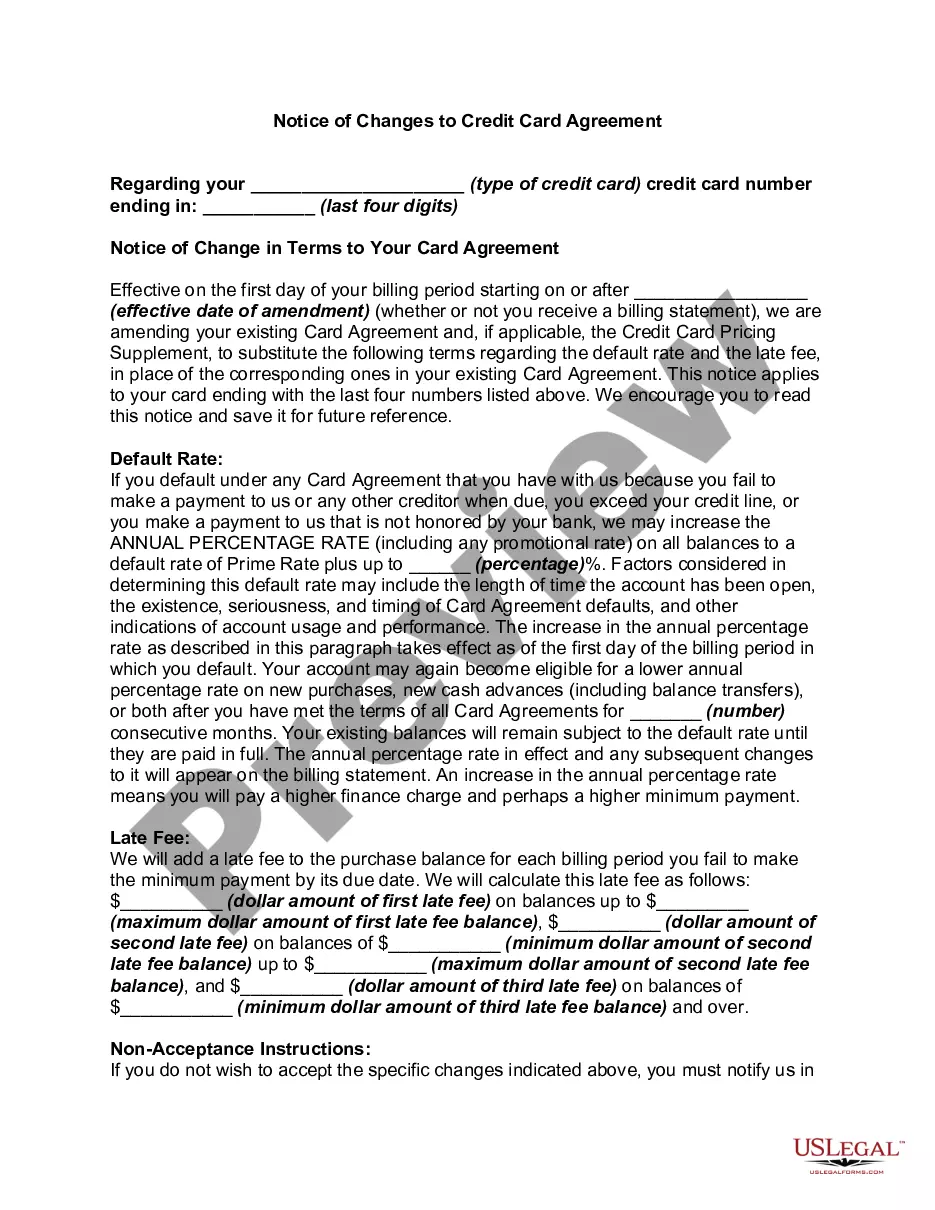

Virginia Notice of Changes to Credit Card Agreement

Description

How to fill out Notice Of Changes To Credit Card Agreement?

Finding the right authorized papers template can be a have difficulties. Of course, there are a lot of templates available on the Internet, but how can you discover the authorized kind you want? Utilize the US Legal Forms website. The services gives thousands of templates, for example the Virginia Notice of Changes to Credit Card Agreement, which you can use for company and personal requires. All of the kinds are inspected by experts and fulfill state and federal specifications.

In case you are previously signed up, log in to your profile and click on the Down load button to get the Virginia Notice of Changes to Credit Card Agreement. Use your profile to appear with the authorized kinds you have purchased previously. Check out the My Forms tab of your respective profile and have yet another version of the papers you want.

In case you are a fresh customer of US Legal Forms, listed below are straightforward instructions that you should follow:

- Initially, be sure you have chosen the appropriate kind for your personal town/region. You can examine the form using the Preview button and read the form information to guarantee this is basically the right one for you.

- When the kind fails to fulfill your preferences, take advantage of the Seach field to get the proper kind.

- Once you are sure that the form is proper, go through the Acquire now button to get the kind.

- Pick the costs program you want and type in the necessary details. Create your profile and pay for the transaction utilizing your PayPal profile or Visa or Mastercard.

- Pick the document structure and download the authorized papers template to your gadget.

- Total, change and print out and signal the attained Virginia Notice of Changes to Credit Card Agreement.

US Legal Forms is the biggest library of authorized kinds for which you can discover various papers templates. Utilize the company to download expertly-created papers that follow express specifications.

Form popularity

FAQ

It is the intent of the General Assembly that this chapter shall be applied as remedial legislation to promote fair and ethical standards of dealings between suppliers and the consuming public.

§ 18.2-193. Conviction of credit card forgery shall be punishable as a Class 5 felony. Code 1950, § 18.1-125.4; 1968, c. 480; 1975, cc.

The Virginia Consumer Data Protection Act (VCDPA) operates based on the consumer right to opt out of having personal data collected, processed, and sold. Personal data can be collected and processed without consumers' consent, but they have to be provided the option to opt out of that at any point.

Consumer protection laws safeguard purchasers of goods and services against defective products and deceptive, fraudulent business practices.

The Act proscribes a variety of misrepresentations by suppliers to consumers. A violation of the Act subjects the supplier to liability for actual damages for his misrepresentation or a fine of $500, whichever is greater. A willful violation of the Act may subject the supplier to treble damages and attorney's fees.

§ 59.1-198. A layaway agreement, whereby part or all of the price of goods is payable in one or more payments subsequent to the making of the layaway agreement and the supplier retains possession of the goods and bears the risk of their loss or damage until the goods are paid in full ing to the layaway agreement.

This Act applies to every contract for goods or services entered into between a consumer and a merchant in the course of his business.

State Laws & Regulations Virginia Consumer Protection Act - promoting fair and ethical standards of transactions between suppliers and the consuming public. Virginia Freedom of Information Act - a statute giving a person the right to access information from government agencies.