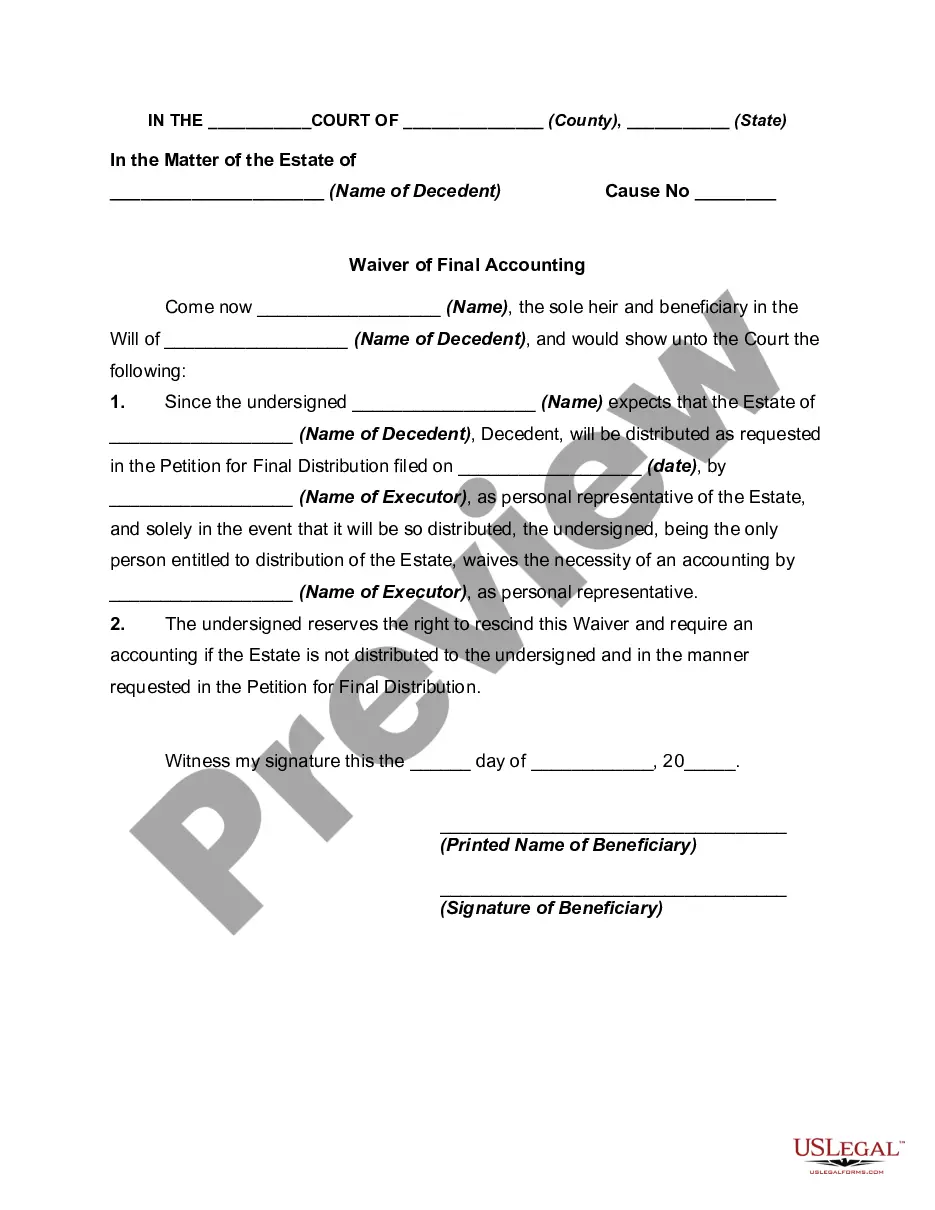

In order to close an estate a petition for final distribution should be filed before the court showing that the estate can be closed and requesting distribution to be made to the beneficiaries. Usually when a petition for final distribution is filed, the court requires detailed accounting of all the monies and other items received and all monies paid out during administration. However, the accounting may be waived when all persons entitled to receive property from the estate have executed a written waiver of accounting. Waiver simplifies the closing of the estate. When all the beneficiaries are friendly obtaining waiver is not a problem.

The Virginia Waiver of Final Accounting by Sole Beneficiary is a legal document used in estate planning to expedite the distribution of assets to a sole beneficiary, typically in a scenario where the decedent has left a significant portion of their estate to one individual. This waiver allows the beneficiary to waive the requirement of the executor or personal representative to file a final accounting with the court, simplifying the probate process and potentially saving time and costs. In Virginia, there are two main types of Waiver of Final Accounting by Sole Beneficiary: 1. Absolute Waiver: This type of waiver completely releases the executor or personal representative from the obligation of filing a final accounting. It signifies the beneficiary's consent to receive their inheritance without the need for a detailed breakdown of the estate's assets, liabilities, and distributions. By signing this waiver, the beneficiary acknowledges that they have received all assets to which they are entitled and are satisfied with the administration of the estate. 2. Conditional Waiver: Unlike the absolute waiver, a conditional waiver is contingent upon the satisfaction of certain conditions by the executor or personal representative. These conditions could include providing the beneficiary with specific information about the estate's assets and liabilities, appraisals, or an interim accounting. Once the beneficiary receives the requested information and is satisfied with the provided details, they can sign the conditional waiver, allowing the estate's distribution to proceed without a final accounting. Both types of waivers are designed to simplify the probate process, especially when there is a sole beneficiary involved. They offer a streamlined approach, eliminating the need for extensive accounting procedures, court filings, and potentially costly delays. However, it is crucial for beneficiaries to fully understand the implications of signing any waiver, as they may be forfeiting valuable rights or the opportunity to request additional information about the estate. By utilizing the Virginia Waiver of Final Accounting by Sole Beneficiary, beneficiaries can efficiently receive their inheritance while minimizing administrative tasks and potential conflicts. It is advisable for individuals considering this approach to consult with an experienced estate planning attorney to ensure they fully comprehend the legal implications and safeguard their interests.The Virginia Waiver of Final Accounting by Sole Beneficiary is a legal document used in estate planning to expedite the distribution of assets to a sole beneficiary, typically in a scenario where the decedent has left a significant portion of their estate to one individual. This waiver allows the beneficiary to waive the requirement of the executor or personal representative to file a final accounting with the court, simplifying the probate process and potentially saving time and costs. In Virginia, there are two main types of Waiver of Final Accounting by Sole Beneficiary: 1. Absolute Waiver: This type of waiver completely releases the executor or personal representative from the obligation of filing a final accounting. It signifies the beneficiary's consent to receive their inheritance without the need for a detailed breakdown of the estate's assets, liabilities, and distributions. By signing this waiver, the beneficiary acknowledges that they have received all assets to which they are entitled and are satisfied with the administration of the estate. 2. Conditional Waiver: Unlike the absolute waiver, a conditional waiver is contingent upon the satisfaction of certain conditions by the executor or personal representative. These conditions could include providing the beneficiary with specific information about the estate's assets and liabilities, appraisals, or an interim accounting. Once the beneficiary receives the requested information and is satisfied with the provided details, they can sign the conditional waiver, allowing the estate's distribution to proceed without a final accounting. Both types of waivers are designed to simplify the probate process, especially when there is a sole beneficiary involved. They offer a streamlined approach, eliminating the need for extensive accounting procedures, court filings, and potentially costly delays. However, it is crucial for beneficiaries to fully understand the implications of signing any waiver, as they may be forfeiting valuable rights or the opportunity to request additional information about the estate. By utilizing the Virginia Waiver of Final Accounting by Sole Beneficiary, beneficiaries can efficiently receive their inheritance while minimizing administrative tasks and potential conflicts. It is advisable for individuals considering this approach to consult with an experienced estate planning attorney to ensure they fully comprehend the legal implications and safeguard their interests.