The Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax is a type of leasing agreement specifically designed for businesses operating within the state of Virginia. This lease agreement includes provisions that address the investment tax implications associated with leasing equipment. Under the Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax, businesses can lease various types of equipment required for their operations, such as machinery, vehicles, computers, or office equipment. This leasing agreement is applicable to a wide range of industries, including manufacturing, transportation, technology, and professional services. One of the key aspects of this lease agreement is its provision regarding investment tax. In Virginia, businesses may be subject to various taxes on their equipment or capital investments. The provision within the lease agreement helps businesses navigate these tax implications by outlining the specific terms and conditions related to investment tax. The Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax offers different types of leases to cater to the specific needs and circumstances of businesses. Some of these types include: 1. Financial Lease: This type of lease allows businesses to acquire equipment for an extended period, usually covering the equipment's useful life. At the end of the lease term, the lessee may have an option to purchase the equipment at a predetermined price. 2. Operating Lease: In this type of lease, the lessor retains ownership of the equipment, and the lessee utilizes it for a specific period. Operating leases are typically shorter-term agreements and are useful when businesses require equipment for a limited duration. 3. Sale and Leaseback: This type of lease agreement involves a business selling its owned equipment to a lessor and simultaneously leasing it back. This arrangement allows the business to free up financial resources tied to the equipment while still maintaining access to its use. Regardless of the lease type, the Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax includes detailed terms and conditions concerning lease payments, maintenance responsibilities, insurance requirements, termination clauses, and dispute resolutions. These provisions provide clarity and legal protection to both the lessor and lessee throughout the lease term. In conclusion, the Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax is a comprehensive leasing agreement specifically tailored to address the investment tax implications associated with equipment leasing in Virginia. This lease agreement offers various types, ensuring businesses have flexible options that suit their specific needs. By providing detailed provisions, this lease agreement promotes transparency and minimizes potential conflicts between the lessor and lessee.

Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax

Description

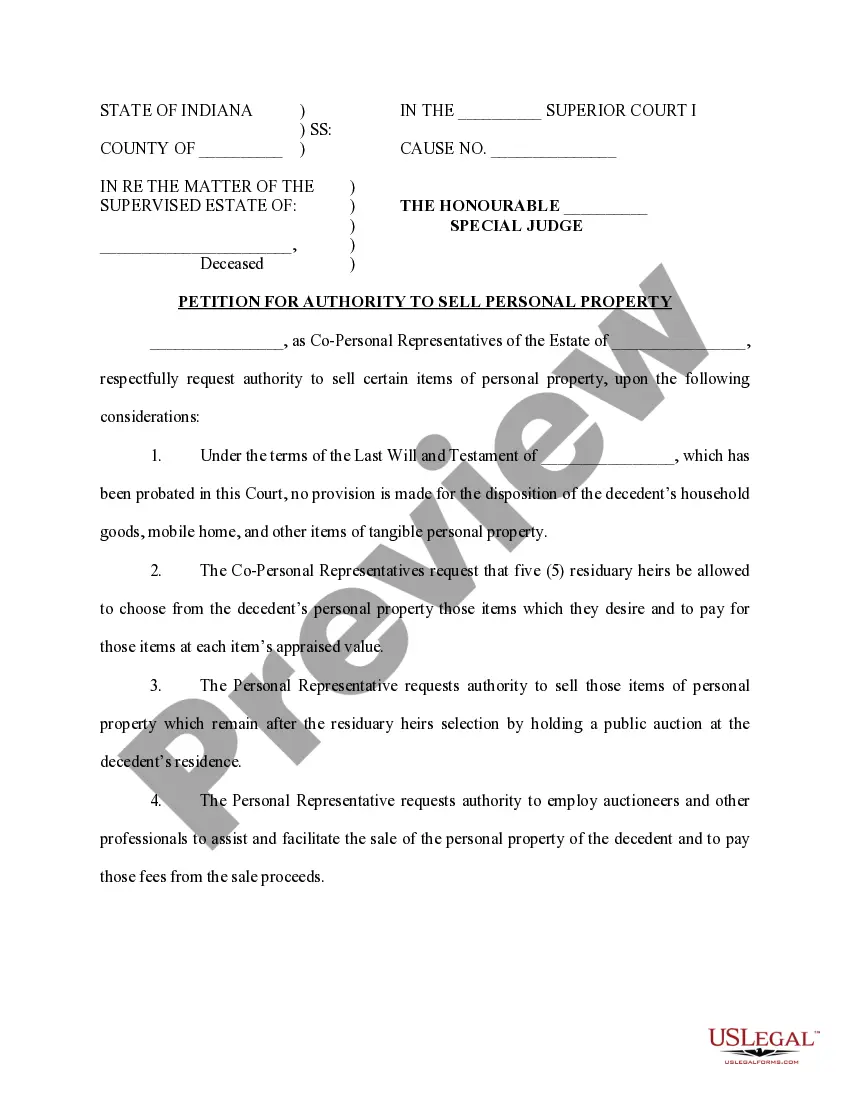

How to fill out Virginia Comprehensive Equipment Lease With Provision Regarding Investment Tax?

If you have to total, acquire, or printing legal record templates, use US Legal Forms, the greatest variety of legal kinds, that can be found on the web. Make use of the site`s simple and easy convenient look for to find the paperwork you require. Various templates for company and specific uses are categorized by groups and states, or keywords and phrases. Use US Legal Forms to find the Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax in just a few click throughs.

If you are already a US Legal Forms buyer, log in for your profile and click the Download switch to have the Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax. You may also accessibility kinds you previously saved from the My Forms tab of the profile.

If you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the shape for your appropriate area/region.

- Step 2. Take advantage of the Preview method to look over the form`s articles. Don`t neglect to see the explanation.

- Step 3. If you are not happy with the type, utilize the Look for industry at the top of the screen to get other variations of the legal type design.

- Step 4. When you have found the shape you require, select the Get now switch. Select the pricing program you choose and put your qualifications to register on an profile.

- Step 5. Approach the financial transaction. You can utilize your credit card or PayPal profile to accomplish the financial transaction.

- Step 6. Choose the format of the legal type and acquire it on your own product.

- Step 7. Full, edit and printing or signal the Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax.

Each legal record design you buy is yours for a long time. You may have acces to every single type you saved inside your acccount. Click the My Forms area and choose a type to printing or acquire yet again.

Remain competitive and acquire, and printing the Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax with US Legal Forms. There are many specialist and status-certain kinds you can use for your personal company or specific needs.

Form popularity

FAQ

To avoid Virginia personal property tax, consider using a Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax. This lease structure not only helps you manage your equipment but can also provide tax advantages. By adhering to the terms of such a lease, you may qualify for tax exemptions or reductions. Exploring this option with platforms like uslegalforms can guide you in structuring your lease to best suit your financial needs.

To determine if you qualify for the Virginia tax rebate, you must review specific eligibility criteria set by the state. Those engaging in a Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax will want to check if their lease or purchased equipment meets these standards. Gathering necessary paperwork and consulting with tax professionals can streamline this process. Platforms like uslegalforms can help you access the information you need to claim your rebate efficiently.

In Virginia, leased vehicles are subject to the same sales and use tax as purchased vehicles. If you have a Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax, it's essential to factor in how taxes apply to your leased vehicle. The leasing company usually collects these taxes at the start of the lease to ensure compliance. Consider reaching out to uslegalforms for tailored advice on handling leased vehicle taxes.

Typically, the lessee is responsible for paying property taxes on leased property in Virginia. This includes situations involving a Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax, where tax obligations may arise based on the equipment's value. It is key to review your lease agreement for specific details on tax responsibilities. Utilizing resources like uslegalforms can guide you through your lease’s tax implications.

Yes, rental equipment is generally subject to sales and use tax in Virginia. This means that when you enter into a Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax, it is important to account for any applicable taxes. The tax rate can vary, and understanding this aspect can help avoid unexpected costs. Consulting with tax professionals or using platforms like uslegalforms can provide clarity.

To calculate your Modified Adjusted Gross Income (MAGI), start with your Virginia Adjusted Gross Income (VAGI) and add back specific amounts such as tax-exempt interest. This adjustment is useful when determining eligibility for certain tax credits or deductions. By accurately calculating your MAGI, you can ensure compliance with tax regulations linked to a Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax. Many resources, including uslegalforms, provide guidance on MAGI calculations.

You can find your Virginia Adjusted Gross Income (VAGI) by reviewing your federal tax return, specifically the adjusted gross income line. Use this figure to account for any specific Virginia adjustments that apply to your situation. Additionally, utilizing the resources available through platforms like uslegalforms can simplify this process. Knowing your VAGI helps you better navigate the benefits of a Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax.

To determine your Virginia Adjusted Gross Income (VAGI), start with your gross income from all sources. Then, subtract any allowable deductions such as retirement contributions or specific business expenses. It's essential to follow Virginia tax guidelines while calculating this figure. Understanding VAGI is crucial when considering tax implications for a Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax.

To fill out the Employee Withholding Certificate form, begin by entering your personal information, such as your name and Social Security number. Then, detail your expected income and any additional withholding requests related to your Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax. Carefully review the instructions to ensure accuracy and completeness. Properly completed, this form will help ensure the correct amount of taxes is withheld from your paycheck.

Leased equipment, such as that included in a Virginia Comprehensive Equipment Lease with Provision Regarding Investment Tax, is usually treated differently than owned property for tax purposes. The lessee often claims deductions related to lease payments, whereas ownership may allow for depreciation. It's important to maintain accurate records of all lease agreements and related expenses. Consulting a tax professional can also provide clarity on your specific circumstances.

More info

In short, you want a company with good financing. We believe that equipment leasing is the way to go. Not only do we give you more flexibility, but we make sure you have the ability to get back on your feet after selling your equipment, or even before. If something changes in your life, you have easy access to a company like this. If you have used another company for some of your equipment, or you are thinking about trying out this service, get in touch. Whether you are interested in leasing or purchasing, our goal is to help you buy or lease the equipment you need. Our rates are always the low, low prices. We believe you should have to work for every ounce of profit that you earn. It's time for big companies to take a second look if you need our support.