If a product is defective or stops working after it is paid for, your dispute is with the store and not with your card issuer. Your best course of action in this case is to contact the store, the manufacturer, and/or the service center.

" You sign a blank receipt. If you sign a blank credit card receipt before services are rendered, and the service provider determines that additional costs are necessary even though above and beyond what was quoted, you may still liable.

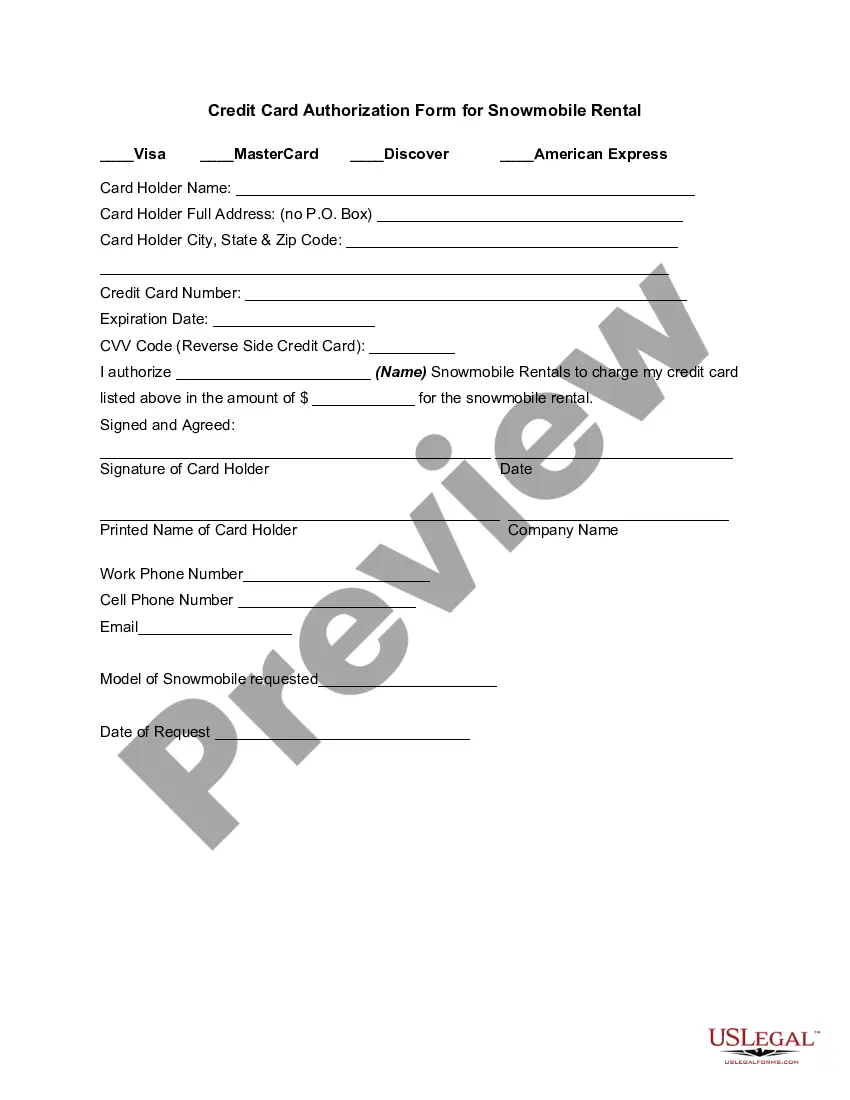

A Virginia Credit Card Authorization Form for Snowmobile Rental is a document that authorizes the credit card holder to be charged for any fees or damages incurred during the rental of a snowmobile in Virginia. This form is typically required by the rental company as a security measure to ensure that they have a valid payment method on file before releasing the snowmobile to the renter. The Virginia Credit Card Authorization Form for Snowmobile Rental is an essential component of the rental process, safeguarding both the rental company and the renter against any financial liabilities. By signing this form, the credit card holder agrees to accept full responsibility for any charges or damages associated with the rental. In addition to the basic information like name, address, and contact details of the credit card holder, this authorization form may also require the credit card information, including the card number, expiration date, and CVV code. This is essential for the rental company to process any charges promptly and accurately. There may be different versions of the Virginia Credit Card Authorization Form for Snowmobile Rental, each tailored to the specific rental company's requirements and policies. These variations can include additional clauses related to insurance coverage, cancellation policies, late return fees, and security deposit requirements. It is crucial for the renter to carefully read and understand the terms and conditions outlined in the form to avoid any surprises or disputes at a later stage. Overall, the Virginia Credit Card Authorization Form for Snowmobile Rental is a necessary document that protects both parties involved in the rental transaction. It ensures that the rental company can recoup any expenses, damages, or fees incurred during the snowmobile rental period, while providing peace of mind to the credit card holder by clearly outlining their financial obligations and limits.