Virginia Judgment Foreclosing Mortgage and Ordering Sale

Description

How to fill out Judgment Foreclosing Mortgage And Ordering Sale?

Finding the right legitimate papers template could be a battle. Naturally, there are a variety of themes accessible on the Internet, but how will you obtain the legitimate kind you will need? Use the US Legal Forms website. The support gives thousands of themes, such as the Virginia Judgment Foreclosing Mortgage and Ordering Sale , which you can use for organization and private requires. Every one of the varieties are examined by pros and meet up with state and federal needs.

In case you are previously authorized, log in in your profile and click on the Obtain switch to obtain the Virginia Judgment Foreclosing Mortgage and Ordering Sale . Make use of profile to check with the legitimate varieties you possess ordered previously. Proceed to the My Forms tab of your own profile and get one more backup of your papers you will need.

In case you are a whole new user of US Legal Forms, listed here are easy instructions for you to follow:

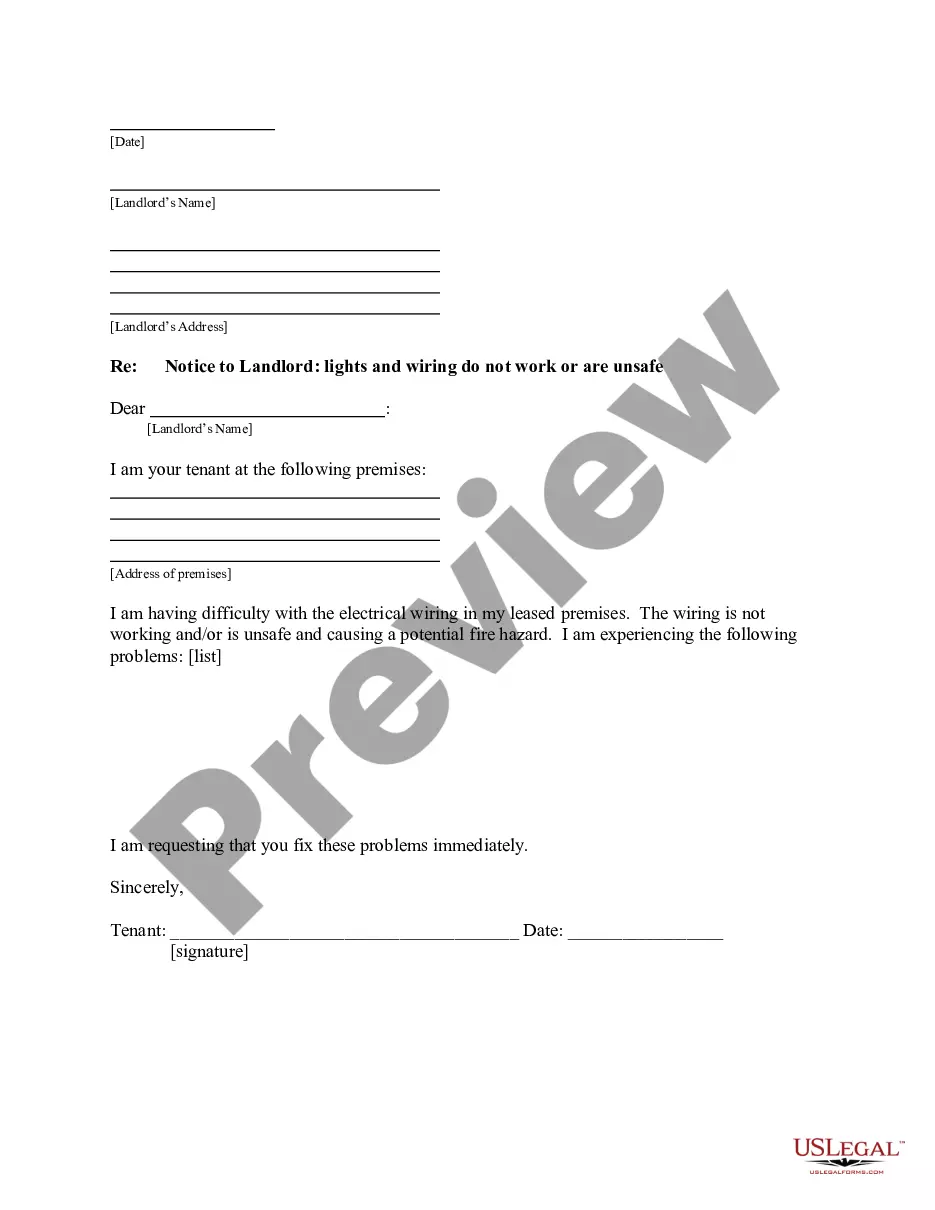

- Initially, make sure you have chosen the correct kind for your personal area/region. You can examine the form while using Review switch and look at the form outline to guarantee it will be the best for you.

- When the kind does not meet up with your preferences, use the Seach area to discover the proper kind.

- When you are positive that the form is acceptable, click the Buy now switch to obtain the kind.

- Select the costs program you desire and enter in the essential info. Create your profile and pay for an order with your PayPal profile or charge card.

- Opt for the file formatting and down load the legitimate papers template in your gadget.

- Comprehensive, change and print and indicator the acquired Virginia Judgment Foreclosing Mortgage and Ordering Sale .

US Legal Forms is the largest collection of legitimate varieties in which you will find numerous papers themes. Use the company to down load appropriately-created documents that follow status needs.

Form popularity

FAQ

You may be able to avoid foreclosure by making arrangements with your lender, such as getting forbearance or agreeing to a loan modification. Other options may include refinancing with a hard money loan or reverse mortgage.

The term ?foreclosure action? refers to legal proceedings initiated by a lender after a borrower defaults on their mortgage. Lenders can enforce their rights through a foreclosure when borrowers fail to either make mortgage payments or fulfill the obligations outlined in their mortgage agreement.

When You Have to Move Out After a Virginia Foreclosure. After a Virginia nonjudicial foreclosure, the purchaser that bought the home at the foreclosure sale may start a separate unlawful detainer (eviction) action. The foreclosed homeowner might get a five-day notice to quit (leave).

A VA foreclosure or VA REO effectively presents an opportunity through which anyone ? real estate buyer or investor ? can pick up a property at a fraction of typical costs. At the same time, these properties are sold in as-is condition, and may need varying amounts of work and tender loving care.

You have the right to challenge a foreclosure if you think your lender made a mistake or has violated the law. A notice of preforeclosure does not mean you need to vacate the home.

In Virginia, a creditor (someone to whom you owe money) may not foreclose unless you're more than 10 days late with a payment. If you make all missed payments and any late fees, within 10 days of the due date, a creditor may not foreclose.

A foreclosure is simply the closing of a Home Loan by paying off the entire amount borrowed in one lump sum amount. It is part of the regular Home Loan process and allows you to pay off the borrowed amount before the EMI schedule. You can opt for a foreclosure even after having made a few EMI payments.

In Canada, foreclosure occurs when the mortgage holder (often a bank) sells the property to recover the owed amount due to default by the owner.