US Legal Forms - one of several largest libraries of lawful forms in the United States - gives a variety of lawful record templates you may download or printing. Making use of the website, you will get a huge number of forms for business and individual purposes, categorized by classes, suggests, or keywords and phrases.You can find the most recent types of forms just like the Virginia Motion for Default Judgment against Garnishee in seconds.

If you currently have a registration, log in and download Virginia Motion for Default Judgment against Garnishee from the US Legal Forms collection. The Obtain switch can look on every single kind you look at. You get access to all in the past downloaded forms within the My Forms tab of your respective profile.

In order to use US Legal Forms initially, here are easy instructions to get you began:

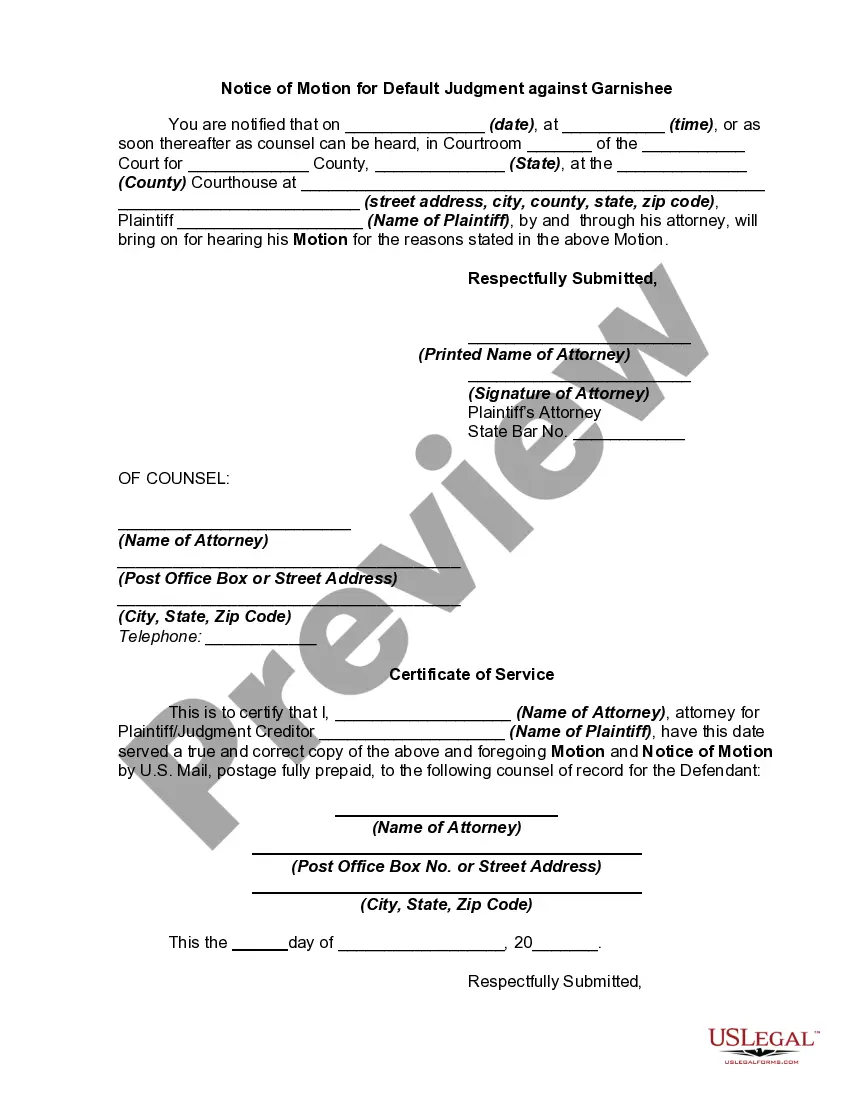

- Be sure you have chosen the best kind for your city/county. Click on the Preview switch to review the form`s content material. Read the kind information to actually have selected the appropriate kind.

- In the event the kind does not fit your demands, utilize the Search industry towards the top of the monitor to obtain the one who does.

- Should you be pleased with the form, verify your selection by clicking on the Buy now switch. Then, pick the costs prepare you like and provide your references to sign up on an profile.

- Approach the purchase. Use your bank card or PayPal profile to accomplish the purchase.

- Find the structure and download the form on your own device.

- Make changes. Load, modify and printing and signal the downloaded Virginia Motion for Default Judgment against Garnishee.

Every single web template you put into your account does not have an expiry particular date and it is your own eternally. So, if you would like download or printing another backup, just proceed to the My Forms section and then click around the kind you need.

Gain access to the Virginia Motion for Default Judgment against Garnishee with US Legal Forms, by far the most comprehensive collection of lawful record templates. Use a huge number of expert and condition-particular templates that fulfill your organization or individual demands and demands.