A Flexible Benefits Plan benefits is a plan that allows employees to select from a pool of choices, some or all of which may be tax-advantaged. Potential choices include cash, retirement plan contributions, vacation days, and insurance. It is also called a cafeteria plan.

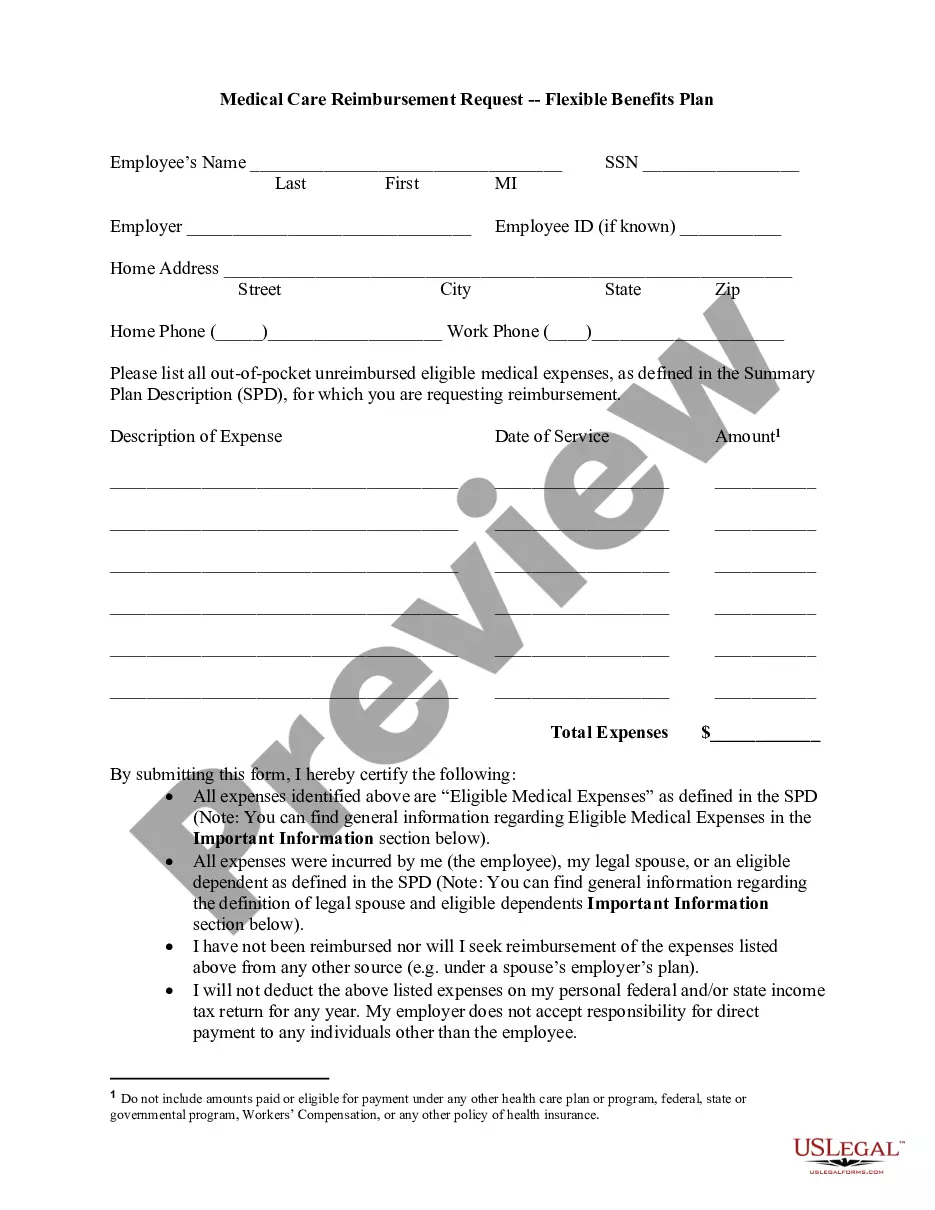

Virginia Medical Care Reimbursement Request - Flexible Benefits Plan

Description

How to fill out Medical Care Reimbursement Request - Flexible Benefits Plan?

If you intend to complete, download, or create approved document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site's user-friendly and convenient search to find the documents you require.

A range of templates for business and personal purposes are categorized by types and states, or keywords.

Every legal document template you purchase belongs to you permanently. You will have access to every form you acquired within your account.

Access the My documents section and select a form to print or download again.

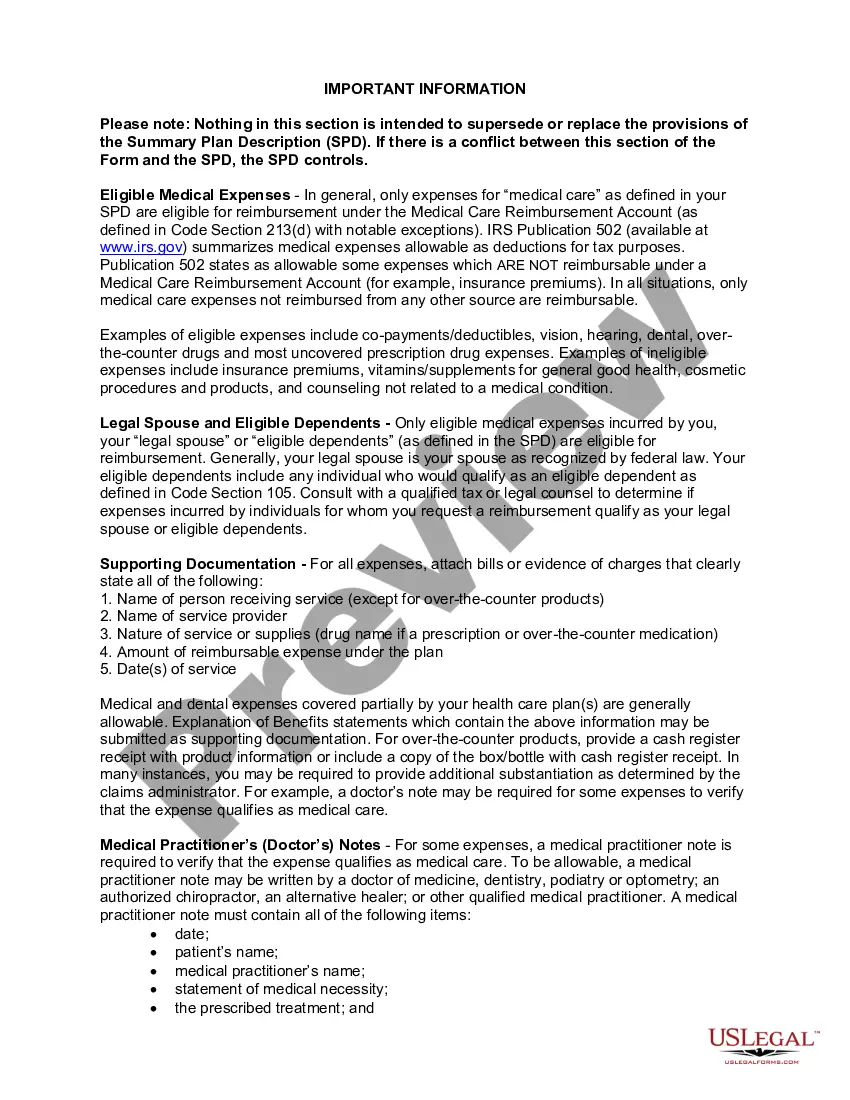

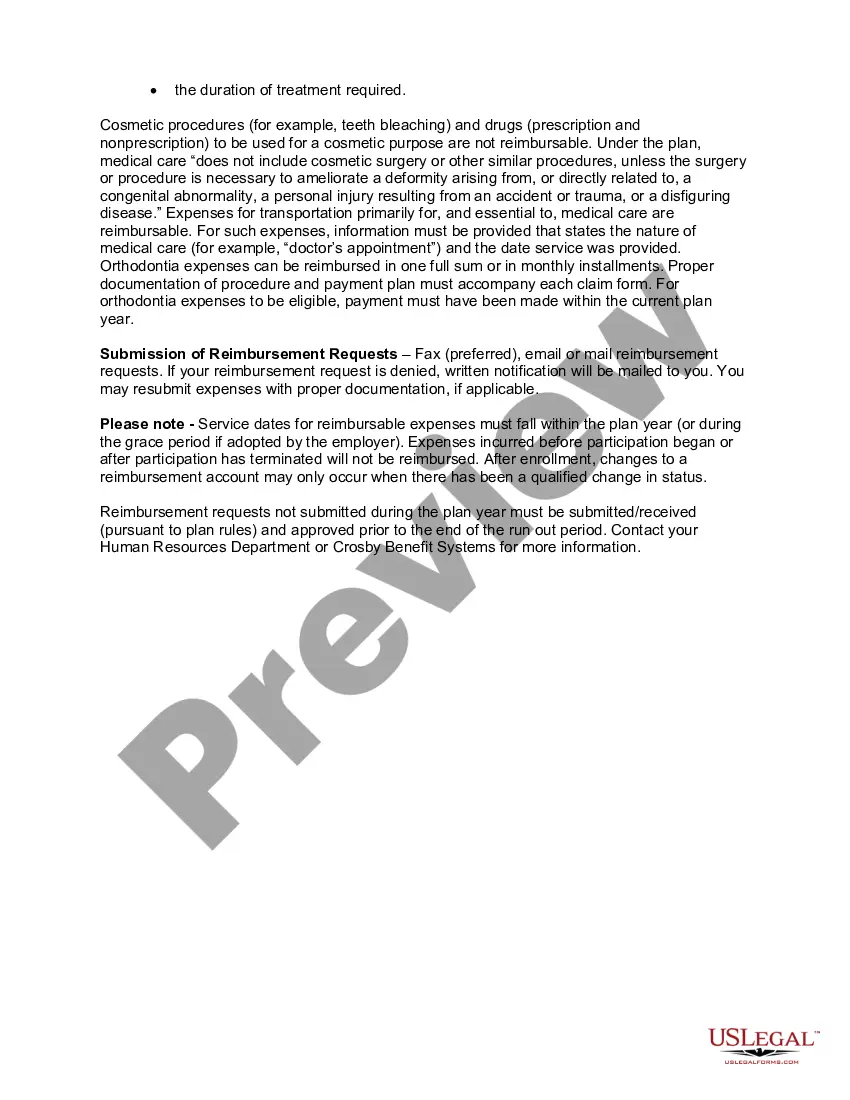

- Step 1. Confirm you have selected the form for your appropriate city/state.

- Step 2. Use the Review feature to examine the form's content. Don't forget to check the details.

- Step 3. If you are not content with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click on the Acquire now button. Choose your preferred pricing plan and provide your information to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Virginia Medical Care Reimbursement Request - Flexible Benefits Plan.

Form popularity

FAQ

Medical flexible spending accounts cover a range of qualified medical expenses, typically including prescriptions, over-the-counter medications, and certain health services. To fully take advantage of this option, consider exploring the Virginia Medical Care Reimbursement Request - Flexible Benefits Plan. Understanding what qualifies under this plan can enhance your financial planning by allowing you to allocate pre-tax dollars towards eligible medical costs effectively.

The Flex plan offers numerous advantages, including personalized health coverage that aligns with your specific needs. Participants can strategically manage their healthcare costs through options like the Virginia Medical Care Reimbursement Request - Flexible Benefits Plan. Furthermore, this personalized approach often results in healthier outcomes, as employees can focus on the care that matters most to them.

Flexible medical benefits refer to a customizable health insurance option that allows participants to select the medical services and coverage they need. Within a flexible benefits plan, options may include preventive care, specialist visits, and the Virginia Medical Care Reimbursement Request - Flexible Benefits Plan. This versatility can lead to improved satisfaction as individuals tailor their medical coverage to fit their personal and family health requirements.

One downside of a flexible benefit plan is the complexity it introduces to health benefits management. Employees need to thoroughly understand their options to maximize their benefits, including the Virginia Medical Care Reimbursement Request - Flexible Benefits Plan. Additionally, some participants might find themselves overwhelmed by choices or underutilizing their benefits, which could lead to undesired financial outcomes.

Flexible health benefits allow employees to choose from a variety of health-related options to fit their personal needs. These options may include medical, dental, and vision insurance, as well as the Virginia Medical Care Reimbursement Request - Flexible Benefits Plan. This approach empowers employees to customize their health benefits according to their own circumstances and preferences.

An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars. Allowed expenses include insurance copayments and deductibles, qualified prescription drugs, insulin, and medical devices.

An FSA is a plan sponsored by the Commonwealth of Virginia that allows you to set aside a part of your income on a pre-tax basis for eligible health or dependent care expenses. The plan year begins July 1 and ends June 30. Your coverage period for incurring expenses is based on your participation in the program.

A Flexible Spending Account (also known as a flexible spending arrangement) is a special account you put money into that you use to pay for certain out-of-pocket health care costs. You don't pay taxes on this money. This means you'll save an amount equal to the taxes you would have paid on the money you set aside.

Health Care FSA You can submit claims for expenses incurred after you leave, up to the end of the plan year in which you terminate, only if you elect to continue your contributions to the account under the Consolidated Omnibus Budget Reconciliation Act (COBRA).

The most significant difference between flexible spending accounts (FSA) and health savings accounts (HSA) is that an individual controls an HSA and allows contributions to roll over, while FSAs are less flexible and are owned by an employer.