Judicial lien is a lien obtained by judgment, levy, sequestration or other legal or equitable process or proceeding. If a court finds that a debtor owes money to a creditor and the judgment remains unsatisfied, the creditor can ask the court to impose a lien on specific property owned and possessed by the debtor. After imposing the lien, the court issues a writ directing the local sheriff to seize the property, sell it and turn over the proceeds to the creditor.

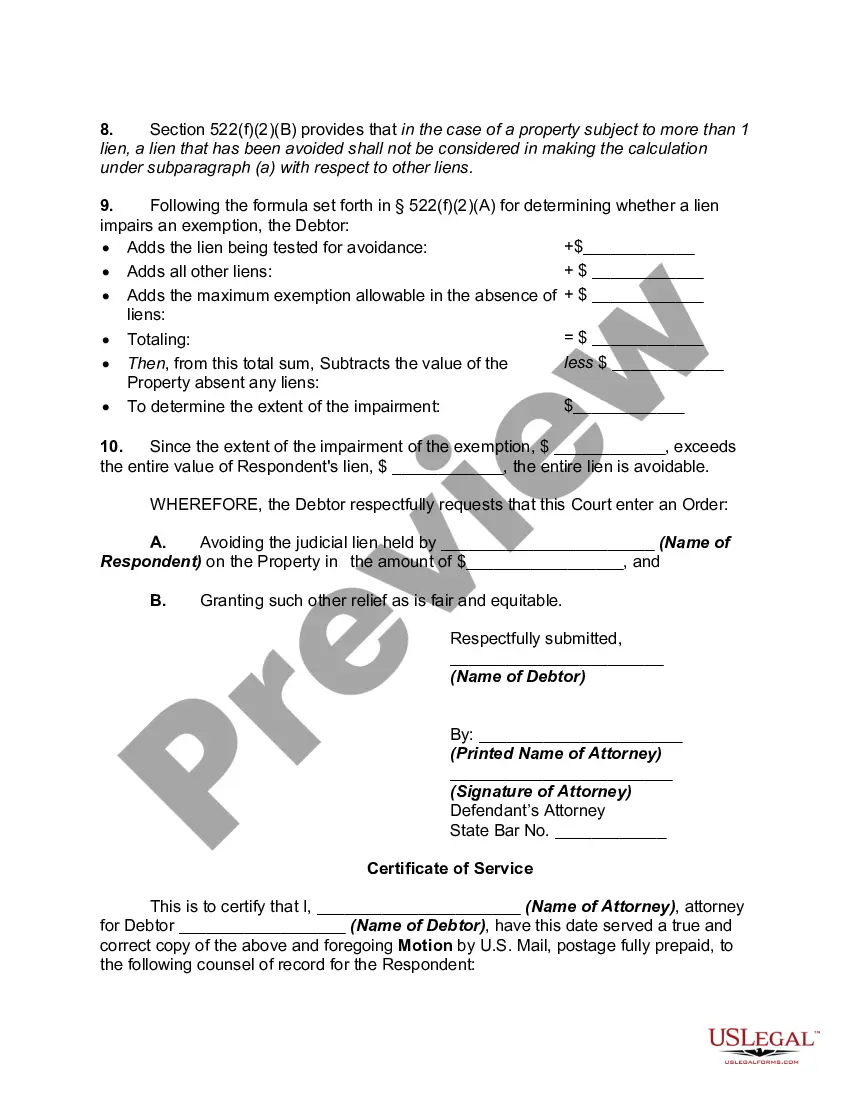

Under Bankruptcy proceedings, a creditor can obtain a judicial lien by filing a final judgment issued against a debtor through a lawsuit filed in state court. A certified copy of a final judgment may be filed in the county in which the debtor owns real property. A bankruptcy debtor can file a motion to avoid Judicial Lien. A Motion to avoid Judicial Lien can be filed by a debtor in either a chapter 7 or chapter 13 bankruptcy proceeding. In a Chapter 7 proceeding, an Order Avoiding Judicial Lien will remove the debt totally.

A Virginia Motion to Avoid Creditor's Lien is a legal document filed by a debtor seeking to eliminate or "avoid" a creditor's lien on their property. This motion is typically filed during a bankruptcy case and is governed by the laws and procedures specific to the state of Virginia. By filing this motion, the debtor is asking the court to recognize that the creditor's lien impairs their exemptions, which in turn affects their ability to obtain a fresh start through bankruptcy. There are different types of Virginia Motion to Avoid Creditor's Lien that can be filed, depending on the specific circumstances of the debtor's case. These types include: 1. Virginia Motion to Avoid Creditor's Lien on Homestead: A debtor may file this motion to eliminate or avoid a lien on their primary residence or homestead. The debtor must demonstrate that the lien impairs their exemption rights and that the property's fair market value does not exceed the applicable exemption limit. 2. Virginia Motion to Avoid Creditor's Lien on Personal Property: This motion is filed when a creditor has placed a lien on the debtor's personal property, such as a car, jewelry, or other valuable items. The debtor seeks to eliminate or avoid the lien, claiming that it impairs their ability to exempt these assets under bankruptcy laws. 3. Virginia Motion to Avoid Creditor's Lien on Tools of Trade: If a creditor has placed a lien on a debtor's tools, equipment, or other essential assets related to their profession or trade, the debtor can file a motion to avoid the lien. This motion aims to protect the debtor's ability to continue working and earning a living during and after the bankruptcy process. 4. Virginia Motion to Avoid Judicial Lien: In situations where a creditor has obtained a judicial lien through a court judgment, the debtor can file a motion to avoid this lien. The debtor must demonstrate that the judicial lien interferes with their exempt property rights, thereby justifying the need for its avoidance. When filing a Virginia Motion to Avoid Creditor's Lien, it is crucial for debtors to provide detailed documentation supporting their claim, including evidence of the lien, the property's value, and their applicable exemption rights. Consulting with an experienced bankruptcy attorney can be beneficial in navigating the specific requirements and procedures involved in these motions.A Virginia Motion to Avoid Creditor's Lien is a legal document filed by a debtor seeking to eliminate or "avoid" a creditor's lien on their property. This motion is typically filed during a bankruptcy case and is governed by the laws and procedures specific to the state of Virginia. By filing this motion, the debtor is asking the court to recognize that the creditor's lien impairs their exemptions, which in turn affects their ability to obtain a fresh start through bankruptcy. There are different types of Virginia Motion to Avoid Creditor's Lien that can be filed, depending on the specific circumstances of the debtor's case. These types include: 1. Virginia Motion to Avoid Creditor's Lien on Homestead: A debtor may file this motion to eliminate or avoid a lien on their primary residence or homestead. The debtor must demonstrate that the lien impairs their exemption rights and that the property's fair market value does not exceed the applicable exemption limit. 2. Virginia Motion to Avoid Creditor's Lien on Personal Property: This motion is filed when a creditor has placed a lien on the debtor's personal property, such as a car, jewelry, or other valuable items. The debtor seeks to eliminate or avoid the lien, claiming that it impairs their ability to exempt these assets under bankruptcy laws. 3. Virginia Motion to Avoid Creditor's Lien on Tools of Trade: If a creditor has placed a lien on a debtor's tools, equipment, or other essential assets related to their profession or trade, the debtor can file a motion to avoid the lien. This motion aims to protect the debtor's ability to continue working and earning a living during and after the bankruptcy process. 4. Virginia Motion to Avoid Judicial Lien: In situations where a creditor has obtained a judicial lien through a court judgment, the debtor can file a motion to avoid this lien. The debtor must demonstrate that the judicial lien interferes with their exempt property rights, thereby justifying the need for its avoidance. When filing a Virginia Motion to Avoid Creditor's Lien, it is crucial for debtors to provide detailed documentation supporting their claim, including evidence of the lien, the property's value, and their applicable exemption rights. Consulting with an experienced bankruptcy attorney can be beneficial in navigating the specific requirements and procedures involved in these motions.