Virginia Sample Letter for Request to Bank for Extension of Time

Description

How to fill out Sample Letter For Request To Bank For Extension Of Time?

US Legal Forms - one of the largest collections of legal documents in the country - offers a vast selection of legal document templates that you can download or print. By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can find the latest forms such as the Virginia Sample Letter for Request to Bank for Extension of Time in just a few seconds.

If you already have an account, Log In to download the Virginia Sample Letter for Request to Bank for Extension of Time from your US Legal Forms library. The Download option will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the transaction. Use a credit card or PayPal account to complete the transaction.

Select the format and download the form onto your device. Make modifications. Fill out, edit, print, and sign the downloaded Virginia Sample Letter for Request to Bank for Extension of Time. Any template you add to your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you desire. Access the Virginia Sample Letter for Request to Bank for Extension of Time with US Legal Forms, one of the most extensive collections of legal document templates. Utilize a vast number of professional and state-specific templates that fulfill your business or personal requirements and needs.

- If you are using US Legal Forms for the first time, here are straightforward instructions to get started.

- Ensure you have selected the correct form for your city/state.

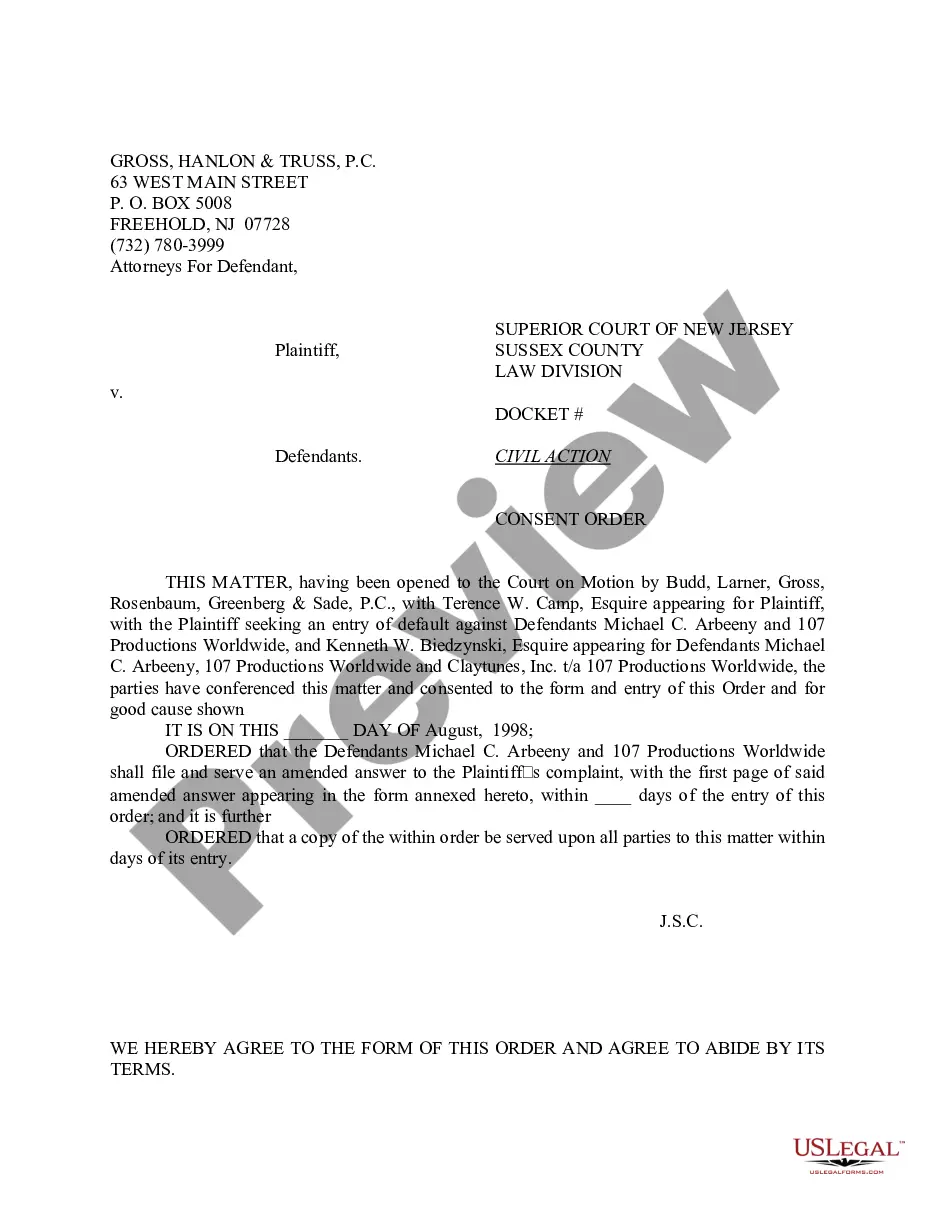

- Review the Review option to examine the content of the form.

- Check the summary of the form to make sure you have chosen the right one.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

When writing a letter to request a payment extension, start by addressing the financial institution directly and clearly stating your intention. Include your account details, the amount due, and the reason for your request. Utilize the Virginia Sample Letter for Request to Bank for Extension of Time for guidance in structuring your letter effectively. Ensure you convey your situation honestly and express your commitment to fulfilling the obligation.

To extend your bank limit, you first need to draft a formal request letter. In this letter, clearly state your current limit, the desired limit, and the reasons for your request. You can use the Virginia Sample Letter for Request to Bank for Extension of Time as a helpful template, ensuring that you include all essential details. Finally, provide any supporting documentation that might strengthen your case.

To craft a letter requesting an extension of time, focus on brevity and clarity. Start with an opening that clearly states your request and includes the context for the extension. By referring to a Virginia Sample Letter for Request to Bank for Extension of Time, you can easily create a letter that meets the bank’s expectations and conveys your sincerity in the request.

Writing an extension of time letter involves a clear structure. Start with a polite salutation, then outline your request with necessary details such as your account information and the reason for the extension. A well-crafted Virginia Sample Letter for Request to Bank for Extension of Time will guide you in maintaining professionalism while expressing your needs effectively.

An example of an extension request might involve a borrower asking their bank for more time to complete payments due to unforeseen circumstances. You could structure this request by including your personal information, the reason for the delay, and requesting the specific new deadline. Utilizing a Virginia Sample Letter for Request to Bank for Extension of Time can simplify this process, providing a clear template to follow.

To write an extension for time request, begin by addressing the letter to the appropriate bank official. Clearly state your need for an extension, providing relevant details such as your account number and the specific time period you wish to extend. Including a Virginia Sample Letter for Request to Bank for Extension of Time can help ensure you cover all necessary points in a professional manner.

When writing a letter requesting an extension of time, start with a formal greeting followed by your reason for the request. Clearly state the current timeline and the new timeline you wish to propose. You might find the Virginia Sample Letter for Request to Bank for Extension of Time particularly useful for crafting a comprehensive request.

Requesting a letter to the bank for an extension of time should include your account information and specific details regarding the extension. Clearly articulate your situation and what you are asking for. Using the Virginia Sample Letter for Request to Bank for Extension of Time can simplify your drafting process and ensure clarity.

To write a letter requesting an extension of payment, clearly mention the payment details, including the amount and due date. Provide a valid reason for the extension while proposing a new payment timeframe. Referencing our Virginia Sample Letter for Request to Bank for Extension of Time can help you convey your message effectively.

When asking for a time extension, start with a warm greeting, followed by a brief explanation of your circumstances. Clearly mention the original deadline and the requested new deadline. The Virginia Sample Letter for Request to Bank for Extension of Time serves as a helpful template to ensure your request is professional yet polite.