Virginia Simple Promissory Note for Family Loan

Description

How to fill out Simple Promissory Note For Family Loan?

Selecting the optimal legal document template can be a challenge.

Undoubtedly, numerous templates exist online, but how can you procure the legal form you require.

Utilize the US Legal Forms platform.

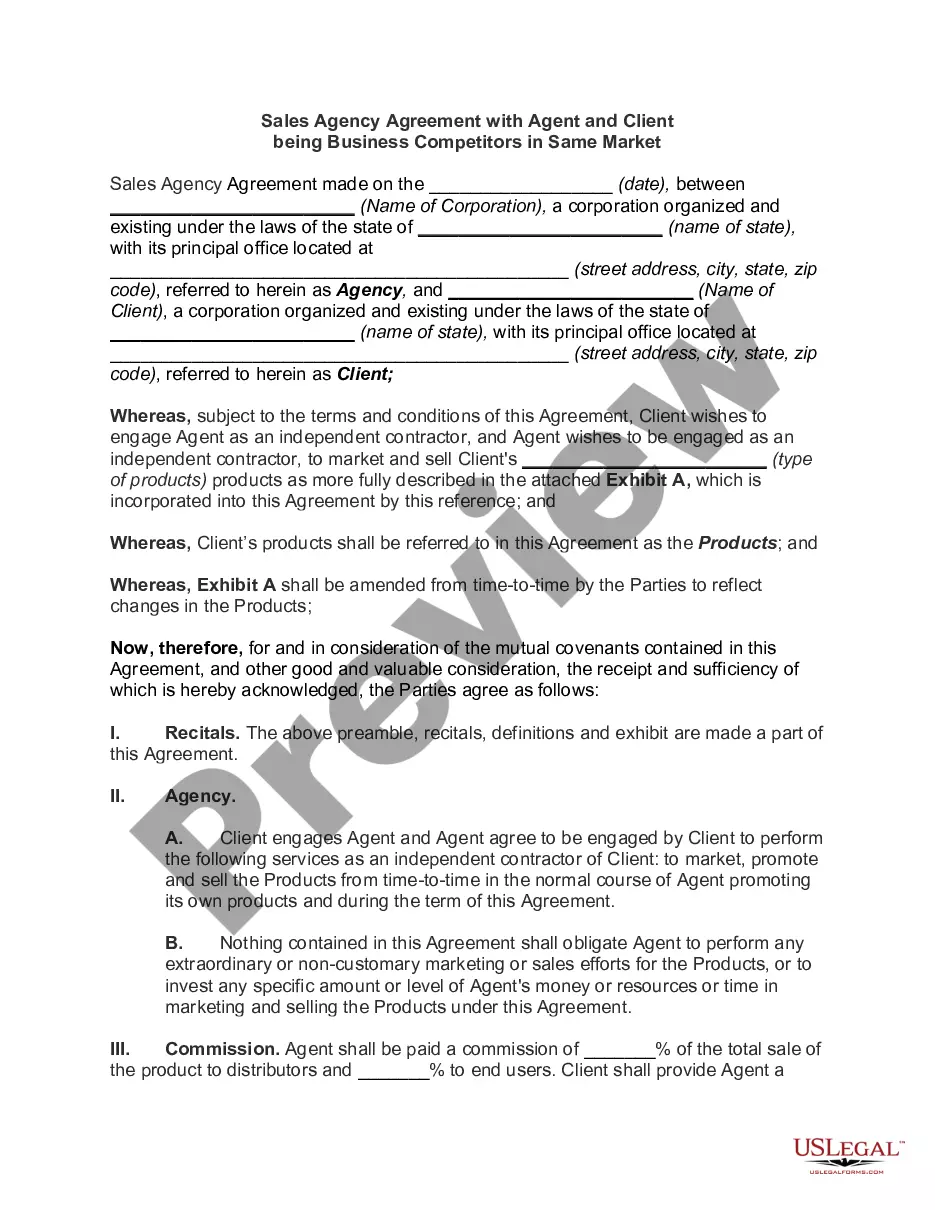

If you are a new user of US Legal Forms, here are simple guidelines to follow: First, ensure you have selected the correct form for your city/state. You can preview the form with the Review button and read the form description to confirm it's the correct one for you.

- This service offers thousands of templates, such as the Virginia Simple Promissory Note for Family Loan, suitable for business and personal needs.

- All the forms are reviewed by experts and meet state and federal standards.

- If you are already registered, Log In to your account and click the Obtain button to access the Virginia Simple Promissory Note for Family Loan.

- Use your account to browse through the legal forms you have previously purchased.

- Visit the My documents section of your account and obtain another copy of the document you require.

Form popularity

FAQ

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

There is no legal requirement for most promissory notes to be witnessed or notarized in Virginia (promissory notes related to real estate must be notarized). Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

The name and address of the person loaning the money. The name and address of the person borrowing the money. Terms of repayment: schedule of repayment, amount of each payment and manner of payments (in-person, cash, check, etc.) Interest to be charged related to the loan, if any.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Pros. Easier approval: There's typically no formal application process, credit check or verification of income when you're borrowing from family. Traditional lenders often require documents such as W-2s, pay stubs and tax forms as part of the loan application process.

In any event, a promissory note does not have to be notarized to be binding. The private respondents have admitted signing the two notes and they have not succeeded in proving that they did so "under duress, fear and undue influence."

A personal loan agreement should include the following information:Names and addresses of the lender and the borrower.Information about the loan cosigner, if applicable.Amount borrowed.Date the loan was provided.Expected repayment date.Interest rate, if applicable.Annual percentage rate (APR), if applicable.More items...?