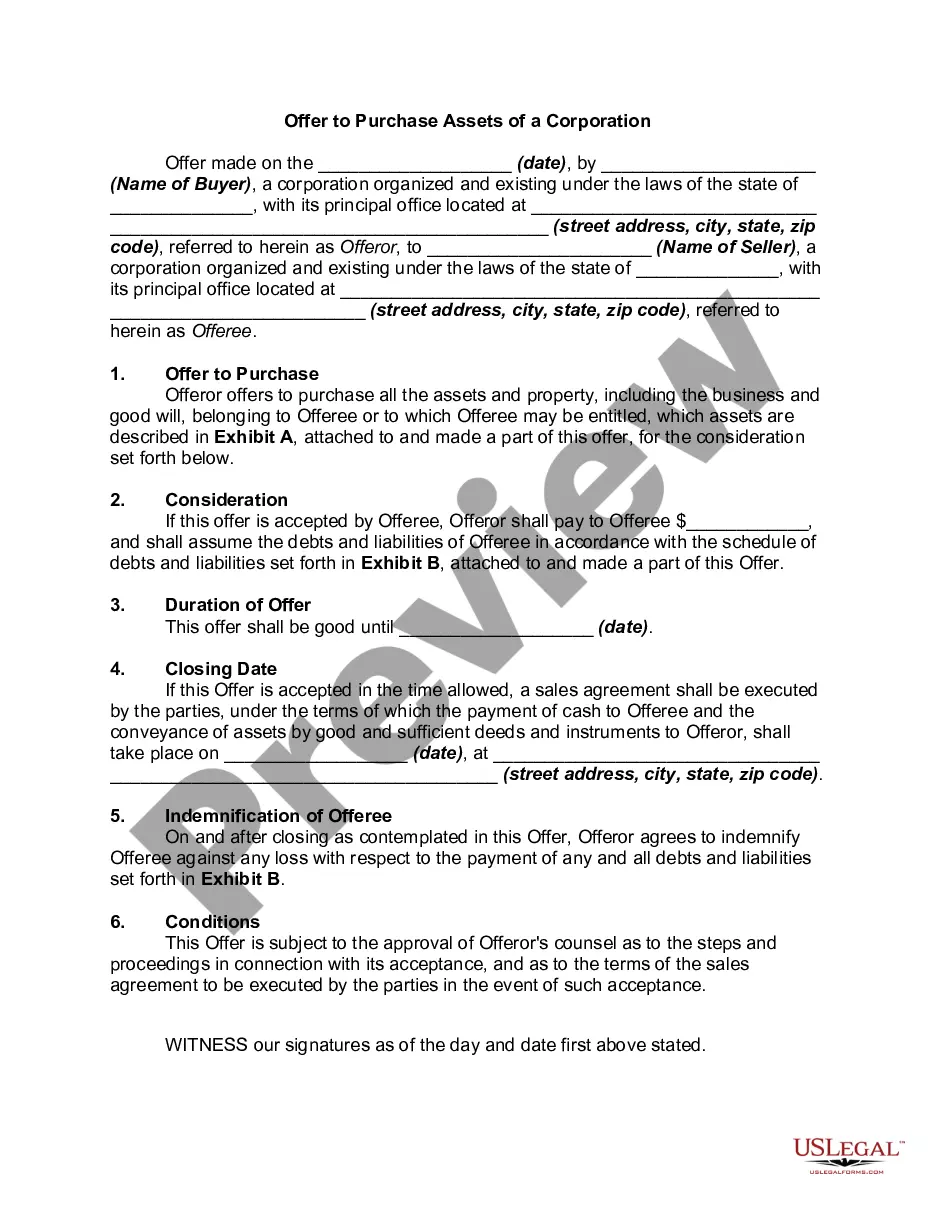

Virginia Offer to Purchase Assets of a Corporation

Description

Pursuant the Model Business Corporation Act, a sale of all of the assets of a corporation requires approval of the corporation's shareholders if the disposition would leave the corporation without a significant continuing business activity.

How to fill out Offer To Purchase Assets Of A Corporation?

If you have to full, download, or produce legal file web templates, use US Legal Forms, the biggest variety of legal forms, which can be found on-line. Take advantage of the site`s simple and convenient research to find the files you need. Numerous web templates for company and person purposes are categorized by classes and claims, or keywords and phrases. Use US Legal Forms to find the Virginia Offer to Purchase Assets of a Corporation in just a couple of clicks.

When you are already a US Legal Forms customer, log in to the profile and click on the Down load key to get the Virginia Offer to Purchase Assets of a Corporation. You can also gain access to forms you earlier saved within the My Forms tab of your profile.

If you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Be sure you have selected the shape for your right metropolis/region.

- Step 2. Take advantage of the Review choice to look through the form`s information. Never neglect to read through the information.

- Step 3. When you are not satisfied together with the form, take advantage of the Search area at the top of the screen to get other variations of your legal form template.

- Step 4. Once you have located the shape you need, click the Acquire now key. Opt for the pricing plan you like and include your accreditations to sign up on an profile.

- Step 5. Process the financial transaction. You can utilize your Мisa or Ьastercard or PayPal profile to complete the financial transaction.

- Step 6. Select the file format of your legal form and download it on the system.

- Step 7. Full, revise and produce or indicator the Virginia Offer to Purchase Assets of a Corporation.

Every legal file template you get is yours permanently. You have acces to every form you saved with your acccount. Select the My Forms section and choose a form to produce or download again.

Remain competitive and download, and produce the Virginia Offer to Purchase Assets of a Corporation with US Legal Forms. There are many expert and state-certain forms you can use for your personal company or person requires.

Form popularity

FAQ

An asset purchase is the transfer of a specific business activity and related assets and employees. The buyer can cherry pick the assets it wants or more particularly (other than in respect of employees) identify what, if any, liabilities it will take on.

What's the Difference? Generally speaking, an asset purchase is when an individual, either with an existing entity or by forming a new entity (LLC or Corporation), buys the assets of a business without buying the business itself. Asset Purchases entail buying everything that the business owns (the Assets).

Key Takeaways. In an asset sale, a firm sells some or all of its actual assets, either tangible or intangible. The seller retains legal ownership of the company that has sold the assets but has no further recourse to the sold assets. The buyer assumes no liabilities in an asset sale.

If purchasing a business entity, you are purchasing all the corporation's shares or if a limited liability company, its membership interest. In contrast, if purchasing the business' assets, you are buying all the assets, contracts, debts, and anything else registered under the business' name.

An asset acquisition is the purchase of a company by buying its assets instead of its stock. In most jurisdictions, an asset acquisition typically also involves an assumption of certain liabilities.

Purchasing Assets The buyer is taking ownership of the company when he or she buys up the shares, and all the company's assets and liabilities become the property of the shareholder who takes ownership. Only certain company assets can be purchased, not the liabilities as a way to reduce the potential risk.

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.