Virginia Subscription Receipt

Description

How to fill out Subscription Receipt?

Selecting the optimal legal document format can be a challenge.

Certainly, there are numerous templates available online, but how do you identify the legal form you need.

Utilize the US Legal Forms website. The platform offers a vast array of templates, such as the Virginia Subscription Receipt, suitable for both commercial and personal purposes.

If the form does not meet your requirements, use the Search field to find the correct form. Once you are confident that the form is appropriate, click the Get now button to obtain the form. Choose the pricing plan you desire and enter the necessary information. Create your account and process the transaction using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Virginia Subscription Receipt. US Legal Forms is the largest repository of legal forms where you can discover a multitude of document templates. Take advantage of the service to download professionally crafted paperwork that adheres to state stipulations.

- All the documents are reviewed by experts and comply with state and federal regulations.

- If you are already registered, sign in to your account and click the Obtain button to access the Virginia Subscription Receipt.

- Use your account to search through the legal documents you have previously purchased.

- Visit the My documents section of your account to download another copy of the documents you need.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

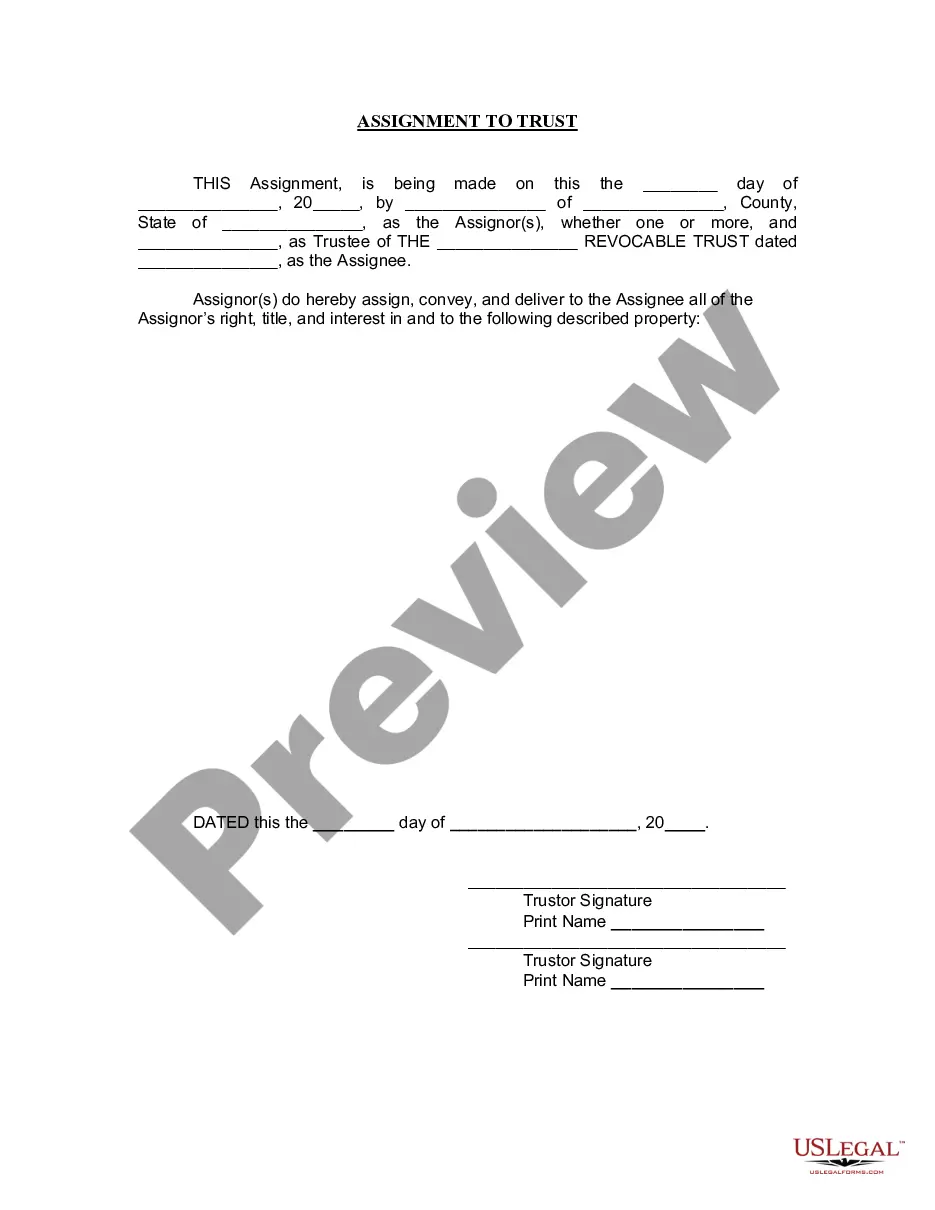

- First, ensure you have selected the correct form for your locality/state. You can examine the form using the Preview button and read the form description to confirm it is the right fit for you.

Form popularity

FAQ

Yes, you can request a certificate of Good Standing online through the Virginia Secretary of State's website. This online service simplifies the process, allowing you to obtain the necessary documents quickly. Utilizing platforms like ours can also streamline the process, especially when handling your Virginia Subscription Receipt.

Sales Tax Rates The sales tax rate for most locations in Virginia is 5.3%.

Most businesses operating in or selling in the state of Virginia are required to purchase a resale certificate annually. Even online based businesses shipping products to Virginia residents must collect sales tax. Obtaining your sales tax certificate allows you to do so.

Virginia does not require businesses to collect sales tax on the sale of digital goods or services. However, Virginia has one exception to this policy. Businesses must collect sales tax on pre-written computer software that is sold online.

Magazine and newspaper subscriptions (Va. Code § 58.1-609.6(3)) Purchases from out-of-state mail order catalog(s) totaling $100 or less for the calendar year. If you spent more than $100 on these items, then you must report the purchases and pay consumer use tax on the total cost.

Membership fees that do not exceed the nominal amount are generally not subject to tax. In addition, membership fees that are not related to the anticipated retail sales of tangible personal property are not subject to tax.

The Taxpayer is correct that the sale of software delivered electronically to customers does not constitute the sale of tangible personal property and is generally not subject to Virginia sales and use taxation.

Usually exempt in local jurisdictions is food which has been bought from a grocery store, the majority of agricultural supplies, and prescription medicines. These categories may have some further qualifications before the special rate applies, such as a price cap on clothing items.

Virginia does not usually collect sales taxes on services. However, services which considered part of the physical merchandise purchased, as valued is money or in (such as setup of a purchased piece of machinery)seen as being taxable. Some services are entirely taxable.

The Taxpayer questions the application of tax to membership fees it receives. If the fees do not include the provision of tangible personal property, such fees would not be considered taxable.