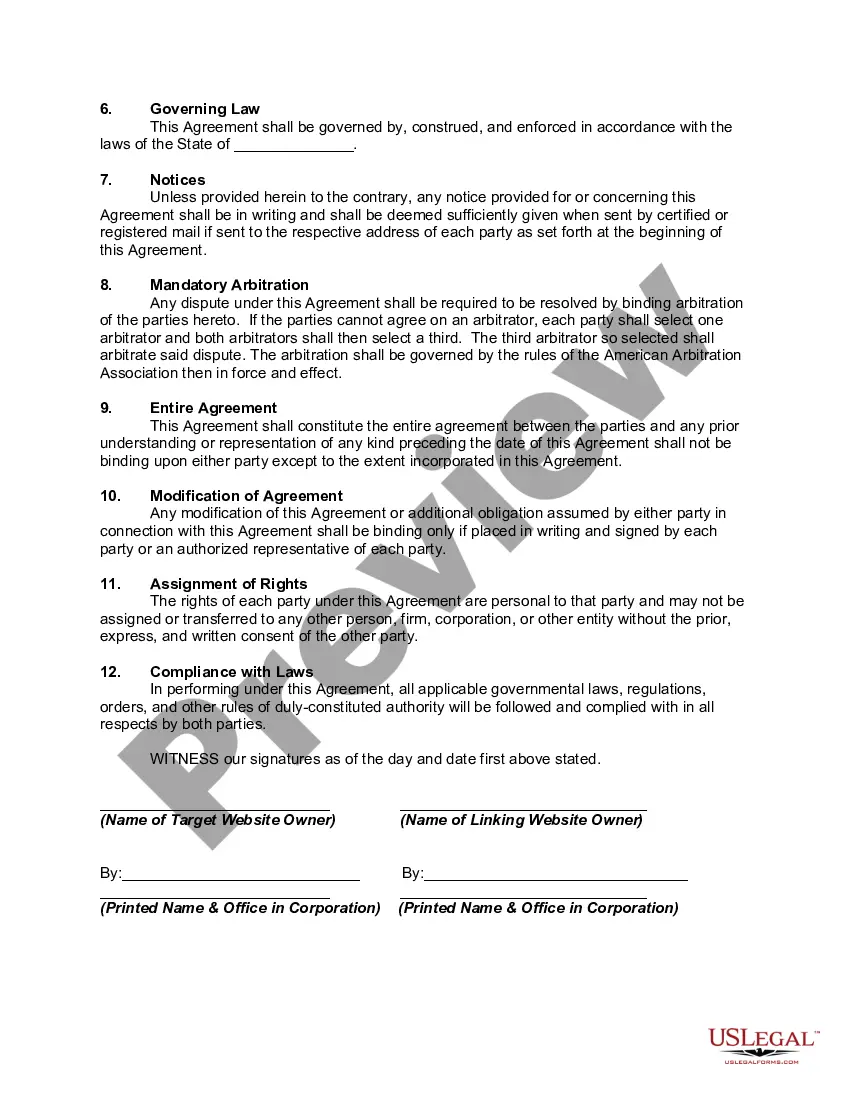

Virginia Free Linking Agreement

Description

How to fill out Free Linking Agreement?

You might spend time online searching for the approved document template that fulfills the state and federal criteria you require.

US Legal Forms provides a vast array of legal forms that are reviewed by professionals.

You can easily download or generate the Virginia Free Linking Agreement from their service.

To acquire another version of the form, utilize the Search field to find the template that meets your needs and requirements.

- If you already possess a US Legal Forms account, you may Log In and click on the Obtain button.

- Next, you can complete, modify, print, or sign the Virginia Free Linking Agreement.

- Every legal document template you purchase is your property indefinitely.

- To obtain an additional copy of any purchased form, go to the My documents section and click the relevant button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/town of your choice.

- Review the form description to confirm you’ve chosen the appropriate template.

Form popularity

FAQ

Virginia has reciprocity agreements with several neighboring states, allowing residents to benefit from tax credits on income taxes. Generally, nearby states like Maryland and Washington, D.C., maintain these agreements. It is important to check the Virginia Department of Taxation website for the most current list and details on how these agreements work. For further tax-related resources, consider platforms like uslegalforms.

To obtain an operating agreement for your LLC in Virginia, you can create one through templates available on various platforms. An operating agreement outlines the management structure and operational procedures of your LLC. Uslegalforms provides customizable templates to suit your specific business needs, making the process simple and efficient.

You can find tax forms and instruction booklets on the Virginia Department of Taxation website. This site serves as an important resource for obtaining all the tax-related documents you need. If you're looking for a more user-friendly method, uslegalforms can help you access these materials without any stress.

The age deduction for form 760 in Virginia benefits taxpayers who are 65 years or older. This deduction ensures you can reduce your taxable income based on your age. Understanding this deduction can significantly impact your tax return, so reviewing the specifics on the Virginia Department of Taxation website is advisable. Our resources at uslegalforms can also provide clarity on such benefits.

Virginia state tax forms are available on the Virginia Department of Taxation website. Here, you can find not only form 760 but also other relevant tax forms for various purposes. Additionally, uslegalforms offers an easy way to access these forms in one platform, simplifying your tax preparation process.

You can obtain Virginia form 760 directly from the official Virginia Department of Taxation website. This form is essential for filing your state income tax. By visiting the site, you can download the form and review related instructions. For convenience, consider using uslegalforms to get access to additional tax forms and resources.

An operating agreement isn't mandatory, but it's a great idea to have one, even if your LLC only has one member and you'll be making all of the decisions. Having a written operating agreement lends credibility to your LLC.

How to Form a Virginia Professional Corporation (in 11 Steps)Step One) Choose a Name.Step Two) Select a Registered Agent.Step Three) Complete Your Articles of Incorporation.Step Four) Establish a Corporate Record.Step Five) Designate a Board of Directors.Step Six) Create Corporate Bylaws.More items...?

A PLLC is a kind of LLC specifically for licensed professionals. The difference between an LLC and a PLLC is mainly that only licensed professionals such as architects, doctors, lawyers and accountants can form PLLCs. Check with your state to determine if they permit licensed professionals to form a standard LLC.

"Professional limited liability company" means a limited liability company whose articles of organization set forth a sole and specific purpose permitted by this chapter and that is either (i) organized under this chapter for the sole and specific purpose of rendering professional service other than that of architects,