Title: Virginia Letter to Foreclosure Attorney — Fair DebCollectionio— - Failure to Provide Notice Description: In this article, we will provide a detailed description of what a Virginia Letter to Foreclosure Attorney is, particularly in cases of Fair Debt Collection when there has been a failure to provide notice. We will discuss the importance of such letters, the legal framework in Virginia, and different types of letters related to this context. Keywords: Virginia, Letter to Foreclosure Attorney, Fair Debt Collection, Failure to Provide Notice, legal framework, importance, types. 1. Understanding the Purpose and Importance of a Virginia Letter to Foreclosure Attorney: — Explore why homeowners facing foreclosure may need to communicate with foreclosure attorneys. — Discuss how such letters can help protect the rights of homeowners and ensure fair debt collection practices. — Emphasize the significance of providing notice before initiating a foreclosure proceeding. 2. Virginia's Legal Framework for Fair Debt Collection: — Explain the legal requirements in Virginia for debt collection practices. — Highlight specific laws and regulations governing foreclosure proceedings and debt collection. — Discuss how failure to follow the legal framework can lead to potential violations and penalties. 3. Failure to Provide Notice in Fair Debt Collection and Foreclosure Cases: — Detail circumstances under which a failure to provide notice might occur. — Describe the potential consequences for homeowners when they are not properly notified about foreclosure proceedings. — Explain the homeowner's right to challenge and seek remedies for such failures through a Virginia Letter to Foreclosure Attorney. 4. Types of Virginia Letters to Foreclosure Attorney — Fair DebCollectionio— - Failure to Provide Notice: — Name and describe various types of letters related to fair debt collection and foreclosure cases in Virginia. — Demand letters highlighting the failure to provide notice and requesting clarification/documentation. — Cease and desist letters urging foreclosure attorneys to halt any collection activities until proper notice is given. — Dispute letters addressing inaccurate or misleading information and requesting the correction of foreclosure-related records. 5. Crafting an Effective Virginia Letter to Foreclosure Attorney: — Provide tips and guidelines for homeowners when writing a letter addressing a failure to provide notice. — Include key elements to address within the letter, such as case details, specific violations, and requested actions. — Offer language suggestions that assertively convey the homeowner's rights and expectations. By understanding the importance of a Virginia Letter to Foreclosure Attorney in cases of Fair Debt Collection — Failure to Provide Notice, homeowners can protect their rights and seek proper remedies against potential violations. This comprehensive guide empowers homeowners with the knowledge and tools needed to navigate this complex legal landscape.

Virginia Letter to Foreclosure Attorney - Fair Debt Collection - Failure to Provide Notice

Description

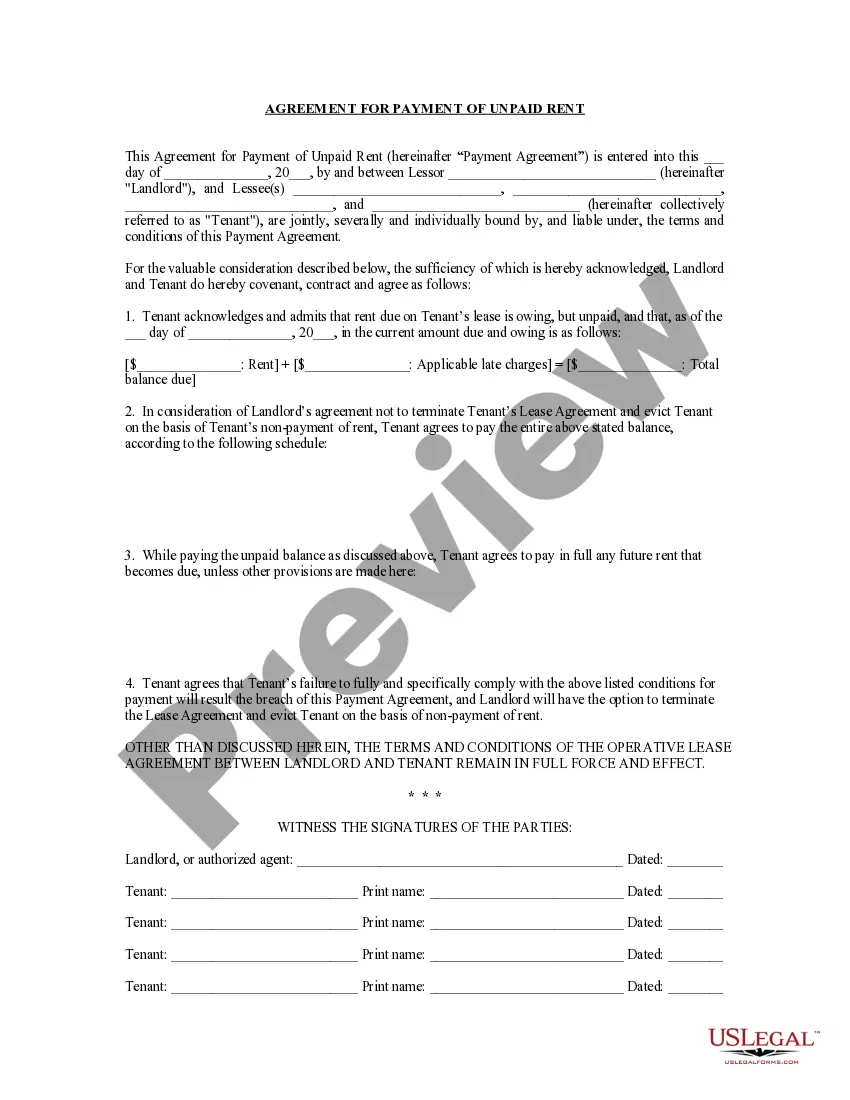

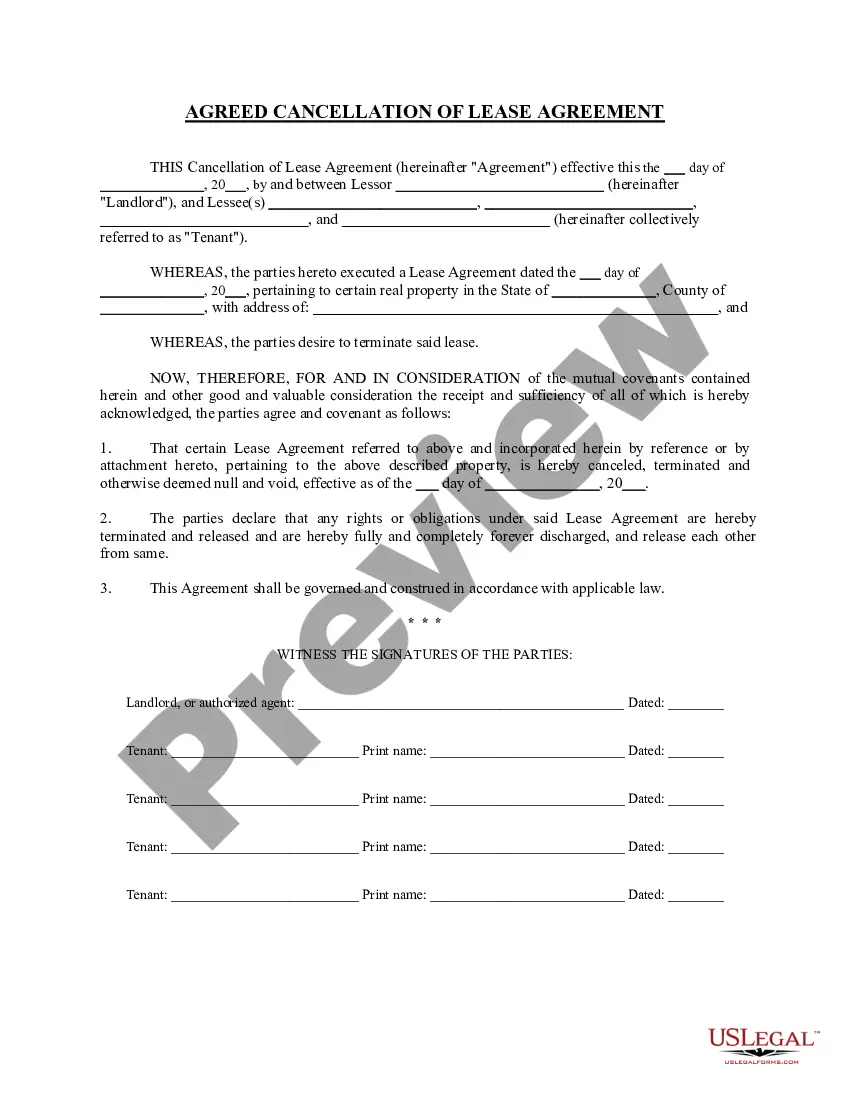

How to fill out Virginia Letter To Foreclosure Attorney - Fair Debt Collection - Failure To Provide Notice?

If you wish to full, acquire, or produce legitimate document themes, use US Legal Forms, the largest selection of legitimate varieties, that can be found on the Internet. Take advantage of the site`s basic and practical research to find the paperwork you need. Numerous themes for enterprise and person functions are sorted by types and suggests, or key phrases. Use US Legal Forms to find the Virginia Letter to Foreclosure Attorney - Fair Debt Collection - Failure to Provide Notice in just a couple of click throughs.

When you are already a US Legal Forms customer, log in for your profile and click the Obtain button to get the Virginia Letter to Foreclosure Attorney - Fair Debt Collection - Failure to Provide Notice. You can even entry varieties you previously saved inside the My Forms tab of your respective profile.

If you are using US Legal Forms the first time, refer to the instructions under:

- Step 1. Be sure you have selected the shape for your right town/land.

- Step 2. Utilize the Preview choice to check out the form`s content material. Don`t forget about to learn the outline.

- Step 3. When you are unhappy using the develop, take advantage of the Look for area towards the top of the display screen to find other versions of the legitimate develop web template.

- Step 4. After you have identified the shape you need, click on the Acquire now button. Select the pricing plan you favor and put your references to register for an profile.

- Step 5. Process the transaction. You may use your Мisa or Ьastercard or PayPal profile to accomplish the transaction.

- Step 6. Pick the structure of the legitimate develop and acquire it on your own product.

- Step 7. Comprehensive, revise and produce or indicator the Virginia Letter to Foreclosure Attorney - Fair Debt Collection - Failure to Provide Notice.

Each legitimate document web template you purchase is your own property for a long time. You have acces to every develop you saved with your acccount. Go through the My Forms area and pick a develop to produce or acquire once again.

Be competitive and acquire, and produce the Virginia Letter to Foreclosure Attorney - Fair Debt Collection - Failure to Provide Notice with US Legal Forms. There are millions of skilled and express-specific varieties you can use for your personal enterprise or person requirements.

Form popularity

FAQ

I am responding to your contact about a debt you are attempting to collect. You contacted me by [phone/mail], on [date]. You identified the debt as [any information they gave you about the debt]. Please stop all communication with me and with this address about this debt.

Equity of redemption (also termed right of redemption or equitable right of redemption) is a defaulting mortgagor's right to prevent foreclosure proceedings on the property and redeem the mortgaged property by discharging the debt secured by the mortgage within a reasonable amount of time (thereby curing the default).

STRATEGIES FOR KEEPING YOUR PROPERTY AND STOPPING FORECLOSURE REINSTATE YOUR MORTGAGE ? ... REFINANCE ? ... REPAYMENT PLAN ? ... FORBEARANCE ? ... LOAN MODIFICATION ? ... BANKRUPTCY (Chapter 13) ? ... SELL THE PROPERTY ? ... SHORT SALE ?

Some states have a law that gives a foreclosed homeowner time after the foreclosure sale to redeem the property. Virginia, however, doesn't have a law providing a post-sale redemption period. So, you won't be able to redeem the home following a foreclosure.

Virginia law makes it a crime for debt collectors to send documents simulating legal process. The federal Fair Debt Collection Practices Act (FDCPA) regulates debt collectors. The FDCPA applies to every state, and it protects consumers from unfair and deceptive debt collection practices.

When It's Not Your Debt Write a letter disputing the debt. You have 30 days after receiving a collection notice to dispute a debt in writing. ... Dispute the debt on your credit report. ... Lodge a complaint. ... Respond to a lawsuit. ... Hire an attorney.

VA Loan Foreclosure Waiting Period Generally, Veterans must wait two years after a foreclosure event to reapply for a VA loan. This period is a mandatory cooling-off phase to ensure that the borrower has regained financial stability. While two years may sound like a long time, it's better than some alternatives.

In Virginia, a creditor (someone to whom you owe money) may not foreclose unless you're more than 10 days late with a payment. If you make all missed payments and any late fees, within 10 days of the due date, a creditor may not foreclose.