Title: Virginia Sample Letter for Revised Promissory Note: Comprehensive Guide and Templates Introduction: A Virginia Sample Letter for Revised Promissory Note provides a solid framework for individuals and businesses in Virginia who seek to modify the terms and conditions of an existing promissory note agreement. This document allows parties involved to revise and update the repayment schedule, interest rates, payment terms, or any other crucial elements pertaining to the promissory note. In this article, we will explore the details of such a letter, its importance, and discuss various types of sample letters available for different scenarios. 1. Understanding the Purpose of a Revised Promissory Note: A revised promissory note letter serves as a formal written agreement between the lender and borrower to modify the terms of an existing promissory note. It aims to establish clarity, protect the rights and responsibilities of both parties, and minimize potential misunderstandings. 2. Importance of a well-drafted Revised Promissory Note: 2.1 Ensuring Legal Compliance: A revised promissory note letter helps ensure that modifications to the original agreement comply with Virginia state laws, thereby reducing the risk of disputes or legal complications. 2.2 Facilitating Clear Communication: A well-crafted revised promissory note promotes transparent communication regarding changes made to the initial agreement, ensuring all parties involved have a clear understanding of their obligations. 2.3 Preserving Lender-Borrower Relationship: By addressing modifications through a formal letter, a revised promissory note preserves relationships, as both parties are on the same page, preventing future conflicts. 3. Different Types of Virginia Sample Letters for Revised Promissory Note: 3.1 Revised Promissory Note for Loan Repayment Extension: This sample letter is geared towards extending the repayment period of a loan, allowing borrowers extra time to fulfill their obligations without defaulting. 3.2 Revised Promissory Note for Interest Rate Modification: This sample letter caters to situations where parties wish to revise the interest rate of the loan, ensuring fairness and financial sustainability. 3.3 Revised Promissory Note for Monthly Payment Modification: This sample letter is helpful when changes need to be made to the monthly payment amount to align with the borrower's financial circumstances, ensuring affordability. Conclusion: When considering revisions to a promissory note in Virginia, it is crucial to utilize a well-structured and legally-compliant sample letter. The provided Virginia Sample Letters for Revised Promissory Note, such as those for loan repayment extension, interest rate modification, and monthly payment adjustment, can help simplify the process and maintain a good lender-borrower relationship. Implementing modifications through a formal letter remains important to ensure transparency, legal compliance, and effective communication between all parties involved.

Virginia Sample Letter for Revised Promissory Note

Description

How to fill out Virginia Sample Letter For Revised Promissory Note?

US Legal Forms - one of several largest libraries of legitimate types in the USA - provides an array of legitimate record templates you may download or print out. Utilizing the website, you will get a huge number of types for enterprise and person uses, sorted by categories, states, or keywords and phrases.You will discover the most up-to-date versions of types just like the Virginia Sample Letter for Revised Promissory Note in seconds.

If you have a registration, log in and download Virginia Sample Letter for Revised Promissory Note through the US Legal Forms local library. The Download key will appear on every single form you perspective. You get access to all earlier delivered electronically types from the My Forms tab of your own profile.

In order to use US Legal Forms initially, listed here are basic recommendations to help you get started out:

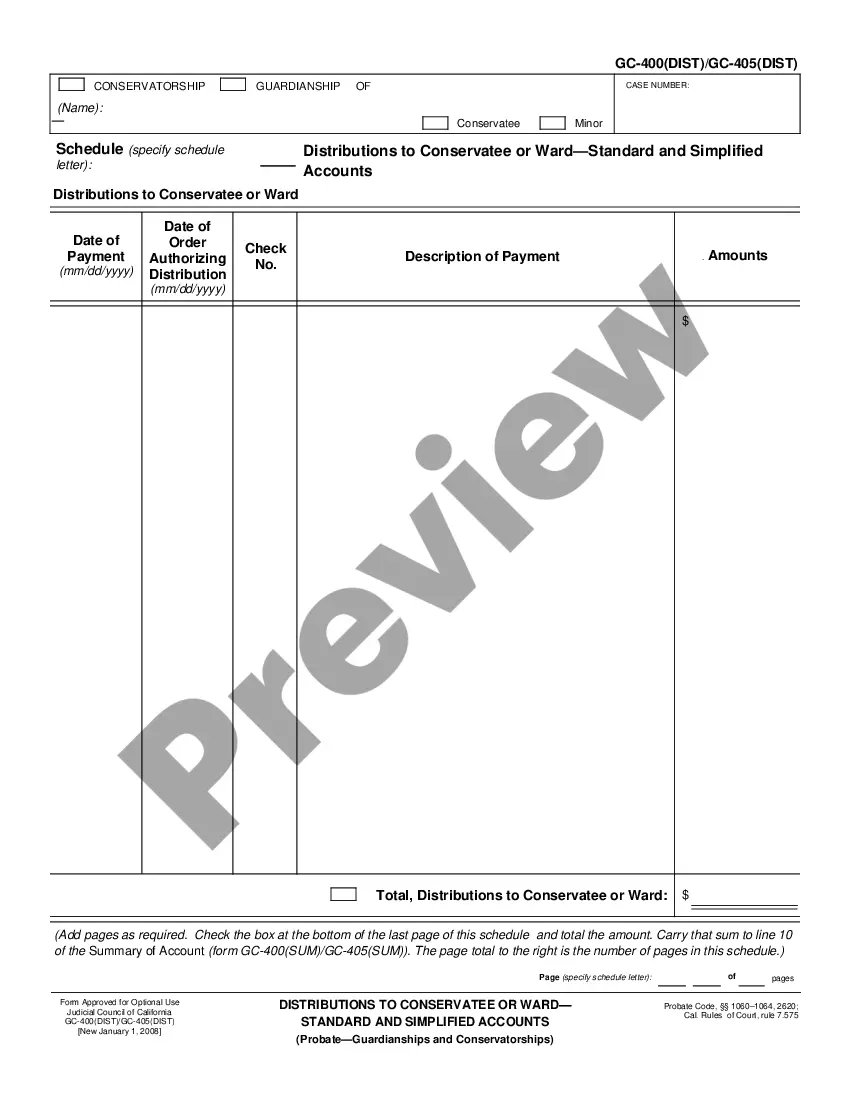

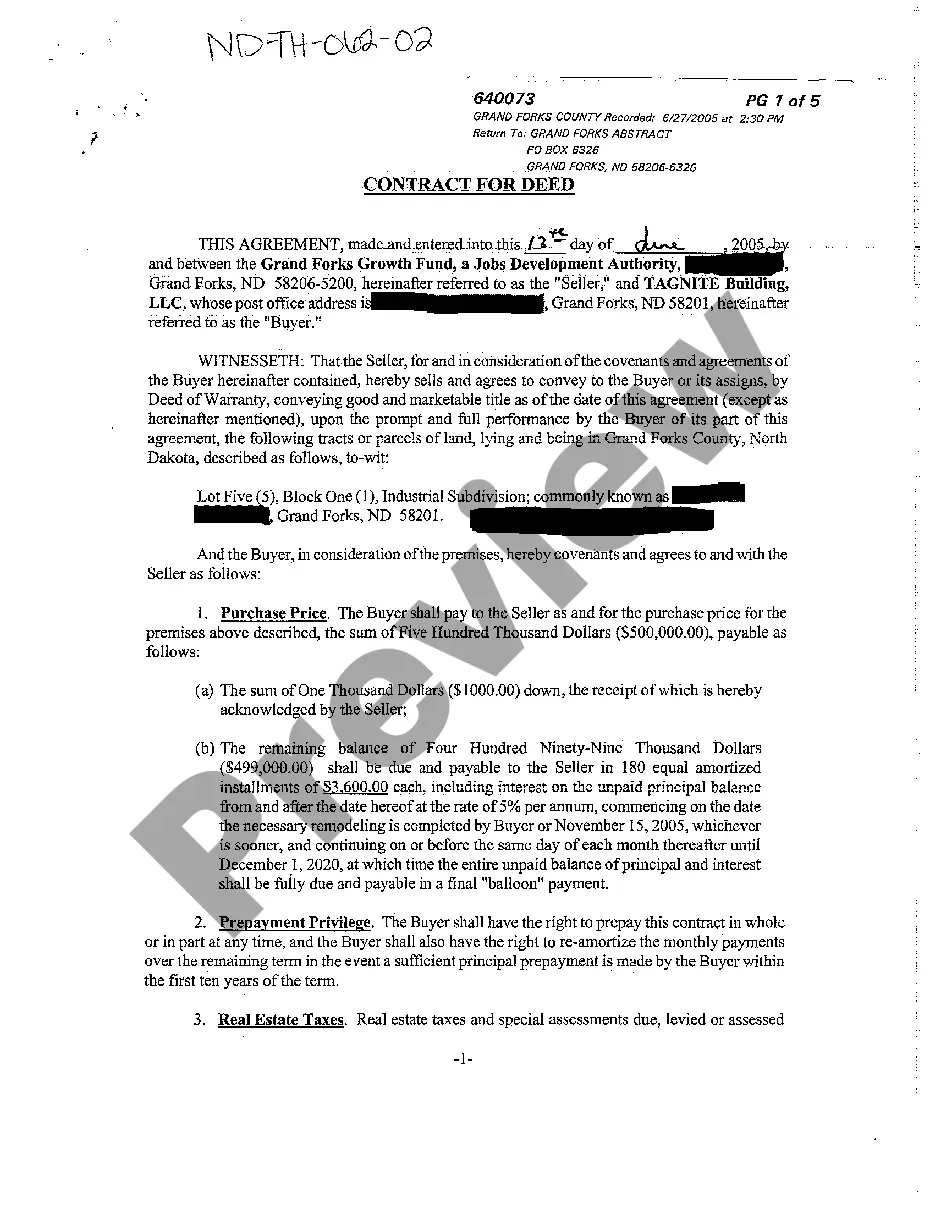

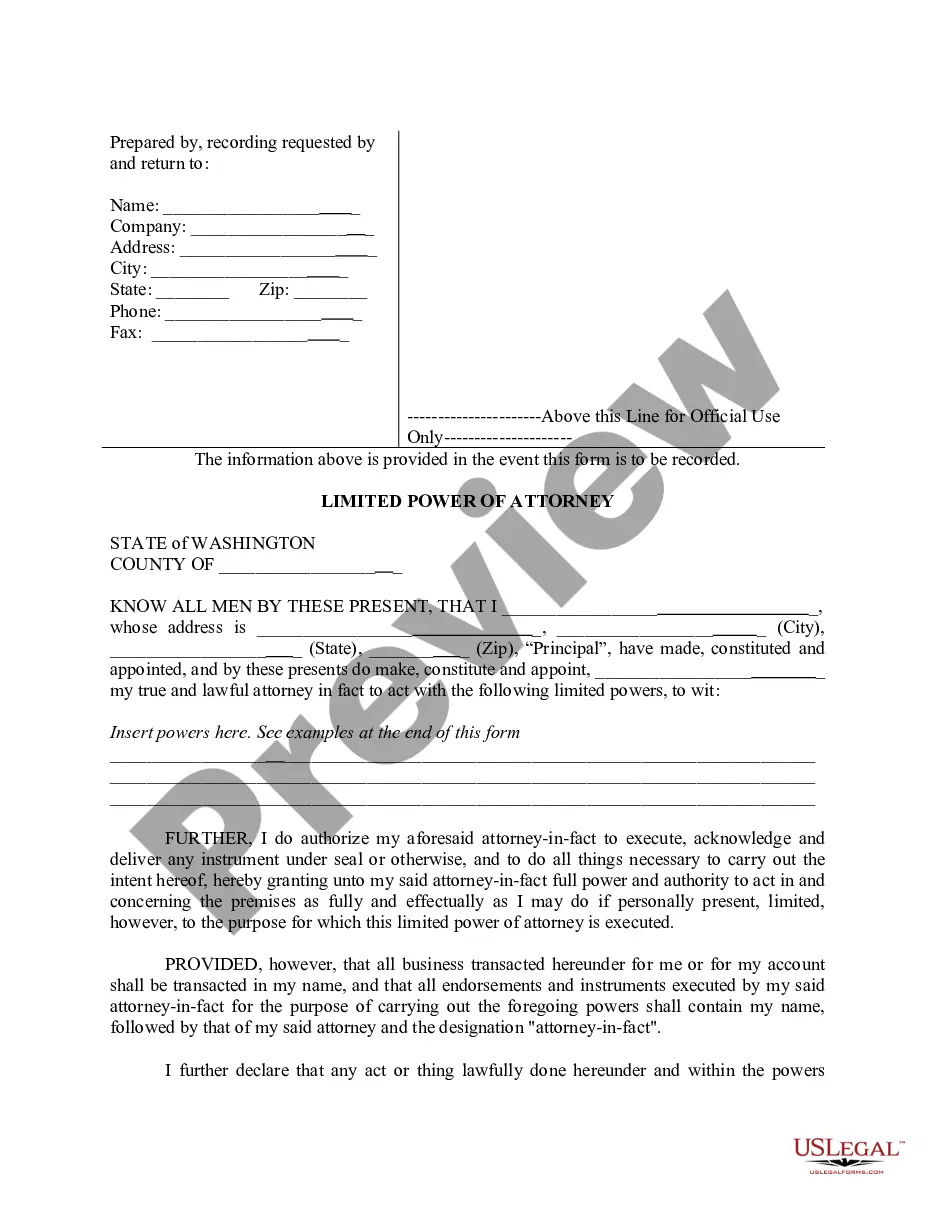

- Make sure you have chosen the proper form for your town/state. Select the Preview key to examine the form`s information. Look at the form explanation to ensure that you have chosen the correct form.

- In case the form does not match your needs, take advantage of the Look for field towards the top of the display to find the the one that does.

- When you are pleased with the shape, affirm your decision by clicking the Buy now key. Then, choose the costs plan you prefer and offer your qualifications to sign up for an profile.

- Approach the financial transaction. Utilize your charge card or PayPal profile to complete the financial transaction.

- Select the format and download the shape on the device.

- Make modifications. Complete, modify and print out and indication the delivered electronically Virginia Sample Letter for Revised Promissory Note.

Every single template you added to your money does not have an expiry day and is your own for a long time. So, if you would like download or print out an additional version, just check out the My Forms portion and then click around the form you want.

Obtain access to the Virginia Sample Letter for Revised Promissory Note with US Legal Forms, one of the most considerable local library of legitimate record templates. Use a huge number of professional and express-certain templates that meet your small business or person needs and needs.

Form popularity

FAQ

An amended promissory note is a legal document that changes the terms of the original promissory note. These amendments should be made with consent from the lender and, once in place, will be considered binding by all parties involved. Canceling a promissory note is a completely different process from amending it.

An amended promissory note is a legal document that changes the terms of the original promissory note. These amendments should be made with consent from the lender and, once in place, will be considered binding by all parties involved. Canceling a promissory note is a completely different process from amending it.

If there is a breach of the terms of a promissory note by the maker, the bearer can seek to enforce the note by filing a claim in Court.

An amended and restated promissory note is a legally binding addition to a promissory note that notes any significant changes and replaces the original agreement. Amended and restated promissory notes are seen as the most recent and up-to-date versions of the promise to pay between a borrower and a lender.

How to Modify a Promissory NoteIdentify the terms of the note that are creating difficulty in repayment.Communicate your need to modify the terms of the note to the note holder.Have the holder of the note draft modifications to the original note.Sign and notarize the modified promissory note.

An amended and restated promissory note is a legally binding addition to a promissory note that notes any significant changes and replaces the original agreement. Amended and restated promissory notes are seen as the most recent and up-to-date versions of the promise to pay between a borrower and a lender.

Refinancing a hard money note is exactly like refinancing a bank mortgage. Find the refinancing lender and loan, go through a qualifications process, have the property appraised, and give contact information for the original note holder to your new lender so it can make arrangements to pay off the privately held note.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.