This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Virginia Gift of Entire Interest in Literary Property

Description

How to fill out Gift Of Entire Interest In Literary Property?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal paperwork templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest versions of forms such as the Virginia Gift of Full Interest in Literary Property within moments.

If you already have an account, Log In and download the Virginia Gift of Full Interest in Literary Property from the US Legal Forms library. The Download button will be visible on every form you view. You have access to all previously downloaded forms in the My documents section of your account.

Process the payment. Use your Visa or Mastercard or PayPal account to finalize the transaction.

Choose the format and download the form onto your device. Edit. Complete, modify, and print and sign the downloaded Virginia Gift of Full Interest in Literary Property. Every template you added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the document you want. Access the Virginia Gift of Full Interest in Literary Property with US Legal Forms, the most extensive collection of legal paper templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for your locality.

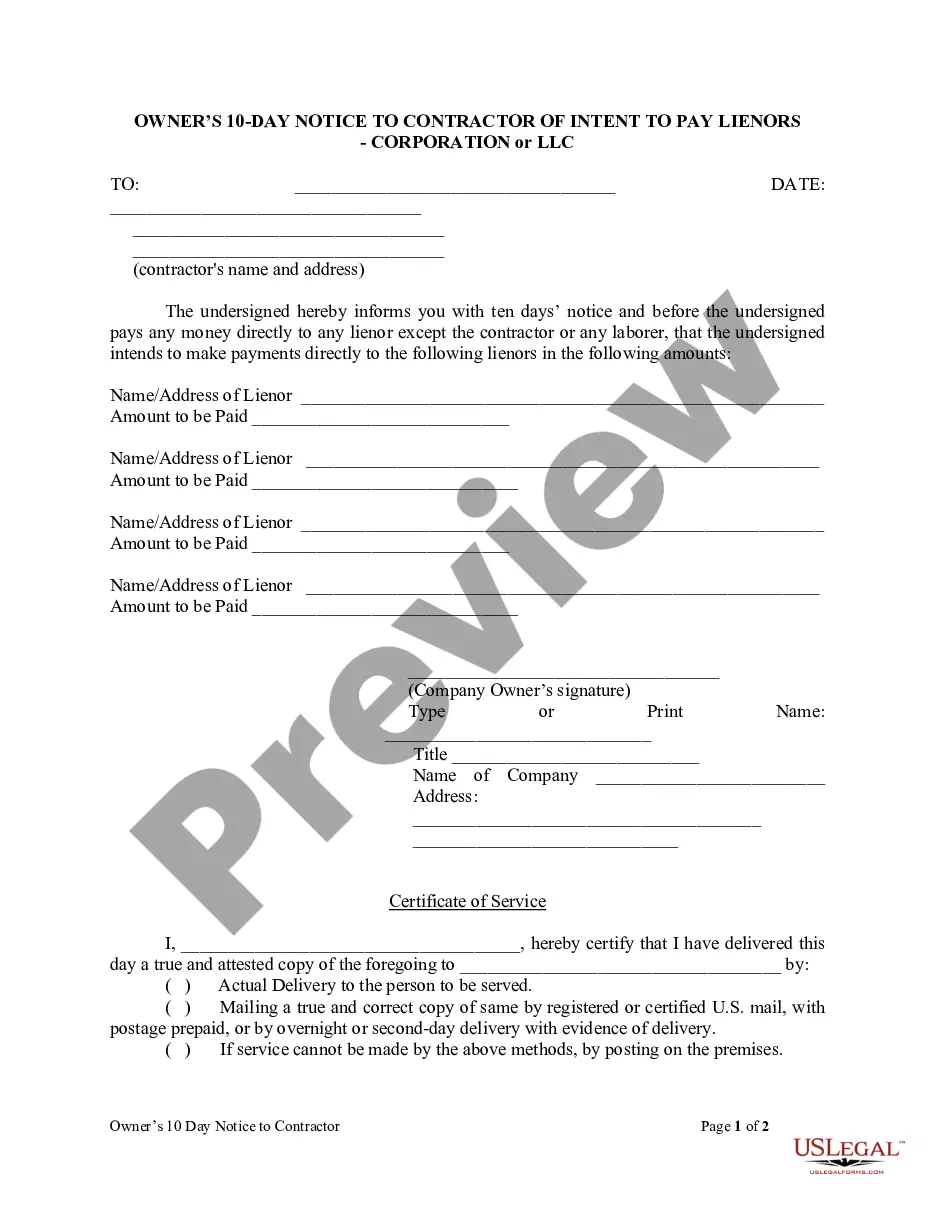

- Click the Preview button to review the form's content.

- Examine the form summary to confirm that you have chosen the appropriate document.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select the pricing plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

To qualify as a valid gift of personal property, three key conditions must be met. First, there must be a clear intention from the giver to make the gift. Second, the property must be delivered to the recipient, with the giver relinquishing control. Lastly, the recipient must accept the gift, completing the transfer process. By adhering to these requirements, you ensure your Virginia Gift of Entire Interest in Literary Property is effective and meaningful.

In Virginia, a deed of gift must include specific elements to be legally valid. Firstly, it must clearly identify the property being gifted and the parties involved. Additionally, it needs to be signed by the giver and may require witnesses or notarization to ensure authenticity. Taking these steps ensures that your Virginia Gift of Entire Interest in Literary Property is legally recognized.

Gifting a house to a family member without incurring taxes in Virginia can be accomplished by utilizing the annual gift tax exclusion. You can gift up to a certain amount each year without triggering taxes. Also, consider recording the gift using a deed, which should clearly state it is a gift, ensuring proper documentation of the Virginia Gift of Entire Interest in Literary Property. Consult a tax advisor for tailored advice.

Transferring a property title in Virginia involves filling out a deed form, such as a quitclaim deed or warranty deed. Both the current owner and the family member receiving the property must sign this document. After signing, you must record the deed with the local county clerk's office to make the transfer official. This process can ensure that the Virginia Gift of Entire Interest in Literary Property is handled properly.

The three main elements necessary for a gift include intention, delivery, and acceptance. Intention involves the giver clearly expressing their desire to gift the property. Delivery ensures that the property is physically handed over or otherwise transferred to the recipient. Acceptance concludes the process, where the recipient acknowledges and agrees to receive the gift, which is crucial in the context of a Virginia Gift of Entire Interest in Literary Property.

To create a valid gift, three essential elements must be present. The giver must intend to transfer ownership of the item, facilitating the intent of a true gift. Then, the gift must be delivered to the recipient, ensuring actual possession is granted. Importantly, the recipient needs to accept the gift, making the transfer legally binding, especially when considering something like a Virginia Gift of Entire Interest in Literary Property.

Transferring a property title to a family member in Virginia involves several straightforward steps. Start by drafting a deed that outlines the transfer and includes details like the property description. Then, ensure the deed is signed, notarized, and filed with the local land records office. This process provides a formal method for making a Virginia Gift of Entire Interest in Literary Property to a loved one.

To establish a valid gift, you must satisfy three key requirements. First, there needs to be the intent to give, meaning the giver must clearly intend to transfer ownership. Second, the property must be delivered to the recipient, transferring possession. Lastly, acceptance by the recipient is essential, confirming their agreement to receive the Virginia Gift of Entire Interest in Literary Property.

Section 17.1-223 of the Virginia Code deals with the limitations on actions that can be taken regarding property disputes. This section establishes specific timeframes for filing lawsuits or claims related to property issues. Knowing these limitations is crucial for property owners, especially when considering legal matters involving gifts like a Virginia Gift of Entire Interest in Literary Property.

Section 55.1-117 of the Virginia Code pertains to the rights of homeowners to access certain documents maintained by their property owners association. This section ensures that homeowners can review relevant records, fostering transparency within the association. Familiarity with this code can aid in making informed decisions about property transfers, such as a Virginia Gift of Entire Interest in Literary Property.