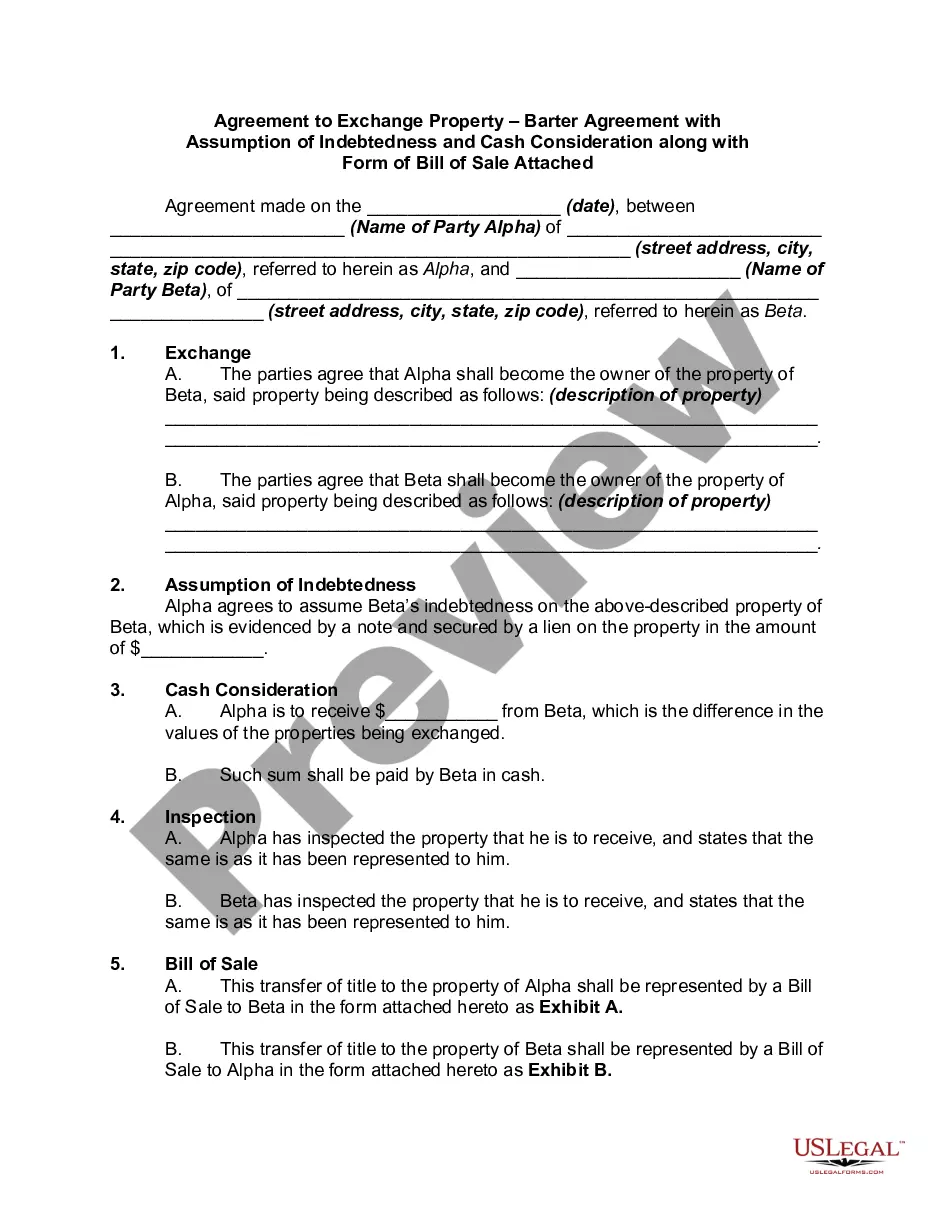

Virginia Agreement to Exchange Property - Barter Agreement with Assumption of

Description

How to fill out Agreement To Exchange Property - Barter Agreement With Assumption Of?

Have you found yourself in a scenario where you need documentation for either business or personal matters almost every day.

There are numerous legal document templates accessible online, but locating those you can rely on is challenging.

US Legal Forms provides an extensive collection of form templates, such as the Virginia Agreement to Exchange Property - Barter Agreement with Assumption of, which are designed to comply with federal and state regulations.

Once you find the suitable form, click Purchase now.

Select your desired pricing plan, fill in the necessary details to set up your payment, and complete your order using PayPal or credit card. Choose a convenient document format and download your copy. Access all the form templates you have purchased in the My documents section. You can also retrieve an additional version of the Virginia Agreement to Exchange Property - Barter Agreement with Assumption of at any time, if needed. Just click the required form to download or print the document template. Use US Legal Forms, one of the largest selections of legal forms, to save time and prevent errors. The service offers professionally crafted legal document templates that can be utilized for a variety of purposes. Create an account on US Legal Forms and start making your life a bit simpler.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can obtain the Virginia Agreement to Exchange Property - Barter Agreement with Assumption of template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/county.

- Utilize the Review feature to examine the document.

- Check the description to confirm you have selected the correct form.

- If the form isn’t what you’re looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

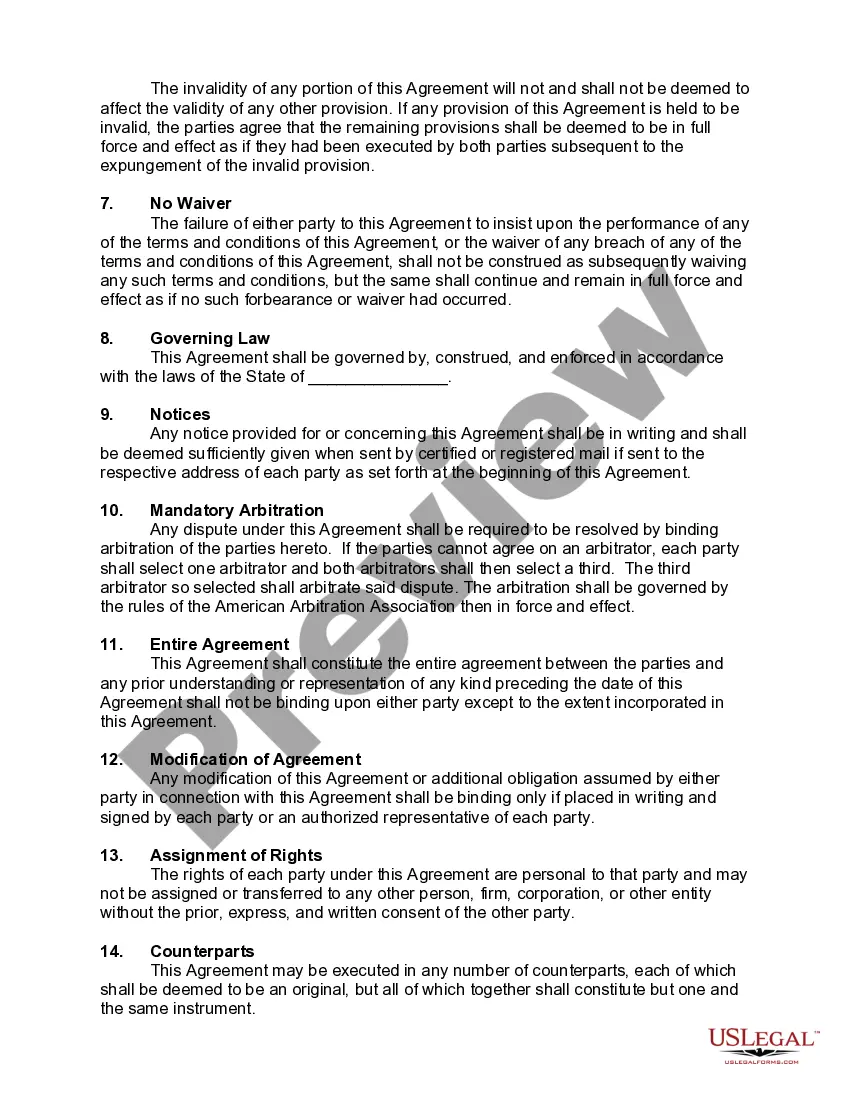

Certain properties cannot qualify for a 1031 exchange in Virginia; primarily, these include personal residences, properties used primarily for personal use, and any property that is not held for investment or productive use in a trade or business. If the property does not meet these criteria, it cannot be included in your Virginia Agreement to Exchange Property - Barter Agreement with Assumption of. Understanding these disqualifications early can help you make informed decisions about your investments.

To successfully execute a 1031 exchange in Virginia, start by consulting a qualified intermediary who will handle the exchange funds and ensure compliance with IRS rules. Next, document your Virginia Agreement to Exchange Property - Barter Agreement with Assumption of to outline the terms clearly. After selling your property, identify a suitable replacement property and complete the transaction within the required timelines. Proper planning and professional guidance can make this process seamless.

In Virginia, the regulations governing a 1031 exchange emphasize that the properties involved must be considered like-kind. This means that both the relinquished property and the replacement property should be of a similar nature as defined by the IRS. Furthermore, you must adhere to a strict timeline: identify the replacement property within 45 days and close on the new property within 180 days. Utilizing a Virginia Agreement to Exchange Property - Barter Agreement with Assumption of will help you outline these terms effectively.

In Virginia, a property settlement agreement does not always require notarization, but having it notarized adds extra security and legitimacy. A notarized document can be beneficial if disputes arise in the future. If you are unsure, consult legal resources or professionals to clarify your needs. Using a Virginia Agreement to Exchange Property - Barter Agreement with Assumption of can provide a well-structured agreement.

Yes, you can transfer a deed without an attorney in Virginia, but it is crucial to understand the legal requirements. You will need to prepare a proper deed, sign it with witnesses, and ensure it is recorded with the local government. However, consulting a professional can help you avoid mistakes. A Virginia Agreement to Exchange Property - Barter Agreement with Assumption of may also guide you to ensure compliance.

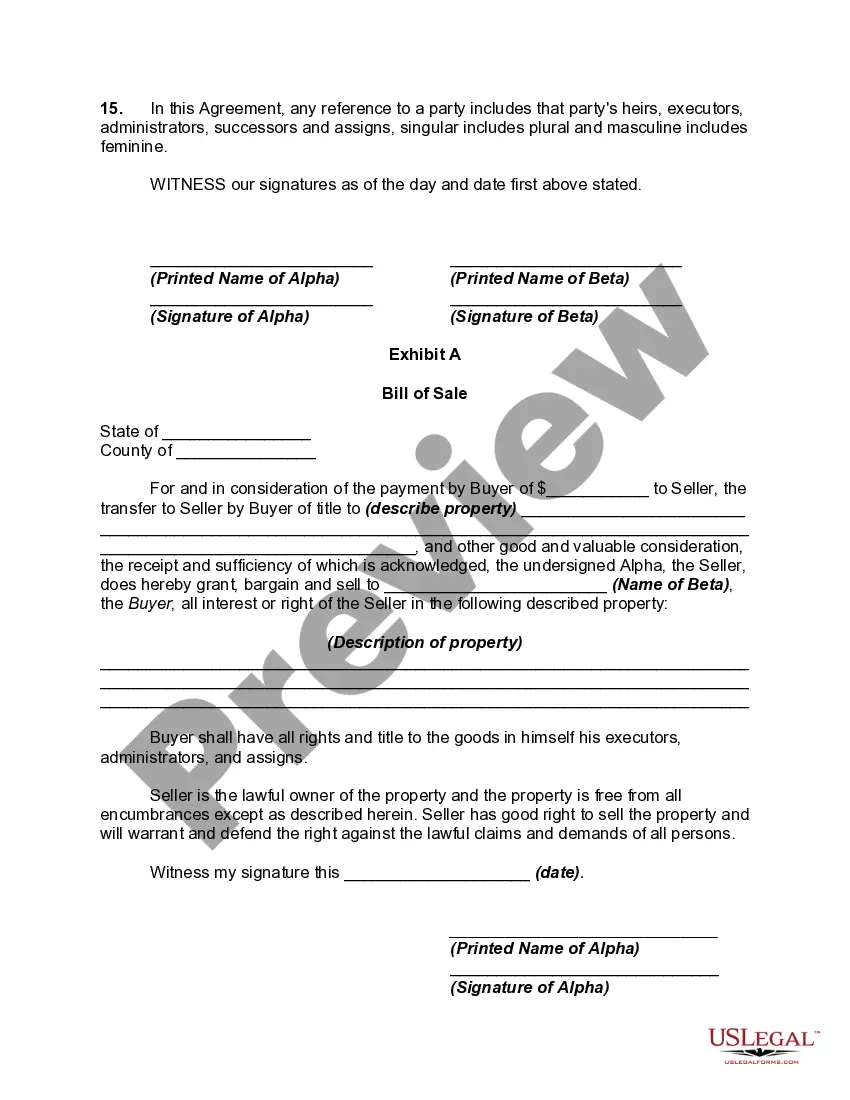

Transferring ownership of a property in Virginia involves drafting a new deed that outlines the change in ownership. You must include all pertinent details of the property and the parties involved. After execution, the deed should be recorded at the local county clerk's office to ensure the transfer is official. Consider using a Virginia Agreement to Exchange Property - Barter Agreement with Assumption of for a structured and legal method.

To transfer a property title to a family member in Virginia, you need to complete a deed that reflects the transfer. This deed should include a clear description of the property and the names of both the grantor and grantee. Once you create the deed, signed documents must be recorded at the local courthouse. Utilizing a Virginia Agreement to Exchange Property - Barter Agreement with Assumption of can simplify this process.

In real estate, an exchange agreement facilitates the trade of properties between owners while deferring taxes associated with the sale. This type of agreement clearly defines the properties involved, the timelines, and the responsibilities of each party during the exchange process. It is crucial for maximizing investment potential while minimizing tax liabilities. A well-structured Virginia Agreement to Exchange Property - Barter Agreement with Assumption of can guide you through this complex transaction.

An exchange agreement is a contract that lays out the terms under which properties or goods will be exchanged between parties. This agreement typically includes critical elements like timelines, property descriptions, and any financial terms involved. It ensures that all parties understand their responsibilities during the transaction. Using a Virginia Agreement to Exchange Property - Barter Agreement with Assumption of can simplify this process.

One negative aspect of the 1031 exchange is the potential tax implications if the timing is not managed properly. If you do not identify a replacement property within the required timeframe, you might lose the tax deferral benefit. Additionally, the complexities involved in completing a 1031 exchange can create additional costs and challenges for sellers. It's essential to understand these factors when considering the Virginia Agreement to Exchange Property - Barter Agreement with Assumption of.