Description: A Virginia Angel Investor Agreement refers to a legally binding agreement between an angel investor and an entrepreneur or startup company operating in the state of Virginia. This agreement outlines the terms and conditions of an investment made by the angel investor into the business or project, protecting the rights and interests of both parties involved. Keywords: Virginia Angel Investor Agreement, legally binding, angel investor, entrepreneur, startup company, investment, terms and conditions, rights, interests. Types of Virginia Angel Investor Agreements: 1. Equity-based Angel Investor Agreement: This type of agreement involves the angel investor providing funding in exchange for an ownership stake in the company. The agreement typically specifies the percentage of equity the investor will hold and any future rights or privileges associated with this ownership. 2. Convertible Note Angel Investor Agreement: This agreement involves the angel investor giving a loan to the entrepreneur or startup, which then converts into equity under pre-defined conditions, usually triggered by a subsequent funding round or event. The terms and conditions related to the conversion process are outlined in the agreement. 3. Royalty-based Angel Investor Agreement: In this type of agreement, the angel investor receives a portion of the company's revenue or profits for a specific period of time, as a return on their investment. The agreement will detail the percentage of royalties the investor will receive and the duration of this arrangement. 4. Loan-based Angel Investor Agreement: This agreement involves the angel investor providing a loan to the entrepreneur or startup, with repayment terms, interest rates, and other loan-related details specified. It outlines the obligations and responsibilities of both parties regarding loan repayment and any applicable penalties or consequences. 5. Customized Angel Investor Agreement: This refers to an agreement tailored to specific requirements and preferences of the investor or the entrepreneur. It may combine elements from different types of agreements or include additional clauses, provisions, or conditions based on mutual negotiations and agreement between the parties. Overall, a Virginia Angel Investor Agreement establishes a framework for investment between an angel investor and an entrepreneur or startup in Virginia, ensuring clarity, protection, and a mutually beneficial relationship.

Virginia Angel Investor Agreement

Description

How to fill out Virginia Angel Investor Agreement?

Are you in the situation that you need papers for sometimes organization or individual functions almost every working day? There are a lot of legitimate document templates available on the net, but locating ones you can rely on isn`t easy. US Legal Forms delivers 1000s of form templates, just like the Virginia Angel Investor Agreement, which can be composed to satisfy state and federal demands.

Should you be currently knowledgeable about US Legal Forms site and also have your account, merely log in. Afterward, you can acquire the Virginia Angel Investor Agreement web template.

Unless you provide an account and would like to begin to use US Legal Forms, abide by these steps:

- Find the form you need and ensure it is for that proper city/area.

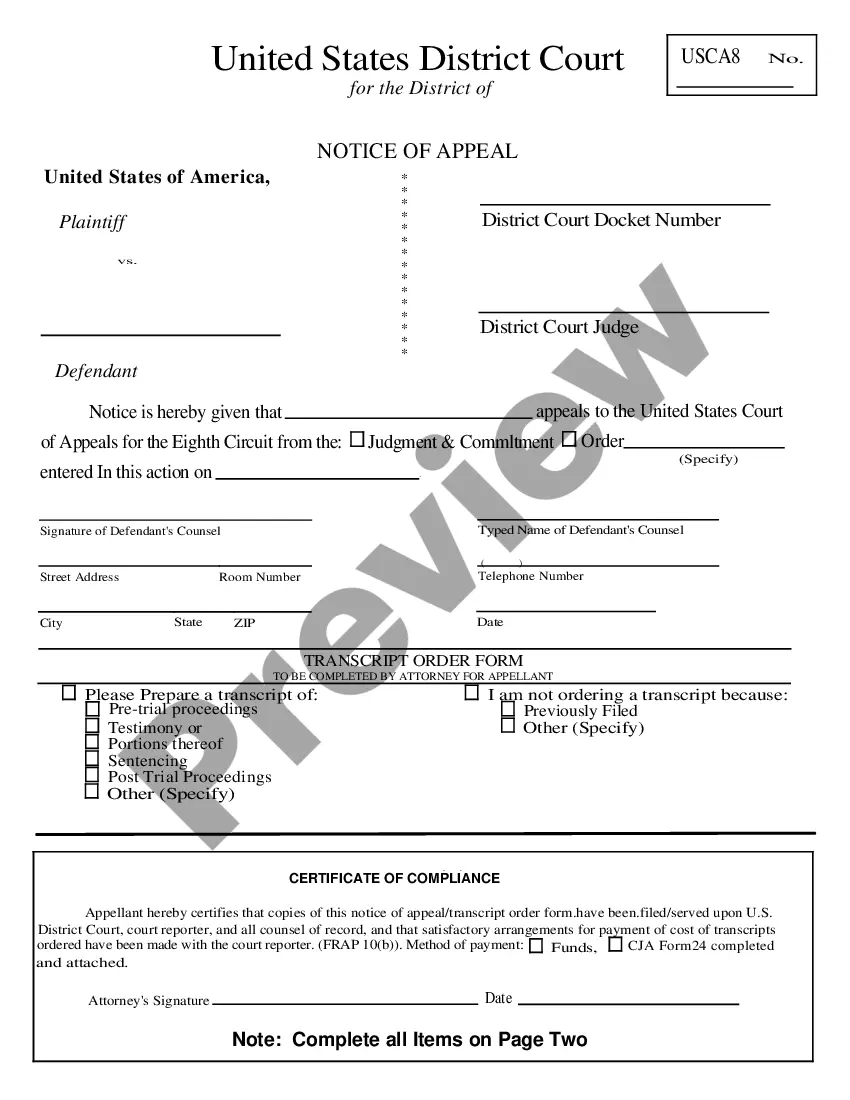

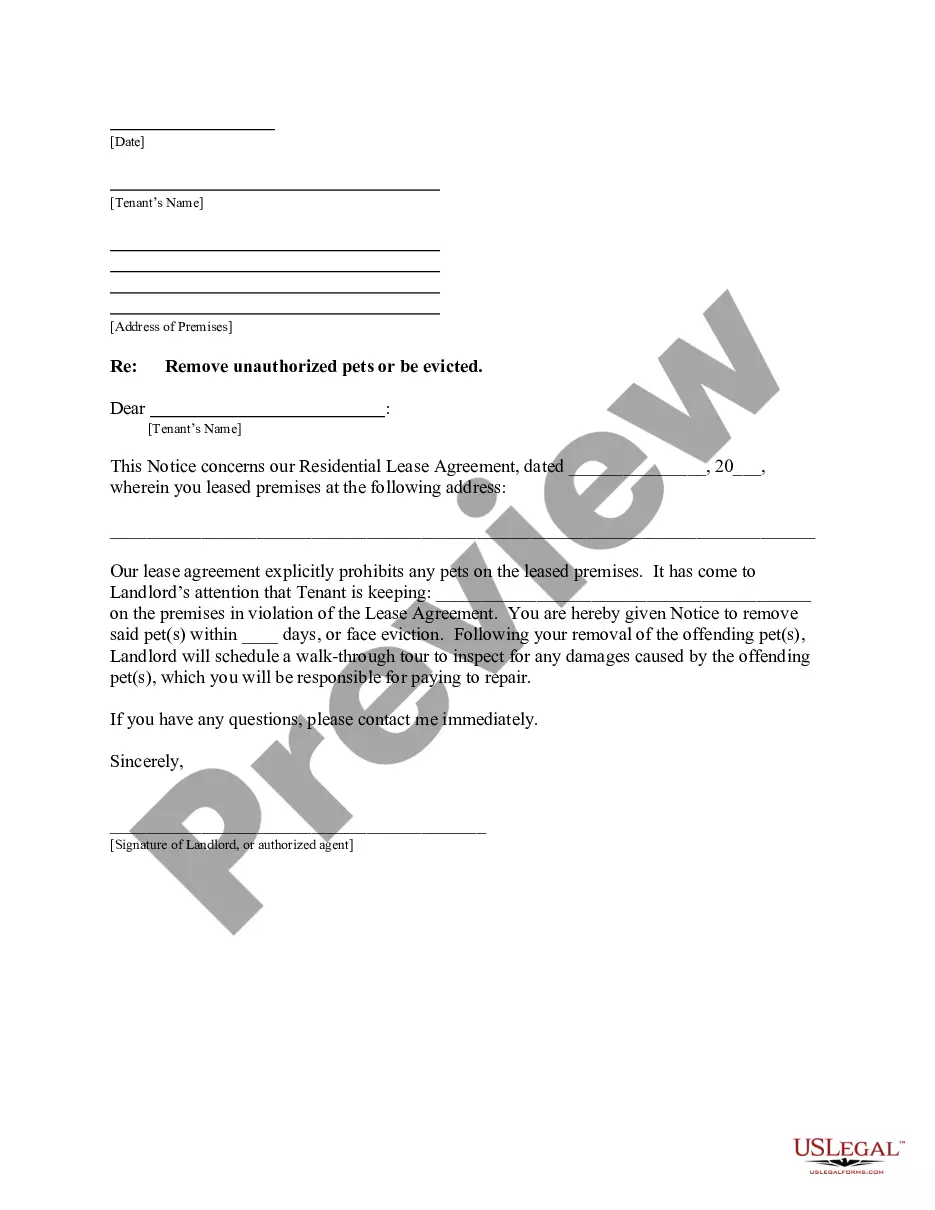

- Use the Preview switch to review the form.

- Read the description to actually have chosen the correct form.

- If the form isn`t what you are looking for, use the Research field to obtain the form that meets your requirements and demands.

- If you obtain the proper form, simply click Get now.

- Pick the prices strategy you desire, complete the specified details to generate your bank account, and pay money for the transaction utilizing your PayPal or Visa or Mastercard.

- Pick a hassle-free data file structure and acquire your copy.

Locate each of the document templates you may have bought in the My Forms food list. You can aquire a more copy of Virginia Angel Investor Agreement at any time, if possible. Just select the necessary form to acquire or printing the document web template.

Use US Legal Forms, the most comprehensive assortment of legitimate forms, to conserve time and prevent errors. The services delivers expertly produced legitimate document templates which can be used for a variety of functions. Generate your account on US Legal Forms and begin making your way of life a little easier.

Form popularity

FAQ

The main purpose of an angel investor is to provide capital to startups in exchange for equity ownership or convertible debt. Angel investors often bring not just funds but also valuable experience and mentorship to the businesses they invest in. In the context of a Virginia Angel Investor Agreement, this relationship aims to support business growth while reducing financial risk for the investor. Ultimately, angel investors play a crucial role in turning innovative ideas into successful companies.

The typical angel investor deal involves an investor providing funds in exchange for equity or convertible debt in a startup. These deals often range from $25,000 to $1 million, depending on the business's stage and potential. In a Virginia Angel Investor Agreement, you will find specific terms that cater to the unique needs of both investors and startups, ensuring clarity and mutual benefit. Understanding this structure helps you make informed decisions as you navigate investment opportunities.

An angel investor agreement is a legal document that outlines the terms and conditions between a startup and an angel investor. This agreement typically includes details such as the amount of investment, ownership stakes, and exit strategies. In a Virginia Angel Investor Agreement, both parties establish clear expectations to foster a healthy business relationship. It is crucial for protecting the interests of both the investor and the entrepreneur.

To write off an angel investment, you need to detail the circumstances surrounding the loss in your tax filings. Generally, if the investment becomes worthless, you can count it as a loss against your income. Keeping precise records and consulting with a tax professional can clarify this process, ensuring that your Virginia Angel Investor Agreement supports your financial strategies.

Angel investors typically fall into the category of individual investors who provide financial backing to startups or early-stage businesses. They are often characterized by their personal wealth and willingness to take risks in pursuit of high returns. Recognizing this category is essential when forming your Virginia Angel Investor Agreement, as it helps tailor the terms to suit their investment style.

To write off worthless investments, you must first assess the investment's value and document your losses thoroughly. In many cases, you can claim the loss on your tax return as a capital loss, which can offset other gains. Consulting a financial advisor or tax professional is vital when handling your Virginia Angel Investor Agreement to ensure compliance with tax regulations.

Angel investors may qualify for tax credits when they invest in certain qualified small businesses, subject to state laws. For instance, Virginia offers tax credits to encourage investments in startups that meet specific criteria. Understanding these benefits can enhance your Virginia Angel Investor Agreement, making your business more attractive to potential investors.

Typically, angel investors take between 10% to 30% equity in exchange for their investment, depending on the company’s stage and valuation. This percentage can vary based on negotiations and the perceived risk associated with your business. When drafting your Virginia Angel Investor Agreement, ensure you reflect these terms clearly to avoid future disputes.

While angel investors can provide invaluable support, they also come with potential drawbacks. You may have to give up a percentage of ownership and control in your business. Additionally, their involvement can lead to differing expectations and pressure for rapid growth, which might not align with your business goals. Understanding these aspects is crucial when considering a Virginia Angel Investor Agreement.

To write an investor agreement, start by clearly outlining the terms of the investment, including the amount, type of securities, and the rights of each party involved. Incorporate the essential elements such as funding stages, equity stakes, and exit strategies. A well-crafted Virginia Angel Investor Agreement not only protects both parties but also clarifies expectations for a successful partnership.