Title: Virginia Sample Letter for Breakdown of Account Arbitrage — Detailed Description and Different Types Introduction: In Virginia, when dealing with overdue account payments, it is essential to have a clear understanding of the arbitrage breakdown. A comprehensive breakdown of account arbitrage can provide transparency and clarity for both parties involved. This article focuses on providing a detailed description of the Virginia Sample Letter for Breakdown of Account Arbitrage. Virginia Sample Letter for Breakdown of Account Arbitrage: 1. Letter Format: Begin the letter with a professional salutation and include the recipient's name, address, and contact information. The letter should be concise, clear, and avoid any unnecessary details. 2. Account Information: Provide the necessary account details, such as the account holder's name, account number, and relevant dates. Accurate and up-to-date account information ensures that both parties are on the same page. 3. Arbitrage Breakdown: The main objective of this letter is to provide a comprehensive breakdown of the account arbitrage. Include a detailed list of outstanding payments, specifying dates, amounts, and any additional charges or interest accrued. Ensure that all calculations are accurate and include a total arbitrage figure. 4. Payment History: To further clarify the arbitrage, include a summary of payment history. This section should highlight the dates and amounts of all previous payments, indicating which outstanding amounts they were allocated towards. 5. Late Fees and Penalties: If applicable, document any late fees, interest charges, or penalties incurred due to late or missed payments. Clearly state the basis for calculating these charges and ensure their accuracy. 6. Contact Information: Provide contact information for both the debtor and the creditor to facilitate communication, address queries, and encourage prompt resolution. Different Types of Virginia Sample Letters for Breakdown of Account Arbitrage: 1. Personal Account Arbitrage: This type of letter is suitable for individuals who owe overdue payments to a creditor, such as personal credit cards, loans, or other personal debts. 2. Business Account Arbitrage: Designed for businesses, this letter can be used to address outstanding payments owed to suppliers, vendors, or business loans. 3. Mortgage Account Arbitrage: Specifically tailored to those experiencing difficulties in meeting mortgage payments, this letter helps outline overdue amounts, including principal, interest, and any associated mortgage fees. 4. Utility Account Arbitrage: This type of letter is used to communicate overdue utility bill payments, such as electricity, water, or gas bills. Conclusion: Utilizing a Virginia Sample Letter for Breakdown of Account Arbitrage enables individuals and businesses to maintain transparency and effectively communicate arbitrage details. By providing a comprehensive breakdown of outstanding account balances, payment history, and any associated charges, this letter assists in resolving financial matters in a clear and professional manner. Remember to adapt the letter based on the specific situation and type of arbitrage being addressed.

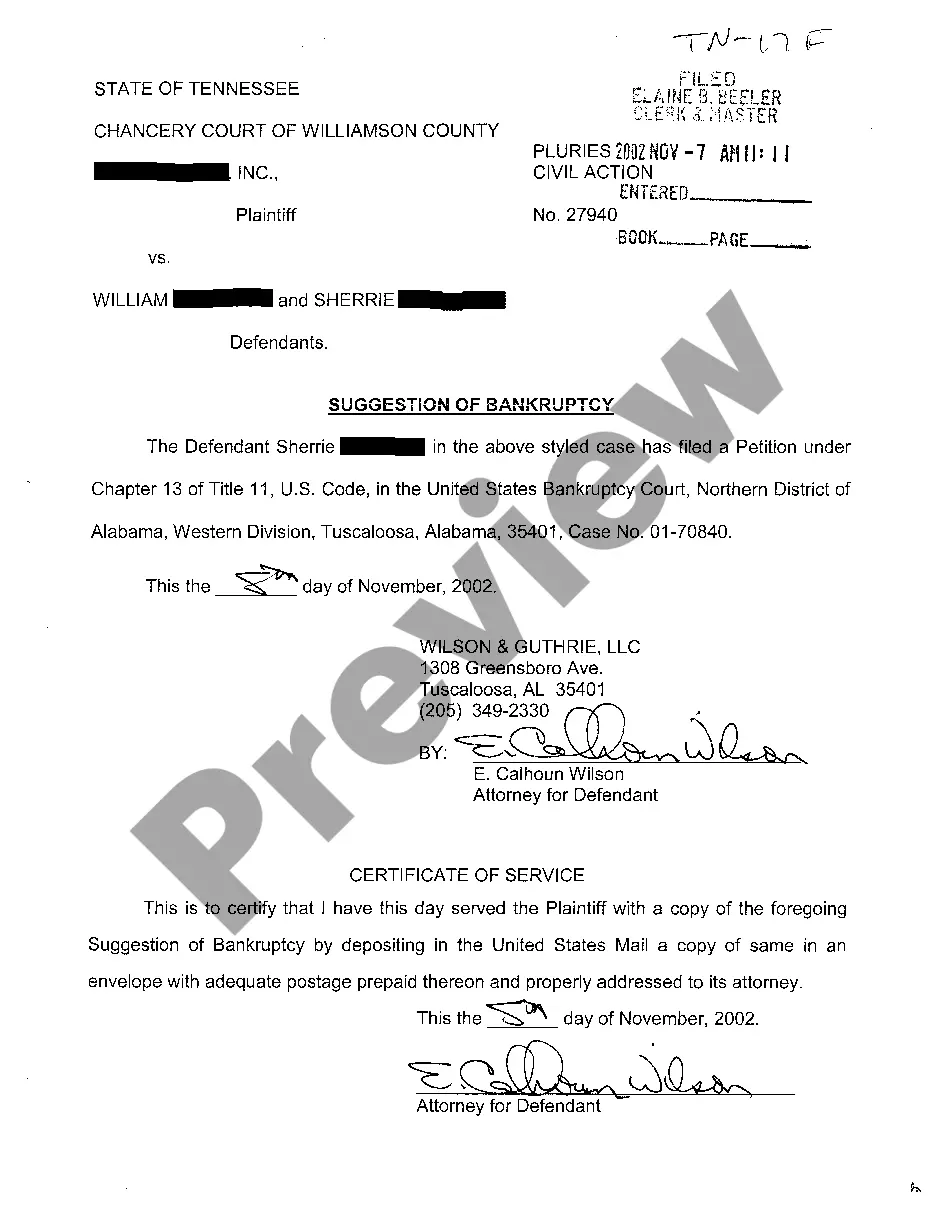

Virginia Sample Letter for Breakdown of Account Arrearage

Description

How to fill out Virginia Sample Letter For Breakdown Of Account Arrearage?

Are you currently inside a placement that you require files for sometimes enterprise or personal reasons almost every working day? There are tons of lawful file themes available online, but finding ones you can depend on isn`t easy. US Legal Forms gives a large number of form themes, just like the Virginia Sample Letter for Breakdown of Account Arrearage, that happen to be published to fulfill federal and state specifications.

If you are already acquainted with US Legal Forms website and possess a merchant account, simply log in. Afterward, you can acquire the Virginia Sample Letter for Breakdown of Account Arrearage web template.

Should you not offer an account and want to start using US Legal Forms, abide by these steps:

- Obtain the form you will need and make sure it is for that right metropolis/county.

- Use the Preview key to review the form.

- Browse the outline to ensure that you have selected the proper form.

- In the event the form isn`t what you`re trying to find, make use of the Research field to find the form that meets your requirements and specifications.

- If you get the right form, simply click Purchase now.

- Choose the prices prepare you want, complete the specified info to generate your money, and pay for the order making use of your PayPal or charge card.

- Pick a practical file file format and acquire your copy.

Get every one of the file themes you possess purchased in the My Forms food selection. You can aquire a additional copy of Virginia Sample Letter for Breakdown of Account Arrearage at any time, if required. Just select the necessary form to acquire or printing the file web template.

Use US Legal Forms, by far the most extensive selection of lawful kinds, to save time and avoid errors. The services gives expertly created lawful file themes which you can use for a variety of reasons. Produce a merchant account on US Legal Forms and begin creating your way of life easier.