A Virginia Subcontractor Agreement for Insurance is a legally binding contract that outlines the terms and conditions between a subcontractor and an insurance company in the state of Virginia. This agreement is designed to protect the rights and interests of both parties involved in the subcontracting of insurance services. Keywords: Virginia, subcontractor agreement, insurance, terms and conditions, legally binding, subcontracting, rights, interests There are several types of Virginia Subcontractor Agreements for Insurance, each catering to specific aspects of insurance services: 1. General Virginia Subcontractor Agreement for Insurance: This agreement covers a wide range of insurance services subcontracting, including but not limited to claims processing, policy underwriting, risk assessment, and customer service. 2. Virginia Subcontractor Agreement for Health Insurance: This agreement specifically focuses on subcontracting health insurance-related services, such as medical claims processing, provider network management, and policy administration. 3. Virginia Subcontractor Agreement for Property Insurance: This type of agreement is tailored to subcontracting property insurance services, including property valuation, risk analysis, policy management, and claims adjustment. 4. Virginia Subcontractor Agreement for Life Insurance: Life insurance-specific subcontractor agreements deal with services related to life insurance products, such as policy administration, beneficiary management, premium collection, and claims settlement. 5. Virginia Subcontractor Agreement for Auto Insurance: This agreement pertains to subcontracting auto insurance services, covering areas such as underwriting policies, claims processing, accident investigation, and vehicle valuation. It is essential for both parties involved to carefully review and understand the terms and conditions outlined in the Virginia Subcontractor Agreement for Insurance. Parties should consider seeking legal advice to ensure compliance with Virginia laws and regulations regarding insurance subcontracting.

Virginia Subcontractor Agreement for Insurance

Description

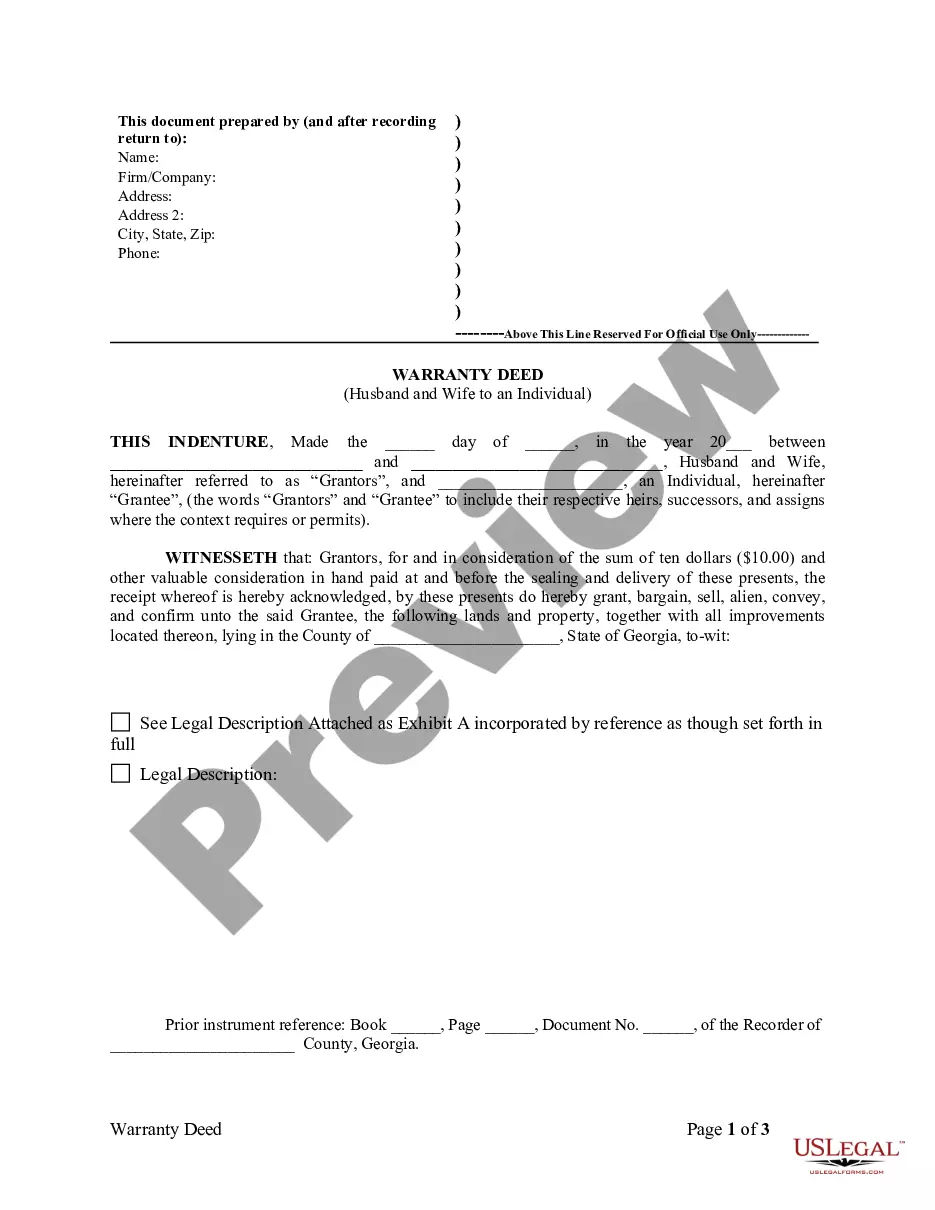

How to fill out Virginia Subcontractor Agreement For Insurance?

You can devote hrs on-line attempting to find the lawful file web template that suits the state and federal needs you want. US Legal Forms supplies 1000s of lawful forms that happen to be reviewed by specialists. You can actually acquire or print the Virginia Subcontractor Agreement for Insurance from our service.

If you already possess a US Legal Forms account, you are able to log in and then click the Download switch. After that, you are able to full, modify, print, or indicator the Virginia Subcontractor Agreement for Insurance. Every single lawful file web template you get is the one you have eternally. To obtain another copy of the bought kind, visit the My Forms tab and then click the related switch.

If you use the US Legal Forms site initially, keep to the easy recommendations beneath:

- Very first, make certain you have selected the proper file web template for the state/city of your choice. See the kind explanation to ensure you have picked the appropriate kind. If readily available, make use of the Preview switch to appear from the file web template also.

- If you would like locate another model of the kind, make use of the Research field to obtain the web template that meets your needs and needs.

- Once you have discovered the web template you want, simply click Acquire now to continue.

- Select the prices program you want, type in your accreditations, and sign up for an account on US Legal Forms.

- Comprehensive the purchase. You should use your charge card or PayPal account to fund the lawful kind.

- Select the file format of the file and acquire it to your device.

- Make adjustments to your file if necessary. You can full, modify and indicator and print Virginia Subcontractor Agreement for Insurance.

Download and print 1000s of file layouts utilizing the US Legal Forms website, which provides the greatest selection of lawful forms. Use professional and express-certain layouts to tackle your business or specific requirements.

Form popularity

FAQ

While Virginia does not mandate all contractors to hold insurance, having it is widely recognized as a best practice. It adds a layer of security for contractors and their clients. By including insurance stipulations in your Virginia Subcontractor Agreement for Insurance, you can mitigate risks and enhance trustworthiness in your professional relationships.

In Virginia, liability insurance is often essential for contractors, especially those working on larger projects. Workers' compensation insurance is also a must for businesses with employees. Including these requirements in your Virginia Subcontractor Agreement for Insurance can help ensure compliance and protect all involved parties.

In Virginia, while it is not universally required for all contractors to have insurance, it is highly recommended. Insurance protects against potential claims and liabilities resulting from construction projects. Including an insurance clause in your Virginia Subcontractor Agreement for Insurance can safeguard all parties involved.

To write a subcontractor agreement, start by outlining the project scope, including detailed deliverables and timelines. Clearly define payment schedules, project milestones, and incorporate provisions for insurance. Utilizing a Virginia Subcontractor Agreement for Insurance template can streamline the process and ensure essential details are not overlooked.

Yes, while it can depend on the type of work and contractual agreements, many independent contractors benefit from having insurance. Insurance can cover potential liabilities and protect against unforeseen circumstances. Hence, including insurance provisions in your Virginia Subcontractor Agreement for Insurance is a prudent decision.

Writing a subcontract agreement involves clearly outlining the roles and responsibilities of each party involved. Start with basic project details, then specify the scope of work, payment terms, and deadlines. Incorporating a Virginia Subcontractor Agreement for Insurance into your document can provide added protection and clarity for all parties.

Yes, Virginia requires contractors to be licensed based on the type and scope of work they perform. It’s essential to check the specific licensing requirements applicable to your project. When drafting a Virginia Subcontractor Agreement for Insurance, ensure that all parties comply with these licensing regulations to avoid legal complications.

Writing a simple contract agreement begins with stating the purpose of the agreement, defining the involved parties, and detailing the deliverables and payment terms. Clear and concise language helps to avoid misunderstandings. For specific projects, consider using a Virginia Subcontractor Agreement for Insurance to ensure that all legalities are properly addressed.

To fill out an independent contractor agreement, make sure to include parties' names, the nature of services, payment terms, and project duration. Additionally, clarify responsibility for taxes and insurance coverage. A carefully structured Virginia Subcontractor Agreement for Insurance can help simplify this process by providing clear guidelines.

The 2 year contractor rule generally refers to specific regulations governing how long an independent contractor can work under similar terms without being classified as an employee. Understanding this rule is crucial when drafting your agreements. By including provisions in your Virginia Subcontractor Agreement for Insurance, you can clarify expected relationships and avoid misclassification.

More info

Title Administration Code of Virginia Administrative Code Article 24 Chapter 25 Public Business, Section 23.2 Public Business, Subchapter G (§ 23 – 23.2.01). In this subtitle, “sale of insurance” means the purchase directly through the insurer of an insured's property or the leasing of an insured's property to the insurer. All persons shall be entitled to sue for damages arising out of the act of leasing or purchase of real property for the purpose of leasing or purchasing insurance on the property for sale or lease by the insurer of the insured. For purposes of this section, the termrealal property” has the same meaning as set forth in § 13-7-102. A “liable policyholder” for purposes of this subsection means a policyholder with respect to the property of any other person that owns an interest in the property or leases the property to another person. The termliablele policyholder” includes a person with respect to a property that owns an interest in the property.