Virginia General Form of Assignment as Collateral for Note

Description

How to fill out General Form Of Assignment As Collateral For Note?

If you require to acquire, download, or produce legal document templates, utilize US Legal Forms, the most extensive array of legal forms available online.

Utilize the site's straightforward and user-friendly search to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is your personal property permanently. You have access to all the forms you saved in your account. Visit the My documents section and select a form to print or download again.

Be proactive and download, print, and obtain the Virginia General Form of Assignment as Collateral for Note with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to obtain the Virginia General Form of Assignment as Collateral for Note in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click on the Download button to retrieve the Virginia General Form of Assignment as Collateral for Note.

- You can also access forms you previously saved from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have selected the form for the correct city/state.

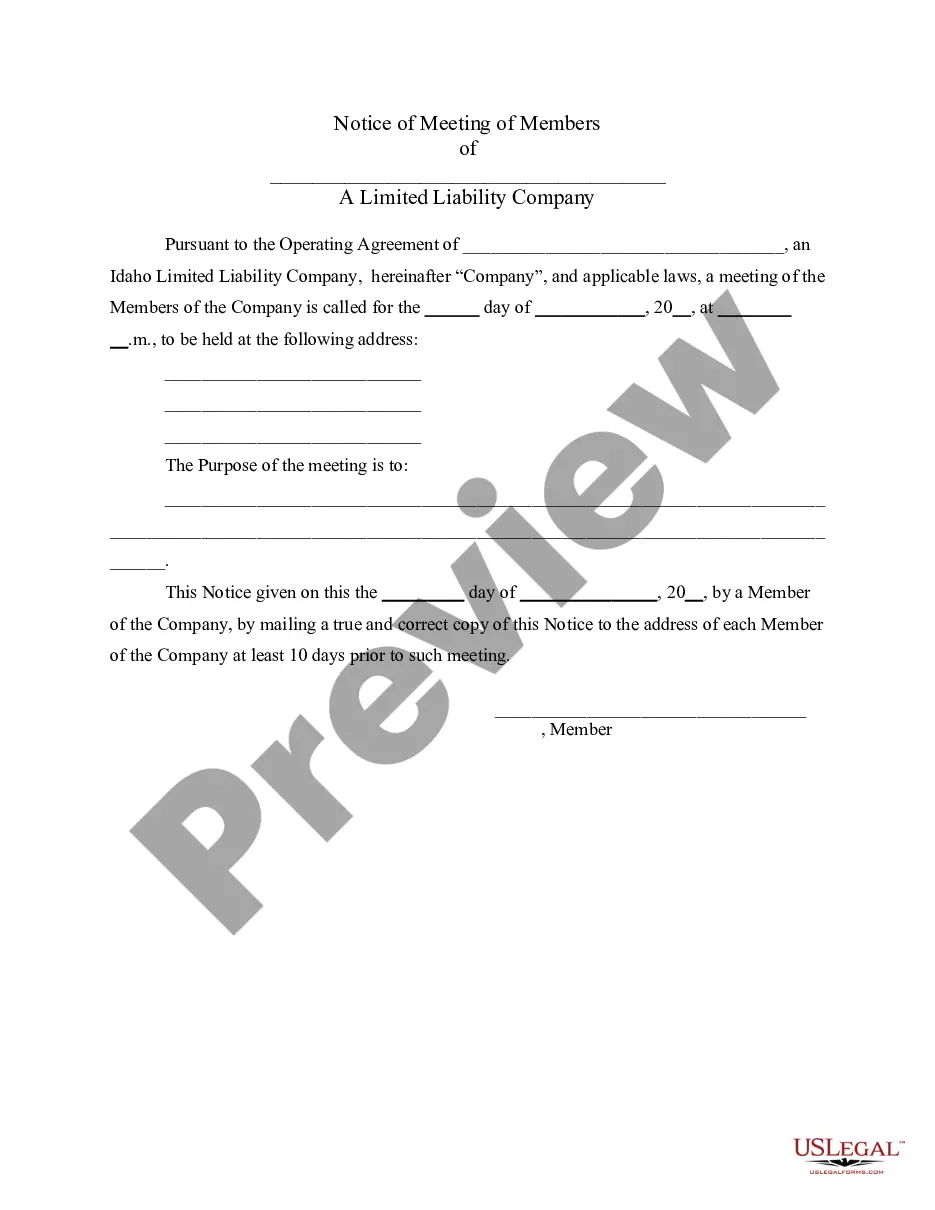

- Step 2. Utilize the Preview option to review the content of the form. Remember to read the description.

- Step 3. If you are not satisfied with the template, use the Search field at the top of the page to find alternative templates in the legal form repository.

- Step 4. Once you locate the form you need, click the Get now button. Choose your preferred pricing plan and input your details to register for an account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Virginia General Form of Assignment as Collateral for Note.

Form popularity

FAQ

Assignment of interest denotes the transfer of someone’s rights or benefits in a contract or agreement to another party. In relation to the Virginia General Form of Assignment as Collateral for Note, it outlines how one party may assign their rights to the collateral to another. This process can streamline transactions and clarify the rights of each party involved, ensuring that there is a clear understanding of ownership and obligations throughout the agreement.

Perfection of security interest in collateral refers to the legal steps taken to ensure that a lender's claim to an asset is enforceable against third parties. In the context of the Virginia General Form of Assignment as Collateral for Note, this involves filing necessary documents to publicly register the security interest. By properly perfecting the interest, lenders can protect their rights over the secured asset in case of borrower default. This process is essential for securing financing.

The assignment of security refers to the process of transferring a security interest in a property from one party to another. In the context of a Virginia General Form of Assignment as Collateral for Note, this means pledging an asset as collateral to secure a debt. It protects the lender by providing them a claim to the asset if the borrower defaults. Understanding this concept is crucial for anyone dealing with secured transactions.

A collateral assignment form is a legal document where a lender holds rights to a borrower’s collateral to secure a debt. This form outlines the specific terms and conditions associated with the collateralized note. Using the Virginia General Form of Assignment as Collateral for Note ensures you have a robust template that meets legal requirements and provides the necessary protections.

Yes, a promissory note remains legal without notarization in Virginia. The essential elements involved, such as clear terms and mutual consent, create a binding agreement between parties. Nevertheless, using a Virginia General Form of Assignment as Collateral for Note with notarization adds a layer of protection and can help settle any disputes. It's advisable to consult platforms like uslegalforms that can guide you through the process for a smooth experience.

Virginia law outlines specific documents that cannot be notarized, including certain governmental forms and anything that conflicts with state regulations. For instance, wills and trust documents may require other forms of validation. When dealing with a Virginia General Form of Assignment as Collateral for Note, it's crucial to ensure that all paperwork complies with legal standards, as this will prevent any future disputes or issues.

In Virginia, a promissory note does not require notarization to be enforceable. However, if you plan to use a Virginia General Form of Assignment as Collateral for Note, notarizing the document can enhance its credibility and streamline the execution process. Many lenders prefer notarized documents to fulfill their legal requirements easily. Thus, while notarization is not mandatory, it often proves beneficial.